Table of Contents

The GTA housing market looks rough. Sales volumes are down, inventory is piling up, and prices are slipping. On paper, it feels like a market to avoid.

But that might be exactly why this is one of the best times to buy in years.

We’re entering a rare pocket of time where motivated sellers, slower competition, and creative deal structures, like Power of Sale (POS), Vendor Take-Back (VTB), and Mortgage Support (MS) converge. For strategic buyers, it’s time to move.

The Data Looks Bearish & That’s the Point

Sales Are Slumping, But Inventory Is Surging

Let’s not sugarcoat it: the latest TRREB numbers are ugly.

- Sales are down 23.3% year-over-year.

- Active listings have jumped 54.0%.

- Prices are down 4.1% overall, with condos seeing steeper drops in both 416 (-7.3%) and the 905 (-6.1%) areas.

- The average time on market (LDOM) is up 31.6%

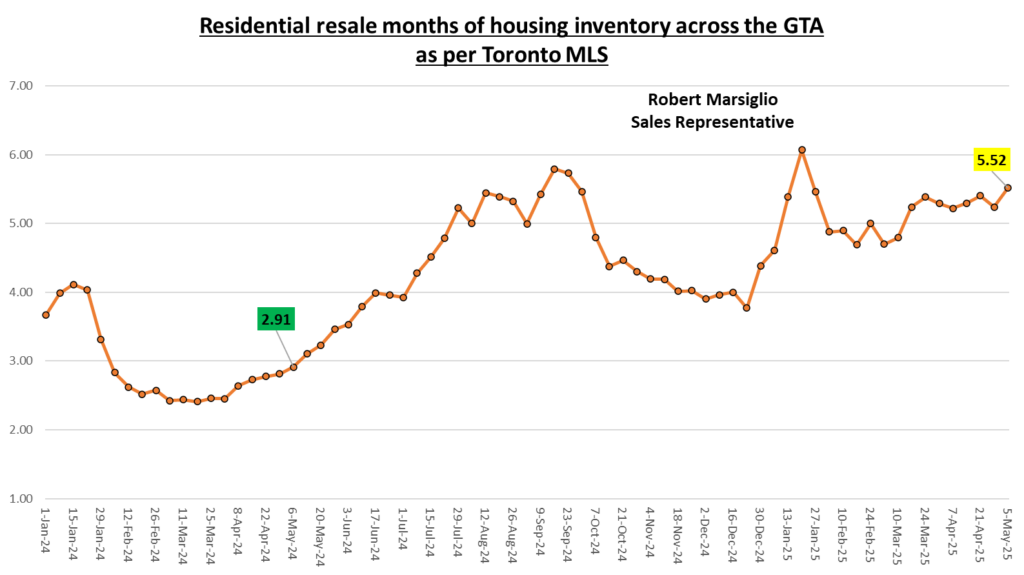

It’s not just about fewer buyers. It’s about listings accumulating. Early May 2025 shows one of the highest levels of active listings in the GTA housing market on record since the start of 2024, pushing the market into buyer’s territory, with 5.52 months of inventory, nearly double of what we saw a year ago.

What the GTA Housing Market Offers Buyers Right Now

Power of Sale, VTB, and Mortgage Support Deals Are Back

Markets like this create opportunity, just not for everyone. But if you’re an investor, downsizer, or a first-time buyer with cash or strong financing, this is your moment.

- Power of Sale: Distressed listings are rising. These are properties that must sell fast. They rarely come in hot markets.

- Vendor Take-Back (VTB): Sellers may offer to finance part of the deal themselves to attract buyers. That’s practically unheard of in tight markets.

- Mortgage Support: We’re seeing signs of more flexible terms being offered privately and even by lenders to keep deals moving.

These tools give buyers an unmatched advantage in negotiation, especially when many sellers in the GTA housing market are already reducing price expectations just to get offers.

Rents Are Flat, Prices Are Falling — Ownership Regains Its Edge

The Rent Plateau Is Real

One of the strongest indicators that buyers have leverage? Rents are no longer rising.

