Table of Contents

While some may still find it difficult to come to terms with the 2025 federal election results, the real estate industry is already looking forward. With a Liberal minority government now in place, expectations are high, especially when it comes to tackling affordability and restoring balance in a market defined by uncertainty.

Perhaps, the most important puzzle to solve for buyers, sellers and agents is the navigation of the post-election market. That is why in our latest Market Call, hosted by Daniel Foch, our Chief Real Estate Officer, we try to simplify what this political outcome means for housing policy, the economy, and market momentum in the months ahead.

How the Industry Feels About the Election Results

Before the election, a survey of 674 realtors from across the country was conducted with Real Estate Magazine (REM). There were two main questions asked: ‘Who do you believe would be better for the Real Estate Industry in Canada’ and ‘Which leader do you think would be most likely to make house prices rise?’

The results were surprising.

The majority of respondents (52.7 per cent) felt Pierre Poilievre, the Conservative leader, would be a better choice for the Canadian real estate industry moving forward. However, almost 38 per cent believed Mark Carney, who is now sworn in as Canada’s new Prime Minister, is more likely to support house price appreciation.

In simple words, the industry preferred the Conservative leadership for macroeconomic reasons but also believed the Liberal plan would signal more opportunity as Carney’s proposed policies would push home prices higher.

Policy Consensus: What Both Parties Agreed On

A Housing-Focused Election

Despite the political divide, housing was one issue that was central to the Conservative and Liberal platforms. Both put forward proposals for a major increase in supply. 2.3 million homes over five years were promised by Poilievre, while Carney pledged 500,000 new units. Faster approvals and streamlined development were also emphasised.

Programs That Could Affect Investors and Buyers

The focus wasn’t just limited to supply. Both platforms also put forward ideas regarding investor and buyer incentives:

- The Liberals proposed bringing back the Multiple Unit Residential Building (MERB) program, allowing for tax write-offs for multi-unit residential investments.

- The Conservatives proposed a capital gains rollover, similar to the U.S. 1031 Exchange program, with the motive being to encourage older Canadians, who own most of the investment property, to sell.

- Both proposed the removal of GST on new home construction and lowering income taxes.

Understanding the Political and Economic Cycle

The election also highlighted a recurring pattern in Canadian politics, something called the ‘Political Business Cycle’. Here is what it entails:

- Left-leaning governments prioritise job creation and spend to make that happen. However, this often leads to inflation.

- The rise in inflation frustrates the public.

- Right-leaning governments are then voted in to cut spending and control it.

It is clear that people who voted are demanding inflation control. Should this happen, it would also cause interest rates to go down, thereby improving housing affordability. However, Carney’s platform includes significant government spending, which could actually bring about more inflation if not managed well. Hence, it is too early to say whether the voter calls will be answered.

