The Canadian housing market has moved into 2026 with strained fundamentals. Sales remain below long-term norms, inventory continues to build despite fewer listings, and household behaviour reflects rising leverage rather than renewed confidence. While transactions may increase, pressure from mortgage renewals, uneven regional pricing, and early stress signals suggest the adjustment is ongoing rather than resolved.

Table of Contents

The Canadian housing market has a habit of looking calmer than it really is at the turn of the year. December data is always thin, activity slows as households retreat indoors, and forecasts start leaning forward into spring with a familiar confidence. This rhythm is well understood by anyone who has watched the market long enough. What is less often acknowledged is how easily that seasonal quiet can be mistaken for stability.

This winter, that misreading risk feels elevated. National headlines describe a market that is relatively balanced, resilient, and according to some optimists, on the cusp of renewal. Underneath that language, the underlying structure looks more fragile, more uneven, and more dependent on patience than conviction. The tension is structural. And it is building quietly.

A market still living below its own history

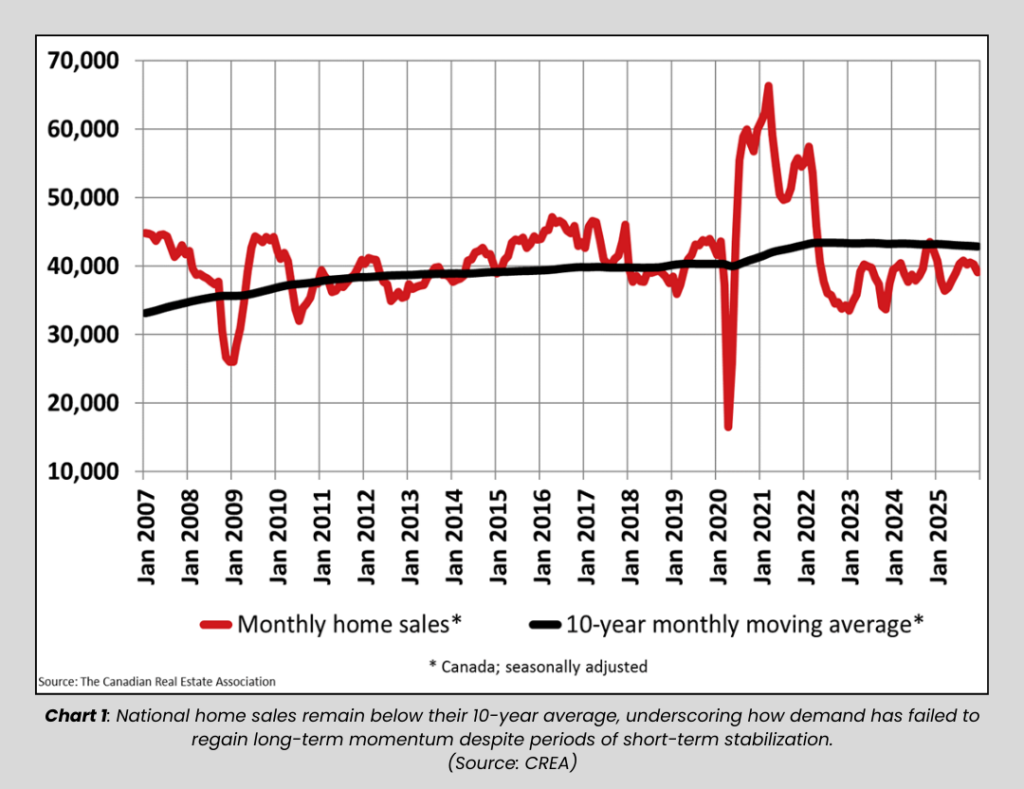

One of the most useful ways to strip away noise in Canadian housing data is to compare current sales activity to long-term norms. On that measure, the market remains subdued. National sales have spent an unusually long stretch below the 10 year average, as the chart below from the Canadian Real Estate Association (CREA) shows. Only once in the past cycle did activity briefly rise above that line before slipping back under. Even more telling, the long-term average itself has stopped climbing. The pace of demand is no longer accelerating.

