Table of Contents

With the federal election now concluded, many potential home sellers are asking the same question: What will happen to the housing market in the coming months? Will demand go up, or will economic uncertainty perpetuate the slowdown observed since the last few months? Timing, of all factors, will be the most crucial one helping you make the decision to sell in this post-election period.

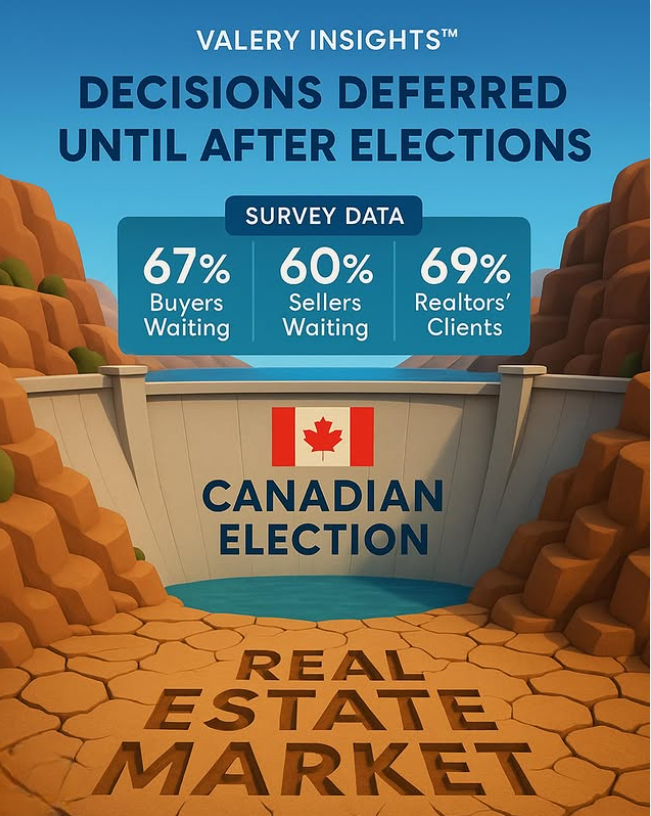

Elections in Canada have often directed stakeholders in the housing market, including homesellers, to take a ‘wait and see’ approach, leading to a pause or decline in activity. The 2025 federal election was no exception (check out the infographic below). But does history really suggest that selling post-election puts you in a better position? Or is that just a common misconception?

In this blog, we examine data from Canada’s last three federal elections (2015, 2019, and 2021) to reveal how the housing market behaves once the government takes charge in Ottawa and what this could imply for your selling strategy in 2025.

A Look Back: How Has the Market Reacted After Past Elections?

2015

In the lead-up to the 2015 federal election, here is what the market looked like: Big cities like Toronto and Vancouver were booming. The interest rates were low (0.50% as of Aug 2015), and limited inventory pushed prices higher and higher. However, in other places, things did not look encouraging. In Calgary, a market dependent on the energy sector, sales declined because falling oil prices jolted the local economy.

Even after the new government assumed charge, the Toronto and Vancouver markets kept growing. National monthly sales hit a six-year high in November, a month after the election, and prices rose over 10 per cent compared to the previous year. Persistently low inventory kept driving the prices up. The momentum carried into 2016, especially in Ontario and B.C., where even markets like Hamilton showed signs of overheating. However, Calgary continued to struggle till late 2016 due to the unemployment caused by low oil prices.

Overall, the election did not negatively affect Canada’s hot housing markets. Post-election data only confirmed further gains. In these markets, the underlying forces (low supply, strong demand, and low interest rates) were so strong that they ensured any pre-election pause was negligible. The difference between these markets and ones like Calgary signified that regional economic fundamentals play a pivotal role in market activity.

2019

Before the 2019 election, the Canadian housing market had entered recovery mode after a slowdown brought about by policy interventions like Ontario’s Fair Housing Plan, the OSFI mortgage stress test and previous interest rate hikes. From a six-year low in February 2019, national sales started trending upward through the spring and summer. GDP growth was moderate, and affordability concerns made real estate a burning issue in election debates.

The recovery accelerated after the Liberal minority win. Throughout the country, tightening supply became a standout characteristic, with new listings falling sharply while sales rose year-over-year. Key indicators like the sales-to-new-listings ratio (66.3 per cent, November) and Months of Inventory (4.2, November) were pushed into seller’s market territory, furthering price growth. GTA saw double-digit year-over-year increases in home sales (+14.2 per cent, November), while Vancouver’s sales rebound signalled stabilisation after previous slumps.

