Table of Contents

National housing averages often blur more than they clarify. CREA’s April 2025 data confirms what many on the ground have already observed: Canada’s housing market is increasingly shaped by where you live, not by what national figures suggest.

In Ontario and British Columbia, prices are trending downward, listings are rising, and buyers are increasingly cautious. But in Alberta, Quebec, and much of Atlantic Canada, the momentum is heading in the opposite direction. Prices are climbing, demand remains strong, and inventory is tight.

This divergence isn’t new and it is becoming more pronounced. And it’s not a short-term quirk either. It’s the result of factors like migration shifts, regional affordability and varying levels of economic resilience that continue to shape the Canada housing market.

To make sense of where the market is heading, it’s no longer enough to look at the average. You need to understand the map.

British Columbia and Ontario: Softness Turns into Stagnation

Home Prices Continue to Drift Down

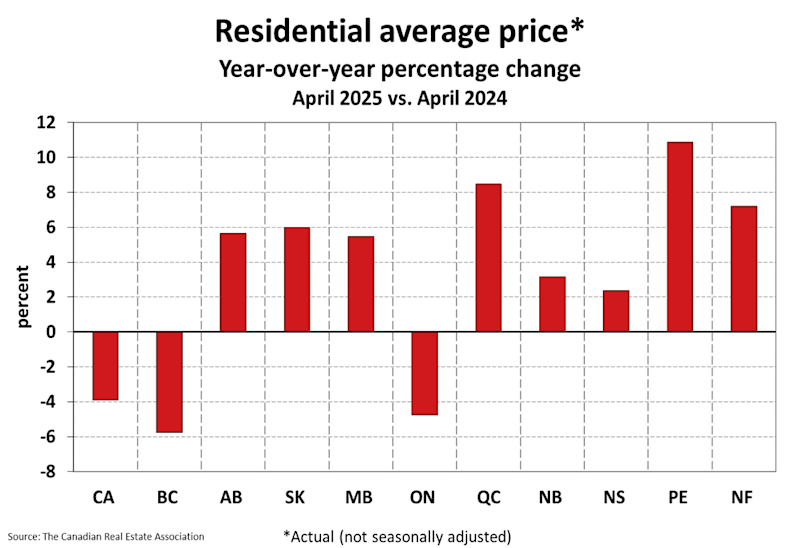

Ontario and BC, once the pillars of Canadian housing growth, are now pulling national averages lower. According to CREA:

- Ontario home prices declined 4.8 per cent year-over-year

- BC prices dropped 5.8 per cent year-over-year

- The national average fell 3.9 per cent year-over-year

The trend is clear. Markets in both provinces are retreating, not crashing, with buyers taking a wait-and-see approach.

Confidence Has Not Recovered

While interest rates have remained relatively stable lately, buyer psychology hasn’t. CREA highlights tariff-related economic uncertainty, particularly in Ontario, as a growing factor holding buyers back. Buyers in these markets are no longer deterred by price alone. They’re hesitant, and in real estate, hesitation often leads to softening prices.

Atlantic Canada and the Prairies: Quiet Strength in the Margins

Price Growth in Secondary Markets

Outside Ontario and BC, housing conditions look much stronger. As of April 2025, year-over-year price growth was:

- Prince Edward Island: +10.9 per cent

- Quebec: +8.5 per cent

- Newfoundland & Labrador: +7.2 per cent

- Alberta: +5.6 per cent

- Saskatchewan: +6.0 per cent

- Manitoba: +5.5 per cent

These provinces didn’t see the same level of speculative growth during the 2020–2022 boom and thus have had less ground to give back. Their relative affordability and supply constraints are helping prices hold and climb.

