Table of Contents

The GTA housing market has long moved past the frenzied activity of its pandemic-era highs. Those days of rapid transactions now feel like a distant memory. In their place, lies a steadier market where buyers tread carefully, sellers recalibrate expectations, and policymakers observe from the sidelines.

TRREB’s June report suggests a market gradually finding balance rather than slipping into stagnation. Prices have softened, inventories have expanded, and borrowing costs, while still elevated, have eased slightly from last year’s peaks. These shifts have not sparked a rapid increase in demand but have ushered in a period of cautious engagement as buyers weigh their options.

The result is a moment of uneasy calm in a market still searching for direction.

More Listings, Less Urgency

At first glance, the numbers seem favorable for buyers. Active listings soared 30.8 per cent year over year, pushing available inventory above 31,600 homes. New listings also climbed 7.7 per cent. Prices have moderated, with the average GTA home selling for $1.1 million, a 5.4 per cent drop from June 2024.

Yet sales volumes tell a more restrained story. June recorded 6,243 transactions, down 2.4 per cent from the same month last year. Homes now take an average of 26 days to sell, and relisted properties often linger for over six weeks before finding a buyer.

This slowdown reflects a buyer pool still hesitant to commit. Economic headwinds, uneven job growth, and geopolitical uncertainty continue to weigh heavily. Even as mortgage rates trend downward from 2024 peaks, the effects of previous hikes remain front of mind for many households.

Toronto Versus the Suburbs

Within the GTA, the split between Toronto’s 416 and the suburban 905 regions is becoming more pronounced.

