Table of Contents

The market isn’t what it was a year ago.

Inventory across Toronto has surged, buyers have more options than ever, and the bidding wars of yesteryear have largely fizzled out. Interest rates, while still elevated, have settled into a holding pattern. On the surface, conditions should be tipping in buyers’ favour.

But if you’re shopping for a new home, especially pre-construction, one cost still quietly looms in the background, inflating prices and eroding affordability: development fees.

These hidden charges, tacked on by municipalities and passed through by developers, can now add $100,000 or more to the cost of a new home in the GTA. And despite market shifts elsewhere, this burden hasn’t budged. In fact, it’s grown. In some cases, nearly a quarter of your new home’s price isn’t for the land or the bricks, it’s just municipal fees.

It’s time we called this out for what it is: a silent tax on the next generation of homeowners. And for savvy buyers and investors, it may be the clearest case yet for pivoting to resale.

What Are Development Fees, and Why Do They Exist?

The logic behind development charges isn’t inherently flawed. New homes require infrastructure, which includes roads, sewers, water systems, transit, etc. and cities need funding to build that. The Development Charges Act, passed in 1989, gave municipalities the legal right to collect these fees upfront from developers to help “growth pay for growth.”

The problem? Scope creep.

What began as a way to fund pipes and pavement has morphed into a general revenue stream. Municipalities now levy charges well beyond actual infrastructure costs and then rely on them to plug budget gaps. Developers pay these fees when applying for building permits, but they don’t absorb them. They pass them directly to the end buyer. You.

So when you walk into a shiny new sales office and see that $1.2 million price tag? Know this: a big chunk of it has nothing to do with granite countertops or energy-efficient appliances, it’s a bill from City Hall.