This matters because recoveries are often defined by a return to excess. Canada is not there. Even if sales improve modestly, the best-case scenario implied by the data is a return to historical normality rather than a renewed expansion. That distinction is frequently lost in headline narratives, but it defines the difference between a market regaining balance and one rebuilding momentum.

In my recent breakdown of the CREA’s December data and updated outlook, I walked through these trends chart by chart and explained why the rebound narrative looks overstated when set against the underlying data:

Quarterly sales since 2020 reinforce that view. After the pandemic surge and subsequent reset, activity has settled into a narrow band well below the peak. December sales fell 2.7 per cent month over month and were 4.5 per cent lower than a year earlier. Seasonal effects explain some of that softness, but the broader signal is choppy, fragile demand rather than latent strength waiting to reassert itself.

When fewer listings still mean more supply

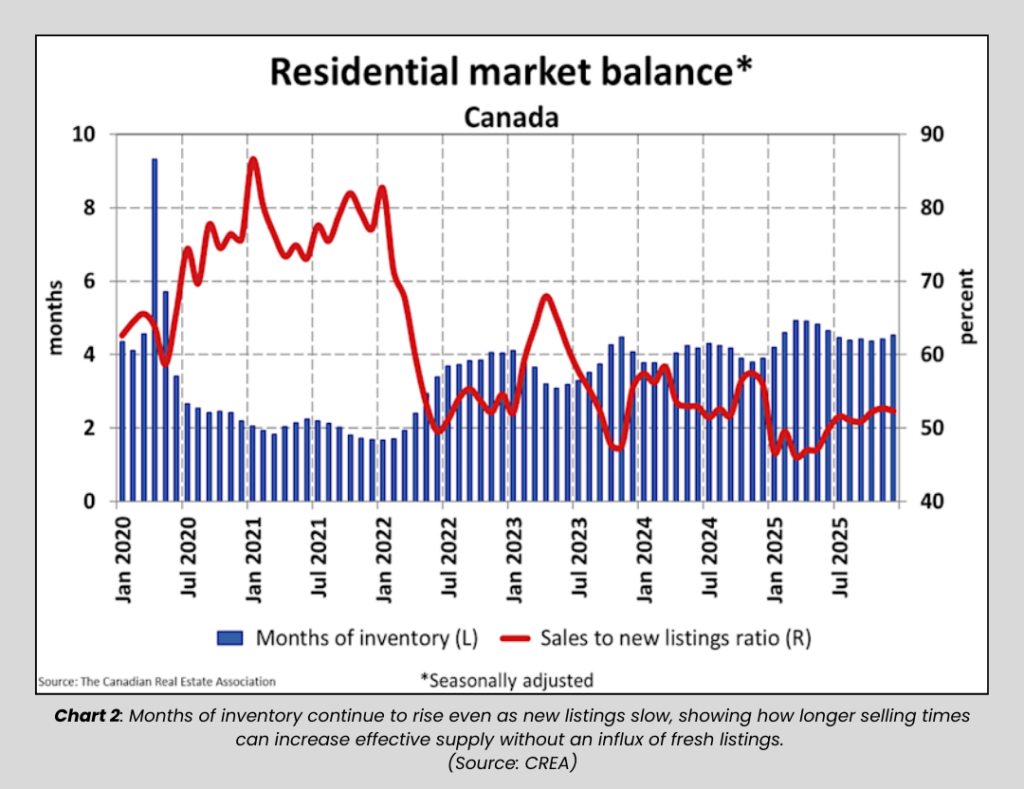

New listings have been declining, a fact often cited as evidence of tightening conditions. On its own, that observation is incomplete. Supply is not just what enters the market in a given month. It is also what fails to leave.

