The Bank of Canada’s latest policy rate hold at 2.25 per cent cannot hide the stress accumulating across households and real estate. The conditions shaping the market are moving faster than the indicators describing them.

Table of Contents

A rate hold is often interpreted as a pause in uncertainty, yet this one arrived at a moment shaped by rising household tension, softening private sector momentum and a housing market that has entered a new, complex phase of a slow correction. The Bank of Canada kept the policy rate at 2.25 per cent. At first glance, this appears calm. The larger story however, is more intricate. The economy is sending mixed signals and households are responding to conditions that are far more fragile than the headline data suggests. The stakes for real estate are significant because the direction of the policy rate now interacts directly with the financial stress people are living through every month.

Official Data Shows Resilience Yet Housing Conditions Tell a Different Story

GDP in the third quarter turned positive after a contraction in the second quarter. Earlier GDP estimates were revised upward. Headline inflation is within the Bank’s preferred band. The labour market appears stable in the official reports. These indicators create an impression of momentum. They do not capture the reality of slower wage growth, rising part-time work, greater reliance on self-employment and a consumer environment shaped by exhausted budgets. These pressures influence how people make housing decisions. A household that faces stagnant income and persistent cost inflation adjusts its behaviour even when national statistics appear stable.

Government Spending Is Holding Up Growth

Much of the recent economic expansion has come from public sector activity. Government spending is lifting GDP at a time when private sector investment is slowing. More public sector jobs have been added this year than private sector jobs. Many of the economic gains now depend on fiscal spending rather than organic business strength. This dynamic is known as fiscal dominance because the policy actions taken by governments are doing more to support growth than the policy rate can restrain.

The Policy Rate Hold and the Mortgage Path Ahead

Mortgage markets reacted immediately to the rate hold. The Canada five-year bond yield moved sharply on the labour release before the announcement, then settled slightly lower after the decision.See the chart below. Fixed mortgage pricing follows this yield closely. A stable policy rate helps anchor expectations, yet it does not guarantee relief.

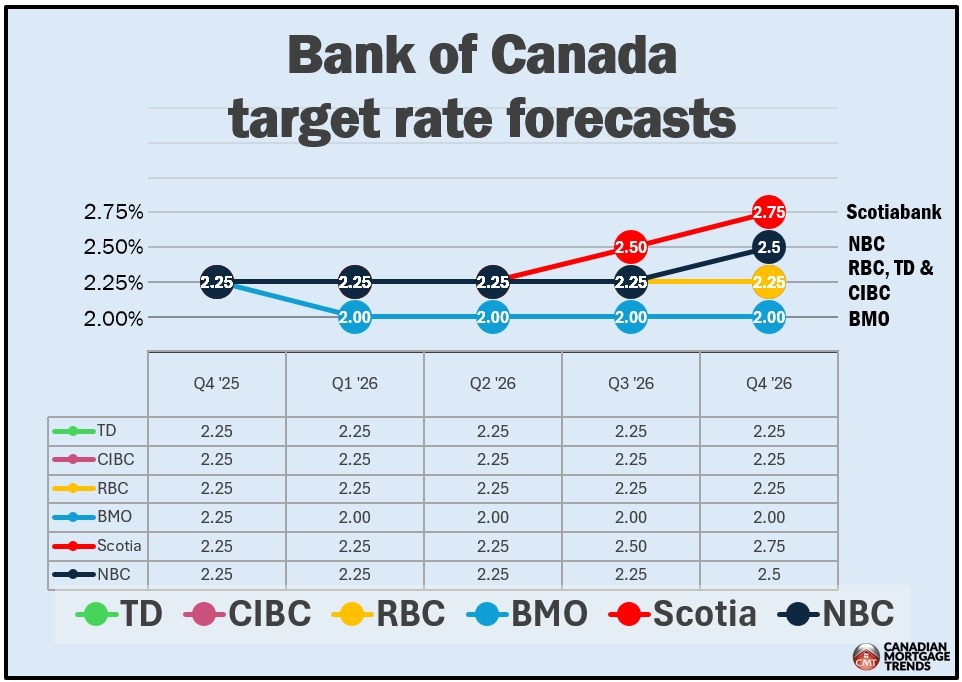

Several major banks now forecast different rate paths for 2026. Some anticipate gradual cuts. Some foresee extended stability. A few argue that the policy rate could rise again if headline indicators remain positive. This wide spread of forecasts reflects a market struggling to reconcile surface resilience with the financial strain many households face. Anyone renewing a mortgage in 2026 must prepare for a year shaped by uncertainty rather than a quick return to low borrowing costs.

