Table of Contents

Buying your first home is one of the most significant milestones in many people’s lives. It can be both exhilarating and daunting, especially for first time home buyers in Ontario. With rising prices and intricate processes, having effective strategies is essential to navigate the real estate market successfully. This article will explore the top five strategies that every first-time homebuyer should consider in order to make informed decisions and maximize the benefits available to them.

Understanding the Benefits for a First Time Home Buyer Ontario

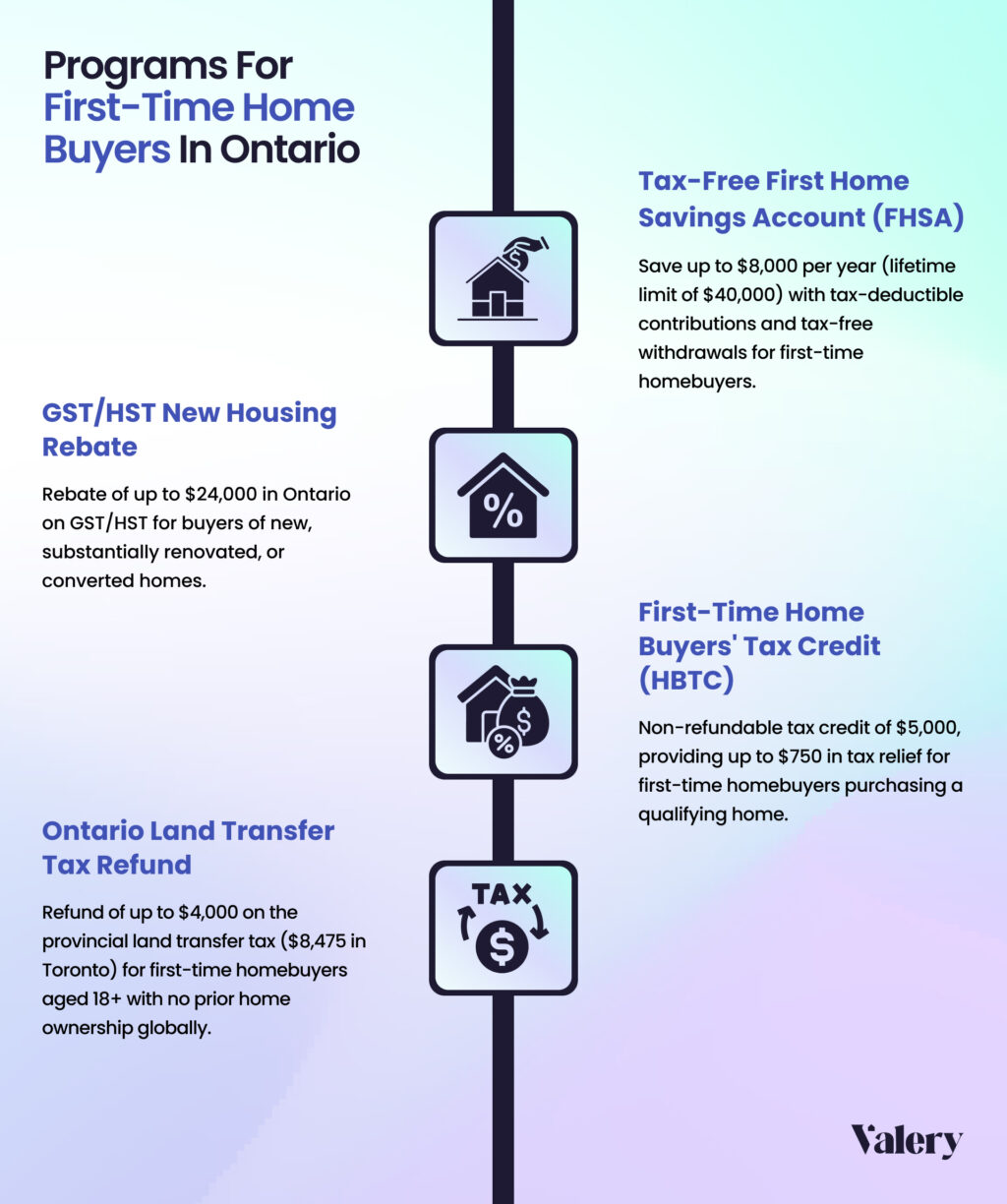

Before exploring the strategies, it’s crucial to understand the benefits available to you as a first time home buyer in Ontario. These incentives are designed to ease your financial burden and support you through the buying process.

Key Benefits

- First Home Savings Account (FHSA): The FHSA is a powerful tool designed specifically for first-time homebuyers looking to save for their first home. Contributions of up to $8,000 per year are tax-deductible and withdrawals made for purchasing your first home are tax-free. This means you can grow your savings without worrying about taxes eating into your funds, making it an excellent option for those planning to enter the housing market.

- Home Buyers’ Plan (HBP): The HBP allows you to withdraw up to $35,000 from your Registered Retirement Savings Plan (RRSP) without incurring penalties, which can be crucial for your down payment.

- Land Transfer Tax Refund: As a first time home buyer in Ontario, you may be eligible for a refund of up to $4,000 on your land transfer taxes. This can significantly reduce your closing costs.

Understanding these benefits can provide you with a financial cushion as you embark on your home-buying journey.

Strategy 1: Get Pre-Approved for a Mortgage

Why Pre-Approval Matters

One of the most critical steps in the home-buying process is obtaining mortgage pre-approval. This step not only clarifies your budget but also strengthens your position when making an offer on a property.

Benefits of Pre-Approval

- Know Your Budget: Pre-approval gives you a clear understanding of how much you can afford, helping you narrow down your search effectively.

