The Greater Toronto Area (GTA) real estate cooled in August as sales edged lower on a month-to-month basis while listings grew sharply. Prices remained stable compared with July but continued to lag last year’s levels. Buyers now have more options, but affordability challenges persist despite lower borrowing costs.

Table of Contents

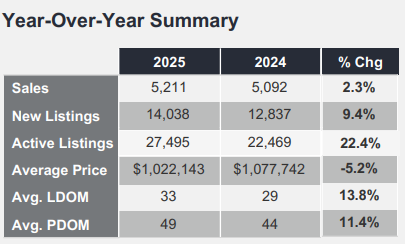

After several months of modest recovery, the GTA real estate showed signs of slowing in August. The Toronto Regional Real Estate Board reported 5,211 transactions, slightly higher than a year earlier. On a seasonally adjusted basis, however, sales slipped for the first time since March.

The MLS® Home Price Index benchmark stood at $978,100, steady compared with July but lower than in August 2024. New listings reached 14,038, lifting active inventory more than 22 per cent year-over-year. Buyers are still navigating a market with an abundance of choice.

Affordability Still Challenging

Even as borrowing costs have eased from last year’s highs and average selling prices are lower, affordability remains elusive. A household earning the GTA’s average income still struggles to finance an average-priced home. This reflects a long-standing imbalance, which is wage growth has not kept pace with housing costs. The result is a market that appears well supplied on paper yet delivers limited options that typical buyers can afford.

Regional and Property Type Trends

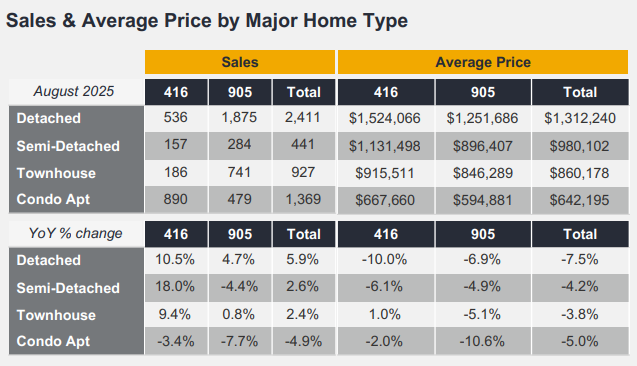

Market performance varied across the region. In the City of Toronto, detached sales increased 10.5 per cent and semi-detached transactions climbed 18 per cent, showing that some urban buyers are taking advantage of softer prices. In the 905 suburbs, results were mixed, with gains more modest and some categories posting declines. Condominiums continued to weaken. Both sales and prices fell across the 416 and 905, highlighting investor caution and an oversupply of smaller units.

Policy at a Crossroads

The Bank of Canada is expected to decide on further rate cuts in mid-September. Lower borrowing costs could draw more buyers off the sidelines, yet monetary easing alone is unlikely to solve affordability challenges. Without structural improvements to supply, income growth, and infrastructure, cheaper credit risks reigniting cycles of volatility. TRREB’s call for broader investment in transit, housing, and economic infrastructure points to a more durable strategy.

Builders and Buyers in a Market of Choice

For developers, swelling inventory signals a need to adjust. Projects that continue to assume scarcity may struggle, while those that offer family-sized units, purpose-built rentals, or mixed-income communities are better positioned for stable demand.

For buyers, the environment has shifted in their favor for quite some months now. Homes are spending longer on the market, and the range of options is wider. This gives them leverage to negotiate, but caution is warranted given the likelihood of further economic headwinds.

Housing and the Broader Economy

The GTA real estate reflects wider economic trends. Benchmark prices are moving in tandem with trade and manufacturing slowdowns, particularly in Ontario’s steel and automotive sectors. Historically, housing has helped lead recoveries by stimulating spending and construction. Whether it can do so again will depend on how effectively monetary easing is paired with long-term investments in supply, infrastructure, and affordability.

At Valery, we help clients move with insight, not impulse. Whether you’re looking to enter, exit, upgrade, or invest, the opportunity is there. You just need to move with clarity.

Our AI is trained on the latest market data and local trends, so your next move is grounded in real-time intelligence.

Get your personalized, AI-crafted real estate playbook that fits this market and your goals.

Frequently Asked Questions (FAQs)

1. Did home sales rise or fall in August 2025?

Sales totaled 5,211, up slightly year-over-year but down 1.8 per cent on a seasonally adjusted month-to-month basis.

2. What happened to home prices in August 2025?

The benchmark price was $978,100, flat compared with July but down 5.2 per cent from August 2024. The average selling price, at $1,022,143, was also down by 5.2 per cent compared to August 2024.

3. Which property types performed best?

Detached and semi-detached homes in Toronto saw double-digit sales growth, while condominiums declined across both the 416 and 905 regions.

4. Why is affordability still a problem?

Even with lower rates and prices, average incomes in the GTA do not cover the mortgage costs of an average-priced home.

5. What role does policy play in the outlook?

The Bank of Canada may cut rates further, but sustainable improvement depends on infrastructure investment, income growth, and increasing the supply of affordable housing.

About the author

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, The Globe & Mail, Storeys and Real Estate Magazine (REM). His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.