Canada’s housing pipeline is stalling under the weight of soaring development charges. Ottawa’s plan to relieve these fees could revive projects, reshape affordability, and reset the balance between municipalities, builders, and buyers.

Table of Contents

Where does the real drama in Canada’s housing crisis unfold? It begins upstream, at the very point where new homes are meant to originate. Pre-construction sales in the Greater Toronto Area have fallen to the weakest level in a generation, with developers cancelling thousands of units and shelving entire phases. That collapse is starving tomorrow’s supply at the precise moment households need relief. The cause is not mysterious. When municipal development charges soar to six-figure sums per unit, the basic math of building breaks. Projects do not pencil out, lenders hesitate, buyers balk, and the pipeline seizes.

Ottawa now sits at the fulcrum. The federal government has floated relief on development charges. Done well, it could restart stalled projects, expand rental construction, and cool price pressures. Done poorly, it risks entrenching bad local incentives and transferring costs to taxpayers without fixing the bottleneck. The choice will set the cadence of Canadian housing for the rest of the decade.

What are development charges and why do they matter?

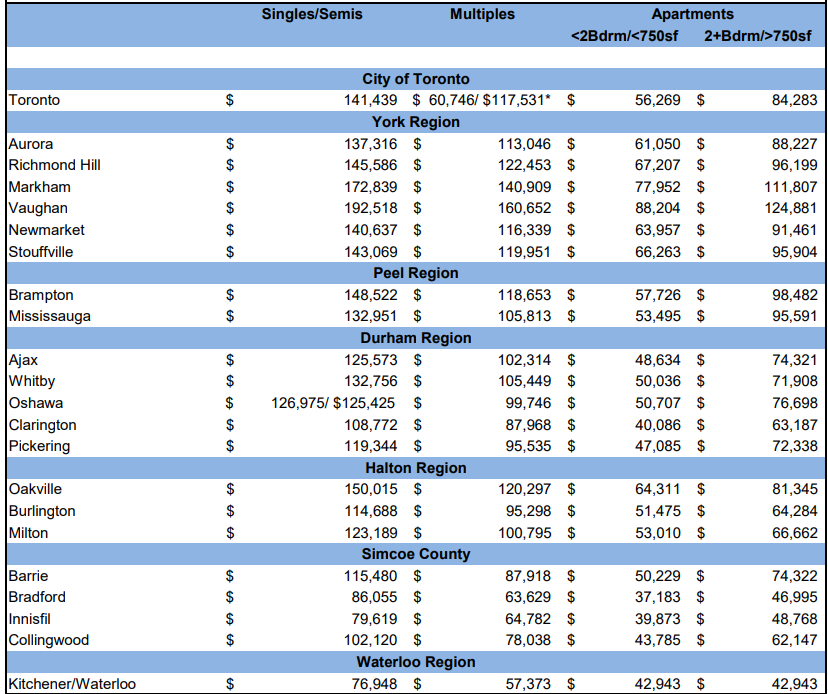

Development charges are one-time municipal fees on new homes. Cities use them to fund growth infrastructure such as water, sewer, roads, and parkland. In Ontario, these fees have marched upward for more than a decade. In Toronto they now add roughly the price of a mid-range car times three to a single new home. Oakville and Burlington are comparable. The latest Development Charge numbers compiled by Rescon Financial, for GTA are given below.

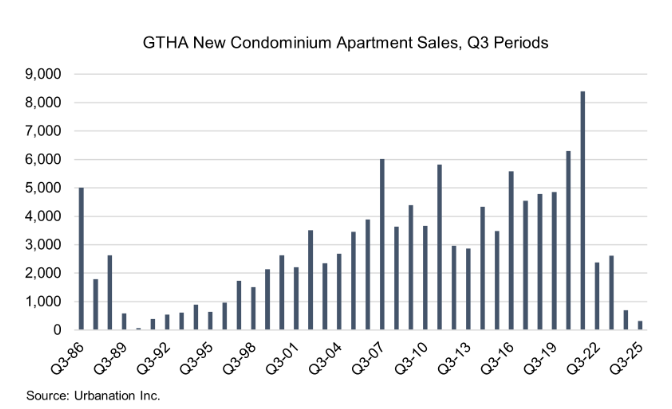

When fees rise faster than revenue, land, labour, and financing costs, the pro-forma collapses. Builders either raise prices, which the market will not absorb in today’s conditions, or pause and cancel. The result shows up in the charts. Sales of pre-construction condos in GTHA peaked in 2021 then slid to the slowest year since 2008, with 2025 tracking lower still. See the chart below. Cancellations have already set a record.

Why are municipalities stuck?

Municipalities argue that growth must pay for growth. They also face a cash flow squeeze when starts fall and fee revenue dries up. Toronto pencilled hundreds of millions in development charge collections, a figure now at risk as launches stall. Many municipalities also hold large development charge reserve balances that are committed to capital projects and cannot plug operating gaps. The distinction matters. Capex funds pipes and parks. Opex funds salaries and services. Cutting fees helps projects move but forces a rethink of how to finance infrastructure over time.

