Table of Contents

The Canadian condo market is undergoing its sharpest structural shift in decades, with the pre-construction condo market at the centre of the change. From Toronto’s record-high inventory to the unprecedented climb in rental housing starts, the balance between ownership and rental is tilting faster than most expected. The numbers tell a story that is both local and national, cyclical and structural. Also, in some markets, deeply risky.

While Vancouver leads in absolute unsold condo units, smaller BC cities like Chilliwack and Kelowna face the most severe pressure per-capita. Toronto, for all its headlines, may not be the most overbuilt city on a per-capita basis, but the dynamics unfolding here will shape housing outcomes across the country.

In this breakdown, we tap into the insights from our Chief Real Estate Officer, Daniel Foch, whose latest video analysis maps out the risks, the market shifts, and what they mean for the future of homeownership and rental housing in Canada.

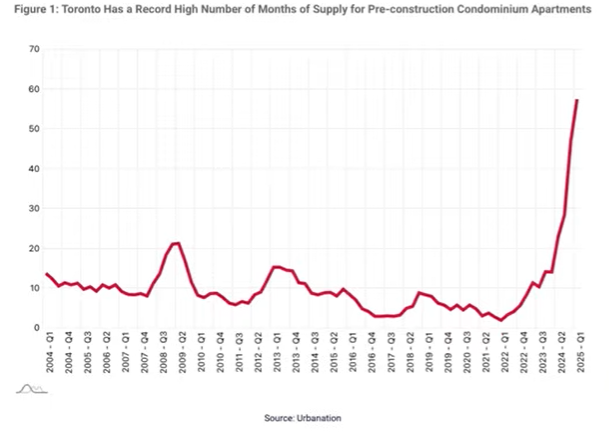

Record Months of Supply in Toronto’s Pre-con Market

Toronto’s pre-construction condo market has hit 57.4 months of supply, the highest on record. The pre-con model depends on strong early sales to secure financing. In the boom years, investors lined up for contracts on future units, betting on appreciation and bypassing the need to manage rentals immediately.

Today, with no overflow demand from the resale market, that mechanism is breaking down. Buyers can find better economics in resale condos: lower prices, faster possession, and fewer carrying cost uncertainties. Daniel notes this is the core reason the speculative pre-con bid has evaporated.

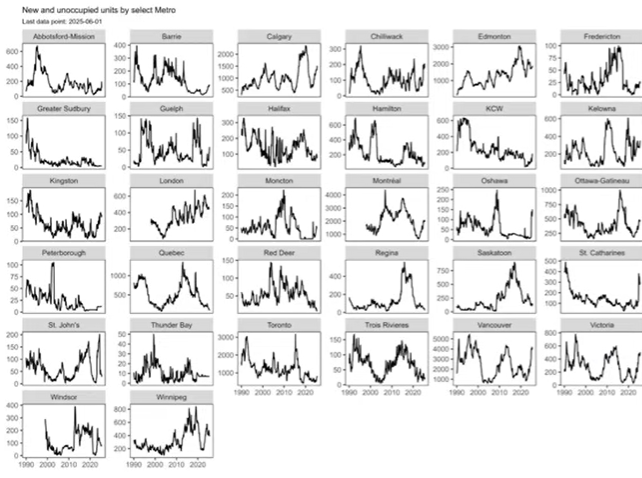

Regional Patterns in Unsold Inventory

While Toronto, Montreal, and Vancouver dominate the national picture in absolute unsold units, the raw totals don’t tell the whole story. In some smaller and mid-sized metros, unsold inventory is climbing far faster relative to local demand, and in certain cases, the trajectory is the real red flag.

Ottawa–Gatineau and St. Catharines – Sharp Climbers

Ottawa–Gatineau has seen a notable recent acceleration in unsold units, forming a steep “hockey stick” pattern. St. Catharines is also rising quickly, driven in part by local policy incentives: a grant program and fast-track approvals for garden suites and multiplexes.

In both cases, these are relatively small demand centres. A sudden inflow of new supply can create imbalances faster than in larger metros, where population growth can absorb more units.

