The Bank of Canada’s latest rate cut will offer only modest relief, with policymakers signalling a likely pause in further cuts as inflation, trade tensions, and weakening employment weigh on Canada’s housing market.

Table of Contents

The Bank of Canada’s latest decision to lower its policy rate by 25 bps to 2.25 per cent did not surprise markets. What unsettled expectations was the signal that further reductions are unlikely in the near term. Analysts who had anticipated a sequence of cuts must now contend with a central bank that sees limited room for monetary relief until deeper economic challenges are resolved. For households watching mortgage rates, for investors assessing risk, and for governments managing deficits, the implication for the immediate future is clear. Housing conditions in Canada will be shaped by persistent inflation, trade headwinds, and weakening employment.

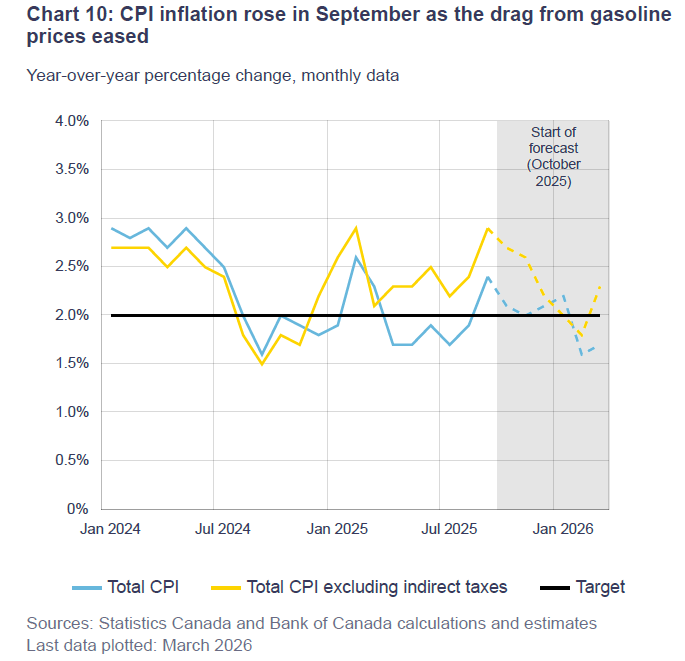

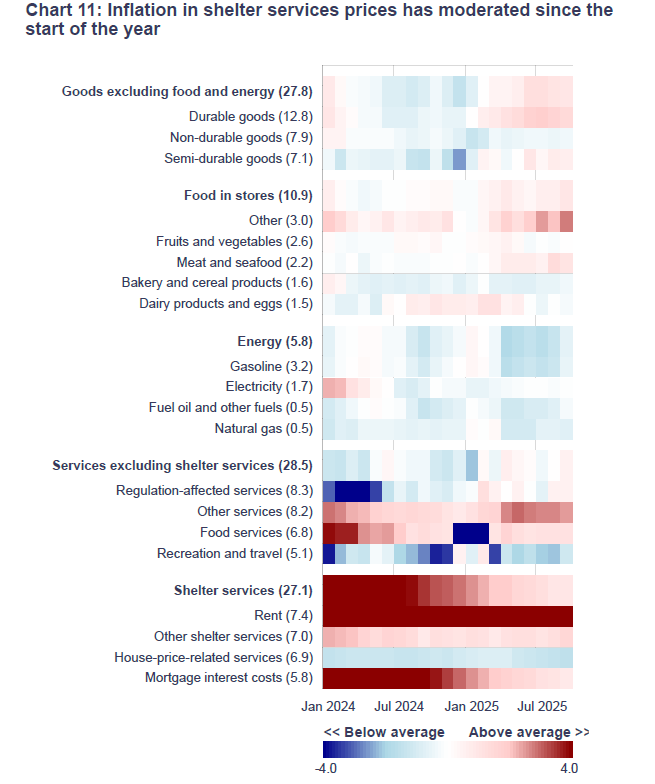

Inflation and the likely pause on rate cuts

Inflation remains the most immediate constraint. September’s increase was driven by energy prices, but the most persistent pressures stem from shelter services. Rent and mortgage costs now dominate the shelter component of CPI, inflating the headline figure beyond what underlying conditions warrant. The Bank of Canada recognises this distortion, which explains its willingness to cut despite inflation still above target. Core measures have cooled from pandemic peaks but remain outside policymakers’ comfort range.