- Interest Rate Lock: Many lenders allow you to lock in an interest rate for a specified period during the pre-approval process. This can protect you from potential rate increases while you search for your home.

- Faster Closing: With pre-approval completed, the closing process can be expedited because much of the paperwork is already done.

Tips for Getting Pre-Approved

- Gather Documentation: Be prepared with necessary documents such as proof of income, credit history and details of any debts.

- Shop Around: Don’t settle for the first lender. Compare rates and terms from various banks and mortgage brokers to find the best deal.

Strategy 2: Research Available Programs for First Time Home Buyer Ontario

Explore Financial Assistance Options

Ontario offers various programs specifically designed for first time home buyers in Ontario. Researching these options can save you money and provide valuable resources that ease your path to homeownership.

Key Programs to Consider

- Ontario Land Transfer Tax Refund: Beginning January 1, 2017, no land transfer tax would be payable by qualifying first‑time purchasers on the first $368,000 of the value of the consideration for eligible homes. First‑time purchasers of homes greater than $368,000 would receive a maximum refund of $4,000.

- GST/HST New Housing Rebate: New homeowners can receive a rebate on a portion of the GST or HST paid on the purchase price or construction costs of a new home, helping them recover some of these taxes.

- First-Time Home Buyers’ Tax Credit (HBTC): First-time homebuyers can receive a non-refundable income tax credit of $5,000 to help cover the costs associated with purchasing a home, providing up to $750 in federal tax relief.

- Tax-Free First Home Savings Account (FHSA): Canadians can save for their first home on a tax-free basis through the First Home Savings Account, allowing contributions of up to $8,000 per year with a lifetime limit of $40,000, where contributions are tax-deductible and withdrawals for a first home purchase are tax-free.

How to Research Programs

- First time home buyers in Ontario should visit government websites dedicated to housing and real estate in Ontario.

- Consult with a Valery Real Estate Agent who is knowledgeable about available programs.

- Attend workshops or seminars aimed at educating first-time buyers about their options.

Strategy 3: Work with a Real Estate Agent

The Value of Professional Guidance for First Time Home Buyer Ontario

Navigating the real estate market can be daunting especially for first time home buyers, which is why working with an experienced real estate agent is invaluable. A knowledgeable agent can provide insights into local market conditions and assist you throughout the buying process.

What to Look for in an Agent

- Experience with First-Time Buyers: Choose an agent who understands the unique challenges faced by first-time buyers and can tailor their services accordingly.

- Local Market Knowledge: An agent familiar with your desired neighbourhoods will have insights into pricing trends and property values.

- Strong Negotiation Skills: A skilled negotiator can advocate on your behalf to secure the best deal possible.

Benefits of Using a Real Estate Agent

- Access to Listings: Agents often have access to listings before they hit public platforms.

- Guidance Through Paperwork: They will help navigate contracts and legal documents, ensuring everything is in order.

- Support During Inspections: An experienced agent can recommend trusted home inspectors and help interpret their findings.

Strategy 4: Understand Market Trends for First Time Home Buyer Ontario

Stay Informed About Housing Prices

Understanding current market trends is vital for first time home buyer Ontario making informed decisions as a first-time buyer. Keeping an eye on housing prices in your desired area will help you identify good deals and avoid overpaying.

Tips for Market Research

- Use Online Tools: Websites like valery.ca provide valuable data on current listings and historical price trends.

- Attend Open Houses: Visiting open houses gives you firsthand experience of what’s available within your budget.

- Follow Local Real Estate News: Subscribe to newsletters or follow local real estate blogs to stay updated on market changes and expert opinions.

Key Indicators to Watch

- Average Home Prices

- Average Days on Market (how long homes are listed before selling)

- Inventory Levels (the number of homes available for sale)

Strategy 5: Be Prepared for Additional Costs

Budget Beyond the Purchase Price

When buying a home, it’s essential to budget for costs beyond just the purchase price. Being financially prepared will help prevent any surprises during the buying process.

Additional Expenses Include

- Closing Costs: These typically range from 1.5% – 4% of the purchase price and include costs such as legal fees, title insurance, and appraisals.

- Home Inspection Fees: Before finalizing any purchase, it’s wise to invest in a professional home inspection (typically $300-$500) to uncover potential issues with the property.

- Moving Costs: Don’t forget about expenses related to moving – whether hiring movers or renting a truck.

- Home Insurance: Required by lenders but also essential for protecting your investment.

Creating Your Budget

- If you’re a first time home buyer Ontario, use online calculators to estimate total costs associated with purchasing a home.

- Create a detailed list of all potential expenses related to to the purchase of and moving into your new home.

FAQs About First Time Home Buyer Ontario

Who qualifies as a first-time home buyer in Ontario?

To qualify as a first-time buyer, you must not have owned any property in Canada within the last four years or meet certain exceptions including divorce or separation from your partner.

What financial benefits are available?

First-time homebuyers can access tax refunds, incentives like the First-Time Home Buyer Incentive and savings plans such as the Home Buyers’ Plan (HBP).

How much do I need for a down payment?

Typically, a minimum down payment of 5% is required for homes under $500,000. However, more expensive homes require larger down payments based on pricing tiers.

Can I buy without being pre-approved?

While it’s possible to buy a home without a pre-approval, it’s highly recommended you acquire one as it gives you clarity on what you can afford and strengthens your offer when bidding on properties.

Conclusion

Becoming a homeowner in Ontario is an achievable goal with careful planning and informed strategies. By understanding first-time home buyer benefits, getting pre-approved for a mortgage, working with an experienced real estate agent and staying informed about market trends—you can confidently navigate the home buying process.

Remember that every step taken towards purchasing your first home brings you closer to achieving one of life’s most rewarding milestones—homeownership!