September’s GTA real estate update paints a picture of activity without stability. Sales climbed after the Bank of Canada’s rate cut, but prices continued to slip and inventory swelled nearly 19%. With homes sitting longer, the data shows the bottom has yet to arrive.

Table of Contents

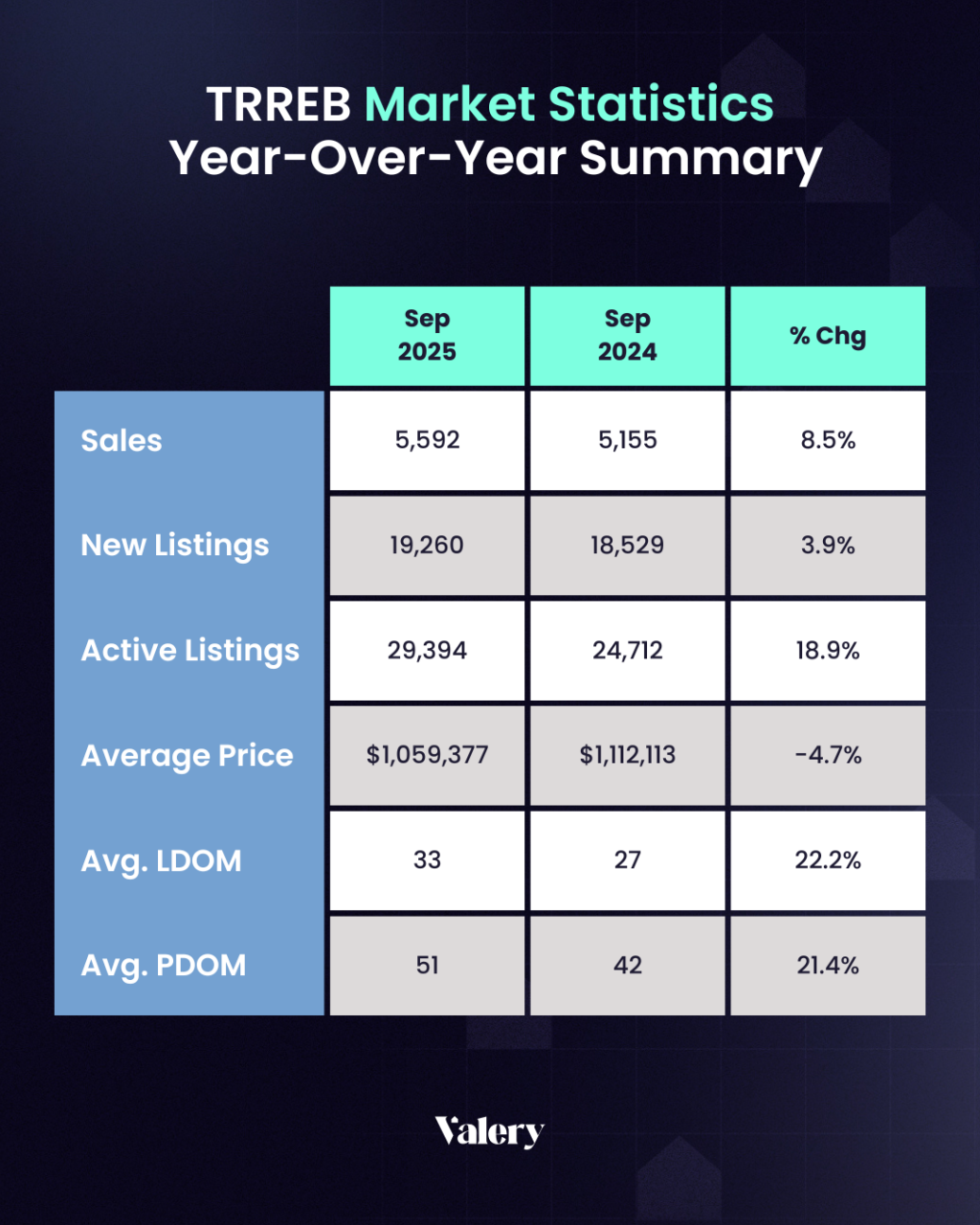

September’s data for Greater Toronto Area (GTA) real estate offered a headline that might have suggested momentum. Sales rose 8.5 per cent compared with a year earlier, and the Bank of Canada’s September rate cut provided a modest boost to affordability. More households stepped into the market as mortgage payments became marginally easier to manage. On the surface, it appeared that conditions were improving. Yet beneath this uptick lies a market still defined by falling prices, expanding inventory, and longer selling times. The result is activity without balance, a system that looks busy but remains under strain.

TRREB reported an average sale price of $1,059,377 in September, down 4.7 per cent year-over-year. The MLS Home Price Index fell by 5.5 per cent, underscoring the erosion of valuations. Month-to-month prices appeared flat, but the underlying trend is one of downward pressure as supply continues to grow faster than demand.

