Power of Sale filings in Ontario are rising at the fastest pace in over a decade, exposing the cracks in Canada’s debt-driven housing market. Understanding this will help stakeholders spot opportunities and risks as the market adjusts.

Table of Contents

Amid the noise of fluctuating sales volumes and cautious rate cuts, a more telling measure of Canada’s housing stress is rising largely unnoticed. Power of Sale filings, Ontario’s unique mechanism for forced disposition, are climbing at the fastest pace in over a decade. What appears to be a technical process is in fact the most revealing indicator of where the housing cycle now stands. It is here, in the spread of compelled listings, that the country’s reliance on leverage, speculation, and private credit meets its moment of reckoning.

What is the difference between Power of Sale and foreclosure?

Unlike the American foreclosure spectacle, Ontario’s Power of Sale is an orderly process designed to protect lenders and preserve market integrity. Lenders do not seize title outright but acquire the right to sell once notice periods expire. They are compelled to seek fair market value, list through MLS, and account for any surplus to the borrower or other creditors. Any shortfall remains the borrower’s liability.

The effect is gradual rather than dramatic. There are no courthouse auctions, no homes changing hands for pennies on the dollar. Instead, Power of Sale listings seep into the market, priced pragmatically, often reduced until they move. Each one sets a new comparable, signalling distress in ways that ripple far beyond the individual borrower.

How quickly are Power of Sale listings increasing?

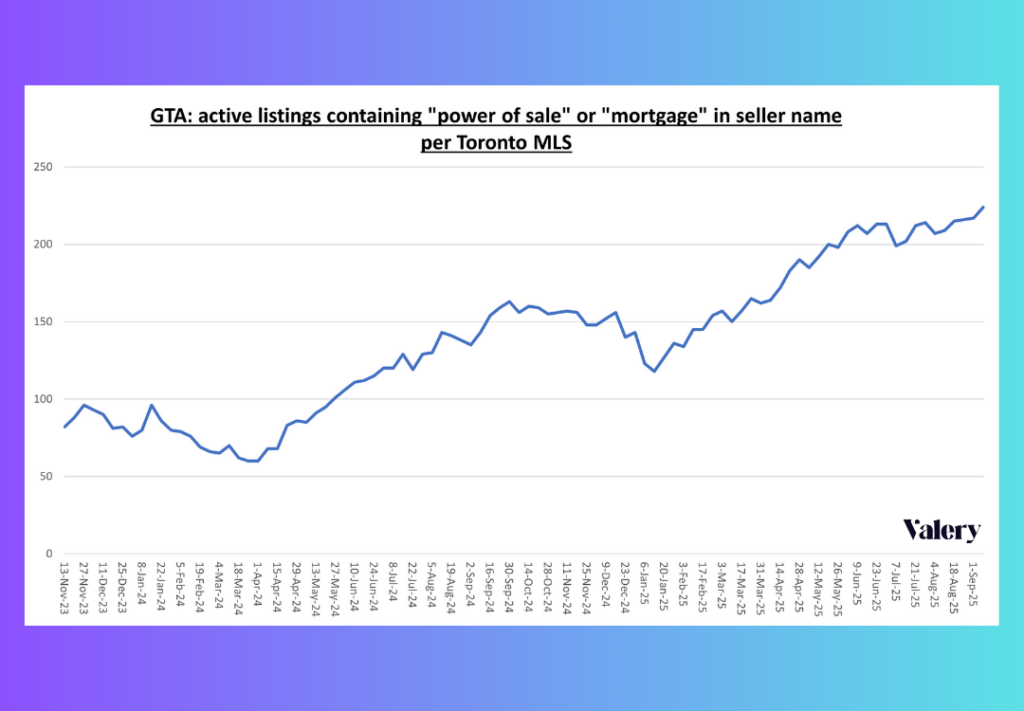

The pace of increase is stark. In September 2025, Greater Toronto recorded 228 active Power of Sale listings, up from 143 a year earlier, a 59 per cent rise. Broader tallies that capture less transparent cases suggest the figure may be closer to 780. During the pandemic boom, months passed with only four such listings.

Detached homes lead this rise, but the most striking trend lies in condominiums. Condos now account for nearly half of all Power of Sale cases in Toronto proper, many linked to investors who accumulated multiple units with negative cash flow. Their models, predicated on endless appreciation, have collapsed under the weight of higher borrowing costs and weakening demand.

Who is really driving the increase in forced sales?