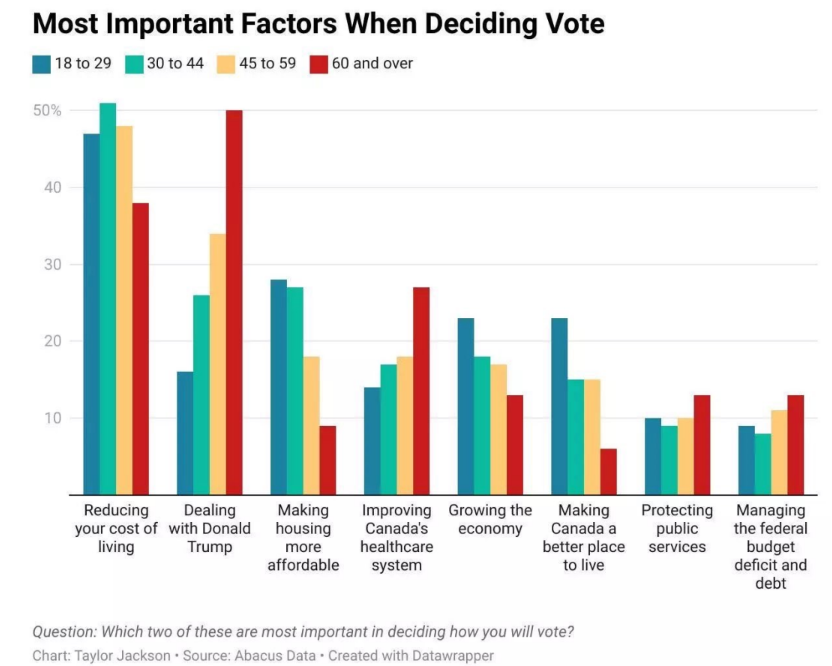

The Generational Divide in Voter Priorities

Here’s an important finding: for voters under 45, the most important housing issue this election was affordability. For ones over 60, it was foreign affairs (see the chart below). To further highlight this divide, If a student vote (conducted by CIVIX, involving 900,000 participants under the age of 18) were to decide the election, the Conservatives would have won.

The takeaway here is that as younger voters enter the electorate in the future and become the dominant demographic, Canada may lean more towards the Conservatives, especially if economic challenges persist.

Government Spending and “Build” as a Growth Strategy

For real estate, infrastructure investment is needed to boost local property values. Cities that build more tend to generally see stable price growth. This is due to sustained demand brought about by improved liveability. That is perhaps why every major contender in the elections had promised to spend more, primarily on capital projects, including the Conservatives.

If the Liberals deliver on their ‘Build’ agenda, we would definitely see steady housing growth and broader economic momentum.

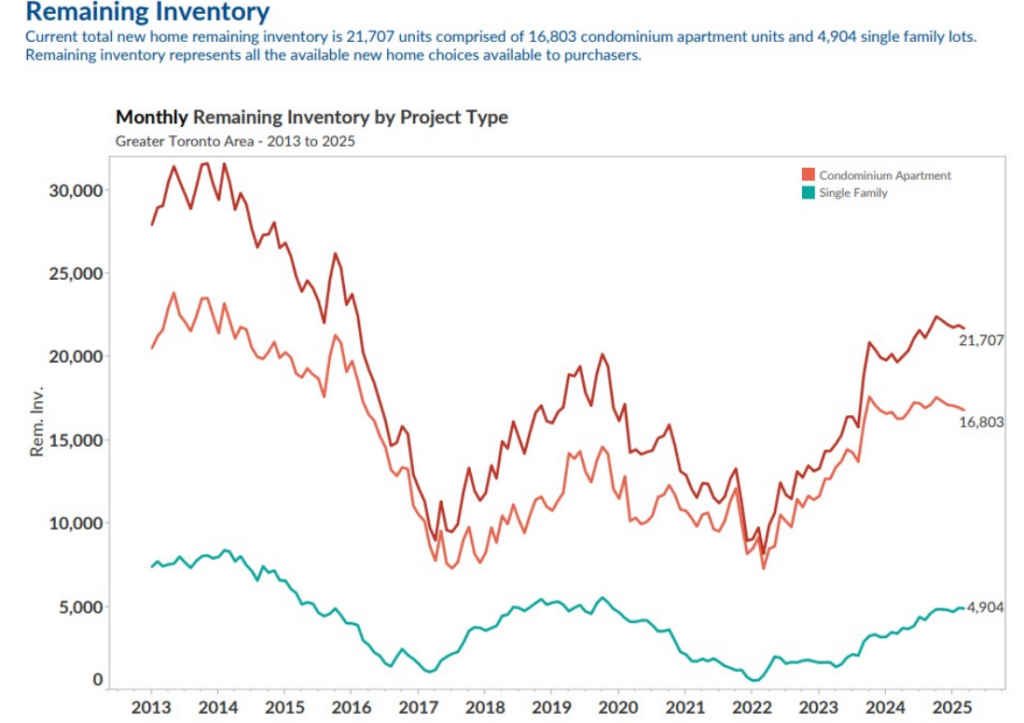

GTA Pre-Construction: Record Inventory, Declining Sales

Inventory in the GTA pre-con market is building up (see the chart below). Though not at crisis levels, it can still be classified as higher than most market participants would like. Improved affordability could be an outcome of this, as the excess is forecasted to drive down prices in the short term.