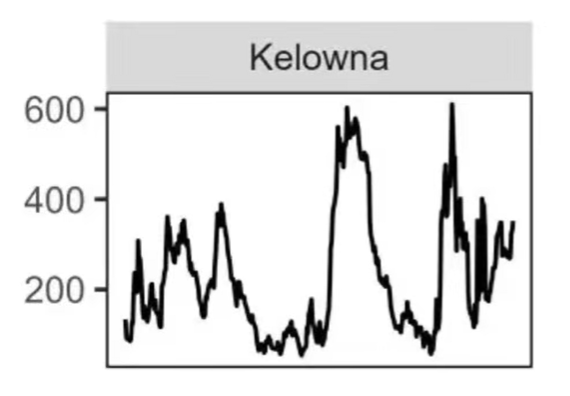

Kelowna – Volatility as a Risk Signal

Kelowna’s unsold inventory has been one of the most volatile in the country. Daniel notes spikes during the 2016–2017 rate-hike cycle, compounded by BC’s foreign buyer tax and the introduction of the federal B-20 stress test. The city saw another sharp rise during COVID.

While the latest climb may be temporary, the market’s volatility itself is a vulnerability. It means builders, investors, and lenders can’t rely on steady absorption rates.

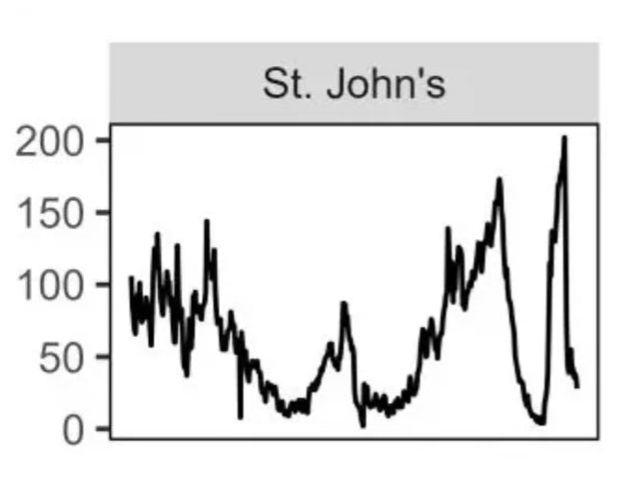

St. John’s – From Spike to Decline

St. John’s experienced a huge increase in unoccupied units before a rapid drop. The market has been buoyed by retirees and “snowbirds” from more expensive provinces attracted to its affordability and beauty.

But smaller metros like St. John’s are more fragile: a sudden slowdown in starts, a vacancy increase, or falling rents can create outsized impacts on values and developer viability.

Toronto and Vancouver – Long-Term Surges and Slowdowns

Both cities saw major run-ups in unsold inventory in the mid-2010s, partially absorbed in the following years, then reignited after COVID. Vancouver currently sits far above Toronto in absolute numbers, but both are dealing with higher interest rates, weaker investor demand, and less overflow from resale markets.

Daniel points out that Toronto’s pre-construction system is better at front-loading sales than Vancouver’s, which helps limit the scale of unsold stock, but doesn’t eliminate risk if buyer financing falls through at closing.

Why Per-Capita Risk Changes the Picture

When we talk about per-capita risk, we mean the likelihood that unsold or soon-to-be-completed units will overwhelm local demand, leading to slower absorption, price cuts, or stalled projects. Looking at risk this way can paint a very different picture than absolute totals.

On a per‑capita basis, Chilliwack is most exposed, followed by Kelowna, Abbotsford–Mission, Edmonton, Vancouver, Saskatoon, Calgary, Victoria, and St. Catharines. That concentration on the West Coast matters because BC’s population growth is barely above zero, so new supply isn’t being absorbed quickly.

Alberta’s big in‑migration softens the blow for Edmonton and Calgary, but Daniel still flags them as high‑risk for overbuilding given how much pre‑con capital and CMHC MLI Select activity is piling in. Meanwhile Ontario is seeing negative interprovincial migration, and federal caps mean non‑permanent residents fall from ~7% to ~5% of population (≈ 800,000 fewer people), with some converting to PR and many leaving, which is another drag on absorption.

Toronto sits lower on this per‑capita list. Its risk is different: not a glut of unsold units, but a sold pipeline heading to closing. Many of those completions could be cash‑flow negative and potentially equity negative, pushing rents to become more negotiable while investors work to cover carrying costs.

The per‑capita lens separates headline cities from true local strain. Some smaller metros carry heavier risk relative to demand, while big markets wrestle with a different problem set: trapped developer capital on unsold stock in places like Vancouver, and closing risk on sold pipelines in Toronto.

The Pivot to Rental Construction

With the pre-construction condo model faltering, many developers are pivoting to purpose-built rentals. The numbers are staggering. Rental units under construction have hit record highs, both in raw unit count and as a share of total housing starts.

Daniel compares the shift to an automaker moving from selling cars outright to leasing them: the product is the same, but the business model is different. In rental construction, developers keep ownership and earn revenue over time rather than selling upfront.

