Toronto’s real estate market continues to be one of the most talked-about topics in Canada. Known for its rapid growth, robust economic foundations, and increasing home prices, this market has captured the attention of both domestic and international buyers. However, with all this attention comes a pressing question: When will the Toronto real estate market crash?

We’ll dive into the current state of the Toronto real estate market, revisit its historical trends, and identify key indicators that might signal a downturn. We’ll also compare Toronto with other major cities, gather expert opinions, and offer strategies for buyers and sellers to navigate these uncertain times. Whether you’re buying, selling, or investing, this article is packed with insights to help you stay ahead.

Current Overview of Toronto’s Real Estate Market

As of July 2024, Toronto’s real estate market is showing signs of growth and stabilization. Home sales in the Greater Toronto Area (GTA) have increased by 3.3% compared to July 2023, with 5,391 transactions reported. This rise can be attributed to recent Bank of Canada rate cuts, which are expected to further reduce borrowing costs, encouraging more buyer activity in the coming months.

While the market remains well-supplied – with new listings up by 18.5% year-over-year – there has been a slight decline in average selling prices, which dipped 0.9% to $1,106,617 compared to last year. The MLS® Home Price Index Composite benchmark also decreased by 5% year-over-year, although prices have shown slight monthly gains since June 2024.

As borrowing becomes more affordable, demand is expected to rise, gradually absorbing the current inventory. This could lead to tighter market conditions and renewed price growth, particularly if housing completions do not increase significantly. The outlook for Toronto’s real estate market remains cautiously optimistic, with innovations in housing construction and infrastructure developments, such as the Crosstown LRT, playing a critical role in shaping future trends.

Historical Analysis of Toronto Real Estate

Toronto’s real estate market has evolved dramatically over the decades. You may have noticed that the city has experienced its share of ups and downs. One of the most notable downturns was the 1989-1996 crisis, during which home prices plummeted by nearly 28%, leading to a prolonged recovery phase.

This period offered valuable lessons on the importance of affordability and economic stability in sustaining market growth. Despite these challenges, Toronto’s real estate market has proven to be resilient.

