Table of Contents

The GTA housing market is flooded with listings and yet, it feels oddly subdued.

Across the region, inventory has soared to levels not seen in years. Mortgage rates have eased slightly. Home prices are softer. By all conventional markers, affordability has improved. It should be the kind of environment where buyers regain control, and activity bounces back.

But that’s not what’s happening.

Instead, May 2025 offered a snapshot of a market swollen with supply but stalled in motion. Buyers are hesitant. Most sellers are inflexible. And despite the data, few believe this is the moment to act.

TRREB’s latest numbers are striking: sales are down, listings are up, and the disconnect between the two has rarely been so pronounced. Yet to truly understand what’s happening, it’s not enough to look at metrics alone. This is a market shaped by psychology, one where caution and uncertainty are doing more to slow momentum than rates or prices ever could.

And until that shifts, the growing pile of inventory won’t be enough to restart movement.

Plenty of Listings, Little Movement

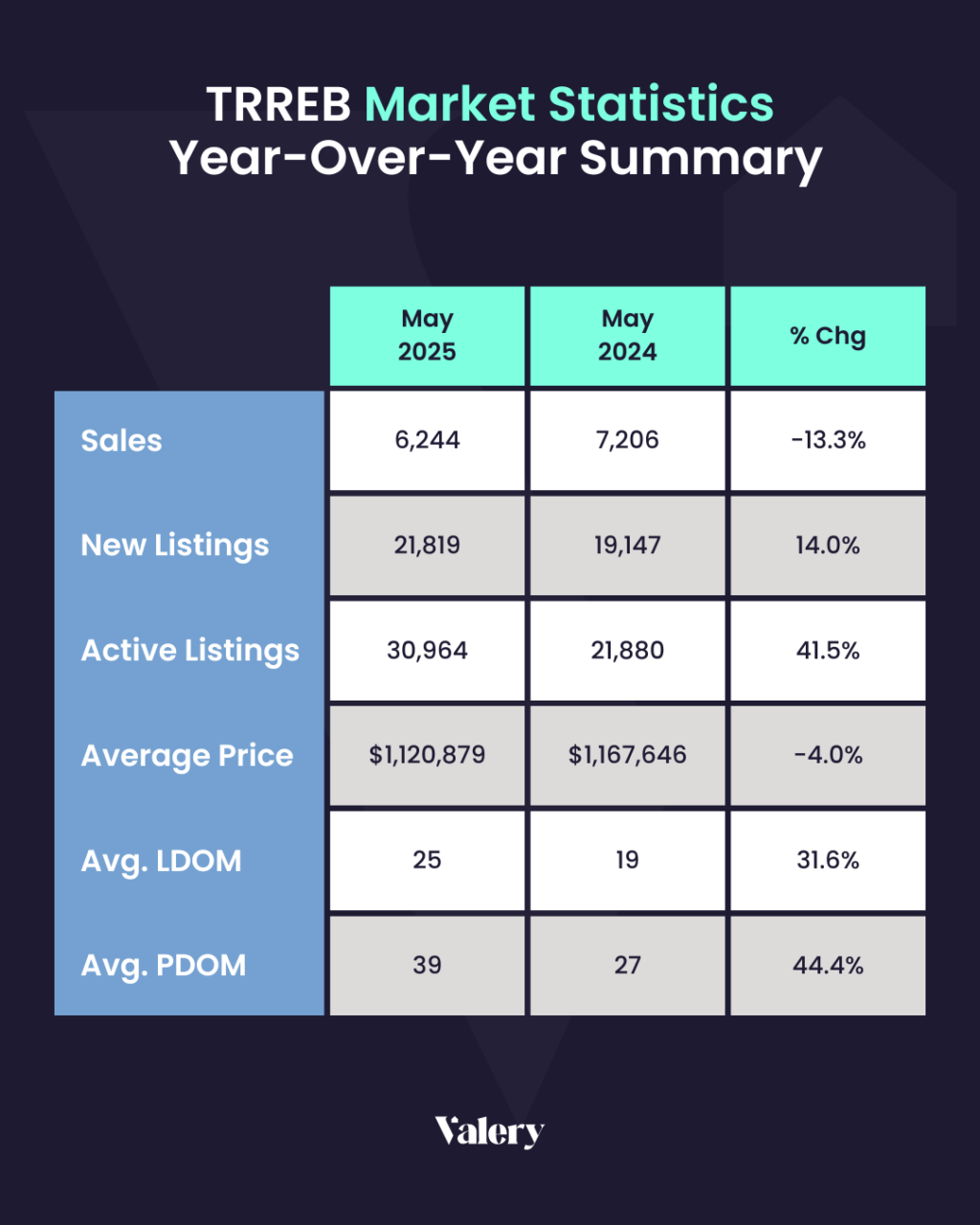

In May, TRREB recorded 21,819 new listings, second only to the rush of 2017, a year that preceded a sharp price correction. Active listings reached 30,964, the third-highest on record. On the surface, the market is brimming with choice.