Toronto Development Charges Have Soared in Recent Years

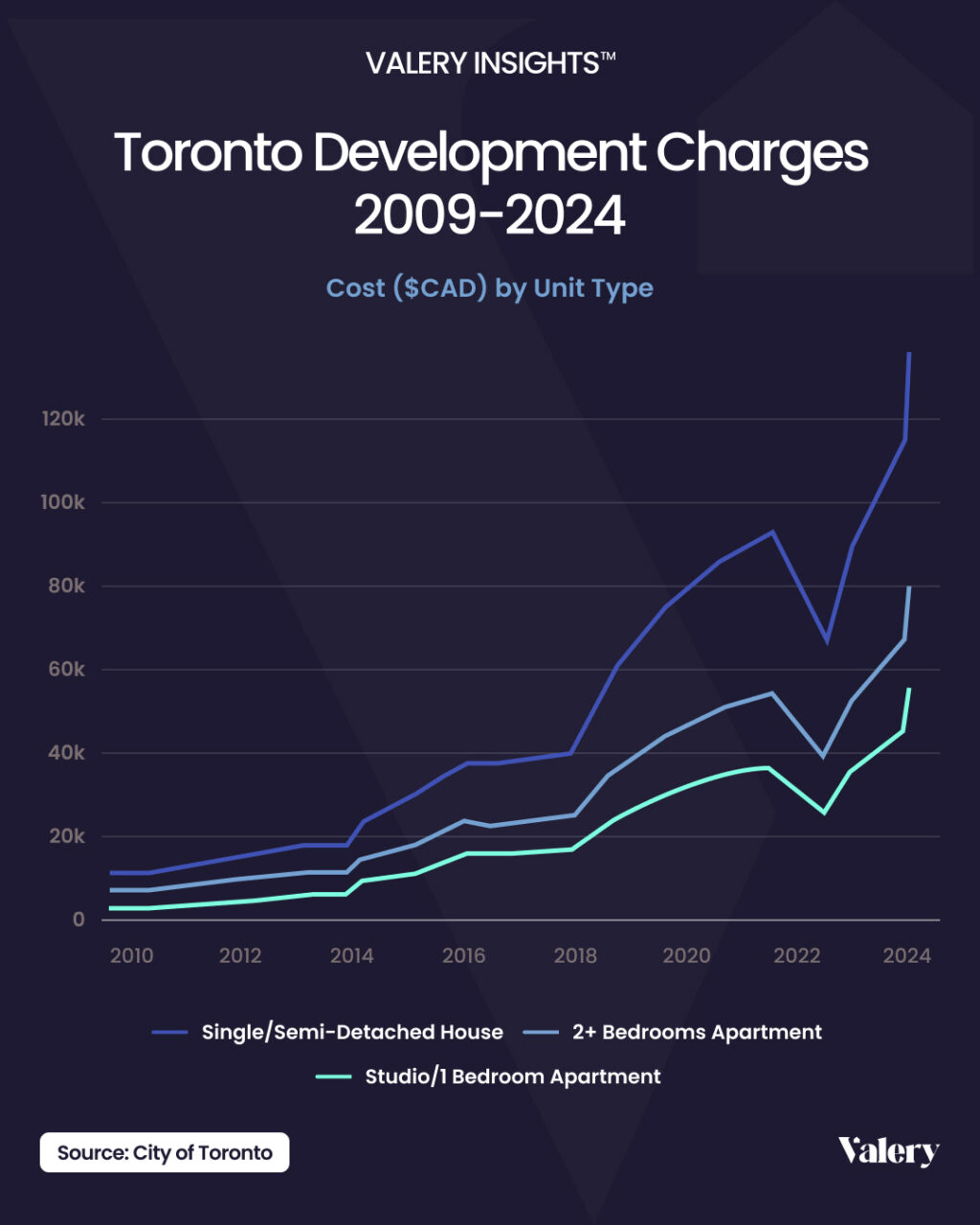

In the last decade, Toronto’s development charges have exploded.

Since 2010, they have jumped nearly 1,000%, outpacing both inflation and home prices. A one-bedroom condo now carries over $50,000 in DCs. A two-bedroom unit? $80,000. Single-family homes can rack up $137,000 or more in fees. The chart below highlights the rise in development charges post 2010.

According to the latest figures, Toronto is now the most expensive city in Canada for government fees per square foot, $86/sq ft compared to $70 in Vancouver and $24 in Montreal.

BILD (the Building Industry and Land Development Association) estimates that these charges add $100,000 to $150,000 to the average new low-rise home in the GTA. That’s a down payment evaporated in bureaucracy.

How Do Development Fees Impact Home Prices and Buyers?

Let’s be clear: development fees aren’t optional, in fact, they’re built into the base price. They increase carrying costs, push buyers further out from city cores, and inflate mortgages. OREA reports the average new home in Ontario carries $135,000 in DCs, and 75% of Ontarians say they want these charges reduced. Frankly, it’s hard to blame them.

For first-time buyers especially, this is devastating. These are often the people eyeing new condos and townhomes, hoping to get a foothold. But instead of finding relief, they’re discovering that municipal fees are keeping new construction prices stubbornly high, even as resale homes become increasingly negotiable. The dream of buying new has become less about personal preference and more about financial constraint. And ironically, resale is now the more affordable and practical option.