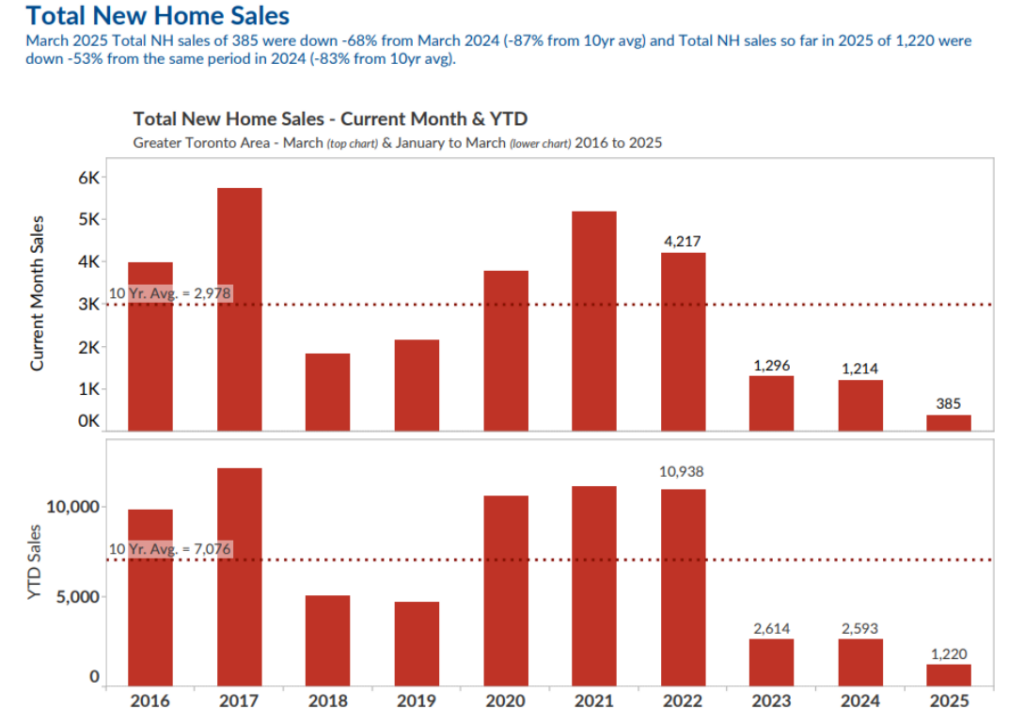

New home sales, on the other hand, are down almost 50 per cent year-over-year, according to the chart given below.

For real estate professionals, this might sound discouraging at first, but it also presents an opportunity. With prices softening and the end of election uncertainty, buyers may come back into the market. Further supporting this idea is a survey that was conducted by our brokerage, which resulted in over 60% of buyers and sellers admitting to having deferred their decisions until the government in Ottawa takes charge.

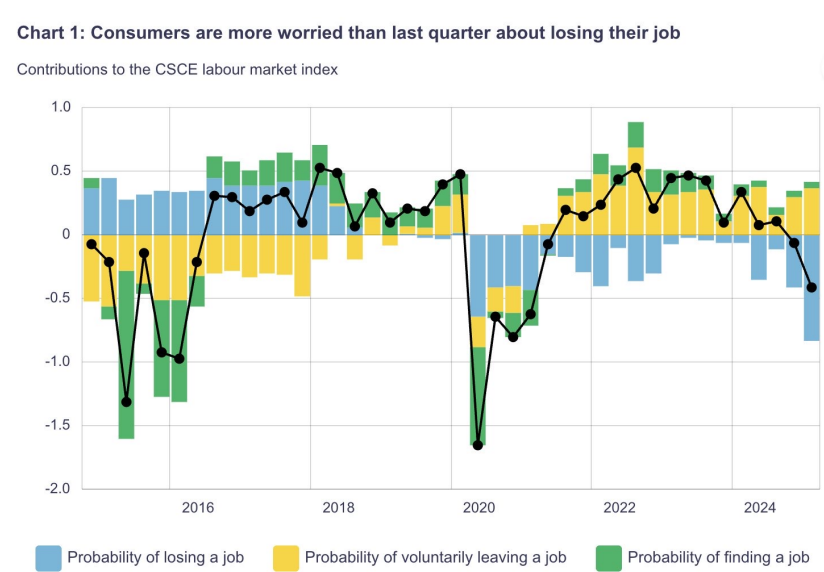

Economic Outlook and Job Market Concerns

The Bank of Canada reports that consumer concern about job loss is at an all-time high. The chart below shows this. Wage growth is slowing too. This becomes a problem for those who expect affordability to improve.