What is Ottawa proposing?

The federal government has signalled a plan to cover a significant share of development charges through budget measures and intergovernmental agreements. The logic is straightforward. Lower the upfront cost and more projects move. The fairness issue is equally plain. Jurisdictions that set the highest fees reap the largest federal subsidy, while cities that kept fees lean and supply moving gain less. A blunt transfer risks rewarding past excess without demanding reform.

A smarter structure would tie federal help to outcomes. Fewer dollars for high fees, more dollars for verified fee reductions and faster approvals. Priority for purpose-built rental and family-sized units. Transparent reporting on reserve balances and delivery milestones. Time-limited support that sunsets as market conditions normalize. Link dollars to doors in the ground, not promises on paper.

The competitive reset already under way

Markets are responding where policy has shifted. Several Ontario municipalities have cut or frozen development charges. Mississauga halved fees and removed them entirely for larger rental apartments. Vaughan rolled back to 2018 levels. Hamilton approved a two-year reduction. Burlington is weighing a full pause. Prices on one major Mississauga launch fell from roughly $1400/sqft to $875/sqft after fee relief and scope changes, a drop near 40 per cent that revived absorption.

This is more than a fiscal tweak. It is a competitive reset among first-ring suburbs that sell very similar products to the same pool of buyers and investors. Lower local costs win projects, jobs, permanent property tax bases, and future retail activity. Higher costs lose them. The effect is quietly deflationary. As pre-construction pricing edges closer to resale, pressure spreads across the market and affordability improves at the margin.

Implications for stakeholders

Buyers

Fee reductions allow new projects to launch at more affordable levels. For buyers, this means more competitive pricing, greater choice, and slower resale price growth as supply re-enters the market.

Renters

When development charges are reduced, purpose-built rental becomes more viable, especially when combined with federal financing programs. The result is easing rent inflation, improved housing quality, and stronger tenure security.

Builders and lenders

Lower and more predictable costs restore the viability of projects and reopen access to construction debt. Developers and lenders will still need to phase projects carefully and manage scope in a cautious demand environment.

Municipal leaders

Cutting fees trades near-term revenue for long-term growth. Municipalities that reduce barriers and streamline approvals can capture new projects, expand their tax base, and attract investment and residents.

Ottawa

Federal support design is critical. Covering inflated charges risks embedding inefficiency. Conditioning relief on actual fee cuts and project delivery offers the best path to expanding supply.

The way forward

Canada cannot solve affordability with resale churn alone. The engine that creates tomorrow’s supply must turn over again. Development charges became a blunt instrument for local finance in an era of easy demand. That era has ended. The federal budget is an opportunity to pivot from front-loaded barriers toward outcome-based partnerships that deliver doors, not delays. If Ottawa insists on transparency, conditionality, and speed, the pipeline can restart. If it chooses a simple transfer, the gridlock will return when the cheques run out.

Potential relief on development charges could open new opportunities for buyers.

👉 Book a Buyer Consultation with Valery to understand what those opportunities mean for your timing, financing, and next move in today’s market.

Frequently Asked Questions (FAQ)

1. Why are new condos not selling?

Because the cost of building has become too high. Developers face rising construction expenses, higher borrowing costs, and very steep municipal development charges. When the numbers no longer work, projects stall or are cancelled, and buyers see fewer units come to market.

2. What are development charges?

They are one-time fees that municipalities collect from builders whenever a new home or condo is created. The money is supposed to pay for infrastructure tied to growth, such as roads, sewers, water systems, and parks. In practice, the fees have grown so large in Ontario that they make many projects financially impossible.

3. Why are development charges so much higher in Ontario than elsewhere?

Over the past decade, Ontario municipalities have leaned heavily on these fees to fund growth, raising them year after year. In Toronto, the charge for a new home has risen from under $15,000 in 2010 to about $138,000 today. By contrast, Calgary averages around $22,000 per unit and Vancouver roughly $40 per square foot on high-rises. Ontario’s dependence on this revenue has pushed costs far above the national norm and created a major barrier to new housing supply.

4. What is the federal government proposing?

Ottawa has signaled that it may cover a portion of municipal development charges, possibly up to half, to help more projects move forward. Details are expected in the federal budget. The goal is to lower upfront costs for builders and accelerate new supply, especially rental housing.

5. Will cutting fees actually lower home prices and rents?

Yes. When fees are reduced, builders can bring projects to market at lower prices, which buyers directly benefit from. Over time, as more supply is built, competition also puts downward pressure on resale prices and rents.

6. What happens if nothing changes?

If development charges remain high and projects continue to stall, Canada’s housing shortage will deepen. Fewer new homes will be built, affordability will worsen, and cities will lose both the short-term fees they counted on and the long-term property tax revenue they could have gained.

ABOUT THE AUTHOR

Daniel Foch is the Chief Real Estate Officer at Valery, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, The Globe & Mail, Storeys and Real Estate Magazine (REM). His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.