In Ontario real estate, power of sale and motivated seller are two terms that signal urgency but mean very different things. One is a lender-driven process and the other reflects a homeowner’s need to sell quickly. Knowing the difference helps buyers, investors, and realtors make smarter decisions in today’s market.

Table of Contents

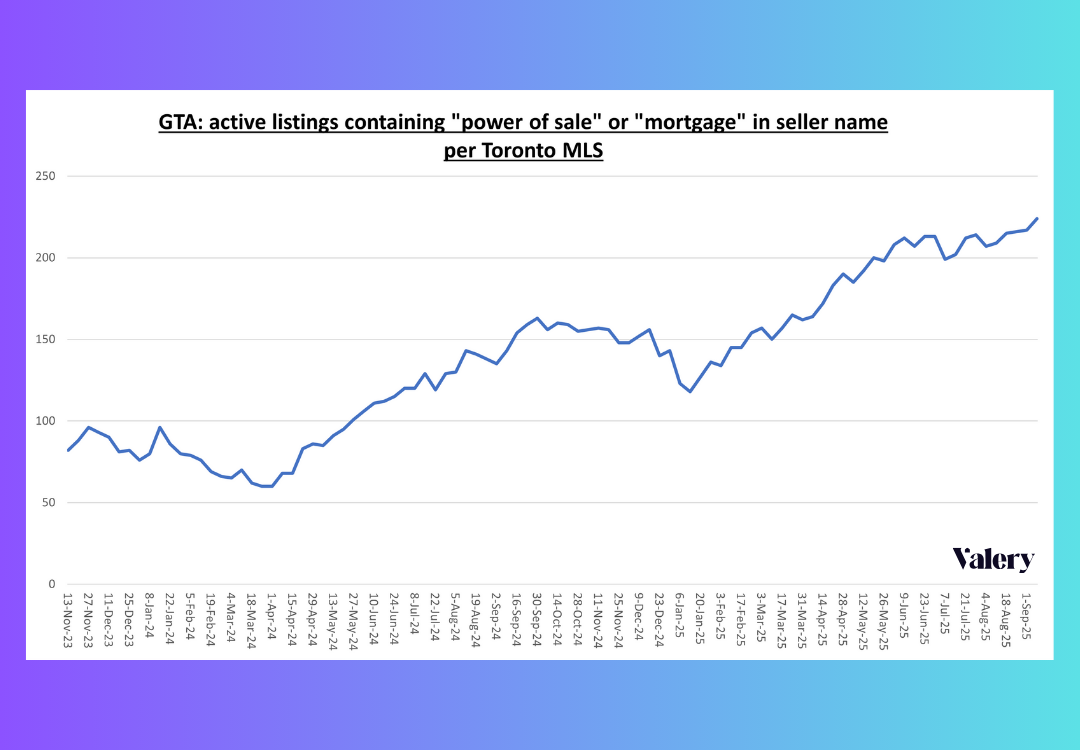

In today’s housing market, terms like power of sale and motivated seller are appearing more frequently in conversations, listings, and investor strategies. While both suggest urgency and potential opportunity, they mean very different things. Understanding the distinction is especially important for buyers and investors in Ontario, where power of sale homes have been climbing and more sellers are showing signs of financial stress. The chart from one of our previous blog pieces on power of sale, illustrates this trend.

In this guide, we’ll break down the meaning of each, compare power of sale vs motivated seller, and explore what these terms mean for homebuyers, real estate investors, and realtors.

What is a Power of Sale?

The power of sale meaning in Canadian real estate law is simple. It allows a lender to sell a property when the borrower defaults on their mortgage. Unlike foreclosure, which transfers ownership of the home to the lender, a power of sale keeps ownership with the borrower until the property is sold. The lender acts to recover the debt as quickly as possible, often through a real estate listing.

In Ontario, power of sale is the most common remedy for mortgage default because it is faster and less costly than foreclosure, as outlined in the province’s Mortgages Act. When browsing MLS, you might see homes listed as “Power of Sale” or “POS,” which signals that the property is being sold by the lender rather than the homeowner.

Buyer advantages:

- Prices are often below market value.

- Properties can be available quickly.

- Buyers may face less competition compared to traditional sales.

Risks to consider:

- Homes are sold “as-is,” meaning repairs or damage are the buyer’s responsibility.

- Limited ability to negotiate with the lender.

- Potential for competing claims if other creditors are involved.

What is a Motivated Seller?

A motivated seller refers to a homeowner eager to sell quickly due to personal, financial, or situational reasons. The term does not carry legal implications but signals that the seller is more flexible on price, terms, or conditions.