Inventory Still Tight Outside the Big Two

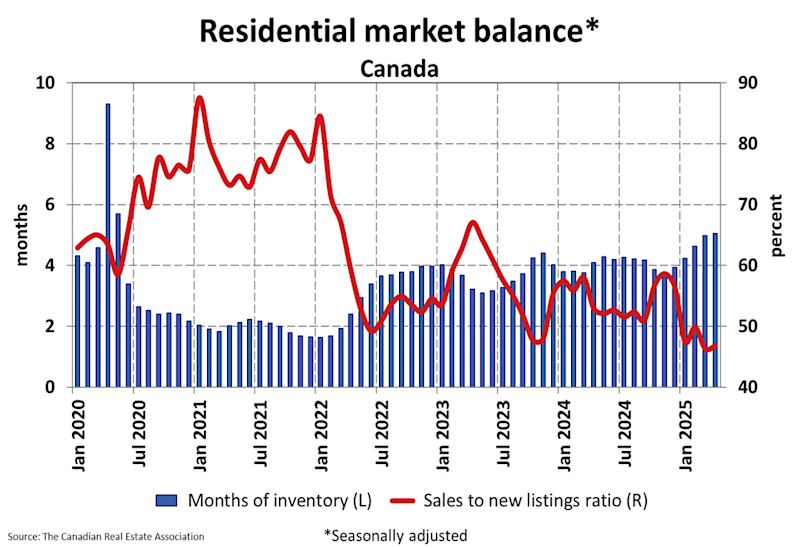

According to CREA, the national sales-to-new listings ratio rose to 46.8 per cent, close to the balanced-market range (long-term average is 54.9 per cent), with 5.1 months of inventory on average across Canada.

But that “balance” hides significant contrasts.

National active listings rose 14.3 per cent year-over-year to 183,000 homes, but the bulk of that increase came from Ontario and BC. In contrast, inventory in Alberta, Quebec, and the Atlantic provinces remains tight, keeping those markets competitive. Homes are still moving briskly, just not making national headlines.

In short, the national numbers tell a stable story. But beneath the surface, some provinces are cooling, while others are still climbing.

Canada housing market chart showing residential market balance from January 2020 to April 2025, with sales-to-new listings ratio and inventory trends.

What’s Driving the Divide in the Canada Housing Market?

Ontario and British Columbia: Demand Drains and Economic Drag

According to BMO Economics, Ontario recorded a net inter provincial outflow of over 32,000 people in 2024, the largest on record. British Columbia followed with a net loss of nearly 10,000. While migration isn’t the sole factor, such a significant population shift likely contributed to softer housing demand in two of the country’s most expensive and traditionally high-growth markets.

Confidence has also taken a hit. Ontario’s economy is vulnerable to U.S. trade tensions, including tariffs on Canadian steel and manufacturing. In BC, stagnant wage growth, high debt levels, and cooling investor interest have weighed on demand.

Alberta, Quebec, and Other Provinces: Growth Anchored in Migration and Affordability

In contrast, Alberta gained nearly 53,000 inter-provincial migrants in 2024. For context, that is the highest in Canada. Quebec and the Atlantic provinces also posted steady population growth, much of it from Ontario and BC. There is a good chance these inflows have influenced housing demand.

These provinces also remain relatively affordable, which has allowed buyers to absorb interest rates more easily. With lower entry prices, demand remains active, and price momentum has continued.

What Buyers and Sellers Should Know

For Buyers: Conditions Vary Sharply by Region

If you’re house hunting in Ontario or BC, you’re entering a market that’s meaningfully cooled. Inventory is up, prices are down, and sellers may be more flexible, especially if facing mortgage renewals. This is a time to negotiate carefully and with data.

But in provinces like Alberta, Quebec, and PEI, the opposite is true. Prices are climbing, and sales-to-new listings ratios remain in seller’s market territory. With affordability still intact and an expected rise in demand, waiting could mean paying more later.

For Sellers: Know Your Local Conditions

In Ontario and BC, overpricing will likely lead to extended days on market. Presentation and pricing strategy are now critical. In active regions, sellers still hold negotiating power but must meet buyers where they are i.e. financially cautious and rate-sensitive.

The Bottom Line

This is no longer about a hot or cold market. It’s about entirely different climates. In some regions, the challenge is absorbing demand. In others, it’s managing risk.

We’re watching a geographic divergence driven by economic fundamentals, migration shifts, and buyer psychology.

So the next time you hear a headline about “the Canadian housing market,” ask a simple question:

Which Canada are they talking about?

Because in 2025, understanding that distinction is the difference between making a smart decision and making a risky one.