Supply Rising Faster Than Demand

The year-over-year summary underscores the fragility of this so-called recovery. Active listings increased by nearly 19 per cent compared with September 2024, while sales grew at less than half that rate. New listings edged up just 3.9 per cent, but with homes lingering longer, total inventory swelled to 29,394. Properties are now taking more time to move, with average listing days rising from 27 to 33 and property days on market extending from 42 to 51.

As I alluded to in my tweet, this imbalance remains the defining feature of the market. As long as supply expands more quickly than demand, price stability will prove elusive.

Geographic Divides and Product-Level Disparities

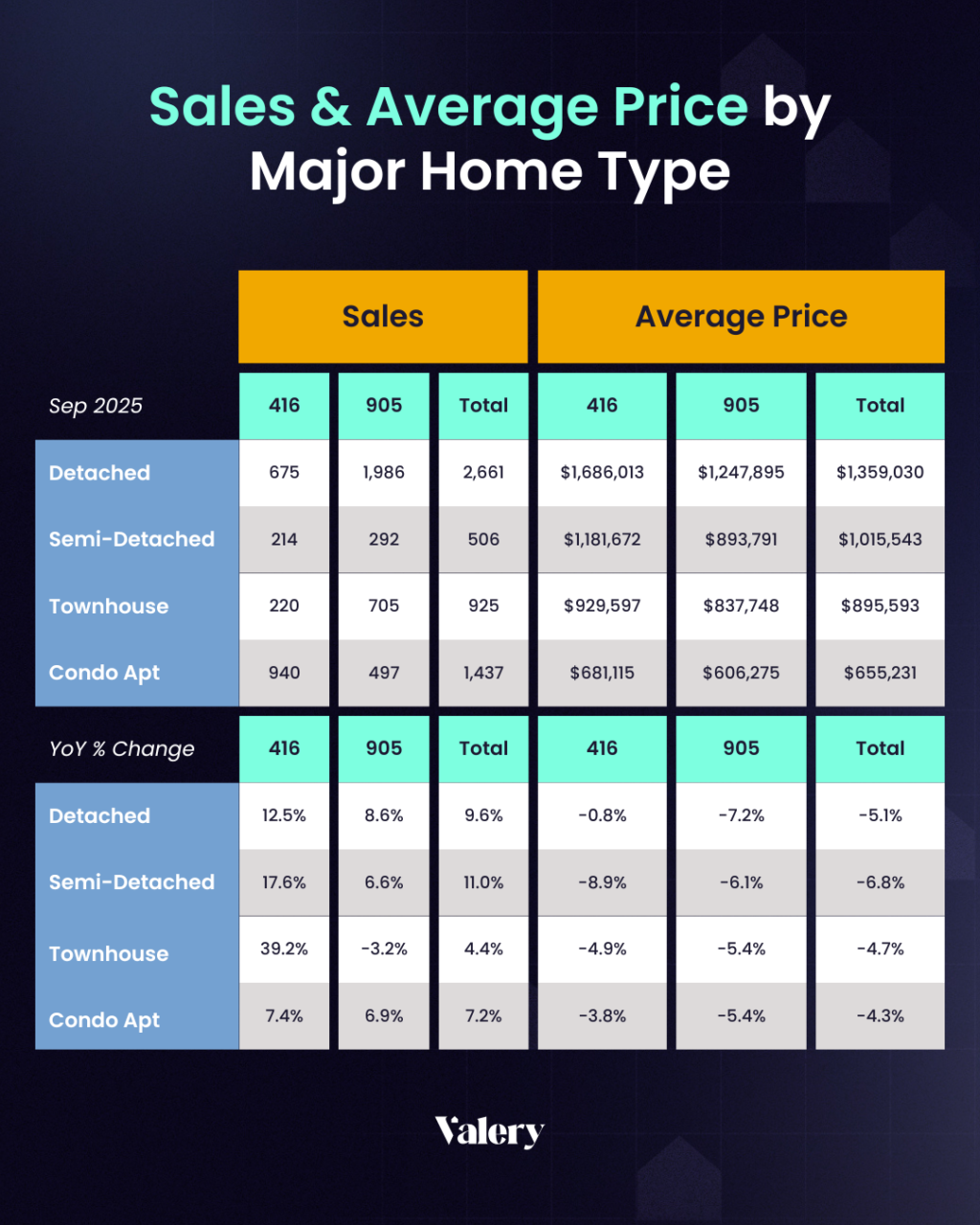

The data by home type reveal sharp contrasts across segments. Detached sales climbed 9.6 per cent year-over-year, yet average prices slipped 5.1 per cent. Semi-detached homes registered an 11 per cent increase in sales alongside a 6.8 per cent drop in prices. Condominiums gained 7.2 per cent in sales while losing 4.3 per cent in value.