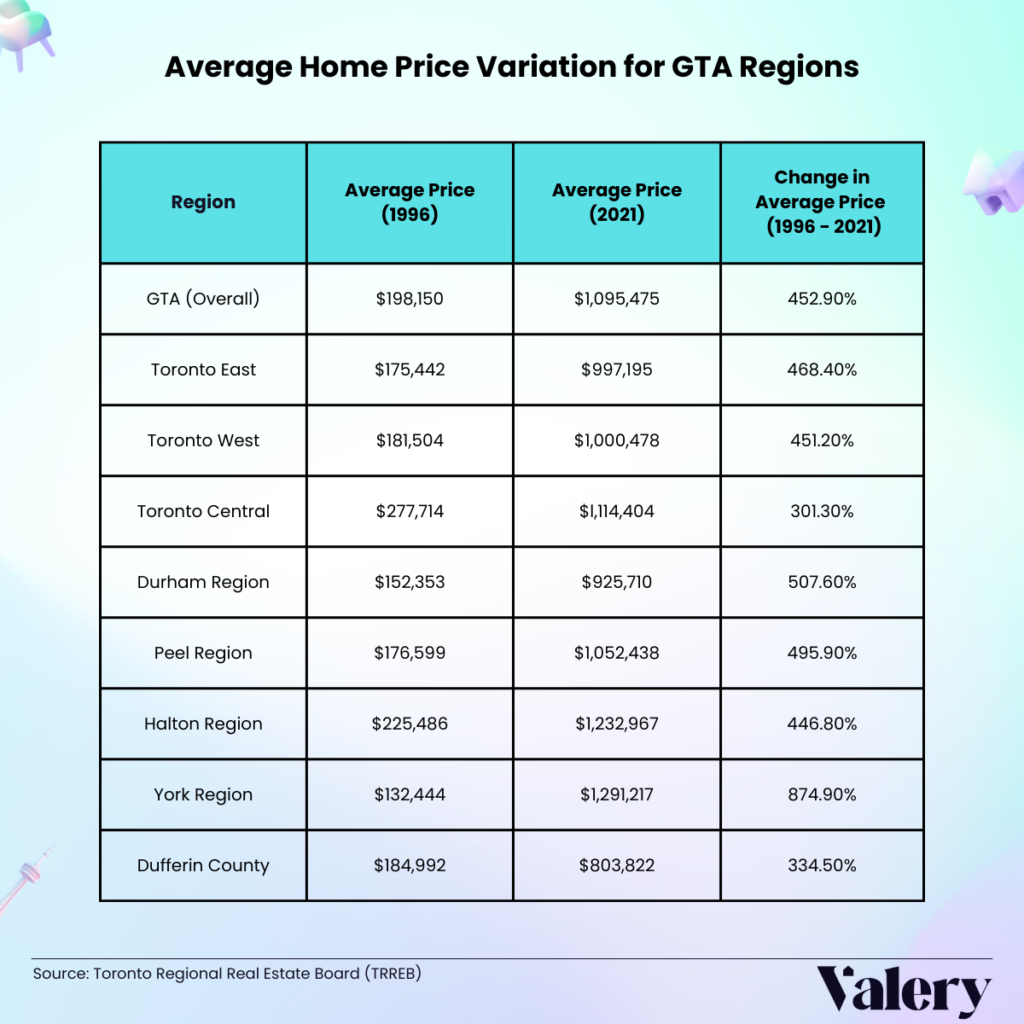

Greater Toronto Area Residential Price Trends

Key Indicators – When will Toronto Real Estate Market Crash

Several key indicators suggest that Toronto’s real estate market could be heading for a correction:

- Overvaluation: Based on the latest statistics, the median annual income for Canadians is $70,500. In comparison, the average home price in the Greater Toronto Area (GTA) is $1,106,617. When home prices significantly exceed what average incomes can support, the market becomes overvalued. This creates a bubble that may eventually burst, particularly if economic conditions worsen.

