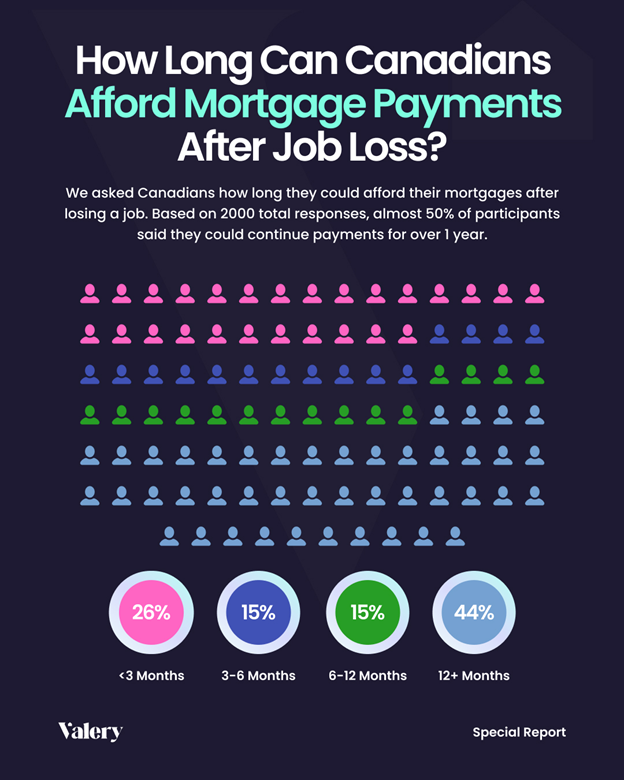

Canada’s housing market is increasingly highlighting a stark financial divide among homeowners. A recent poll* conducted by Valery, surveying nearly 2000 Canadians, revealed that one in four homeowners may need to sell their homes if they lost their jobs. This finding related to payments after job loss underscores the growing disparity in financial security and raises concerns about housing asset inflation eroding the middle class.

While the majority of homeowners remain financially secure, a significant portion is at risk of financial hardship. These individuals, representing 26% of surveyed homeowners, would only be able to sustain their mortgage payments for three months or less without employment / after job loss. This group contrasts sharply with the financially stable homeowners who could manage their mortgage obligations for over a year. This divide reveals how economic factors such as increasing unemployment and inflated home prices are reshaping Canada’s housing market.

The Struggles of At-Risk Homeowners

Homeowners facing financial hardship share common characteristics. Many are younger adults who are newer to the workforce and less likely to have job security or tenure. This demographic frequently includes first-time homebuyers, a sizable portion of whom entered the market during the pandemic, a period marked by surging home prices and record low interest rates. Now, these owners could be faced with two key problems:

- Their equity may have been reduced by falling house prices.

- A mortgage renewal could increase their mortgage payment substantially.

These buyers are now dealing with the serious consequences of purchasing at inflated values. To put it simply, buying at inflated prices typically involves taking on larger mortgages, which translates to higher monthly payments relative to their income. These payments can become unaffordable if interest rates rise or if income levels decrease. The situation is particularly challenging for those who secured homes during the pandemic years (2020–2021), a period of historically low interest rates when the Bank of Canada policy rate was just 0.25%. During that period of time, house prices were at all-time highs, meaning these buyers may not have any equity to draw on if they attempt to use a HELOC or second mortgage to solve financial problems.

