Oxford Economics projects a long plateau for the Canadian housing market. Buyers will retain negotiating power, sellers will have to wait years to regain 2022 peaks, and renters will see relief as fresh supply eases affordability pressures.

Table of Contents

The Canadian housing market has been stripped of its familiar extremes. Oxford Economics’ latest Housing Chartbook dismisses the prospect of both a dramatic crash and a spectacular boom. Instead, it points to something less dramatic, yet far more consequential for households, i.e. a long plateau.

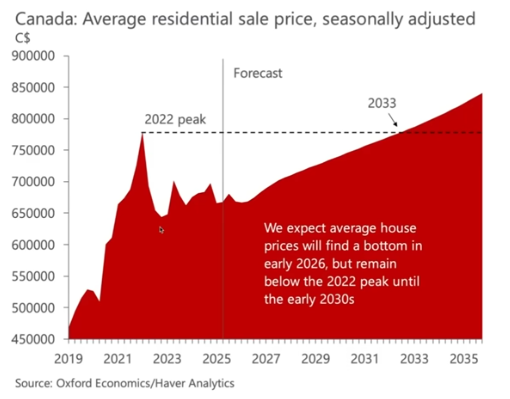

As I talked about in my video on the report, nominal prices will dip into 2026 before inching higher, but once inflation is accounted for, values remain flat through 2030. That forecast reshapes the assumptions that have guided buyers, sellers, and investors for a generation. Housing will not serve as an easy hedge against inflation. It will not be a reliable escalator of wealth. Instead, Canadians will have to navigate a market defined by scarcity, constrained affordability, and subdued growth.

For families making decisions about when to buy, sell, or rent, the implications are immediate.

What Buyers Need to Know

The days of racing to buy before prices accelerate are behind us, according to the report. Prices are expected to decline further into early 2026, then recover only slowly. That creates room for buyers to act strategically.

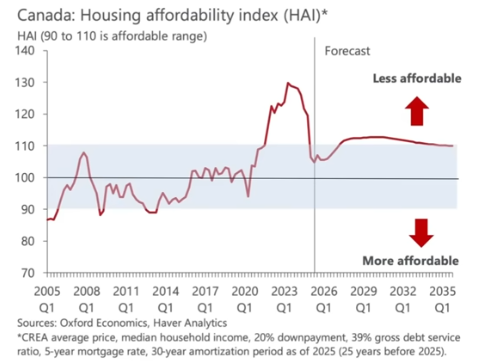

Affordability will remain stretched, so households should focus on what monthly payments look like at today’s fixed rates rather than betting on appreciation. Negotiating power has shifted. Listings are sitting longer, inventory is climbing, and sellers are more willing to accept lower offers to close a deal.

For buyers in Toronto and Vancouver, patience and discipline are critical. For those in Calgary, Halifax, or Montreal, resilience in local markets may shorten the window of opportunity. In every city, the principle is the same. Affordability first, speculation second.

What Sellers Need to Know

The plateau changes the psychology of selling. Homeowners who continue to anchor to 2022 valuations risk stagnation. The forecast suggests it may take a decade or more for prices to revisit that peak in Toronto. Holding out for yesterday’s numbers is likely to mean months of delay and eventual price cuts.

Sellers should work with agents to price competitively from the outset and to invest in presentation and marketing that differentiates their property. In a market where appreciation will not do the work for you, positioning is everything.

What Renters Should Watch

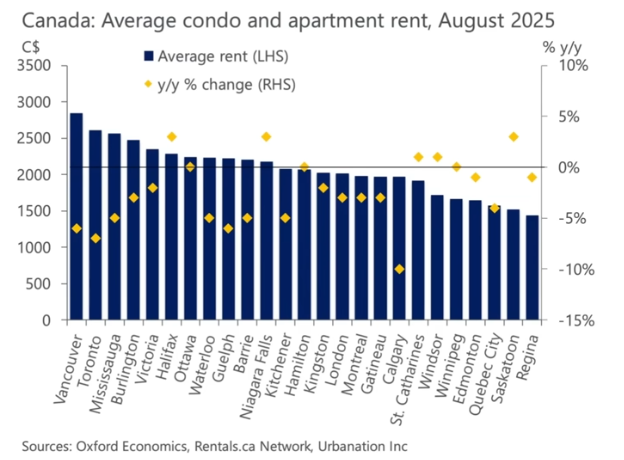

One of the quiet revolutions of this cycle is unfolding in rental housing. Purpose-built rental completions went up 35 per cent in 2025, providing more choice for tenants and easing pressure on rents. Investor-owned condos remain under stress, adding further supply.

For renters, this means greater leverage in lease negotiations, particularly in downtown cores. However, affordability challenges persist in major markets like Toronto and Vancouver, where average rents still exceed what median incomes can comfortably sustain (see the chart below). The shift to purpose-built rental is likely to continue, supported by federal incentives, giving tenants a more stable share of the housing mix.

The Role of Agents in a Plateau Market

In a market deprived of speculative momentum, expertise matters more than ever. Agents are no longer simply intermediaries in a fast-moving market. They must become trusted advisors who can interpret affordability metrics, explain absorption trends, and guide clients through a more complex decision-making environment.

Conclusion

The decade ahead will not reward wishful thinking. Buyers must stress test affordability, negotiate assertively, and buy with the confidence that long-term holding is the only route to security. Sellers must accept the new realities of pricing and resist the temptation to wait for a rebound that may take years. Renters should take advantage of new supply and increased choice.

The picture painted by the report makes clear that decisions in the decade ahead must be grounded in realism. For agents, this environment is not only a challenge but an opening to lead with knowledge and strategy rather than momentum and speculation.

At Valery, agents are equipped with AI-powered tools that turn data into clarity and strategy into results.

In a plateau market, that edge matters more than ever.

If you want to stand out, win clients, and lead with confidence, join Canada’s first AI-powered brokerage.

Frequently Asked Questions (FAQs)

Q1. Will home prices in the Canadian housing market rise again soon?

According to Oxford Economics’ latest Housing Chartbook, nominal prices will decline into early 2026 before slowly recovering. However, when adjusted for inflation, values are expected to remain flat through 2030. This means homeowners should not expect rapid appreciation or a return to 2022 peak prices in the near term.

Q2. Is it a good time to buy a home in Canada?

Buyers have more negotiating power in today’s Canadian housing market as inventory rises and listings sit longer. The key is to focus on affordability at current interest rates rather than betting on short-term appreciation. For those with a long-term horizon, buying during a plateau can still be sensible if the monthly payments work.

Q3. What does this plateau mean for sellers?

Sellers need to be realistic. Holding out for 2022 valuations could lead to long delays and eventual price reductions. Pricing competitively and ensuring strong presentation are essential in a market where buyers have the upper hand.

Q4. How will renters be affected?

Renters are gaining leverage as more supply enters the Canadian housing market. Purpose-built rental completions increased in 2025, easing upward pressure on rents. Investor-owned condos are also under strain, creating more choice for tenants. Still, affordability remains a challenge in Toronto and Vancouver.

Q5. Could the Canadian housing market still crash?

A severe downturn cannot be ruled out. Risks such as a global financial shock or weak absorption of new supply could push prices lower than Oxford’s base case. However, Canada’s chronic housing shortage makes a full-scale crash less likely.

ABOUT THE AUTHOR

Daniel Foch is the Chief Real Estate Officer at Valery, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, The Globe & Mail, Storeys and Real Estate Magazine (REM). His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.