Motivations can include:

- Financial pressure, such as mounting debt or job loss.

- Relocation for work or family.

- Divorce or separation.

- Inheritance of a property they don’t wish to keep.

Why investors seek them out:

Motivated sellers often present opportunities for below-market purchases, quicker closings, or creative deal structures. In competitive markets where good properties are scarce, motivated seller leads can give investors an advantage by revealing opportunities that may not be available through traditional listings.

How to Buy Power of Sale Homes in Ontario

Buying power of sale homes in Ontario requires preparation and careful due diligence. Here’s a step-by-step overview:

- Find listings: Search MLS or specialized pages featuring Ontario power of sale properties.

- Arrange financing early: Lenders typically want a quick sale, so pre-approval is essential.

- Conduct due diligence: Even though properties are sold “as-is,” always inspect for damage, liens, or unpaid taxes.

- Make an offer: Be prepared for strict timelines and minimal negotiation.

- Close quickly: Power of sale transactions often move faster than traditional deals.

Risks buyers should note:

- Limited disclosure from the lender.

- Repairs or hidden issues may become expensive.

- Competition is rising as more investors pursue distressed opportunities.

How to Find Motivated Sellers in Real Estate

Identifying a motivated seller requires more networking and creative prospecting than simply scanning MLS.

Strategies include:

- Networking: Realtors, wholesalers, and lawyers often know clients under pressure to sell.

- MLS filters: Look for terms like “priced to sell,” “must sell,” or repeated price reductions.

- Direct marketing: Some investors target homeowners in pre-foreclosure or with tax arrears.

- Off-market opportunities: Local advertising, social media, and referral networks can reveal leads.

Risks and considerations:

- Ethical responsibility is crucial. Taking advantage of vulnerable sellers can backfire reputationally.

- Not every motivated seller will offer a true discount.

- Due diligence is still essential to ensure fair terms for both parties.

Power of Sale vs Motivated Sellers

Here’s a clear comparison of the two concepts:

| Factor | Power of Sale | Motivated Seller |

| Process | Legal action by lender to recover mortgage debt | Voluntary decision by homeowner to sell quickly |

| Motivation | Borrower default forces lender to act | Personal, financial, or life circumstances |

| Risks for Buyer | Property sold “as-is,” limited negotiation, possible liens | Price may not be as discounted, potential emotional stress in negotiation |

| Deal Type | Formal sale through MLS with lender approval | Flexible, often negotiable, may include off-market deals |

| Common in Ontario? | Yes, widely used instead of foreclosure | Yes, especially in softer markets or high-debt periods |

Which Option is Better for Buyers and Investors?

The choice between pursuing a power of sale property or seeking out a motivated seller depends on your goals.

- For retail buyers: Power of sale homes may provide access to properties at lower prices, though the risks of as-is condition and quick closing must be weighed carefully.

- For investors: Motivated sellers can be more flexible, allowing for creative financing or below-market deals that build stronger returns.

In practice, many successful investors keep an eye on both. Power of sale provides structured opportunities through MLS, while motivated sellers require hustle and networking to uncover mostly.

Final Thoughts

Both power of sale and motivated seller situations reflect stress and urgency in the housing market, but they operate very differently. A power of sale is a legal process triggered by lenders, while a motivated seller is an individual making a quick sale for personal reasons.

For buyers and investors, recognizing the difference can uncover opportunities and help manage risks. If you’re ready to explore current opportunities, sign up to get daily Power of Sale homes and Motivated Seller listings delivered straight to your inbox, for free!

Found something interesting? Book a consultation session with one of our competent agents who will help you get the best possible deal.

Frequently Asked Questions (FAQs)

Q: What does power of sale mean in Ontario?

A: In Ontario, power of sale allows lenders to sell a property directly when the borrower defaults, without going through foreclosure. Ownership remains with the borrower until the property is sold.

Q: Is buying a power of sale risky?

A: Yes, because properties are sold “as-is” with limited disclosures. However, buyers can benefit from below-market pricing if they perform proper due diligence.

Q: Is power of sale the same as foreclosure?

A: No. In foreclosure, the lender takes ownership of the property before selling. In a power of sale, the lender sells on behalf of the borrower to recover the debt.

What does motivated seller mean?

A: A motivated seller is a homeowner who needs or wants to sell quickly, often making them more flexible on price or terms. Their motivation may come from financial stress, relocation, or other personal reasons.

Q: How can you find motivated sellers in Canada?

A: A motivated seller can be found through networking, MLS searches, wholesalers, and direct outreach. Look for price reductions or sellers advertising urgency.