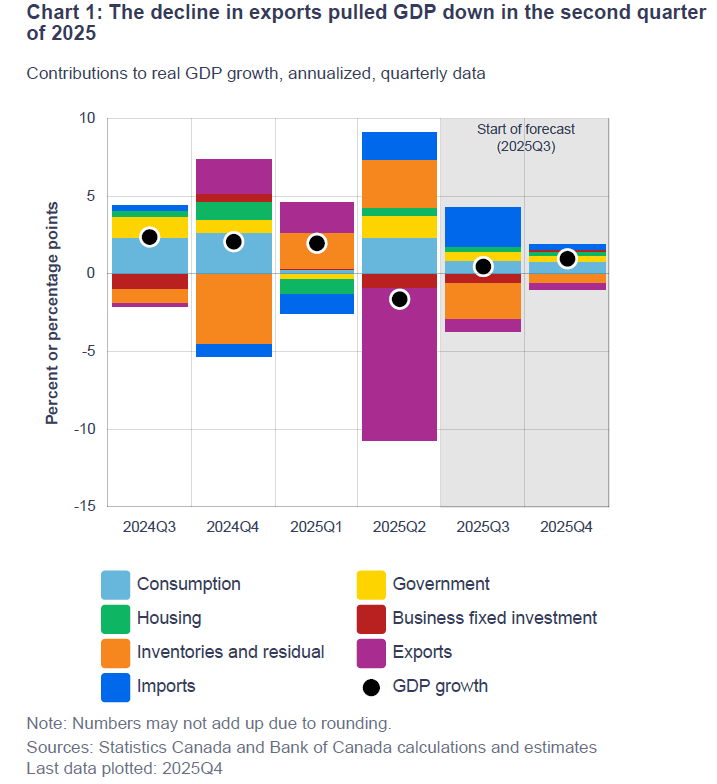

How trade tensions are hurting Canada’s economy

The deeper challenge lies in external accounts. Exports to the United States have contracted sharply, pushing GDP into decline during the second quarter. Gains in other markets are insufficient to offset this loss, and the impending renegotiation of the USMCA casts a long shadow.

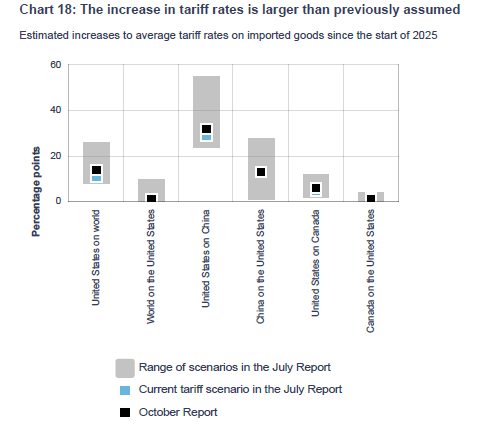

Tariff increases, heavier than initially projected, have eroded the competitiveness of Canada’s auto and manufacturing sectors. These shocks not only restrain national output but also undermine employment in Ontario and other regions deeply tied to cross-border trade.