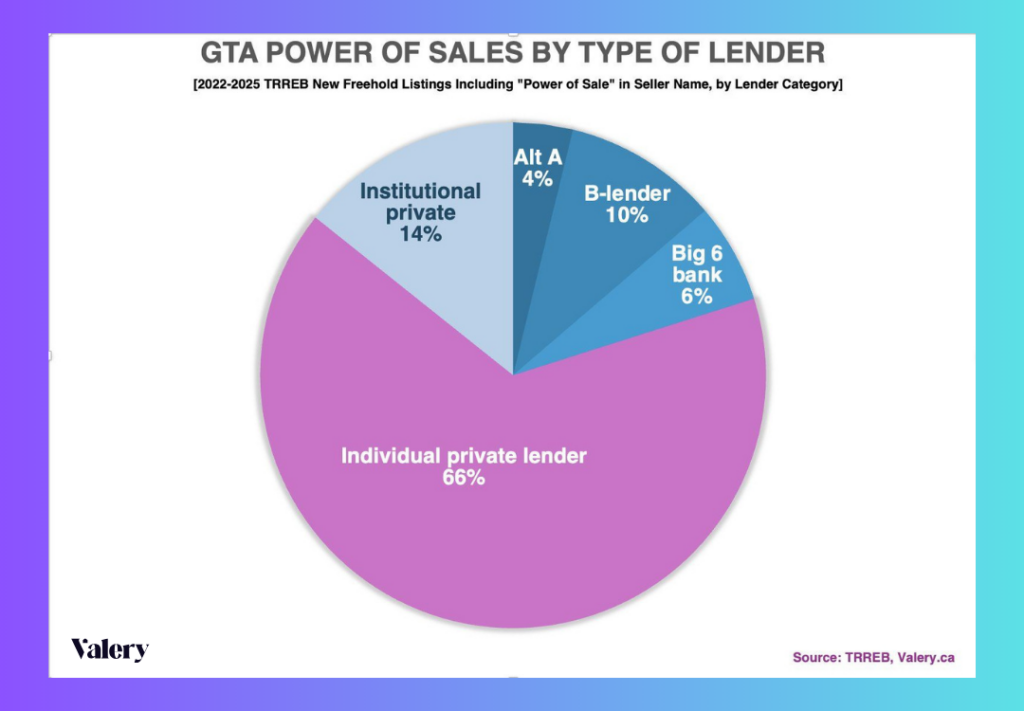

Perhaps the most consequential feature of the current cycle is not who is losing homes, but who is initiating the disposals. Roughly two-thirds of Power of Sale filings since 2022 have been launched not by Canada’s chartered banks, but by private lenders. These are often individuals who borrowed against their own homes through HELOCs and re-lent the proceeds at double-digit rates. For years, this strategy appeared to be an ingenious way to capture spread. Today, it is unravelling.

Second-position lenders are now being wiped out entirely, as sale proceeds flow first to property taxes, legal costs, and the primary mortgage. The shortfall leaves them exposed to six-figure losses. Because these loans were frequently funded by debt secured on their own residences, the feedback loop is severe. Private lenders lose capital, yet remain liable for their own borrowing. What began as a strategy to amplify returns has become a mechanism of contagion, transmitting stress from distressed borrowers back into middle-class balance sheets.

How does the wider economy amplify the strain?

This wave of distress is colliding with other destabilising forces. Unemployment in the GTA has climbed to nearly ten per cent, the highest in more than a decade outside of the pandemic shock. The renewal wall looms, with the majority of mortgages originated in 2020 and 2021 at two per cent now resetting at more than double those rates. On a $600,000 balance, payments rise by over $1,400 a month.

At the same time, equity cushions have thinned. Prices have retreated to 2021 levels, erasing the automatic refinancing escape hatch that once bailed out troubled borrowers. Recent buyers, particularly in pre-construction projects, now face appraisals below purchase price and rents insufficient to cover carrying costs. Some are walking away from deposits, others are listing brand-new units at losses, and many more are being drawn into Power of Sale proceedings.

What are the implications for policymakers and lenders?

Canada is unlikely to replay the American foreclosure crisis of 2008. Its legal structures and banking conservatism ensure that. Yet the attritional rise of Power of Sale is no less significant. It signals the limits of the country’s debt-fuelled housing model, exposes the fragility of its shadow credit market, and threatens to prolong the downturn by eroding confidence.

For policymakers, the challenge is twofold. They have to confront the role of non-bank credit that has quietly underwritten much of the recent boom, and prepare for the social consequences of a slow grind in which households lose equity, lenders absorb losses, and confidence dissipates. For the Big Six banks, the imperative is vigilance. If unemployment remains elevated into 2026, the contagion now visible among private lenders may well migrate upward.

Where does the housing cycle go from here?

Housing markets do not recover until unemployment and arrears peak. On current trajectories, that point lies in late 2026 or early 2027. Until then, Power of Sale filings will continue to mount. Each is both a personal financial collapse and a systemic marker, signalling that Canada’s housing cycle is entering its most testing phase in a generation.

The true risk lies in the gradual attrition of confidence, as each compelled listing expands supply, resets valuations, and unsettles buyers. For households, investors, and policymakers, the lesson is clear. The reckoning has begun, and it will unfold not in sudden drama, but in the steady accumulation of Power of Sale.

If you’re interested in finding a power of sale property in Ontario, sign up to our email list where you’ll get the best power of sale deals straight to your inbox for free.

Frequently Asked Questions (FAQs)

1. What is Power of Sale?

Power of Sale is Ontario’s legal process that allows lenders to sell a property when a borrower defaults. Unlike foreclosure, the lender doesn’t take title but instead lists the home, aiming for fair market value.

2. How is Power of Sale different from foreclosure?

Foreclosure transfers ownership of the home to the lender, often through court proceedings. Power of Sale is faster, less dramatic, and requires the property to be marketed openly, usually on MLS.

3. Why are Power of Sale listings rising now?

A mix of higher interest rates, negative cash flow on investment properties, and rising unemployment is driving more borrowers and their private lenders into distress.

4. Who is most affected by the surge in Power of Sale?

Private lenders, not banks, have triggered most filings since 2022. Many are losing their investments entirely when sale proceeds fail to cover both the first mortgage and their second-position loans.

5. What does this mean for Canada’s housing market?

The rise in Power of Sale signals deep financial stress. It won’t cause a foreclosure-style crash, but it will weigh on confidence, push prices lower, and prolong the housing downturn.

About the author

Daniel Foch is the Chief Real Estate Officer at Valery, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, The Globe & Mail, Storeys and Real Estate Magazine (REM). His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.