Ontario housing starts are collapsing and the consequences for buyers unfold in two stages. In the short term, a wave of completions will add 50,000 homes in 2025, 25,000 in 2026 and 20,000 in 2027. This keeps supply elevated, softening rents and resale prices. Once that backlog clears, the sharp decline in new housing starts means fewer homes will be built in the years ahead, creating the risk of renewed scarcity. For buyers, the outlook is defined by volatility with leverage today and tighter conditions tomorrow.

Table of Contents

Ontario’s housing market is entering a cycle that few buyers have witnessed before. New completions are surging, yet new housing starts are collapsing. For households navigating the market, this creates an unusual mix of immediate relief and looming risk. The abundance of homes reaching completion today may push prices and rents lower, but the absence of new construction will set the stage for scarcity later in the decade. Buyers must read this sequence carefully if they are to avoid being whipsawed by volatility.

The Short-Term Flood

The near-term story is one of supply. Projects launched during the boom years of pre-construction are now moving through the pipeline, adding tens of thousands of units to Ontario’s market. Roughly 50,000 homes are expected to close this year, followed by 25,000 next year and 20,000 the year after. This is an unprecedented wave of completions, concentrated in the Greater Toronto Area but spilling into secondary markets as well.

For buyers, the implications are immediate. More supply creates leverage. Negotiations tilt away from sellers who once relied on bidding wars and toward buyers who can weigh their options. Rents may soften as landlords compete for tenants. In the resale market, abundant listings mean choice returns, and price pressures ease. Buyers entering the market in this phase can afford to be deliberate, to weigh quality over urgency, and to extract concessions that were unimaginable in the frenzy of 2021.

The Coming Scarcity

Yet the relief in supply is temporary. Ontario housing starts have fallen to their weakest levels since the global financial crisis, with only 12,700 units recorded in the first quarter of 2025. This collapse signals a much thinner pool of completions in the years ahead. The abundance of housing reaching the market today reflects projects conceived during years of optimism. The scarcity that follows will reflect the caution of the present moment.