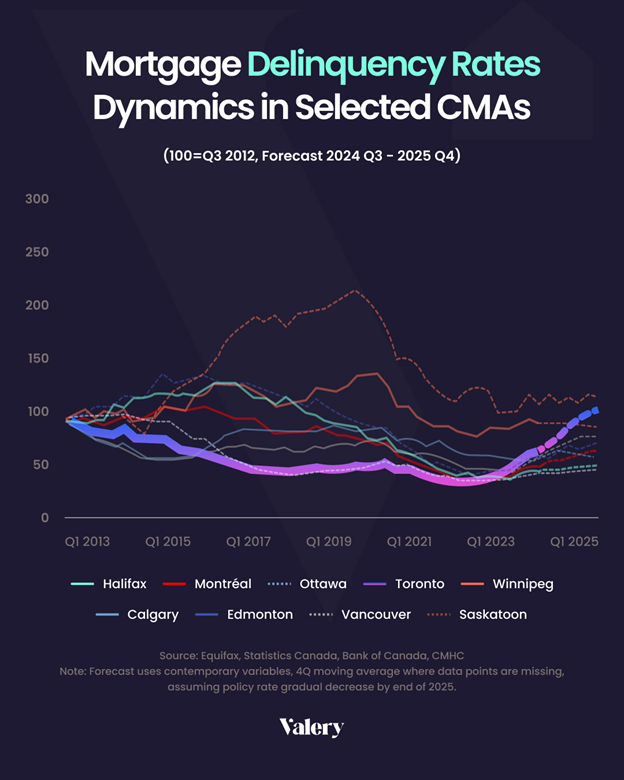

As rates have climbed since then, their monthly mortgage payments may have risen significantly, further intensifying the financial strain. The situation is particularly dire in expensive markets like Toronto, where the Canada Mortgage and Housing Corporation (CMHC) has predicted the largest potential surge in mortgage delinquencies. For many in this group, job loss could quickly lead to mortgage default, leaving no option but to sell their homes to avoid financial ruin.

If you could only afford your mortgage payment for three months after job loss, you’d likely have to list your home for sale almost immediately. Buyers in this category are faced with a difficult position after job loss, often wondering “Should I sell my house at a loss?”

Fortunately, Valery is trained to help you with the calculation so you can understand how much equity you have in your home. This is a complex question that involves a lot of variables listed below:

- How much you paid for your home

- How much your home has changed in value

- What interest rate and amortization rate you purchased with

- The total cost of your CMHC insurance premium

- The total switching cost (realtors, land transfer tax, lawyers, etc.)

- How much principal you paid down since you purchased your home

We’re here to help you understand your options, and we’ve provided a case study of AI-generated calculations below this article.

Feel free to ask Valery in private, or schedule a consultation with one of our experts.

The Stability of Long-Term Homeowners

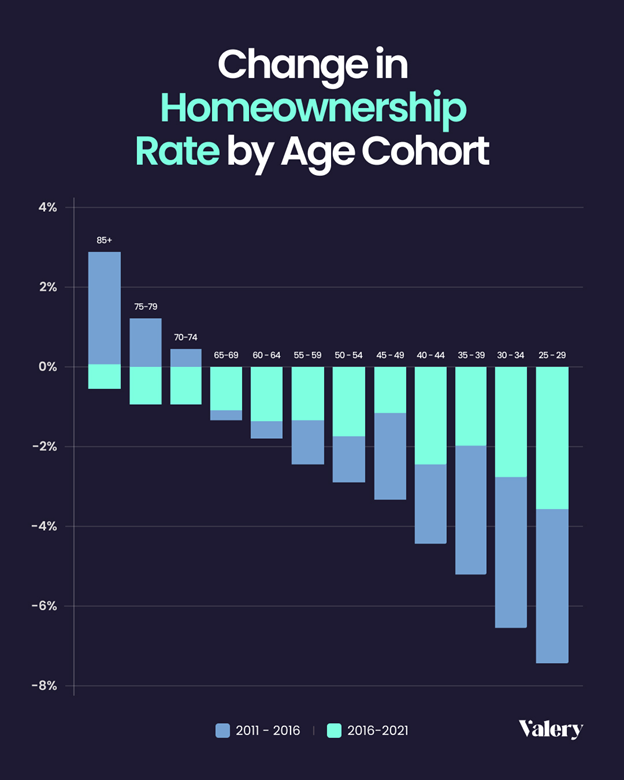

In contrast, a sizable portion of homeowners enjoy financial stability. These individuals are generally older and have owned their homes for many years, allowing them to build significant equity and amortize much of their mortgage debt. Their financial resilience is bolstered by greater job tenure and security, insulating them from the immediate impacts of potential unemployment or sudden job loss.