This isn’t always a choice. Many developers prefer to sell and move on, but with pre-con sales too slow to finance projects, they are “not left a choice” if they want to keep crews busy and land pipelines moving.

The risks are long-term. Real estate supply operates on a multi-year lag: a project started during a 2% vacancy rate could be delivered into a 7% vacancy market if multiple players build at the same time. This “whipsaw” effect can push rents down by 10% or more, undercutting project viability, especially in smaller markets where demand is less resilient.

Ownership Rates Continue to Fall

Between 2011 and 2021, homeownership rates fell across almost every province and territory. The decline is sharpest among younger Canadians, who face both affordability barriers and limited ownership supply.

Daniel ties this directly to the construction shift: as more housing units are built for rental rather than ownership, the trend is self-reinforcing. Policy decisions, whether deliberate or not, are accelerating this change.

While many still view homeownership as a pillar of financial stability and personal freedom, Daniel notes that in Canada, ownership comes with high transaction costs (land transfer taxes, property taxes, development charges) and risks (CRA liens). By contrast, renting can offer more mobility, lower upfront costs, and even greater security in some provinces where eviction protections are strong.

Condo Pipeline Pressures in the GTHA

The condo development pipeline in the Greater Toronto and Hamilton Area is under pressure from both ends: with back-end blockages in completed inventory and front-end weakness in new sales. Together, these forces threaten to slow future ownership supply and reshape the region’s housing mix.

Back-End Blockages – Completed but Unsold Inventory

The GTHA has seen a sharp rise in completed but unsold condo units. These are finished homes that remain vacant, tying up developer capital.

Daniel explains that in development, time is money twice over: every month a unit sits unsold delays the return of invested capital and adds carrying costs. For many developers, that capital was earmarked as equity for the next project. Without it, the financing pipeline seizes up, and the next wave of starts gets pushed back.

Front-End Weakness – Historic Drop in New Condo Sales

On the front end, new condo sales in the GTHA have fallen to their lowest level in more than 30 years. Pre-con sales are the lifeblood of the condo model. Without them, banks won’t fund new projects.

Daniel cautions against assuming this slowdown will inevitably cause a shortage in five years. While fewer ownership units are breaking ground, much of that gap is being filled with rental construction.

The real question is whether population growth, currently muted by policy changes, will rebound enough to create another ownership crunch within 5–10 years. If it does, the lack of new ownership supply could fuel another price surge.

Market Pricing Pressures

The resale market and the broader affordability picture are sending mixed signals: prices are softening in the short term, but ownership remains structurally expensive in the long run.

Resale Prices Losing Ground

In both Toronto and Vancouver, resale condo prices have been trending downward. This shift makes resale units a more attractive economic choice than new pre-construction, where prices are typically higher and closings are years away.

Daniel points out that the economics have always favoured resale, but in the boom years, speculative demand still flocked to pre-con. Pre-construction offered a paper bet on future appreciation without the burden of immediate ownership.

Today, with no excess demand to spill into the pre-con market, that speculative advantage has vanished, eroding the buyer pool for developers.

Affordability Still Out of Reach

Despite these recent price declines, Canada’s price-to-income ratio remains historically high, especially in major cities. For many households, homeownership is still out of reach without making major compromises in location, size, or quality.

Daniel connects this to the structural shift toward rental: if ownership is financially unattainable, demand naturally flows into rental housing. This is one reason why purpose-built rental construction remains robust even as ownership-focused projects slow.

Construction Job Losses and Pipeline Risks

The slowdown in pre-con sales is already rippling through the construction sector. Statistics Canada reports 22,000 construction jobs lost, a 1.3% drop in employment.

Daniel calls this “the pipeline stalling in real time”. When developers can’t clear existing inventory, they can’t start new projects. When projects don’t start, tradespeople, suppliers, and related industries feel the squeeze.

He expects policymakers to react eventually, but warns that they may wait until the damage is obvious, by which time restarting the pipeline will be slower and more expensive.

Final Word

Ownership supply is shrinking while rental supply increases. Developers are shifting business models, some by choice, others by necessity. Smaller markets face acute per-capita risk, while big metros grapple with capital tied up in unsold projects.

If immigration policy, financing models, or market sentiment don’t shift, the “own nothing” trend will continue, not as an ideology, but as an economic reality.

Valery AI is trained on Daniel Foch’s insights and the latest market reports to show you exactly how today’s shifts affect your numbers, risks, and opportunities. Get your Personalized Real Estate Playbook now.