A Delayed Recession Creates Unclear Signals for Housing

Traditional recession indicators are emerging in the latest data on the Canadian economy. Part-time work is rising faster than full-time positions. Self-employment is expanding in ways that suggest people are patching income gaps rather than pursuing new opportunities. Business investment continues to soften. Consumer fatigue is visible across many categories.

These conditions influence the housing market long before a recession is officially declared. Buyers become more careful. Sellers hesitate to test the market. Investors evaluate risk through a more conservative lens. A recession that is delayed rather than acknowledged produces a long period of adjustment. The result is a housing environment defined by cautious behaviour rather than decisive movement.

The Policy Trap Shaping Housing Outcomes

The Bank of Canada must show progress on inflation while avoiding further stress on households that are already stretched. Fiscal dominance limits how effectively monetary policy can moderate or stimulate the economy. A policy rate at 2.25 per cent signals restraint yet also reflects the Bank’s recognition that further tightening could aggravate private sector weakness. The housing market sits between these competing forces. Monetary policy is constrained by the need for stability. Fiscal policy continues to feed growth in ways that the official data presents as strength. Housing becomes the arena where these contradictions play out most visibly.

What Buyers, Sellers and Investors Need to Watch in 2026

The most important reference point remains the Canada five-year bond yield because it guides fixed mortgage pricing. If private sector weakness becomes more visible in the official data, yields may drift lower. If fiscal support continues to hold GDP in positive territory, the adjustment period could extend well into 2026. Buyers will need stronger financing preparation. Sellers will need realistic expectations about timing and pricing. Investors will need careful evaluation of regional labour conditions, rental durability and credit availability. Policy rate announcements in the future will influence every one of these decisions because they set the boundaries within which lenders and households operate.

Final Insight

Canada’s economy looks orderly in spreadsheets. Households feel a very different reality. The policy rate is stable, but stability does not equal relief. The housing market is moving through a deeper adjustment that is not reflected in the calm suggested by the headline data. The next year will determine whether the country moves toward a clearer path or remains in a slow and uneven reset.

If you want tailored insights on how the policy rate affects your next move, chat with the Valery, your AI Powered Real Estate Assistant (click on her in the bottom right corner).

Frequently Asked Questions (FAQs)

1. What is the policy rate in Canada?

The policy rate is the interest rate the Bank of Canada uses to influence borrowing costs across the economy. It guides the rates that banks charge one another and becomes the foundation for mortgage pricing, business credit and household borrowing. When the policy rate moves, the entire financing environment adjusts around it. As of 11 Dec 2025, it remains at 2.25 per cent.

2. Why does the policy rate matter for the housing market?

The policy rate determines the level at which lenders begin to price risk. It shapes the direction of the five year government bond yield, which is the benchmark for most fixed mortgages in Canada. A stable policy rate slows volatility in borrowing costs. A rising policy rate increases the pressure on households that are already stretched, and this influences both sentiment and liquidity in local markets.

3. How does the policy rate affect mortgage rates?

Mortgages in Canada follow market expectations of the policy rate rather than the policy rate alone. When financial markets believe the policy rate will remain stable, the five year bond yield tends to settle. Lenders use this yield as the basis for fixed mortgage pricing. As a result, changes in expectations about the future policy rate often influence mortgages more than the announcement itself.

4. What determines changes to the policy rate?

The Bank of Canada reviews inflation, labour conditions, GDP performance and financial stability risks before deciding whether to adjust the policy rate. These indicators help the Bank judge whether the economy is overheating or losing momentum. When inflation pressures persist, the policy rate may remain high for longer. When economic weakness becomes more visible, room for rate relief increases.

5. How long will the current policy rate shape housing conditions?

A policy rate that stays at 2.25 per cent for an extended period reinforces a slow adjustment in the housing market. Borrowers face elevated costs during renewals, and lenders maintain tighter standards as they evaluate income stability and consumer strength. The impact of this period will continue through 2026 because households and investors make decisions based on expectations of where the policy rate will move next rather than the announcement alone.

ABOUT THE AUTHOR

Daniel Foch is the Chief Real Estate Officer at Valery, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & PropTx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, The Globe and Mail, Storeys and Real Estate Magazine (REM). His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.