Jobs and wages outlook

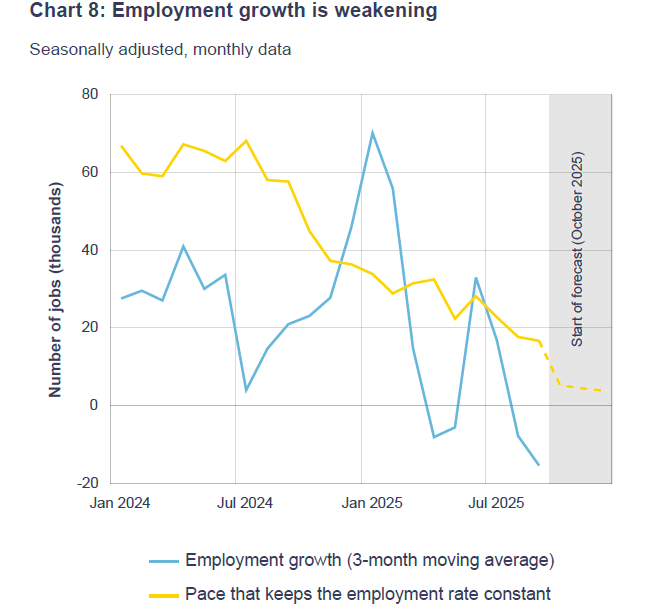

The labour market, once a bulwark against housing weakness, is beginning to deteriorate. Employment growth has fallen below the level needed to maintain participation, with export-linked industries suffering the steepest losses.

Wages continue to rise at roughly 3 per cent, modestly ahead of inflation, but the advantage is too slim to offset layoffs. The Bank’s own indicators reveal a shift from labour scarcity to surplus, with vacancies declining and separations increasing. Historically, employment erosion marks the final stage of a housing downturn, when income stress deepens affordability challenges.

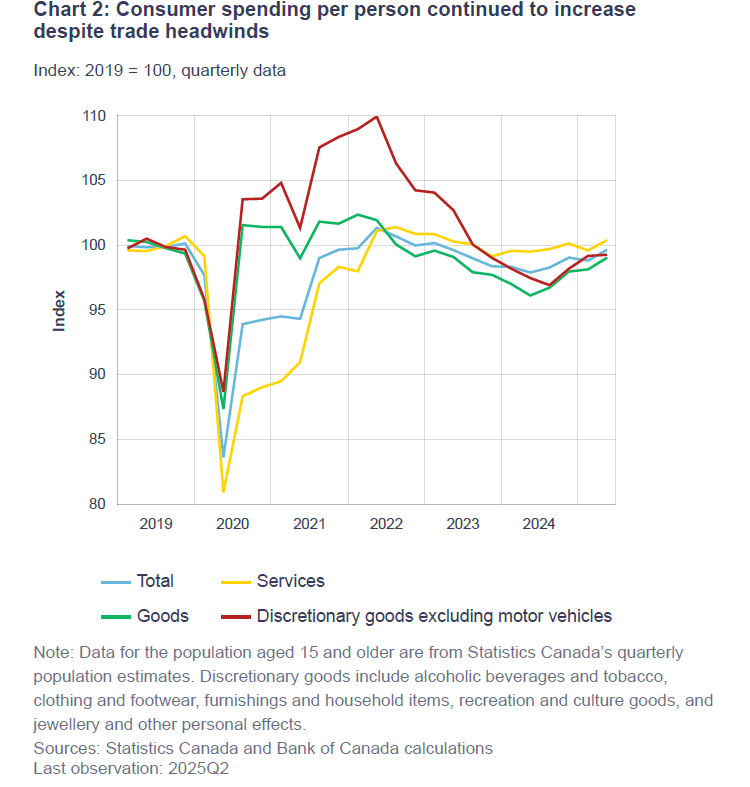

What Canadian consumers are still spending on

Despite these pressures, households continue to spend. Per capita consumption has risen, driven largely by discretionary purchases. Yet, the Bank projects a slowdown beginning in 2025 as job losses spread across services, retail, and warehousing.

This paradox defines the present moment. Consumers appear resilient while the foundations of that resilience are eroding.

What the rate cut means for mortgage rates

The October cut affects borrowers in uneven ways. Variable-rate mortgages, which move in line with the policy rate, are expected to adjust downward, offering modest relief to indebted households. Fixed-rate mortgages, however, remain tethered to bond yields, particularly the five-year benchmark.

Bond yields have eased from their recent peaks yet remain far higher than pre-pandemic levels. As long as bond markets anticipate persistent inflation and large government borrowing, fixed mortgage rates will not decline in tandem with the policy rate. The result is a divided mortgage market, with variable-rate borrowers seeing incremental relief while fixed-rate borrowers remain constrained by historically elevated costs.