Consumer spending is also tightening, and many Canadians expect their financial health to worsen. Mortgage lending conditions have also weakened, with access to credit still far from pre-pandemic levels.

With fewer transactions and growing financial strain on households, real estate is unlikely to recover without stronger employment or rate relief.

Rental Market Cooling Off

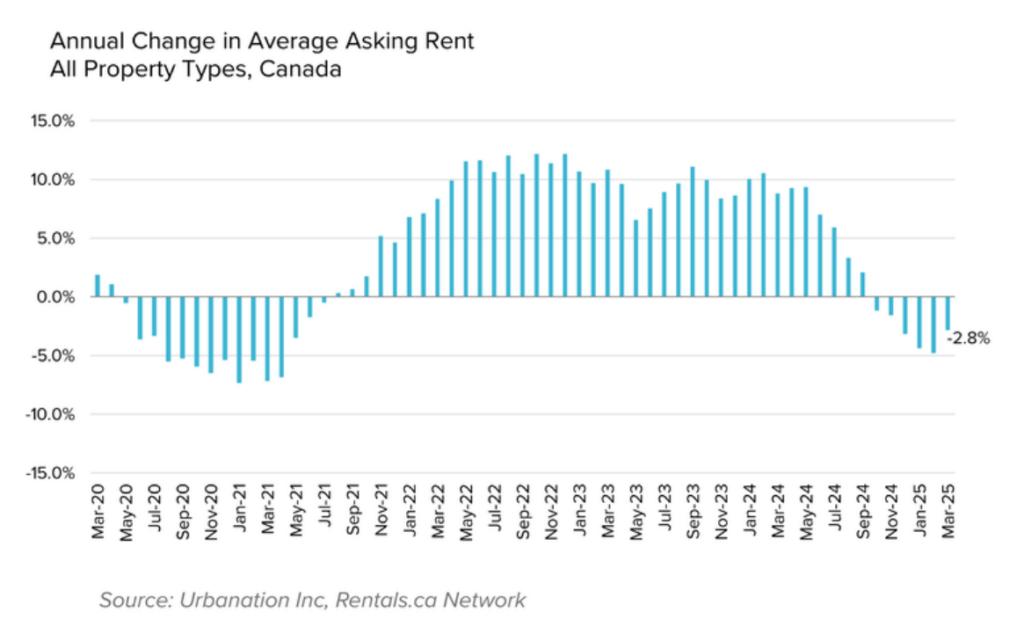

Rents across Canada have been on the decline for the last six months. The chart below, courtesy of Urbanation Inc. and Rentals.ca, shows this. Almost all major markets are seeing a lowering of rents.

While this rental cooling may not be the most talked about trend, it is a quiet signal that affordability could gradually improve in the months to come.

Long-Term Supply and Policy Challenges

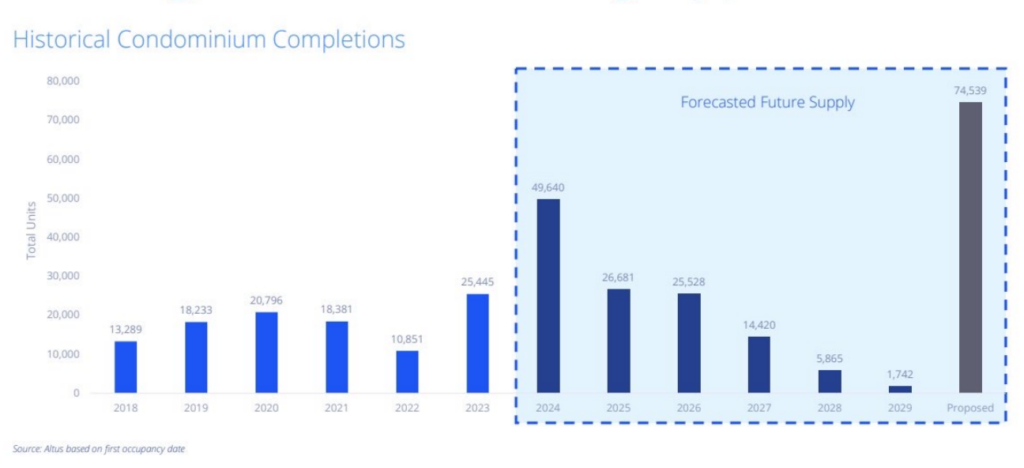

As shown in the chart (courtesy of Altus Group) below, we can see record new housing completions for 2025 in the GTA. A sharp forecasted drop-off begins next year, and by 2028-29, completions could plummet.