Townhouses in the 416, however, present an anomaly. Sales soared by nearly 40 per cent compared with last year, the strongest performance of any category. Prices still declined by almost 5 per cent, but the volume of transactions points to a clear preference for ground-oriented housing that is relatively more attainable than detached homes while providing more utility than a condominium.

The regional divide adds another layer. Detached homes in Toronto proper declined by less than 1 per cent, while suburban detached homes in the 905 lost 7.2 per cent of their value. Urban markets show relative resilience, whereas suburban ones are adjusting more sharply. The townhouse trend inside Toronto underscores the persistent demand for so-called “missing middle” housing, even in an otherwise weakening landscape.

Economic Strain and Fragile Confidence

These developments are unfolding against a challenging macroeconomic backdrop. GDP contracted by 1.6 per cent in the second quarter, and Toronto’s unemployment rate has risen to 9 per cent. Inflation is still below Bank of Canada’s 2.0 per cent target, creating room for further monetary easing, yet households remain cautious. Even with slightly cheaper borrowing, buyers are negotiating harder, leveraging abundant supply to secure discounts.

Lower interest rates can encourage spending and provide modest support for the wider economy. But a real estate market that depends on falling rates to sustain activity reflects deeper vulnerabilities in affordability and income growth. Monetary policy can buy time; it cannot create structural balance.

What Comes Next

The trajectory of the GTA real estate market will depend on whether demand can eventually absorb the build-up of supply. Further rate cuts may spur additional sales, but they will not correct oversupply or restore seller confidence. Policymakers and builders must focus on aligning new housing with actual affordability rather than relying on credit cycles that swing between overheating and retrenchment.

For buyers, this remains a rare period of advantage, marked by choice, longer timelines, and negotiating power. For sellers, the pressure to recalibrate expectations is intensifying. The September numbers point to a clear conclusion. The GTA housing market has not yet found its bottom, and until supply and demand move into closer alignment, recovery will remain more appearance than reality.

At Valery, we help clients move with insight. Whether you’re looking to enter, exit, upgrade, or invest, the opportunity is there. You just need to move with clarity.

Our AI is trained on the latest market data and local trends, so your next move is grounded in real-time intelligence.

Get your personalized, AI-crafted real estate playbook that fits this market and your goals.

Frequently Asked Questions (FAQs)

Q: Are GTA real estate sales actually recovering?

A: Sales in GTA real estate rose 8.5 per cent year-over-year in September 2025, partly due to the Bank of Canada’s rate cut improving affordability at the margins. However, this growth is modest compared with the nearly 19 per cent rise in active listings. Activity is higher, but the market remains imbalanced.

Q: Why are GTA real estate prices still falling despite more sales?

A: Prices are retreating because supply continues to outpace demand. The average sale price across GTA real estate was $1,059,377 in September, down 4.7 per cent from last year, with the MLS Home Price Index sliding 5.5 per cent. Buyers have leverage in negotiations, which keeps valuations under pressure.

Q: Which GTA real estate segments are performing differently?

A: Detached home sales rose 9.6 per cent, but prices dropped 5.1 per cent. Semi-detached homes saw sales rise 11 per cent with prices down 6.8 per cent. Condos were up 7.2 per cent in sales but lost 4.3 per cent in value. The standout was 416 townhouses, with sales up nearly 40 per cent year-over-year, showing strong demand for family-sized, ground-oriented GTA real estate even as prices dipped.

Q: How do Toronto and the 905 suburban markets compare?

A: GTA real estate data from TRREB shows resilience in Toronto proper, where detached prices fell less than 1 per cent, versus the 905 suburbs where detached homes lost 7.2 per cent in value. Suburban markets are bearing the brunt of the correction, while central Toronto shows more stability.

Q: What role does the economy play in GTA real estate trends?

A: Economic headwinds are shaping buyer behavior. GDP contracted by 1.6 per cent in Q2 and Toronto’s unemployment hit 9 per cent. Even with inflation cooling to 1.7 per cent and lower borrowing costs, GTA real estate buyers remain cautious, negotiating harder and relying on oversupply to secure better deals.

Q: Will further rate cuts stabilize the GTA real estate market?

A: Additional Bank of Canada rate cuts may increase sales activity, but they will not address oversupply or affordability challenges. A sustainable GTA real estate recovery depends on aligning new housing with incomes, not just credit cycles.

Q: What does this mean for buyers and sellers in GTA real estate?

A: For buyers, the GTA real estate market currently offers leverage with abundant choice and longer timelines to negotiate. For sellers, conditions are more difficult, with rising inventory and downward price pressure. Both sides should be prepared for continued volatility until supply and demand converge.

ABOUT THE AUTHOR

Daniel Foch is the Chief Real Estate Officer at Valery, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, The Globe & Mail, Storeys and Real Estate Magazine (REM). His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.