And yes, affordability has improved. According to the National Bank of Canada’s Housing Affordability Monitor, early 2025 brought the steepest gains in housing affordability in several years. But sales haven’t followed. They dropped 13.3 per cent year-over-year, to just 6,244 transactions. The sales-to-new-listings ratio plummeted to 34.9 per cent, and months of inventory now sits at 4.3, a signal that properties are entering the market faster than they’re leaving it.

By any measure, the system is out of balance.

It’s Not the Price. It’s the Mood.

Despite the improved numbers, most buyers are staying on the sidelines. Prices are down. Rates are more manageable. But the hesitation remains.

The reason? It’s not financial. It’s emotional.

TRREB’s Chief Market Analyst, Jason Mercer, put it plainly: “The issue is a lack of economic confidence.” Buyers are waiting for clarity more than anything. Until there’s more stability in trade, employment, and cost-of-living signals, buyer inertia will persist.

Confidence Is Missing From This Market

Real estate is powered by perception as much as pricing. When people feel urgency, whether due to rising rates or fear of being priced out, they act. But today’s conditions offer no such cues.

Instead, we’re seeing an unprecedented spread between supply and demand. In May, new listings went up significantly, while transactions failed to keep pace. It’s the widest gap between the two metrics, TRREB has ever recorded. This tweet by Daniel Foch, Chief Real Estate Officer at Valery, talks about it.

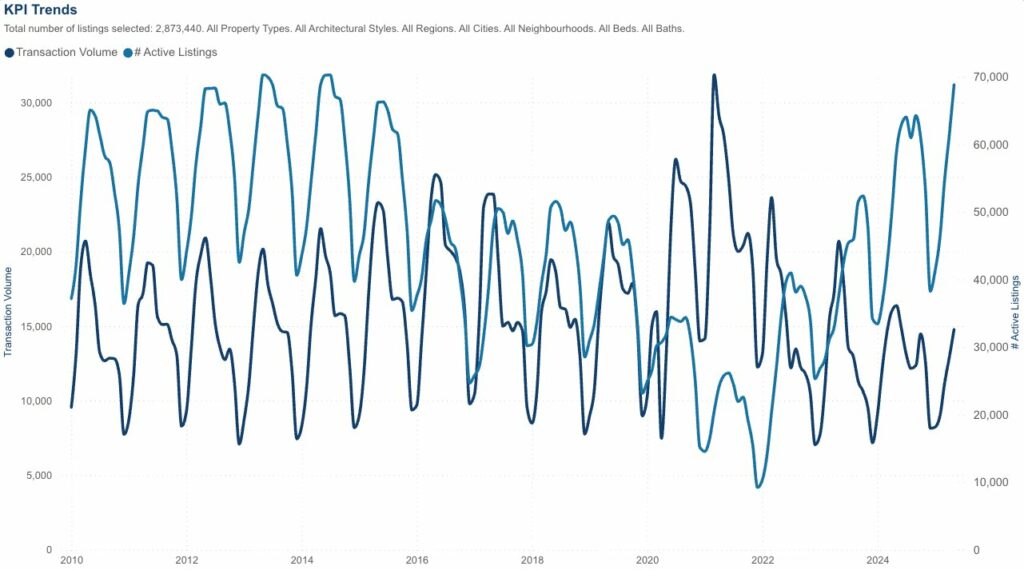

Also, active listings outpaced sales at a scale (see the chart below), which recalled the stretch between 2010 and 2015, a sluggish, sideways market marked by buyer fatigue.

Downtown Holds. The Suburbs Stall.

The numbers also reveal a growing split between the urban core and the outer suburbs.