The direct impact of the 2019 election on the market was very little. Stability in interest rates (1.75 per cent throughout 2019) and pre-election recovery trends drove conditions forward. However, the deepening supply shortage, a critical post-election development, combined with rising demand, set the stage for sustained price growth moving forward.

2021

Prior to the snap election in September 2021, the housing market was still hot, though slightly cooler than the frenzy of spring. Record low interest rates (0.25 per cent, which continued till Mar 2022) and pandemic-related shifts in housing preferences made sure that sales remained well above historical norms. In addition, there were severe supply shortages across most markets, deteriorating affordability and making it a key election issue as in 2019.

The election returned another Liberal minority government, and the market sharply re-accelerated. Home sales across Canada increased 8.6 per cent month-over-month in October, forcing the sales-to-new-listings ratio (SNLR) to 79.5% and Months of Inventory (MOI) to go down to just 1.9 months, i.e., extreme seller’s market conditions. Prices surged 18.2 per cent year-over-year. Major markets like GTA and Vancouver saw intense competition as buyers rushed to secure purchases before the anticipated rate hikes in 2022.

The conclusion of the 2021 election removed political uncertainty and allowed powerful forces (rock-bottom interest rates, pandemic-driven demand, and critical supply shortages) to dominate. Unlike previous elections, where regional disparities were evident, we saw broad-based market strength across major cities. However, the first few months after the election saw a final burst of activity before rising rates resulted in a correction the next year.

Why the Market Moves After an Election

Political Certainty and Market Confidence

Election periods bring about uncertainty related to future government direction, policy changes, and economic management, leading many buyers and sellers to temporarily pause their decisions, causing a market slowdown. But as we have seen in the previous section, once the government takes charge, confidence is usually restored, prompting a resumption or rebound in market activity as pent-up demand and supply return.

Housing Policy: Election Promises vs. Post-Election Realities

After 2015, the most crucial issue in the election related to housing has been affordability, with all parties having proposed various supply- and demand-side policies to fix it. However, what is important to note is that while campaign promises signal long-term intentions, their real-world impact is not as prompt as voters anticipate due to legislative, funding, and implementation delays.

The Macroeconomic Backdrop: Interest Rates, Economy, and Employment

It is safe to say from what we’ve observed in previous election cycles that the broader macroeconomic environment, which includes interest rates, economic growth, and employment, plays a far more critical role in the short-term housing market performance than all other factors combined. Low interest rates in 2015 and 2021 fuelled strong demand and price growth. GDP growth and labour market conditions affect purchasing power too, as was evident in Alberta’s post-2015 energy sector slump, which subdued activity.

Majority vs. Minority Governments: Does It Matter?

Majority governments are typically expected to offer greater political stability and policy clarity, while minority governments carry potential for uncertainty and compromise. With that said, the type of government formed, whether majority or minority, seems to have little influence on immediate housing market performance post-election, as observed in the last three ones. Following the 2015 Liberal win, strong markets carried on from where they left off. With minority governments in 2019 and 2021, housing activity was unaffected by political structure.

What Sellers Can Expect in the Coming Months

We provide prospective sellers with three realistic scenarios for the housing market following the election, based on past results as well as the current political and economic climate:

Scenario 1: Gradual Recovery

If trade shocks are avoided, inflation stays controlled, and rate cuts continue, we can expect the market to recover steadily with moderate price growth.

Scenario 2: Economic Slowdown or Trade Shock

If the U.S. implements new tariffs, this could result in job losses, increasing unemployment and lowering confidence. With the cooling demand that would follow, housing prices would go down, particularly in export-driven regions.

Scenario 3: Supply-Driven Stability

If supply-related proposals overcome municipal and construction roadblocks, increased housing stock could stabilise prices and improve affordability. This is something for the long term, though.

While the Liberal party has promised a strong commitment to housing, movements immediately after the election will depend more on interest rate trends, economic confidence, and external trade factors.

Conclusion: Navigating the Housing Market After the 2025 Federal Election

Historical analysis of the Canadian housing market reveals that markets typically rebound or resume previous trends once political clarity in Ottawa returns. However, immediate post-election activity is driven less by the election outcome or government structure and more by core fundamentals, particularly interest rates, supply-demand balance, and regional economic health.

The market after the 2025 federal election will operate under significantly different conditions than those following previous ones. Therefore, we advise potential sellers to focus more on contemporary drivers of housing market activity: Bank of Canada monetary policy, inflation trends, economic growth, employment figures, and, crucially, the supply and demand dynamics within their specific local market.

Successfully navigating the post-election market will require staying up-to-date on these indicators. Valery, our AI Chatbot, will help you do just that.