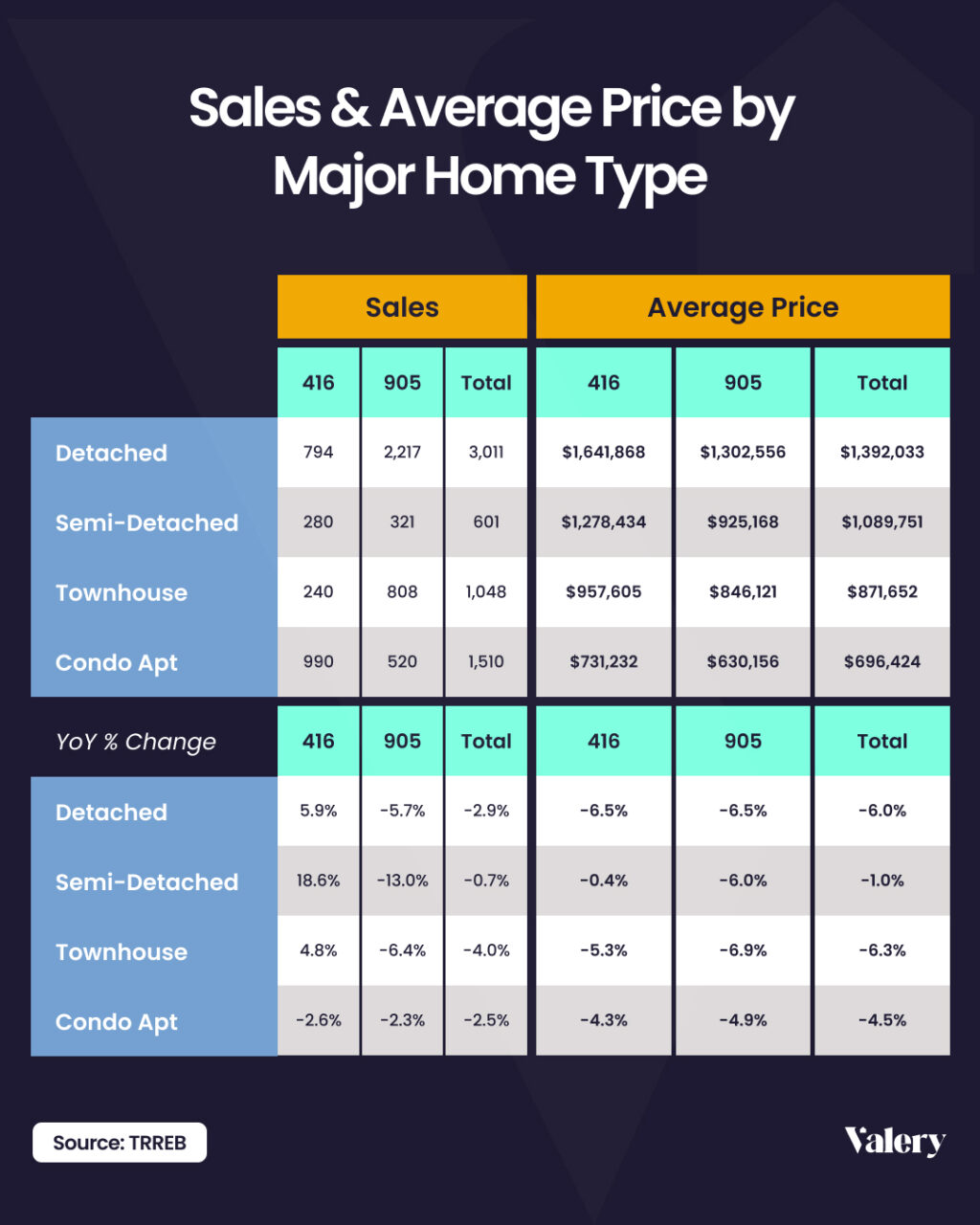

In Toronto, early signs of renewed activity are visible. Detached home prices dipped 6.5 per cent to $1.64 million, and this slight easing appears to have encouraged affluent buyers. Semi-detached homes performed even better, with sales up 18.6 per cent year over year, a possible signal that families are returning to urban neighborhoods after years of suburban migration.

The suburban 905, by contrast, shows a cooler trend. Detached home prices fell by the same margin as Toronto’s, landing at $1.3 million, but sales declined 5.7 per cent. Semi-detached and townhouse sales also slipped, underscoring a quieter market where inventory continues to build without equivalent demand.

Confidence Remains the Missing Link

Jason Mercer, TRREB’s Chief Information Officer, points out that additional interest rate cuts and improved global trade conditions could help rebuild consumer confidence. While borrowing costs are slightly lower than last year, they remain high enough to dampen enthusiasm for many.

A BMO survey earlier this year found nearly 67 per cent of prospective homebuyers delaying purchases until rates drop further. CMHC’s 2025 Mortgage Consumer Survey reinforces this trend, with more than half of first-time buyers citing concerns about overpaying in what still feels like an uncertain market.

This shift in mindset, from urgency to caution, has created an environment where affordability gains alone are not enough to reignite activity.

The Overlooked Factor: Public Safety

TRREB CEO John DiMichele’s remarks on rising home invasions and carjackings highlight an often-overlooked reality: housing markets are not insulated from broader societal concerns. Safety matters to buyers and renters alike. When confidence in public security is shaken, demand can soften in ways that even rate cuts cannot fully offset.

The federal government’s proposed crime bill, aimed at tougher bail and sentencing provisions, may help restore confidence in the long term. But in the near term, unease persists.

A New Generation of Buyers

Generational dynamics are also reshaping the market. Millennials remain the dominant first-time buyer cohort in the GTA, while older Gen Zers, many of whom delayed entry during the pandemic, are only now beginning to explore homeownership.

Unlike previous generations, these buyers are cautious and pragmatic. Faced with high living costs and economic uncertainty, they are more likely to prioritize flexibility and affordability, even if that means exploring alternative ownership models.

A Market on Pause

For buyers, the current environment offers negotiating room not seen in years. Prices are softer, inventory is abundant, and conditional offers are making a comeback. But the broader trajectory of the GTA market depends on more than these individual advantages.

Until confidence, rooted in economic stability, returns, the market is likely to continue along its measured, deliberate path.

The Verdict

June’s TRREB report captures a housing market standing at a threshold. Prices have eased, inventory has swelled, but conviction is still missing. Toronto and its suburbs no longer share the frantic pace of previous years. Instead, they move cautiously, waiting for signals that may come from rate cuts, stronger economic indicators, or simply the passage of time.

For now, the GTA housing market remains at a pause, one that could reset its rhythm or usher in the next great shift.

The GTA housing market may be in a rare moment of pause, but you don’t have to be. Stay ahead of the curve with Valery, your AI real estate assistant.