Table of Contents

As we move into 2025, the housing market trends in Canada are shifting because of economic uncertainty, rising unemployment, and home listings flooding the market. The latest Valery Market Call, hosted by Daniel Foch, examined key data affecting the market, including how housing affordability in Canada is impacting buyers, the trade war impact on real estate, and what role the Canadian unemployment rate plays in shaping a potential buyers market. If you’re wondering, “How to navigate the Canadian real estate market in 2025?”, this breakdown of the latest housing market trends will help clarify what to expect.

The Current State of the Housing Market in Canada

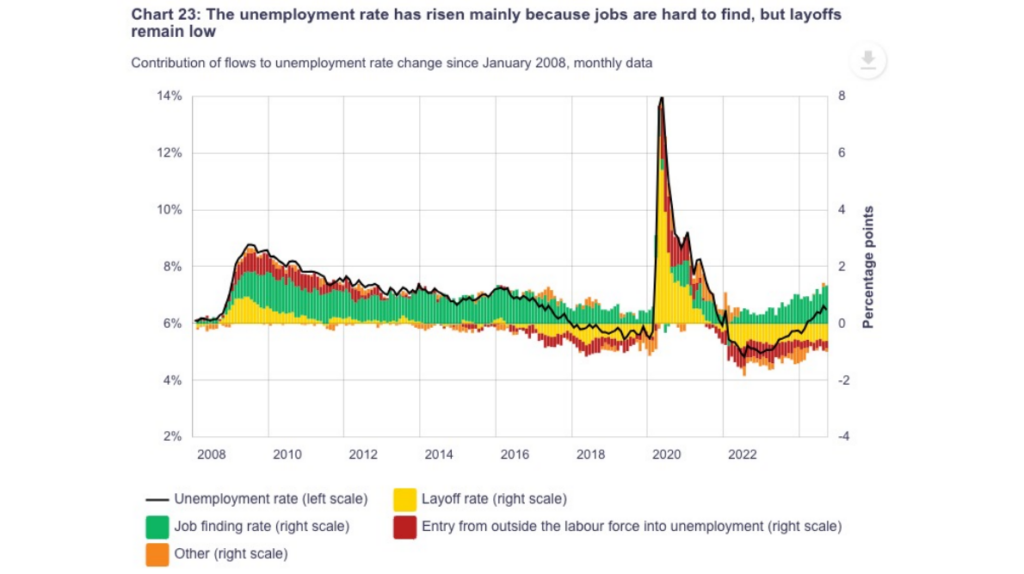

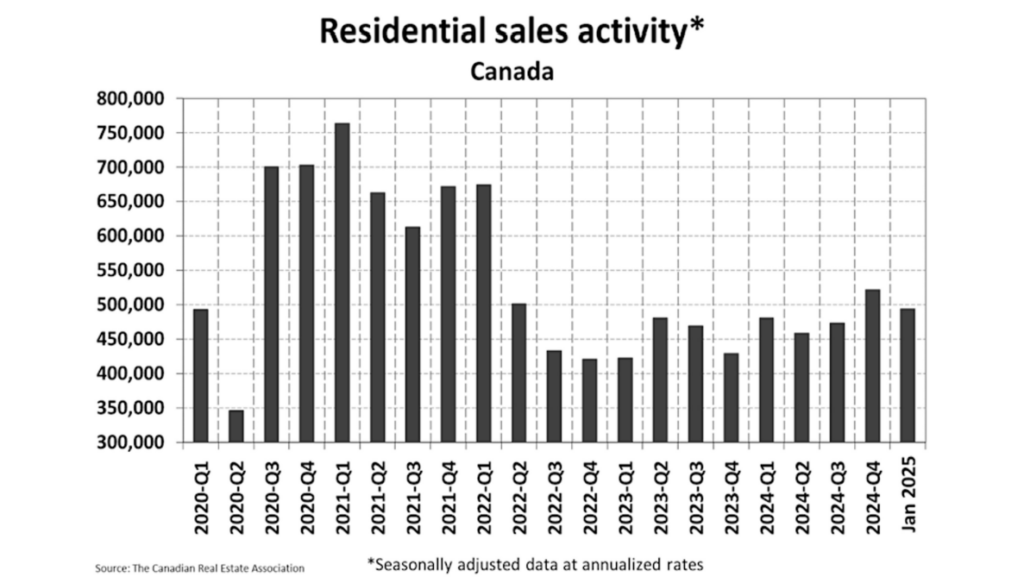

The unemployment rate in Canada has climbed to 6.8%, signaling growing economic distress. But the thing is, many people are struggling to find jobs while large-scale layoffs remain low. This is making it harder for Canadians to afford homes. As a result, more resale homes are hitting the market but are sitting there for longer periods – meaning buyers are holding off on purchasing homes. This is increasing housing supply, setting the stage for a potential buyers market in 2025.

At the same time, economic uncertainty is playing a major role in housing affordability in Canada. The uncertainty surrounding employment and inflation has left many potential buyers hesitant, further slowing down demand. If this trend continues, Canadian house prices may drop, making homeownership more accessible but also impacting property values for current homeowners.