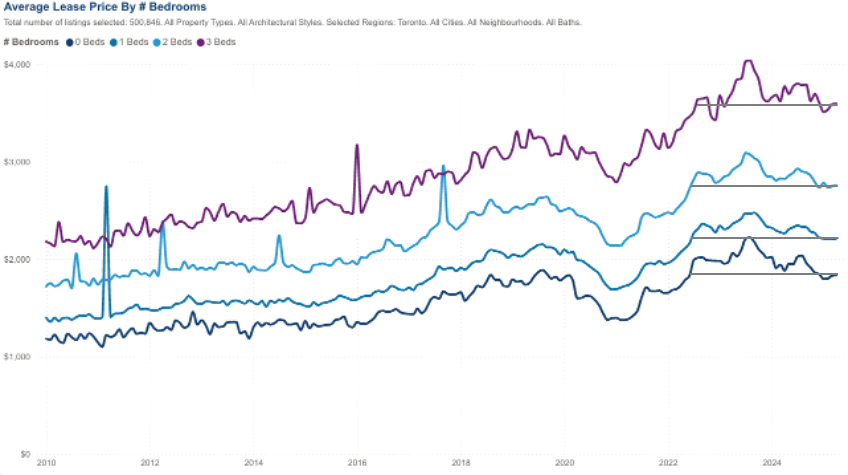

Despite population growth, average lease prices for 1–3 bedroom units have flat-lined at 2022 levels. See the chart below (courtesy The Habistat).

Combine that with falling home prices and rising inventory, and you start to see why buying vs. renting is suddenly becoming a financially sound question again.

The Last Time We Were Here? 2009. Early COVID. You Know What Happened Next.

A Familiar Pattern of Panic and Profits

If you rewind to early 2009 or Spring 2020, you’ll notice a similar setup:

- Sales dipped to multi-year lows

- Inventory ballooned

- Buyers paused in fear

And what followed? A massive appreciation wave within 12–24 months. Those who acted during uncertainty were the ones who came out ahead.

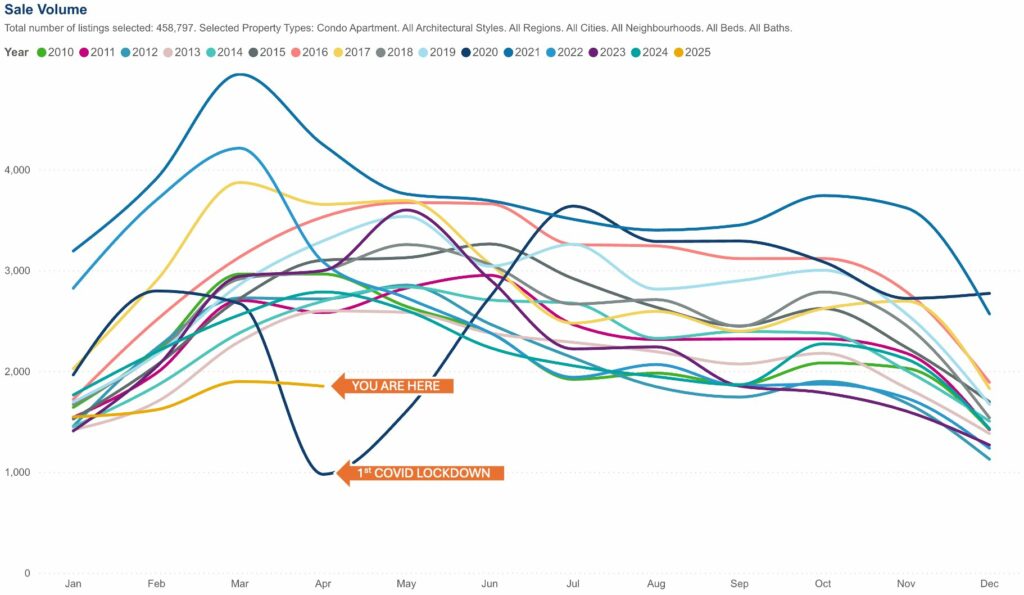

We’re now seeing similar early signals, i.e. a rising inventory, hesitation in the market and sharp pullback in sales activity. In fact, April 2025 condo sales are lower than any April since 2010, with the sole exception being the first COVID lockdown.

These moments don’t last long. If rates go down in the future, as predicted by the latest TD Economics report and buyers return, competition will pick up. The window for smart buys closes quickly.

This Market Isn’t for Everyone — But It’s Perfect for the Bold

Who Should Be Paying Attention?

This market rewards preparation, not perfection. If you’re:

- An investor looking for discounted assets

- A first-time buyer priced out in 2022-23

- Someone with the ability to negotiate terms (longer closings, inspection clauses, seller financing)

Then you’re exactly who this market is quietly rewarding.

And no, you won’t find many of these deals on the MLS with bold banners. You’ll find them through POS alerts, networked agents, and creative structuring.

Final Thoughts: Don’t Let Fear Distract You From the Math

The headlines scream uncertainty, but under the surface, the numbers paint a different picture: this is a high-inventory, low-pressure market where buyers finally have room to breathe, think, and negotiate.

Sellers are struggling to adjust. Many are open to conversations they would have laughed at two years ago. If you’re ready, the opportunity is there and it’s better than it’s been in years.

Want to track the best POS, VTB, or mortgage-assisted deals?

Get them delivered to your mailbox!