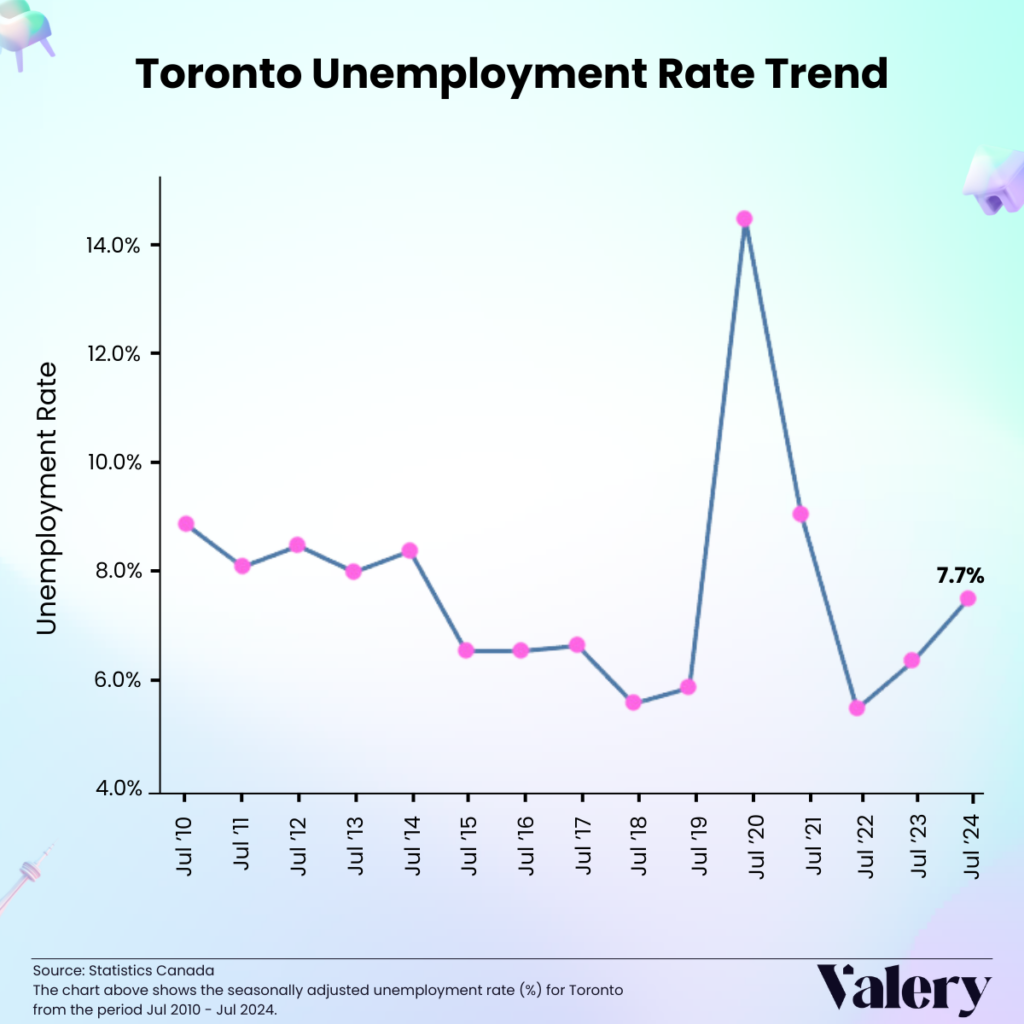

- Economic Conditions: Weakening economic conditions, including rising unemployment rates—7.7% in Toronto as of July 2024—can reduce consumer confidence and housing demand. If more homeowners default on their mortgages, it could trigger a market crash.

What’s Driving Toronto’s Real Estate Market Right Now

Despite concerns, several factors continue to drive Toronto’s real estate market:

- Population Growth and Urbanization: Toronto’s population has been steadily increasing, with a 2.3% rise from 2016 to 2021, according to the latest census. This growth is fueled by immigration and urbanization which is sustaining housing demand despite economic challenges. Urbanization trends, in particular, have led to rising property values as more people seek to live in city centers with better access to employment, amenities, and transportation.

- Government Policies: Policies such as the Prohibition on the Purchase of Residential Property by Non-Canadians Act, extended to January 1, 2027, aims to curb speculation and stabilize prices. The Act bans non-Canadian citizens and non-permanent residents from purchasing non-recreational residential properties, such as detached homes, semi-detached houses, and condos, within major cities. Such policies aim to help maintain market balance.

- Infrastructure Development: The city’s expanding infrastructure, including the ongoing Crosstown LRT project, enhances Toronto’s appeal to both domestic and international buyers.

However, the ongoing supply-demand imbalance, with limited housing availability, keeps prices elevated. Understanding these dynamics is crucial for predicting whether the market will crash or continue to climb.

Warning Signs to Keep an Eye On

If you’re buying, selling, or investing in real estate, monitoring the market for warning signs is essential:

- Sudden Price Declines: A sharp drop in home prices may indicate a cooling market.

- Decreasing Sales Volumes: Fewer sales and longer listing times suggest a slowdown in demand.

- Increase in Mortgage Defaults: A rise in foreclosures signals that homeowners are struggling to keep up with payments.

Changes in government policies, such as interest rate adjustments or new housing regulations, can also have a significant impact.

What Experts Are Saying About – When will the Toronto Real Estate Market Crash?

Economists and real estate analysts offer varied opinions on whether Toronto’s market is heading for a crash. TD Economics expects a moderate recovery in sales during the second half of 2024, driven by gradual interest rate reductions. However, they also warn that price growth may remain constrained due to ongoing affordability challenges and potential increases in listings.