These homeowners are less affected by the recent surge in interest rates or housing prices, having secured their homes long before the pandemic-driven price boom. With reduced monthly obligations and a cushion of equity, this group can weather temporary financial disruptions far more effectively than their at-risk counterparts.

The Growing Financial Divide

The contrast between these two groups, those at risk and those secure, highlights the growing financial divide within Canada’s housing market. Younger, less established homeowners face the dual burden of higher home prices and the direct impact of increasing interest rates. Older, long-term homeowners benefit from decades of stability and financial gains, meaning they have more equity in their homes, and they’re less vulnerable to price declines. Since they’ve owned their homes longer, older Canadians typically carry smaller mortgages, meaning they’re less vulnerable to interest rate increases, as well. This division not only underscores the challenges of housing affordability but also raises broader questions about the sustainability of the middle class in Canada.

As mortgage delinquencies become more pronounced in cities like Toronto and Vancouver, the economic risks are becoming increasingly evident. These delinquencies not only threaten individual homeowners but also pose broader risks to the stability of local housing markets and the overall economy. Without targeted interventions, such as policies to address housing affordability, provide financial relief, and support vulnerable homeowners, this financial divide could grow wider, potentially leading to long-term consequences like declining property values, reduced consumer spending, and greater economic inequality. While we have seen demand-stimulating policies like extending amortizations to 30 years and increasing CMHC-insured mortgage limits to $1.5 million, the Bank of Canada’s Deputy Governor says over-reliance on such measures could have long-term negative impacts.

Final Thoughts

The findings from this survey paint a troubling picture of Canada’s housing market. While many homeowners remain insulated from financial shocks, a significant 26% are vulnerable to job loss, potentially forcing them to sell their homes. This disparity underscores the urgent need to address rising housing costs and ensure the market remains accessible and sustainable. Protecting the most vulnerable homeowners is essential to preserving the middle class and fostering long-term economic stability.

Case Study by Valery AI

“Should I Sell My Home at a Loss?”

Prompt Sent to Valery AI:

"I purchased a home in the Greater Toronto Area (GTA) at the market peak in 2021 for $800,000 with a 2.99% interest rate and a 25-year amortization. I put the minimum down payment required for a CMHC-insured mortgage. I am considering selling the home in 2024, assuming the current market value has dropped to $720,000. Please calculate the financial outcome of the sale, including:

1. Realtor fees (5%),

2. Remaining mortgage balance after 3 years,

3. CMHC insurance costs,

4. Initial costs like the down payment and land transfer tax, and

5. Total financial loss or gain.

Break down the calculations step by step and explain the factors contributing to the result."Valery AI Response

Purchase costs in 2021

1. Home Price: $800,000

2. Down Payment: For CMHC-insured mortgages, the minimum down payment for an $800,000 home is:

• 5% on the first $500,000: $25,000

• 10% on the remaining $300,000: $30,000

• Total Down Payment: $55,000

• Mortgage Amount: $800,000 - $55,000 = $745,000

3. CMHC Insurance Premium:

• The premium for a 7.6% loan-to-value mortgage ($745,000 on $800,000) is 4%.

• Premium: $745,000 × 4% = $29,800

• Total Mortgage: $745,000 + $29,800 = $774,800

4. Other Costs:

• Land Transfer Tax: $12,950 (approx. for Ontario, including Toronto's municipal LTT)

• Legal Costs: $2,000 (estimated)Total Initial Costs:

Down Payment ($55,000) + LTT ($12,950) + Legal Costs ($2,000) + CMHC Premium ($29,800) = $99,750Monthly Payments

Assume a 25-year amortization at 2.99% fixed for 5 years:

• Monthly payment: ~$3,670

• Over the first 3 years, approximately 20-25% of payments go toward the principal, and the rest is interest.

• After 3 years, the principal paid down is about $55,000-$60,000 (estimated).Selling the Property in 2024

Assume the Market Value Has Dropped

Many GTA homes have dropped in value since the 2021 peak. Assume the current market value is $720,000.

