Table of Contents

Two consecutive CREA reports now read like chapters from the same book. June’s numbers echo May’s with uncanny precision: a modest uptick in sales, prices holding their ground, and a market dynamic that speaks in hushed tones rather than loud proclamations.

Real estate rebounds are often dramatic, but not this time. This recovery is slow, deliberate, and almost tentative. We see a market feeling its way forward like someone testing thin ice.

The takeaway is obvious. Canada’s housing market remains suspended, waiting for a clear signal to move decisively, all while trade tensions and tariff threats add an extra layer of uncertainty.

A Second Month of Cautious Progress

In May, national home sales broke a six-month slide with a 3.6 per cent month-over-month rise. June extended that trend, albeit slightly, with a 2.8 per cent increase. Together, these gains point to a slow return of activity after months of hesitation.

The Greater Toronto Area continues to lead this modest recovery, its sales climbing a cumulative 17.3 per cent since April. Yet even this momentum leaves the GTA well below its usual levels of activity. Confidence may be returning, but it remains measured.

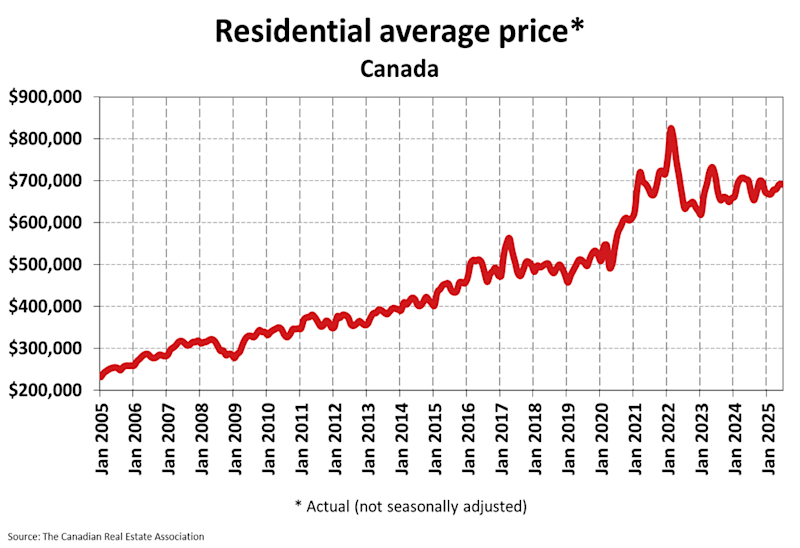

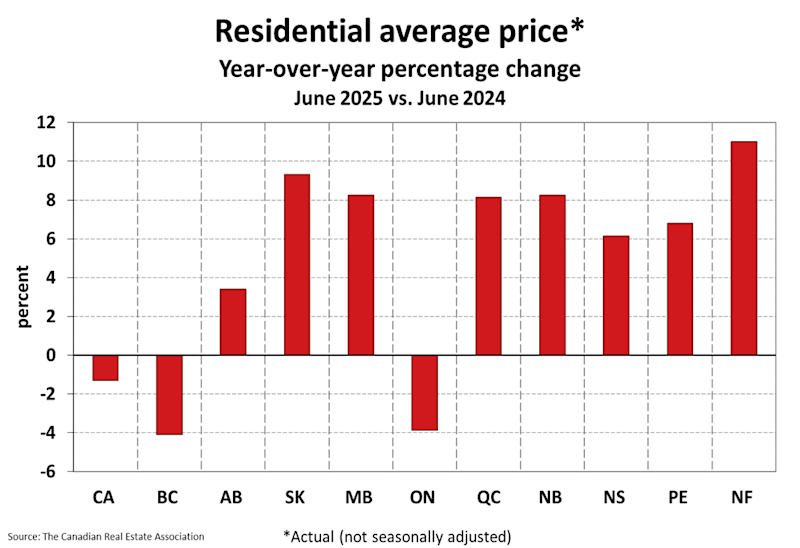

Nationally, the average home price in June was $691,643, nearly identical to May’s figure of $691,299. Compared to last year, the average sits 1.3 per cent lower, a softer decline than May’s 1.8 per cent year-over-year drop.

Balanced But Not Settled

CREA’s data reflects a national market that is balanced overall, yet this balance masks stark regional contrasts.