Some real estate experts believe that while demand may slow, there is still strong support for prices in

the Toronto market due to continued immigration and a tight rental supply.

So while the risk of a market downturn exists, many experts believe that Toronto’s real estate market will remain resilient, with slower growth and potential corrections rather than a full-blown crash.

Understanding both perspectives can help you make informed decisions based on your financial goals.

Comparing Toronto with Other Major Real Estate Markets

Toronto’s real estate market shares similarities with other major cities like Vancouver, Montreal, New York, and London:

- Toronto vs. Vancouver: Both cities face affordability challenges and tight housing supply, but Vancouver generally remains more expensive.

- Toronto vs. Montreal: Montreal offers a more affordable alternative, attracting buyers priced out of Toronto. However, both cities benefit from high migration rates, which sustain demand.

- Toronto vs. Global Markets: On the global stage, cities like New York and London grapple with overvaluation. They have been dealing with similar issues of housing affordability and market corrections.

These comparisons provide valuable insights into potential outcomes for Toronto.

What a Market Crash Could Mean for Homeowners and Investors

If Toronto’s real estate market crashes, the consequences for homeowners and investors could be significant:

- Property Values: A market crash could lead to plummeting property values, resulting in substantial losses for those who purchased at peak prices.

- Equity Reduction: First-time buyers may face reduced equity, while existing homeowners could see their investments shrink.

- Rental Income: Real estate investors relying on rental income may find their returns diminished as rental demand fluctuates.

Preparing for these potential impacts can help protect your assets.

Strategies for Buyers and Sellers in Uncertain Times

Timing is everything in a volatile market. Here are some strategies for buyers and sellers:

- For Buyers:

- Get Pre-Approved: Secure a mortgage pre-approval to understand your budget and act quickly in a competitive market.

- Consider Fixed-Rate Mortgages: Fixed-rate mortgages offer stability in uncertain times by locking in your interest rate.

- Be Patient and Flexible: Market conditions may fluctuate, so it’s essential to be flexible with your property search.

- For Sellers:

- Price Competitively: In uncertain markets, pricing your property correctly from the start can attract more buyers and lead to a quicker sale.

- Stage Your Home: Present your home in the best possible light through staging to make it more appealing to potential buyers.

- Work with an Experienced Agent: An experienced agent can provide valuable insights into market conditions and help you navigate the complexities of selling during a downturn.

Government and Regulatory Measures

The Canadian government has implemented several measures to prevent a housing market crash:

- Interest Rate Adjustments: The Bank of Canada has adjusted interest rates to make borrowing more affordable, stimulating the real estate market.

- Housing Supply Initiatives: Programs to increase the supply of affordable housing, such as easing building regulations, help balance supply and demand.

- Foreign Buyer Restrictions: By limiting foreign investment in real estate, the government aims to prevent market overheating.

Staying updated on government policies is crucial for understanding the market’s trajectory.

Lessons from Past Real Estate Market Crashes in Canada

Looking back at past market crashes, such as Toronto’s 1990s crash and the 2008 global financial crisis, provides valuable insights:

- 1990s Market Crash: The early 1990s housing market crash in Canada was marked by a significant drop in home prices and a recession that impacted economic stability and consumer confidence.

- Government Intervention: During this period, the Bank of Canada adjusted interest rates to address inflation and economic slowdown. The government introduced mortgage assistance programs to help homeowners facing financial difficulties, including options for mortgage restructuring and support for those at risk of foreclosure. There was also a focus on infrastructure spending to stimulate economic growth and create jobs, which indirectly supported the housing market. Increased regulatory measures were implemented to improve market stability and oversight, aiming to prevent future downturns.

- 2008 Crisis: While the U.S. housing market collapsed, Canada’s real estate market faced a significant downturn.