We definitely need more supply from the private sector, especially if Canada’s population growth continues at the same pace.

To fill this gap in supply, the federal government is expected to continue the expansion of programs like CMHC’s MLI Select, which, through insured debt, supports new construction. Success from these efforts cannot be predicted, though.

Buyer’s Market Dynamics and Agent Takeaways

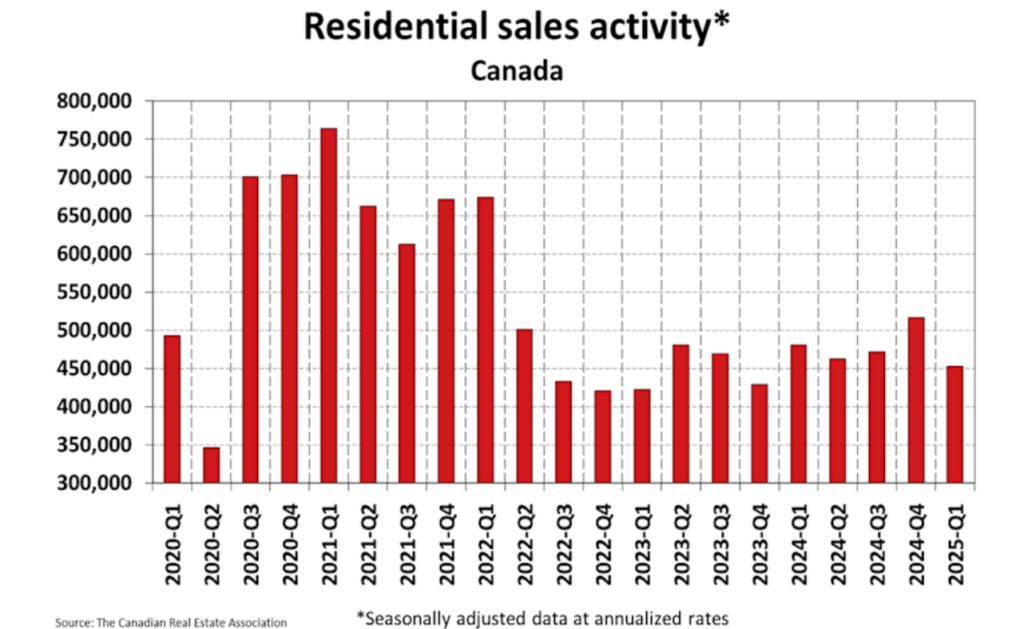

National sales activity across Canada is the lowest since Q4-2023, with transaction volumes below the 10-year average.

Active listings match the 2014-2015 levels, but with far fewer transactions, though. This describes a buyer’s market; high supply, low competition and room to negotiate. In many cases, buyers can secure around 10-20 per cent below asking. Most buyers may experience financial concerns; however, for others, this is a unique window to enter the market on favourable terms.

In such an environment, agents should be coaching clients to act strategically. They should not chase the bottom, but take advantage of soft conditions. Meanwhile, many sellers are adjusting expectations or sitting on the sidelines, creating room for prepared buyers to move.

Looking for direction in a market full of unknowns?

With policy shifts, affordability pressures, and evolving buyer sentiment, now’s the time to sharpen your skills and deepen your strategy.

Join us on May 30 for our AI & Real Estate event—where top agents and tech leaders will break down how to thrive in today’s market.

Register for Agent Academy, launching soon, to learn the systems, automations, and data-driven content strategies that drive real results.

This isn’t about watching from the sidelines. It’s about showing up ready.This isn’t about watching from the sidelines. It’s about showing up ready.