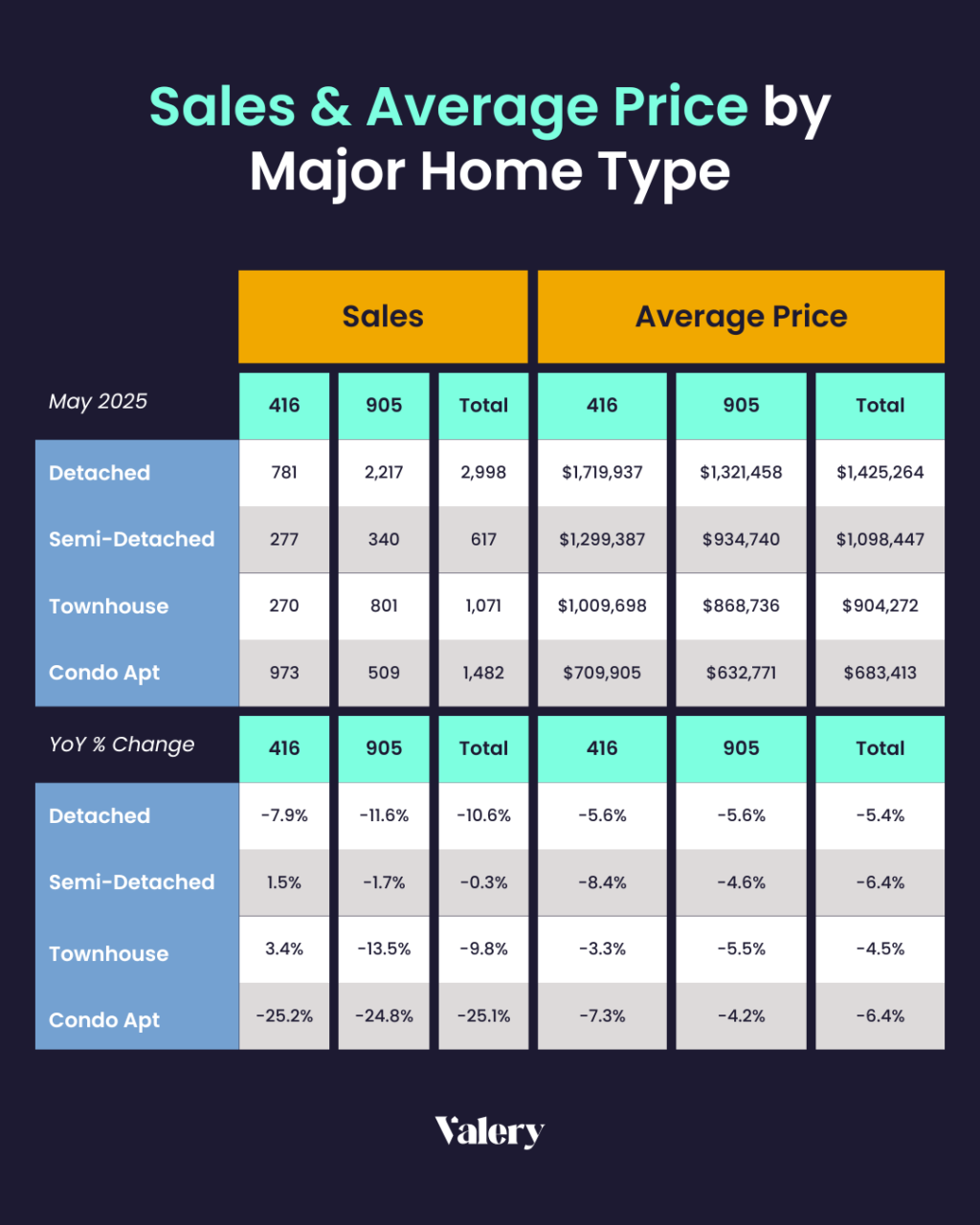

In the 416, semi-detached homes and townhouses posted modest year-over-year sales gains, even as overall activity fell. These segments, often favored by entry-level or value-seeking buyers, appear to be stirring with tentative interest.

But the same can’t be said for condos or detached homes. Condo sales in the city are down over 25 per cent, facing both investor retreat and oversupply. Detached homes, still priced well over $1.7 million, are proving too expensive for all but the most qualified buyers.

In the 905, the pullback is broader. Detached and townhouse sales are down sharply. Pandemic-era demand for space has faded, and buyers are reconsidering long commutes unless the price drop is compelling. As rates fall further, this urban-suburban divergence could become one of the defining shifts in the next housing cycle.

Sellers Haven’t Gotten the Memo

While buyers are cautious, most sellers are stuck in the past.

Prices have only declined modestly. Listings remain anchored to peak-era expectations. Detached homes in Toronto still hover near $1.72 million; 905 townhomes list above $860,000. But the market no longer supports those numbers, at least not broadly.

And the longer properties sit, the more leverage swings to the buyer. Flexibility on pricing, timing, and presentation is no longer optional.

You Can’t Legislate Confidence

Policymakers have pledged to act. The federal government has doubled down on its housing affordability platform, promising more supply, faster permitting, and innovation in construction.

But sentiment doesn’t shift with legislation. Buyers aren’t holding back because there aren’t enough homes. They’re holding back due to uncertainty about the economy and doubts that our trade relationship with the U.S. is on solid ground. And until that changes, supply-side measures may only deepen the imbalance.

The Market’s in Limbo

Right now, Toronto’s housing is in a state of pause.

Buyers have options, but not urgency. Sellers have listings, but not pricing power. Policymakers have plans, but little credibility with the people who matter most: those making the biggest financial decision of their lives.

Until trust returns, until buyers see a floor, and sellers accept a ceiling, the market will remain in stasis.

Not rising. Not falling. Just stuck.

Looking to make sense of this shifting market?

Whether you’re buying, selling, or just watching from the sidelines, understanding the dynamics of the GTA housing market has never been more important.

Visit our website to explore listings, market insights, and connect with a local expert today.