Inventory continues to rise nationally even as new listings slow. Homes are taking longer to sell. Listings linger. Selection increases. Months of inventory have climbed to roughly 4.5 months, a level that materially changes negotiating dynamics even though headline measures still describe the market as balanced. In practice, balance does not feel balanced when buyers have more time and more choice.

This is where the market enters a more delicate phase. Elevated cancellations suggest many sellers are pausing rather than exiting. In markets like Toronto, terminations ran far above prior years throughout 2025. That behaviour is consistent with households waiting for a better window rather than capitulating outright. Spring has always been that window.

The risk is not that listings disappear. It is that they reappear all at once.

Spring as a stress test rather than a release

Spring markets are routinely framed as a return to normal activity. In 2026, spring functions more as a stress test. Two outcomes are plausible. One aligns with the optimistic view that buyers return, demand absorbs supply, and inventory tightens. The other is less comfortable but increasingly consistent with recent behaviour. Sellers who delayed listing bring supply forward at the same time. Carryover inventory remains. New listings arrive. Buyers, having been rewarded for patience, stay selective.

In that scenario, spring will concentrate pressure instead of relieving it.

The balance of forces matters here. Interest rates have come down but appear broadly stable. Unemployment is rising. Mortgage renewals are cresting at historically high volumes, with roughly 60 per cent resetting at higher rates than before. None of these dynamics create urgency on the buy side. Several create pressure on the sell side.

That asymmetry helps explain why buyer leverage has quietly improved even without a sharp price break.