How the Economy and Trade War Are Affecting Canada

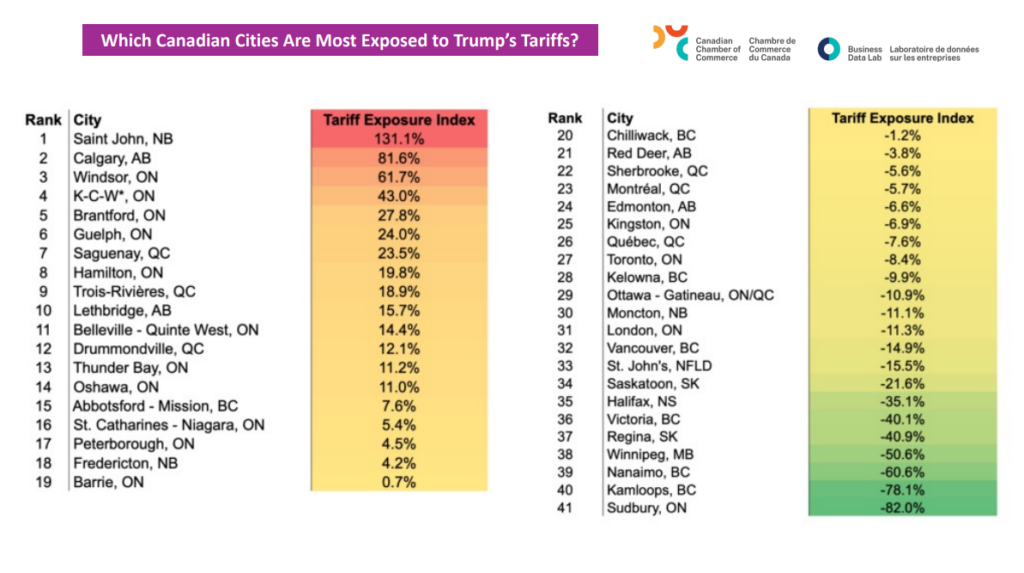

The looming trade war with the U.S. is directly affecting real estate in certain Canadian cities. The trump trade war with canada will hit areas that depend on exports the hardest. Which means fewer people are looking to buy homes. This drop in demand can lead to lower home prices, especially in cities where many jobs are tied to manufacturing and trade.

Another factor at play is the expected decline in interest rates. While rates are likely to drop in 2025, providing relief for buyers and mortgage holders, the market remains cautious. Lower rates may stimulate demand, but they won’t necessarily offset the broader issues of housing affordability in Canada and employment insecurity.

What Effects Does Unemployment Have on the Canadian Housing Market?

A rising Canadian unemployment rate means fewer people qualify for mortgages – this causes slower home sales and possibly lower prices. Employment stability is one of the most important factors influencing real estate, and in 2025, the uncertainty around employment is expected to shape Canada’s housing market trends the most. Many experts believe that if unemployment remains high, housing demand will weaken further, leading to a sustained buyers market where buyers will hold all the cards and have more negotiating power than sellers.

Why Aren’t Houses Selling in Canada?

One of the biggest questions right now is, “Why aren’t houses selling in Canada?” The answer lies in a combination of factors:

- Affordability Issues: Many Canadians are struggling with higher costs of living, making it harder to enter the housing market.

- Increasing Supply: More homes are being listed, but buyers are hesitant due to economic uncertainty.

- Market Hesitation: Potential buyers are waiting to see if Canadian house prices drop further before making a purchase.

- Financing Challenges: Mortgage qualification rules remain strict, preventing some buyers from securing loans.

With Canada real estate trends pointing toward a buyers market, sellers must be realistic with pricing and expectations. Overpricing homes will lead to prolonged listings, making it essential for sellers to adjust to market conditions.

Final Thoughts: What’s the Prediction for Canada Real Estate in 2025?

So, what is the prediction for Canada real estate in 2025? If supply continues to outpace demand and economic uncertainty persists, the market could remain soft for most of the year. However, if interest rates drop and employment improves, we could see a return of buyers by late 2025.

For homebuyers, this means watching for good deals and taking advantage of lower prices while they last. For investors, rental properties continue to be a strong option, given the demand for affordable housing. And for sellers, understanding the market shift and pricing properties realistically will be key to closing deals.

Canada’s real estate market is at a crossroads, and the trends emerging now will set the stage for the next several years. Keeping an eye on economic indicators, employment rates, and government policies will help you stay ahead in the market.

Get Discounted Property Alerts Sent to Your Inbox

Power of sale listings are surging, offering quick sales to avoid bank repossession. We built a tool with Valery AI to find these discounted properties for you.

→ Subscribe to our email list to get instant updates on power of sale, motivated sellers, and vendor take-back deals, saving you time and money in your home search.

FAQ

1. What’s causing the shift in Canada’s housing market trends for 2025?

The shift is primarily due to economic uncertainty, rising unemployment (currently at 6.8%), and an increase in home listings. These factors are creating a potential buyers market as demand slows and supply increases.

2. How is housing affordability in Canada being affected?

Housing affordability is under pressure due to the rising unemployment rate and economic uncertainty. However, expected interest rate cuts may improve affordability for some buyers.

3. What impact is the potential trade war with the U.S. having on Canadian real estate and housing market trends?

The looming trade war is creating economic uncertainty, particularly in areas dependent on exports. This uncertainty is contributing to reduced housing demand and could lead to lower home prices in affected regions.

4. How does the unemployment rate affect the housing market?

The rising unemployment rate (6.8%) is reducing the number of people qualifying for mortgages, leading to slower home sales and potentially lower prices. It’s a key factor shaping Canada’s housing market trends in 2025.

5. What is the meaning of a buyer’s market?

A buyer’s market is a real estate market condition where the supply of homes for sale exceeds the demand from buyers. This imbalance gives buyers more negotiating power and often leads to lower prices, as sellers must compete for fewer buyers.