The Greater Toronto Area (GTA) housing market showed promising signs of recovery in September 2024, with home sales surging by 8.5% year-over-year, according to the latest TRREB market report. This notable increase comes amid ongoing challenges, including fluctuating economic conditions. Yet, the data suggests a shift in market momentum, sparking renewed optimism in the market.

As we look into the TRREB market report, we’ll explore the factors behind this growth, key market trends, and what they mean for buyers and sellers alike. Despite some hurdles, the September data underscores a potential recovery for the GTA housing market, supported by favourable policy changes and increasing affordability.

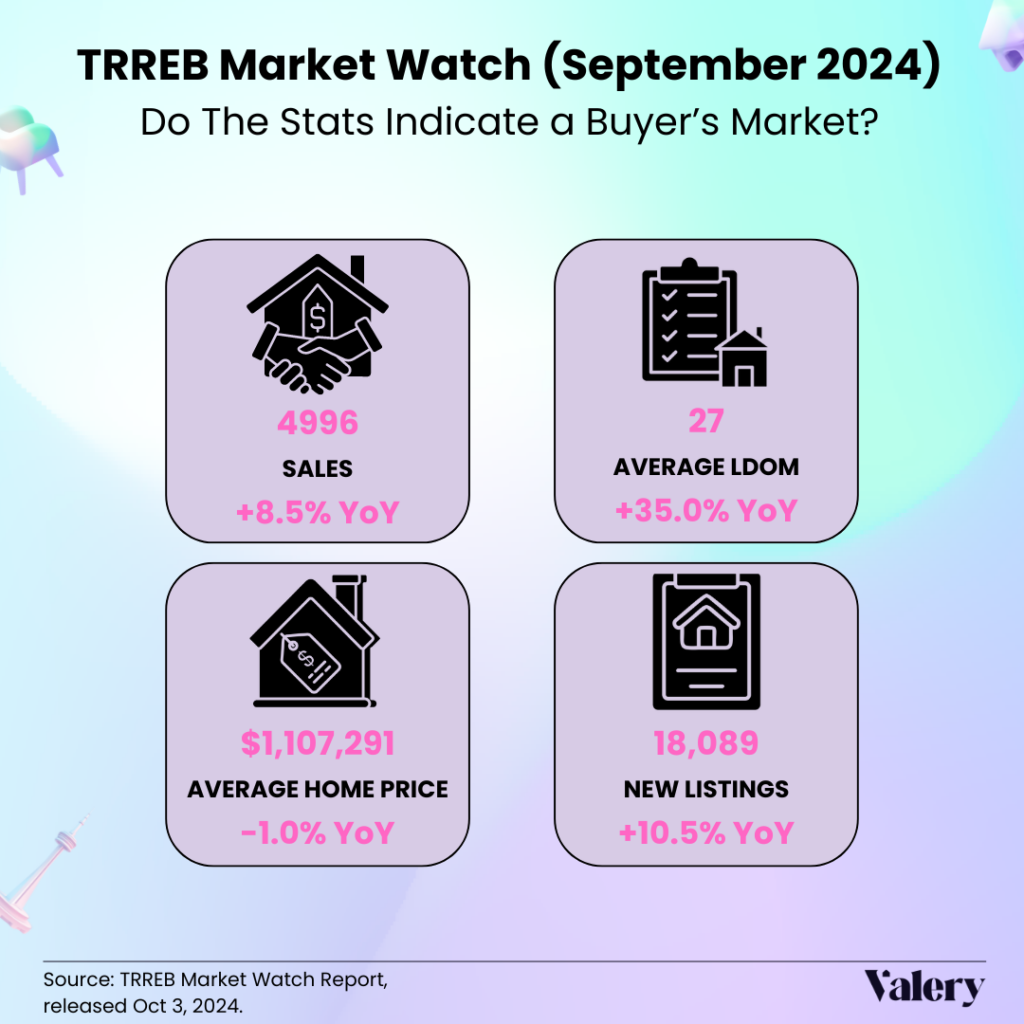

Key GTA Real Estate Market Statistics

One of the major takeaways from the TRREB market report is the 8.5% year-over-year increase in GTA home sales. This marks a significant boost in activity compared to September 2023, highlighting renewed buyer interest across various property types.

- Total Home Sales in September 2024: The GTA saw 4,996 residential transactions, up from approximately 4,606 in September 2023.

- Year-over-Year Comparison: This 8.5% surge reflects growing market confidence, aided by a combination of interest rate cuts and lower home prices.

- New Listings Data: New listings increased with about 18,089 properties listed in September 2024, up 10.5% year-over-year.

- Sales-to-New-Listings Ratio: With more properties hitting the market, the sales-to-new-listings ratio stood at 39.3%, showing a balanced market, slightly favouring buyers.

These statistics indicate that while new listings are on the rise, the demand from buyers remains robust.

Price Trends in the GTA Housing Market

The GTA housing market witnessed a price decline alongside the rise in sales. The MLS® Home Price Index Composite benchmark was down by 4.6 per cent year-over-year in September 2024.

- Average Selling Price: In September 2024, the average selling price for homes across the GTA was approximately $1.107 million, down from $1.118 million in September 2023.

- Price Trends by Property Type:

- Detached homes saw a 1.1% decrease in prices, averaging $1.423 million.

- Semi-detached homes and townhouses had average prices down by 0.4% and 4.0% respectively.

- The condo market remains a key focus, with average prices down by 3.6% as demand for affordable housing options continues to grow.

With prices decreasing, this indicates an improvement in GTA housing affordability, especially for first-time home buyers.

