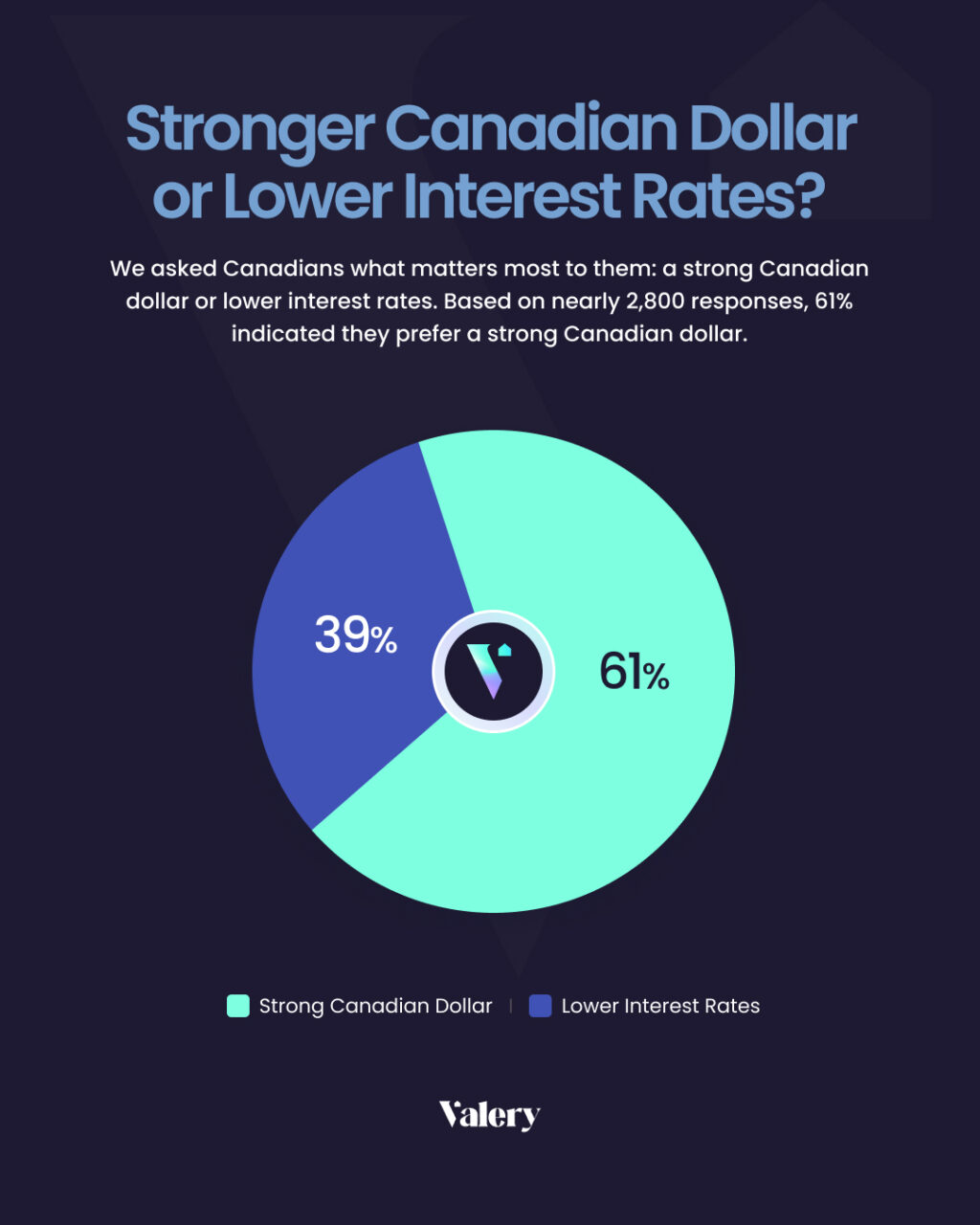

Valery’s latest survey asked Canadians to choose between two economic priorities: a strong Canadian dollar or lower interest rates. Even after the Bank of Canada’s latest 50 basis point (bps) rate cut, reducing the overnight rate to 3.25%, the results were decisive – 61% favored a strong dollar, while 39% preferred lower interest rates. These preferences highlight Canadians’ concerns about economic stability, purchasing power, and long-term prosperity. In this special report, we’ll explore why Canadians prioritize a strong currency, what it says about their economic realities, and how this choice impacts key areas such as inflation, trade, and real estate.

Why Canadians Fear a Weak Dollar

The Imported Inflation Effect

One of the most immediate consequences of a weak currency is imported inflation. Imported inflation occurs when the cost of goods and services purchased from abroad rises due to a devalued domestic currency. For a country like Canada, where imports play a significant role in daily life, this can have far-reaching effects. Everything from energy to groceries to electronics becomes more expensive, creating a ripple effect that impacts every household.

Consider Canada’s reliance on international markets for essential goods. For example, Canada imports over $9 billion worth of fresh fruits and vegetables annually, according to the latest statistics. A weaker dollar would increase these costs, making healthy eating less affordable for Canadian families. Similarly, the cost of fuel – a commodity largely tied to global prices – would rise, further straining household budgets.

A Global Perspective on a Weak Dollar

Beyond domestic concerns, a weak Canadian dollar would also reduce Canadians’ purchasing power on the global stage. Whether traveling abroad or shopping online, a weaker dollar means Canadians get less for their money. This diminished purchasing power can also hurt Canada’s trade balance. While a weaker dollar might make Canadian exports cheaper and more competitive globally, the benefits are often neutralized by the rising costs of importing raw materials and goods needed for production and consumption.