- Government Intervention: In response, the Bank of Canada implemented substantial interest rate cuts to make borrowing cheaper and stimulate the housing market. The federal government introduced incentives for first-time homebuyers, such as increasing the Home Buyers’ Plan withdrawal limits. Plus, a large economic stimulus package was rolled out, focusing on infrastructure investments to boost employment and economic activity. The Canada Mortgage and Housing Corporation (CMHC) provided insurance for high-ratio mortgages to maintain market confidence and support mortgage liquidity.

These case studies highlight the importance of government action and the resilience of the Canadian market in the face of global economic challenges.

Could a “Soft Landing” Prevent a Crash?

A “soft landing” refers to a gradual market correction rather than a crash. This ideal scenario can be achieved through:

- Gradual Interest Rate Hikes: If rates are increased too quickly, it could lead to a significant drop in demand and potentially trigger a market downturn. Moderate increases in interest rates can prevent sharp declines in demand.

- Increased Housing Supply: Boosting housing supply helps balance the market and avoid price spikes.

However, achieving a soft landing requires careful management of supply and demand dynamics, as well as responsive government policies.

What Could Trigger a Toronto Market Crash?

Several factors could trigger a market crash in Toronto:

- Economic Slowdown: A recession or job losses could dampen housing demand.

- Oversupply in the Condo Market: An oversupply of condos, coupled with reduced demand, could lead to a sharp drop in prices.

- Policy Shifts: Changes in immigration or population growth policies could reduce demand for housing, exacerbating a potential crash.

Many factors could cause the market to crash. It’s important to understand these triggers to protect your investments and make smart real estate decisions.

Long-Term Outlook for Toronto Real Estate

Despite short-term uncertainties, the long-term outlook for Toronto’s real estate market remains positive:

- Population Growth: Driven by immigration, population growth continues to support long-term housing demand. According to figures from CREA, international immigration added 92,722 people to Ontario’s population in the first quarter of 2024.

- Economic Recovery: Economic growth is expected to strengthen in the latter half of 2024, driven by a pickup in exports and household spending. As interest rates gradually ease, consumer confidence and spending are anticipated to rise further in 2025. A strong economic recovery could bolster confidence and real estate activity.

While corrections may occur, Toronto’s real estate market is expected to remain resilient in the face of challenges.

Final Thoughts

Predicting when Toronto’s real estate market might crash isn’t easy because of the complex factors at play. While there are risks, such as overvaluation, strong demand and government actions provide some protection against a major downturn.

For buyers, sellers, and investors, staying informed and ready for different scenarios is crucial. By understanding market dynamics and adopting smart strategies, you can confidently navigate the uncertainties of Toronto’s real estate market.

Source & Citations:

- https://www.nerdwallet.com/ca/mortgages/canada-housing-market-crash

- https://economics.td.com/ca-provincial-housing-outlook

- https://www.elevatepartners.ca/resources/2024-toronto-real-estate-outlook/

- https://www.noradarealestate.com/blog/toronto-housing-market/

- https://gordcollins.com/real-estate/toronto-market-forecast/

- https://www.canadianrealestatemagazine.ca/news/canada-real-estate-2024-trends-in-toronto-vancouver-montreal/

- https://www.koho.ca/learn/the-housing-market-in-toronto-vs-vancouver-what-you-need-to-know/

- https://www.condosales.ca/canada-real-estate-2024-trends-in-toronto-vancouver-montreal/

- https://www.emergenresearch.com/blog/analyzing-the-real-estate-market-across-canada

- https://wowa.ca/montreal-housing-market

- https://www.nesto.ca/real-estate/canadian-housing-market-outlook/

- https://www.noradarealestate.com/blog/toronto-housing-market/

- https://toronto.citynews.ca/2024/06/25/inside-torontos-slumping-condo-market/

- https://www.movesmartly.com/monthly-report-2024-june

- https://www.mortgagesandbox.com/toronto-real-estate-forecast

- https://thoughtleadership.rbc.com/wp-content/uploads/Canadian-Housing-Market-Forecast-Update-2024.pdf

- https://www.cbre.ca/insights/reports/canada-market-outlook-2024