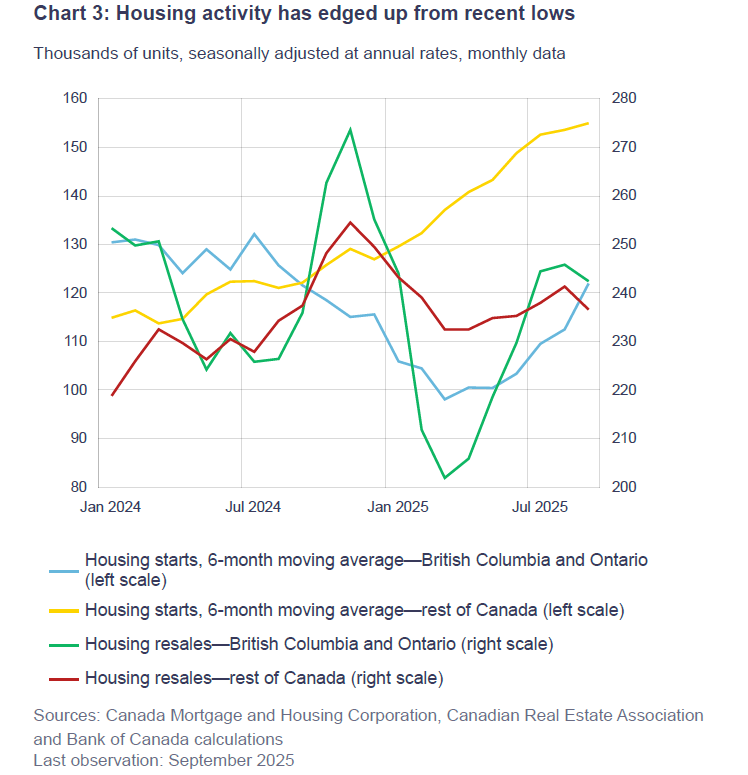

Recent activity in Canadian Real Estate

Resale activity has improved from recent lows, particularly in Ontario and British Columbia. National transaction volumes have risen, but prices remain flat.

Liquidity has returned, but valuation gains are absent. For real estate professionals, the lesson here is higher volumes do not equate to recovery. Without firmer labour conditions and more affordable credit, prices are unlikely to advance.

What the Bank of Canada rate cut means for real estate

Taken together, the picture is one of constrained recovery. The October cut has provided modest relief, but policymakers have signaled it is likely to pause. Inflation remains above target, trade is eroding output, the labour market is softening, and consumers will eventually exhaust their resilience.

For Canadian real estate, this means transaction volumes may continue to rise, yet valuations will not mount a durable recovery until employment and wage growth provide a firmer foundation. The housing market remains suspended between liquidity and value, awaiting the stabilising force of jobs and incomes.

Frequently Asked Questions (FAQs)

Q1. When was the latest Bank of Canada rate cut?

The most recent cut was in October 2025, lowering the policy rate to 2.25 per cent.

Q2. When is the next Bank of Canada rate cut expected?

According to various analysts, there could be a pause in cuts for a while.

Q3. How much did the Bank of Canada cut rates?

The October move was a 25-basis-point reduction, to 2.25 per cent.

Q4. How do Bank of Canada rate cuts affect mortgage rates?

Variable mortgages adjust immediately with the policy rate. Fixed mortgages are tied to bond yields, which remain higher than before the pandemic.

Q5. Why is Canadian housing activity rising but prices remain flat?

Resale volumes have increased, particularly in Ontario and British Columbia, but national price levels have not followed. Higher activity reflects liquidity returning to the market, yet employment weakness and high financing costs prevent valuations from recovering.

Q6. What are the main risks to Canada’s housing recovery after the Bank of Canada rate cut?

The Bank of Canada has signalled a likely pause in further cuts. At the same time, inflation remains above target, exports are weakening under tariff pressures, and the labour market is softening. Without stronger employment and wage growth, the housing market is unlikely to mount a durable recovery.

ABOUT THE AUTHOR

Daniel Foch is the Chief Real Estate Officer at Valery, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, The Globe & Mail, Storeys and Real Estate Magazine (REM). His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.