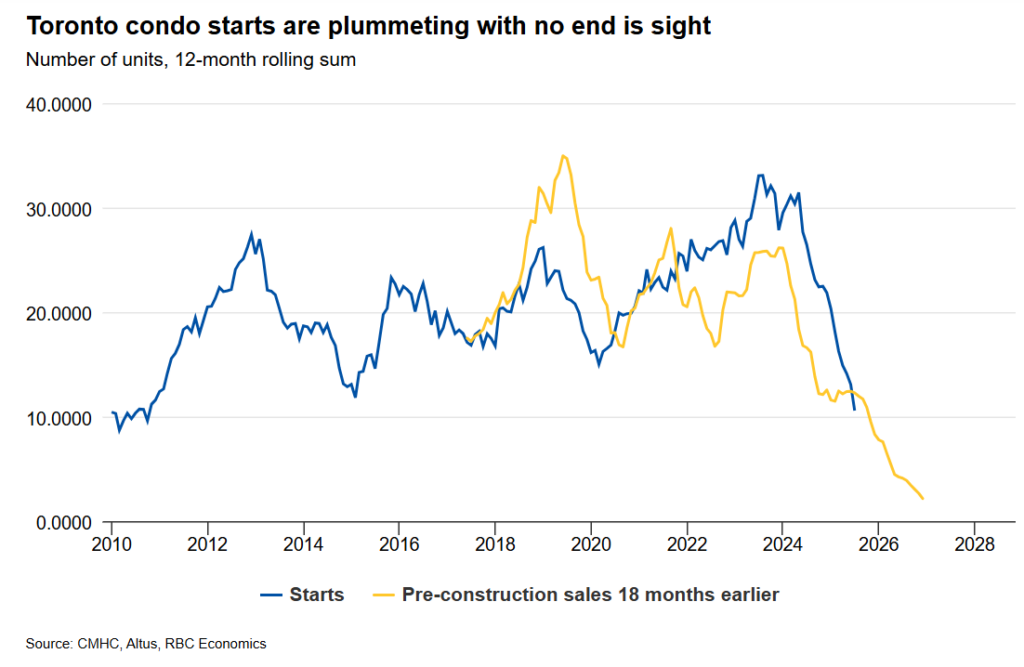

The trend is most visible in Toronto’s condominium sector, which has long been the province’s housing engine. Pre-construction sales, once the foundation of Ontario’s housing model, have collapsed to thirty-year lows. Since new starts are closely tied to pre-construction demand, both are now plunging in tandem.

Affordability Whiplash

The cycle of glut and scarcity creates a deeper problem known as volatility. For households, the ability to plan around stable expectations is crucial. When supply swings from excess to shortage, affordability is destabilized at both ends. A young family buying in a soft market may find relief at first, only to face rising valuations and higher carrying costs when the cycle turns. Those who postpone purchases in anticipation of further declines may discover that opportunity has evaporated once supply contracts.

This whiplash effect is not simply a matter of market timing; it is a structural feature of Ontario’s housing ecosystem. The province’s reliance on pre-construction sales, combined with its elevated costs and fragile rental sector, ensures that supply will remain cyclical rather than steady. For buyers, that means vigilance is not optional.

Navigating a Market in Flux

How, then, should buyers respond? The first step is recognising the dual nature of the current environment. In the near term, leverage belongs to the buyer. Patience and scrutiny will be rewarded as more completions reach the market. But longer-term planning must account for scarcity. Those with multi-year horizons should not assume that today’s abundance will endure.

Buyers should monitor completion data closely, track absorption rates, and pay attention to neighbourhood-level dynamics. Areas saturated with new supply may provide value opportunities, while undersupplied corridors may prove more resilient. Above all, buyers should avoid complacency. Affordability today offers no assurance of affordability tomorrow.

Conclusion

The collapse in Ontario housing starts signals a cycle with profound consequences for households. The immediate flood of completions provides relief, but the drought of new construction ensures that this relief will be short-lived. Buyers who grasp this dynamic will be better equipped to navigate volatility, protect affordability, and make decisions that endure beyond a single market cycle.

Today’s completions create leverage, tomorrow’s slowdown signals scarcity. Valery AI is built to help buyers navigate this volatility with clarity. Get your Personalized Real Estate Playbook now.

Frequently Asked Questions (FAQs)

1. Why are housing completions increasing if new housing starts are collapsing?

Completions reflect projects that began several years ago during the pre-construction boom. Even though new starts have slowed dramatically, those earlier projects are now finishing, adding tens of thousands of units to the market in 2025–2027.

2. What does the current wave of completions mean for buyers right now?

It means leverage. With more homes hitting the market, buyers face less competition, more negotiating power, and greater choice. This dynamic also softens rents, giving households temporary relief in both ownership and rental markets

3. Why does the slowdown in new Ontario housing starts matter if so many homes are being completed?

Because once the current pipeline is absorbed, very little new supply will be available in future years. Starts are down 58 per cent in Toronto compared to a year ago, which means the homes not being built today will become the shortage of tomorrow.

4. What is “affordability whiplash” and how does it affect buyers?

Affordability whiplash refers to the cycle of temporary relief followed by renewed scarcity. Buyers may see lower prices and more choice today, but in a few years, they could face rising costs and tighter options as new supply dwindles. This volatility makes long-term planning harder for households.

5. How should buyers navigate this volatile market?

Patience and vigilance are key. In the short term, buyers should use their leverage to negotiate better deals. Longer-term planning, however, should factor in the risk of scarcity. Monitoring completion trends, absorption rates, and neighbourhood-level supply will help buyers act strategically rather than react emotionally.

About the Author

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, The Globe & Mail, Storeys and Real Estate Magazine (REM). His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.