Additionally, a weak dollar makes Canada less attractive for international talent. Skilled workers might prefer countries with stronger currencies, where their earnings have greater global value, creating long-term economic challenges for Canada.

The Lower Interest Rates Conundrum

How Interest Rates Influence the Dollar

Interest rates play a crucial role in determining the value of a currency. Higher interest rates attract foreign investment, increasing demand for the Canadian dollar. Conversely, when interest rates are lowered, the ROI on holding Canadian dollars diminishes. This reduced demand weakens the currency.

Canada’s current interest rate policy reflects a balancing act between fostering domestic economic growth and maintaining the strength of the dollar. While lower rates make borrowing more affordable, they come with trade-offs that Canadians are increasingly wary of.

Our one saving grace is oil. The Canadian dollar (CAD) is often referred to as a “petrodollar” because its value is significantly influenced by the global demand for oil and other natural resources that Canada exports. Canada is one of the largest oil producers in the world, and its crude oil exports, primarily to the United States and other global markets, are priced in Canadian dollars. This creates a unique dynamic where international demand for Canadian oil directly translates into demand for the CAD.

Borrowing Costs vs. Currency Strength

Lower interest rates are typically celebrated for making mortgages and loans more accessible. For Canadians hoping to buy their first home, lower borrowing costs can make the dream of homeownership a reality. However, these benefits are offset by the weakening of the dollar, which drives up the cost of imported goods and contributes to inflation.

To put it simply, the relationship between interest rates and the dollar is like a seesaw – when one goes down, the other often follows. Canadians’ preference for a strong dollar suggests a growing awareness of this trade-off, as they recognize the broader economic stability that comes with a stronger currency.

The Dollar’s Impact on Canadian Real Estate

Foreign Investment

A falling dollar has a unique impact on Canada’s real estate market, particularly in attracting foreign investors. Despite the government’s foreign buyer ban, which was recently extended to 2027, loopholes remain. Foreign investors can still purchase properties in non-Census Metropolitan Areas (CMAs), as well as commercial properties or residential buildings with more than four units. A weaker dollar makes these investments even more attractive, as it effectively lowers the relative price for buyers holding stronger foreign currencies.

For example, a commercial property valued at $5 million CAD becomes significantly cheaper in USD when the dollar weakens. This dynamic creates opportunities for foreign investors, even as domestic affordability worsens.

This potential increase in foreign investment, especially in multi-unit residential and commercial properties, can have a cascading effect on housing prices. If foreign capital floods into these sectors, competition would intensify, driving up prices for these types of properties. This may also indirectly impact related segments of the housing market. For instance, rising demand for multi-unit residential buildings may push developers to prioritize such projects over single-family homes or smaller rental units, further straining supply in those categories. This trend is evident by the growth in purpose-built rental housing starts in Canada alongside falling single-family ownership starts. Ultimately, would lead to overall price inflation in the real estate market, compounding challenges for domestic buyers and renters.

Why Canadians Value a Strong Dollar

Economic Stability and Confidence

Canadians’ preference for a strong dollar is rooted in their desire for economic stability. A strong currency helps control inflation, preserves purchasing power, and ensures that Canadians can maintain their standard of living. It also reflects confidence in the country’s economic fundamentals, from robust trade policies to effective monetary management.

Long-Term Benefits vs. Short-Term Gains

While lower interest rates may offer short-term relief for borrowers, Canadians seem to prioritize the broader, long-term benefits of a strong dollar. This preference aligns with a focus on preserving economic resilience and ensuring that Canada remains competitive in an increasingly interconnected global economy.

Policy Implications and the Path Forward

The survey results reveal a clear message for policymakers: Canadians value economic stability and are wary of the trade-offs that come with lower interest rates. To address these concerns, a balanced approach is necessary – one that prioritizes the strength of the Canadian dollar while implementing measures to support affordable borrowing and housing.

An example of such a targeted intervention is the recent mortgage reform, allowing 30 year insured mortgage amortizations for first-time homebuyers purchasing new builds. Others may include ones like investments in domestic manufacturing to reduce reliance on imports. These strategies could mitigate the negative effects of a weaker currency while preserving the benefits of lower interest rates.

Conclusion

The choice between a strong Canadian dollar and lower interest rates is about more than just money – it’s about what matters most to Canadians: stability, security, and staying competitive in a world where global economic connections are more vital than ever. Choosing a strong dollar says a lot. It protects what we can afford, keeps inflation in check, and shows Canada’s strength globally. During uncertain times, this sends a clear message to policymakers: stop focusing on quick fixes and start planning for lasting solutions.

The survey reflects the preferences of 1003 Instagram users and 1803 Twitter users who participated in the survey. The reported results include 95% confidence intervals, which quantify the statistical uncertainty around the observed proportions under the assumption of simple random sampling. For example, the confidence intervals suggest that, if this poll were repeated under identical conditions, the true population proportions would fall within the calculated range 95% of the time.

However, it is critical to acknowledge that this survey is not based on random sampling; participation is subject to self-selection bias and platform-specific demographic skew. These factors violate the assumptions of classical inference, limiting the external validity of these results. While the confidence intervals accurately describe sampling error, they do not account for potential biases introduced by the non-random nature of the sample. Consequently, these findings should be interpreted as descriptive of this specific respondent group rather than predictive of the broader population.

About the Author

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe & Mail. His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.