National averages hide provincial weight

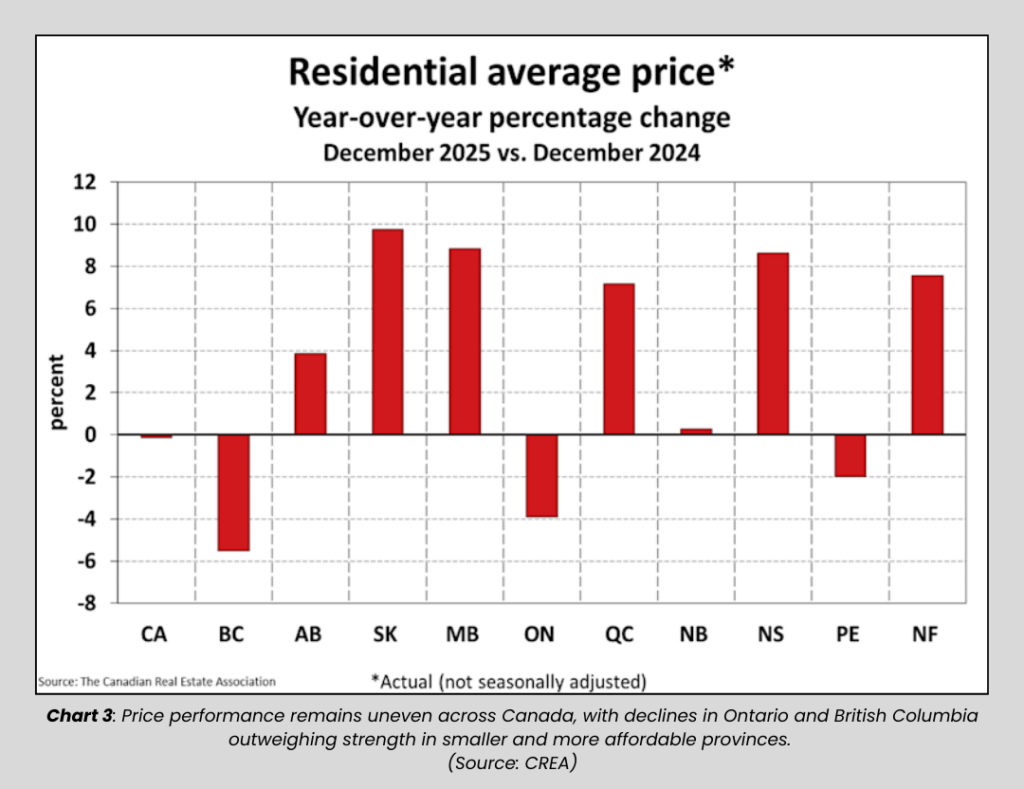

The Canadian housing market has always been regional, but national outcomes are shaped by the largest and most expensive provinces. Ontario prices remain down roughly 4 per cent year over year. British Columbia is closer to 6 per cent lower. Several smaller provinces remain firm or are still posting gains. Alberta is still positive but no longer accelerating after earlier double digit increases.

These stories can coexist without contradiction. What they cannot do easily is offset one another in national aggregates. When the two largest markets are declining, smaller markets struggle to pull the average higher. This is one reason national price growth has been elusive despite pockets of strength. It also explains why confidence drawn from select regional performance can be misleading.

If I have to sum the picture up, I would say that the market is constrained where it matters most.

Household behaviour explains the fragility

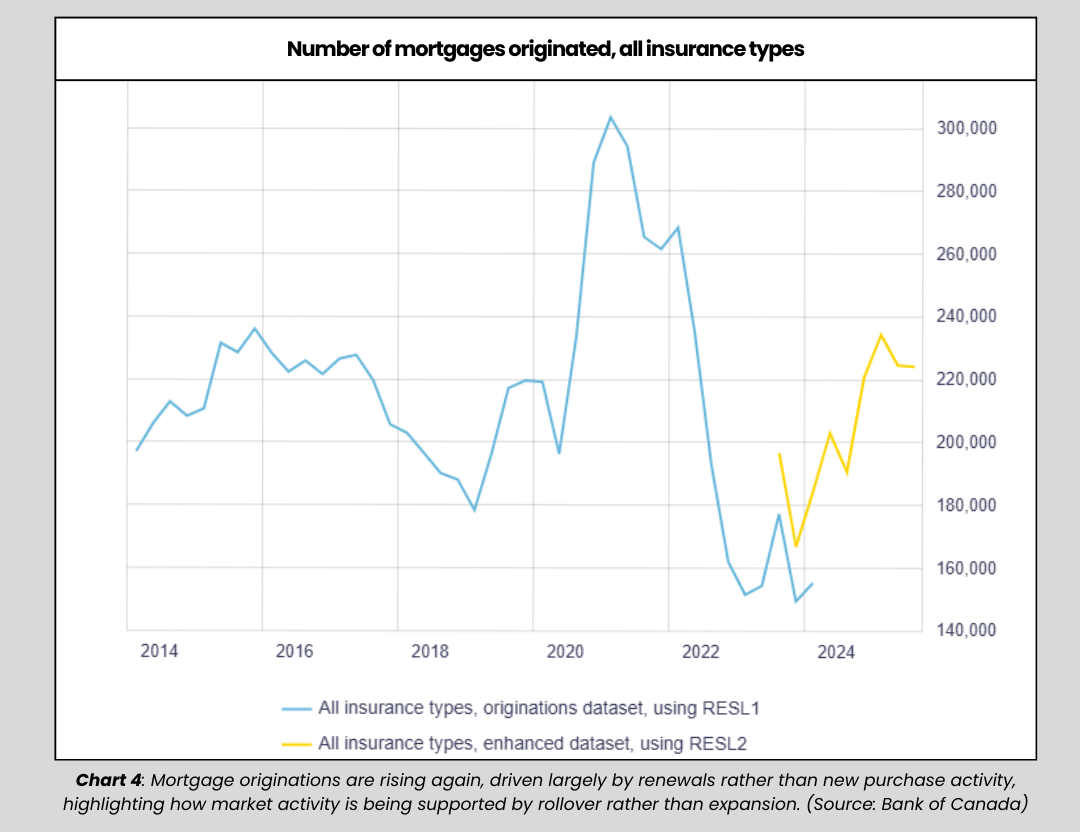

The Bank of Canada’s financial stability indicators help explain why the coming months feel like an unsettled period. Mortgage originations are rising again, but the increase appears driven largely by renewals rather than a resurgence in transactions. Demand exists, but it is acutely sensitive to payment size.