Factors Driving GTA Housing Market Recovery

Several factors are contributing to the gradual recovery of the GTA housing market in 2024, even amidst ongoing economic uncertainty. One of the most influential drivers has been the recent interest rate cuts by the Bank of Canada. These reductions have lowered borrowing costs, making mortgages more affordable and encouraging buyers to re-enter the market. This has been a key factor behind the surge in home sales in September, as many prospective buyers are now seizing the opportunity to purchase homes while rates remain favourable.

On top of that, changes to mortgage lending guidelines, effective December 2024, will play a critical role in making it easier for buyers, particularly first-time home buyers, to qualify for loans. These new regulations will provide increased flexibility in the home-buying process, allowing more individuals to access financing that was previously out of reach.

Segment Analysis of the GTA Real Estate Market

The TRREB market report offers valuable insights into the performance of various housing segments within the GTA real estate market. Sales of detached homes experienced growth, rising by 10.5%. However, the high prices associated with detached properties continue to pose a challenge for many buyers, limiting the accessibility of this segment despite the overall increase in transactions.

Townhouses are becoming increasingly popular outside of Toronto City, if the sales figures are anything to go by. Offering more space than a condo at a lower price point than detached homes, townhouses present a middle ground that appeals to buyers looking for value and room to grow.

Geographically, the GTA saw varied performance across different regions. Areas like the York and Peel Regions posted the highest sales outside of Toronto City. These trends underscore how various property types and regions are responding to evolving market dynamics, with affordability playing a key role in driving demand.

Impact of New Mortgage Lending Guidelines

Changes to mortgage lending guidelines will be instrumental in boosting market activity in the future. These revisions, announced over the past month, include more relaxed stress test requirements and higher borrowing limits, providing much-needed relief to buyers, especially in high-priced markets like Toronto city. By making it easier for potential homeowners to qualify for mortgages, these changes aim to expand the pool of eligible buyers and provide a boost to overall market demand.

TRREB CEO John DiMichele also emphasised the positive impact that recent changes to mortgage lending guidelines will have on homebuyers in the Greater Toronto Area (GTA). He highlighted that these adjustments, such as allowing existing mortgage holders to shop for better rates without undergoing the stress test and offering longer amortization periods, will make mortgage renewals more affordable. Additionally, the ability to insure mortgages for homes over $1 million will provide buyers with greater flexibility, helping to support the GTA housing market’s recovery.

Expert Market Analysis from TRREB

TRREB Chief Market Analyst, Jason Mercer’s analysis on the September situation underlines the growing power shift towards buyers in the GTA housing market.

In his exact wording, Mercer stated: “The annual improvement in September home sales was more than matched by the increase in new listings over the same period. This resulted in a better-supplied market and increased negotiating power for buyers re-entering the market. The ability to negotiate on price led to moderate year-over-year price declines, particularly in the more affordable condo apartment and townhouse segments, which are popular with first-time buyers.”

Opportunities for Buyers and Sellers in the GTA

For both buyers and sellers, the current market conditions in GTA offer unique opportunities. First-time home buyers, in particular, are benefiting from lower interest rates and lower home prices, making this an ideal time to enter the market. Affordable options such as condos and townhouses present a viable entry point for buyers looking to secure their first home. These properties are not only more accessible in terms of price but are also located in areas with strong demand, making them smart investments for long-term growth.

For sellers, especially in high-demand areas like the Peel Region and Toronto City, rising buyer interest is leading to competitive offers. However, pricing homes correctly remains crucial to attracting serious buyers and ensuring a quick sale. Additionally, investors may want to focus on the condo market, particularly in emerging neighbourhoods where the demand for rental properties is increasing. With the right strategy, these market conditions offer promising opportunities for both personal home purchases and real estate investments.

Looking Ahead: GTA Real Estate Market Forecast for 2024

Looking ahead, the GTA real estate market is expected to maintain its recovery throughout the remainder of 2024, with several key trends shaping its trajectory. While recent interest rate cuts have stimulated buyer activity, future rate decisions by the Bank of Canada will be closely watched for their impact on affordability. Experts predict a balanced market moving into 2025, though much will depend on broader economic conditions and government policy. Despite some challenges, the GTA housing market recovery is gaining momentum and appears poised for continued growth.

Conclusion

The TRREB market report points to a housing market in recovery, with opportunities for both buyers and sellers as we move toward the end of the year. Whether you’re a first-time buyer or a seasoned investor, consulting a REALTOR® will help you navigate this evolving landscape and make informed decisions.

FAQs on GTA Housing Market Trends

1. What caused the 8.5% surge in GTA home sales in September 2024?

The surge is attributed to interest rate cuts by the Bank of Canada and lower home prices.

2. What are the current trends in GTA real estate prices?

In September 2024, GTA real estate prices decreased by 1.0% year-over-year, with the average home price in the GTA being approximately $1.107 million.

3. What is the sales-to-new-listings ratio in the GTA housing market?

The ratio for September 2024 was 39.3%, indicating a balanced market, slightly favouring buyers.

4. How have interest rate cuts impacted the GTA housing market?

Interest rate cuts have made it more affordable for buyers, contributing to an increase in home sales across the GTA housing market.

5. Which property types are most in demand in the GTA housing market?

Detached homes and condominiums are currently the most in-demand property type, with townhouses also gaining popularity.

6. How will new mortgage lending guidelines benefit home buyers in Toronto?

The new guidelines will relax stress test requirements and raise borrowing limits, allowing more buyers to qualify for mortgages in Toronto’s high-priced market.

7. Which areas of the GTA saw the highest real estate sales?

Toronto City, York Region and Peel Region experienced the highest sales.

8. What is the forecast for the GTA real estate market in 2024?

Experts predict continued recovery, moderate price growth, and an emphasis on affordable housing options like condos.