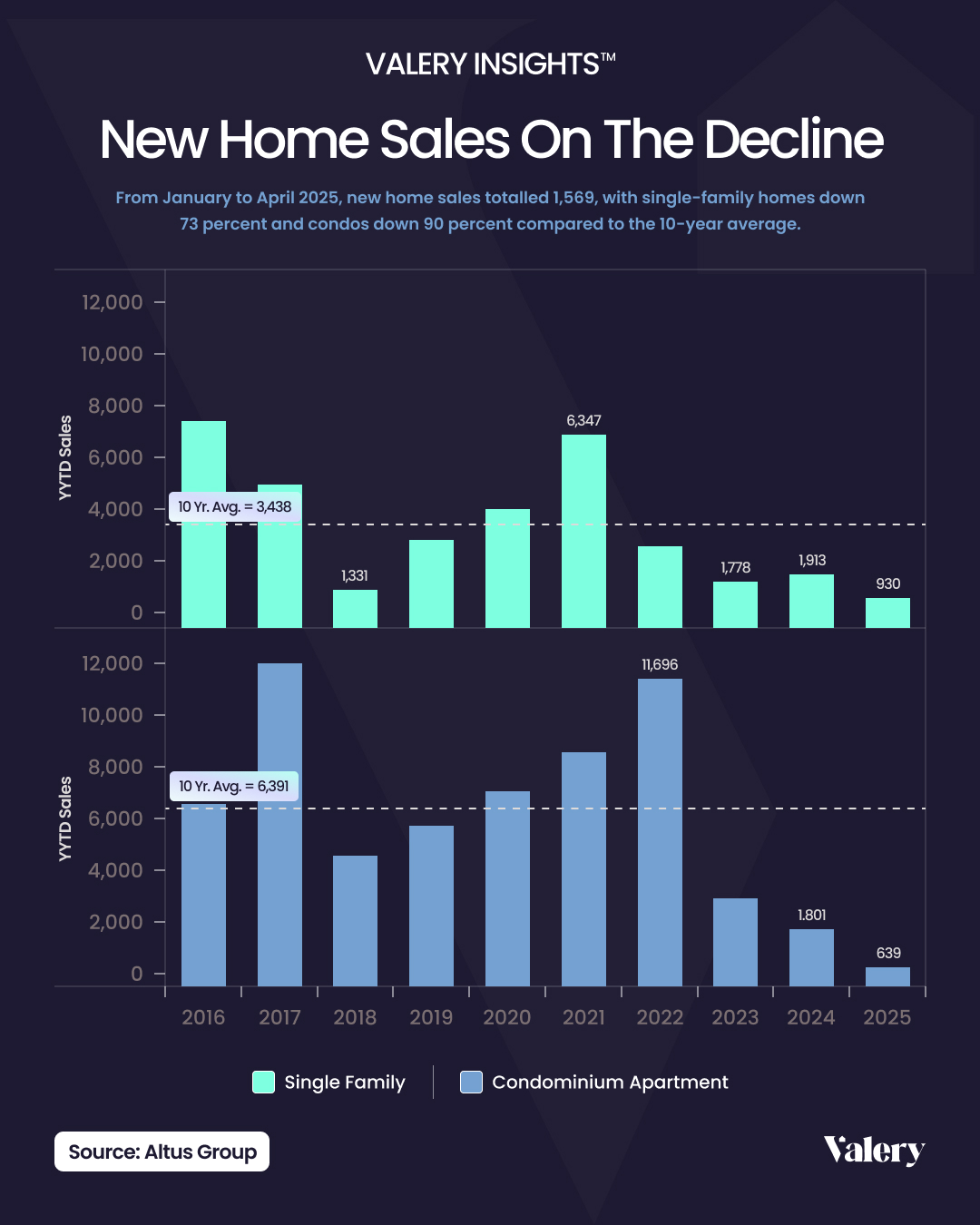

The numbers reflect this shift (see the chart below).

Don’t forget the tax-on-tax. Development charges are taxed via HST and contribute to a higher land transfer tax, meaning you’re paying taxes on the fees that funded your future neighbor’s sewer line. In economic terms, it’s inefficient. In emotional terms, it’s infuriating.

Worse still, these costs are now throttling supply. Some developers have pulled back on projects because they simply can’t make the numbers work. That means fewer new homes getting built, a shrinking future pipeline, and the risk of tighter supply driving prices back up over time.

Policy Responses: Are Changes Coming to Development Fees?

After years of inertia, governments are finally starting to act.

On the municipal front, cities like Burlington, Vaughan, and Mississauga have begun rolling back development fees, acknowledging that the current structure is choking off housing supply. It’s a rare bit of political humility in a landscape that typically rewards short-term revenue over long-term affordability.

Even Toronto, long known for leading the charge on fee hikes, has hit pause. In April 2025, the city halted a planned 4% increase to its already-high development charges, citing sluggish housing starts and mounting pressure on builders. It also approved charge deferrals for 3,000 condo units, providing up to $19,000 in per-unit relief, a clear nod to the urgency of the moment.

At the provincial level, Ontario’s More Homes Built Faster Act (Bill 23) continues to exempt affordable and rental housing from development fees. The Ford government has also pledged to work with municipalities to lower the local costs pushing new homes out of reach. So far, results have been mixed.

These coordinated efforts mark a meaningful shift, but lasting affordability will depend on whether governments can sustain and scale these reforms system-wide.

Buying Resale vs. New: A Way to Avoid the “Development Fee” Premium

So where does that leave you, the buyer or investor trying to make a smart play in this market?

Simple: consider resale.

When you buy a resale property, the development fees were already paid, probably decades ago, and at a fraction of today’s rates. You’re not eating that $100K premium. You’re paying for the home itself, not the paperwork that made it legal.

You also skip the HST. Resale properties aren’t subject to it in Ontario, unlike new builds. That’s almost a 13% savings on your purchase price right off the top, tens of thousands, depending on your price range.

You’re buying into an established neighborhood with parks, schools, and transit already in place, not a construction zone with empty lots and delayed timelines. You can move in (or rent out) immediately. No surprise closing adjustments. No builder delays. No line-item for “development fees: TBD.”

And yes, you might need to update the kitchen. Maybe even redo the windows. But you’ll be renovating with money you didn’t spend on bureaucracy.

Conclusion: Knowledge is Power in the Housing Market

Toronto’s housing affordability crisis isn’t caused by any one thing, but development fees are a silent accelerant. For too long, they’ve operated out of view, cloaked in policy language, and shrugged off as “just the cost of building.” But make no mistake, they are a cost of buying, and a very real one.

While reforms are coming, they won’t happen overnight. And until they do, new construction buyers will continue to foot the bill. If you’re looking to get into the market now, or grow your portfolio, resale offers a clear financial edge.

In a city where every dollar matters, don’t pay for infrastructure twice. Don’t pay tax on a tax. And don’t let a glossy brochure distract you from the real math. The resale market might lack the sparkle of a pre-con model suite, but in this climate, substance beats shine every time.

Ready to skip the fees and find real value?

Explore resale listings on Valery’s platform and discover homes that offer more, without the added cost of development charges.