Borrowers are making payments work by stretching amortizations. Longer terms lower monthly costs but slow equity accumulation and raise total interest paid. At the same time, borrowers are favouring shorter fixed terms, signalling a belief that rates will be lower when they renew. That positioning is rational, but it also increases exposure if that belief proves wrong.

Leverage is creeping higher through the middle of the distribution. Median loan-to-income ratios are rising as rates ease slightly, while the most extreme cases remain constrained by regulation. Fewer buyers are arriving with large equity cushions. First time buyers are increasingly entering with minimal down payments, often near 95 per cent loan-to-value. Thin equity limits flexibility and amplifies risk in a flat or declining price environment.

I explored these dynamics in more detail in another video reviewing the Bank of Canada’s financial stability dashboard, including trends in leverage, delinquencies, and speculation. Check it out:

Early stress signals are also visible. Delinquencies across non mortgage credit categories are rising toward prior cycle highs. Mortgages are usually the last obligation households fall behind on. When stress shows up elsewhere first, it often foreshadows broader pressure if labour conditions continue to weaken.

At the same time, speculation has faded sharply. House flipping activity has collapsed, reflecting higher carrying costs, tighter qualification, weaker price momentum, and less favourable tax treatment. The absence of speculative demand removes an important marginal buyer from the system. That does not cause a crash. It does make recoveries harder to sustain.

Where leverage now belongs to patience

Taken together, these dynamics describe a market that can function but struggles to heal. Transactions may rise as prices drift lower and affordability inches forward. That is not the same as a rebound. It is price discovery playing out over time.

For buyers, this environment rewards preparation and restraint. Selection is improving. Negotiation has returned. Time is an asset. For sellers, the trade-off between price and speed is unavoidable. Pricing to yesterday extends listing timelines and increases the risk of chasing the market down. Flexibility matters more than conviction.

The broader implication is less dramatic but more durable. Canada’s housing market is still adjusting to a higher rate world and a softer labour backdrop. The adjustment is uneven, regional, and slow. It is happening through behaviour rather than headlines.

Spring will reveal how much pressure has accumulated. What follows will depend less on optimism than on whether households and markets can absorb the weight they have been quietly carrying.

Want to find out how inventory, pricing, and leverage are evolving where you live?

Continue the analysis using Valery, your AI real estate companion (click on her in the bottom right corner).

Frequently Asked Questions (FAQs)

Q1. What is happening in the Canadian Housing Market in 2026?

The Canadian Housing Market is entering 2026 with uneven demand, rising inventory pressure, and improving buyer leverage rather than a broad price rebound.

Q2. Why does the Canadian Housing Market feel unsettled right now?

The Canadian Housing Market feels unsettled because sales remain below long-term norms while mortgage renewals, unemployment risk, and delayed supply continue to build pressure.

Q3. Is the Canadian Housing Market becoming a buyers market?

Parts of the Canadian Housing Market are shifting toward buyer-friendly conditions as inventory rises and negotiation power returns, especially in Ontario and British Columbia.

Q4. Will prices recover in the Canadian Housing Market in 2026?

A national price recovery in the Canadian Housing Market appears unlikely in 2026, as weakness in the largest markets continues to weigh on overall performance.

Q5. Why does spring matter for the Canadian Housing Market?

Spring matters for the Canadian Housing Market because it will reveal whether delayed listings and cautious demand lead to tighter conditions or further inventory buildup.

ABOUT THE AUTHOR

Daniel Foch is the Chief Real Estate Officer at Valery, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & PropTx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, The Globe and Mail, Storeys and Real Estate Magazine (REM). His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.