Buyers and Sellers Markets Explained

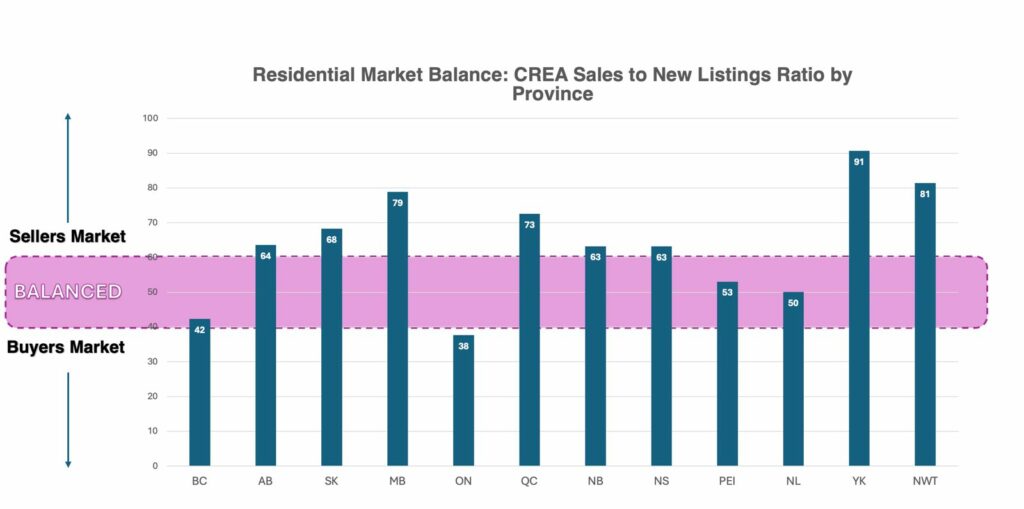

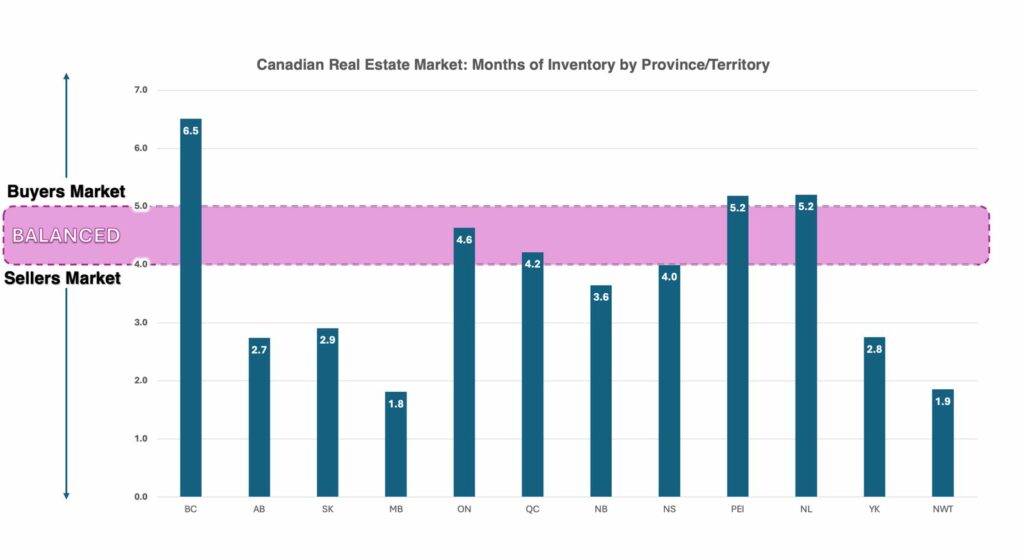

Two key metrics help define market conditions: the sales-to-new-listings ratio and months of inventory.

When supply exceeds demand and the sales-to-new-listings ratio falls below 45 per cent (or inventory climbs above 6.4 months), buyers gain the upper hand. Conversely, a ratio above 65 per cent or inventory under 3.6 months indicates a sellers market. Between these ranges lies a balanced market where neither side dominates.

Regional Realities

In the chart below, Ontario’s ratio of 38 per cent signals a definitive buyers’ market. Here, ample inventory and intense competition among sellers give buyers more breathing room to negotiate and explore their options. Vancouver shows similar conditions, favouring buyers as well.

Conversely, several provinces report ratios above 65 per cent, firmly situating them in sellers’ market territory. With limited supply and heightened demand, buyers in these regions face greater urgency to act swiftly or risk missing out.

Supply Tapers as Sales Edge Higher

June saw new listings slip 2.9 per cent after three months of gains that had begun to favour buyers in some major markets. With sales rising and fewer homes hitting the market, the sales-to-new-listings ratio nudged up to 50.1 per cent from May’s 47.3 per cent.

Active listings at month-end totaled 206,435, up 11.4 per cent from a year earlier and just one per cent below the long-term seasonal average. Nationally, there are 4.7 months of inventory, slightly under the five-month benchmark. Alberta and Manitoba, with 2.7 and 1.8 months respectively, sit firmly in sellers’ territory, while British Columbia’s 6.5 months of inventory points to conditions favouring buyers.

Prices Hold but Regional Divergence Widens

After three consecutive months of nearly one per cent price declines earlier this year, the past two months brought a welcome pause. The MLS Home Price Index dipped only 0.2 per cent from May to June.

Price trends remain uneven across Canada. Saskatchewan, Manitoba, and Newfoundland posted year-over-year gains of 8 to 12 per cent, while Ontario and BC saw average prices slide by about four per cent.

This divergence highlights why local context matters. Buyers in Vancouver and Toronto are navigating markets with more negotiating power. Meanwhile, sellers in cities like Winnipeg are again seeing strong interest in their properties.

The Rise of the Calculated Move

This is no longer a market of rushed deals and inflated risk-taking. Nor is it the frozen landscape of late 2024. Instead, we are in what can only be described as a negotiation market, a climate where thoughtful strategy counts more than speed or bravado.

Today’s buyers are deliberate, scrutinizing their options and walking away when the terms fail to add up. Sellers, meanwhile, are entering the market cautiously, pricing with precision and avoiding overreach.

This balance may not last. If interest rates ease further later this year, sidelined buyers could re-enter in larger numbers, tightening conditions and reducing the breathing room currently available.

Looking Ahead

June’s CREA numbers, much like May’s, do not signal a runaway market. Instead, they reaffirm a trend of cautious recovery and a return to discipline.

As underscored in May’s analysis, this is a market that favours those who move carefully and with purpose. That lesson now feels even more true.

This market currently rewards strategy, not speed. Let Valery craft you a tailored real estate action plan. She’ll call you for a quick chat, analyze your local market in minutes, and send over your Personalized Playbook, so you can move forward with confidence. Get started here!