1. Realtor Commission:

• Assume seller negotiated commission to ~5% of the sale price + HST

• $720,000 × 5% = $36,000

• $36,000 + 13% HST = $40,680

2. Legal Costs (for Sale): $2,000

3. Mortgage Payoff:

• Mortgage balance after 3 years: $715,000 (approx. after ~$60,000 principal paydown).

• Net proceeds from sale: $720,000 - $36,000 (realtor) - $2,000 (legal) = $682,000Net Financial Position

1. Proceeds vs. Mortgage:

• Proceeds: $682,000

• Mortgage: $715,000

Shortfall: $33,000

2. Initial Investment:

• Original cash invested (down payment + other costs): $99,750

3. Total Financial Loss:

• Shortfall: $33,000

• Initial costs lost: $99,750

Total Loss: $132,750Key Drivers of Loss

1. CMHC Premium: Adds $29,800 to the initial mortgage balance but provides no benefit in resale.

2. Land Transfer Tax: A sunk cost paid during purchase.

3. Realtor Fees: A significant cost upon sale.

4. Decline in Market Value: The primary driver of financial loss.

5. Principal Paydown: While ~$60,000 of the mortgage was paid off, it is not enough to offset the loss in value and transaction costs.Conclusion

Even after accounting for principal paydown, the buyer incurs a significant financial loss when selling the home due to:

• Depreciated home value

• High upfront and transaction costs (e.g., CMHC premium, land transfer tax, and realtor fees).

This scenario underscores the risks of purchasing during market peaks with minimal down payments.* This poll reflects the preferences of 780 Instagram users and 1210 Twitter users who participated in the survey. The reported results include 95% confidence intervals, which quantify the statistical uncertainty around the observed proportions under the assumption of simple random sampling. For example, the confidence intervals suggest that, if this poll were repeated under identical conditions, the true population proportions would fall within the calculated range 95% of the time.

However, it is critical to acknowledge that this survey is not based on random sampling; participation is subject to self-selection bias and platform-specific demographic skew. These factors violate the assumptions of classical inference, limiting the external validity of these results. While the confidence intervals accurately describe sampling error, they do not account for potential biases introduced by the non-random nature of the sample. Consequently, these findings should be interpreted as descriptive of this specific respondent group rather than predictive of the broader population.

Frequently Asked Questions

1. What are the main factors contributing to the financial struggles of Canadian homeowners?

Many Canadian homeowners, especially those who purchased homes during the pandemic, are struggling financially due to relatively higher interest rates and declining home equity. About 26% of surveyed homeowners revealed they could only sustain their mortgage payments for three months or less without a stable income. These financial difficulties are exacerbated by inflated home prices and increased mortgage payments following rate hikes.

2. How does job loss and forced home sales in Canada affect the housing market?

Forced home sales due to job loss can lead to increased housing inventory, potentially driving down home prices further. This cycle can weaken the housing market, particularly in high-risk areas like Toronto and Vancouver.

3. How do rising interest rates and mortgage payment difficulties impact homeowners?

Post-pandemic interest rate hikes have significantly increased monthly mortgage payments, especially for those renewing their mortgages or holding variable-rate loans. This has intensified financial strain, leading some homeowners to consider selling their homes to mitigate their losses.

4. Are mortgage default risks in Toronto and Vancouver higher than in other regions?

Yes, mortgage default risks are notably higher in Toronto and Vancouver due to elevated home prices and significant financial burdens on homeowners.

5. What are the major housing market challenges for first-time buyers in Canada?

First-time buyers in Canada face significant challenges, including rising home prices and limited affordability. Many entered the market during the pandemic, purchasing homes at peak prices when interest rates were historically low. However, as interest rates have risen, their mortgage payments have increased substantially, putting additional strain on their finances.

6. How has the pandemic’s impact on Canada’s housing market influenced current conditions?

The pandemic led to record-low interest rates and a surge in housing demand, driving up home prices to inflated levels. As interest rates have risen since then, many homeowners who purchased during this period now face significant financial challenges, including reduced equity and higher monthly mortgage payments.

About the Author

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe & Mail. His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.