Table of Contents

Something feels off in the GTA housing market.

It’s not chaos. It’s not headlines screaming collapse. But talk to any agent, seller, or would-be buyer, and the same themes come up: listings are up, offers are down, and no one’s quite sure where the bottom is.

Sales are drying up. Prices are slipping. And buyers? They’re just not showing up.

Instead, what we’re seeing is a quiet standoff. Sellers keep coming to market, hoping to catch last year’s valuations. Buyers sit back, watching the numbers fall, waiting for a better deal or at least, some clarity.

This isn’t a crash. But it’s not a correction, either. It’s something slower, more psychological. A market that has lost its conviction.

High Supply, Low Urgency

Condo Market Bears the Brunt of the Shift

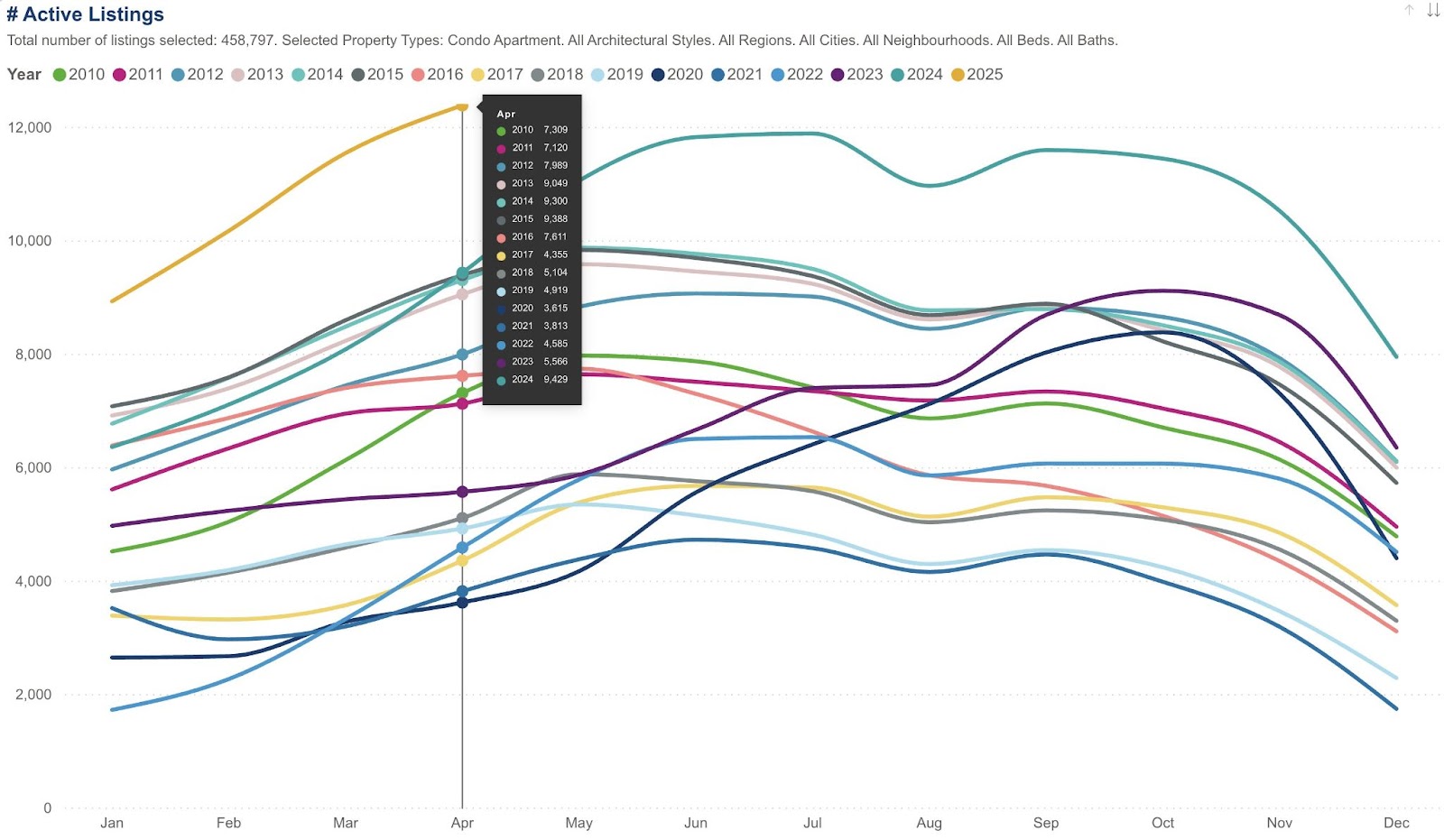

April’s active condominium inventory climbed over 12,000 listings (see the chart below); this number would have been deemed excessive even in the most robust spring markets. For context, 9,000 active listings in April would normally be considered rather high. This is an overhang in supply.

Recent project completions and a slowdown in resale demand are factors to blame for this. Developers are releasing units into a market lacking a queue of end consumers or rental investors.

With only 1,430 condo units sold in April, a significant drop from the usual April range of 2,500–3,500 indicates deteriorating absorption. Simply said, there are almost nine sellers for every buyer.

This imbalance erodes buyer urgency in addition to affecting prices. Why act fast given all this inventory?

Detached and Townhouse Segments Join the Slide

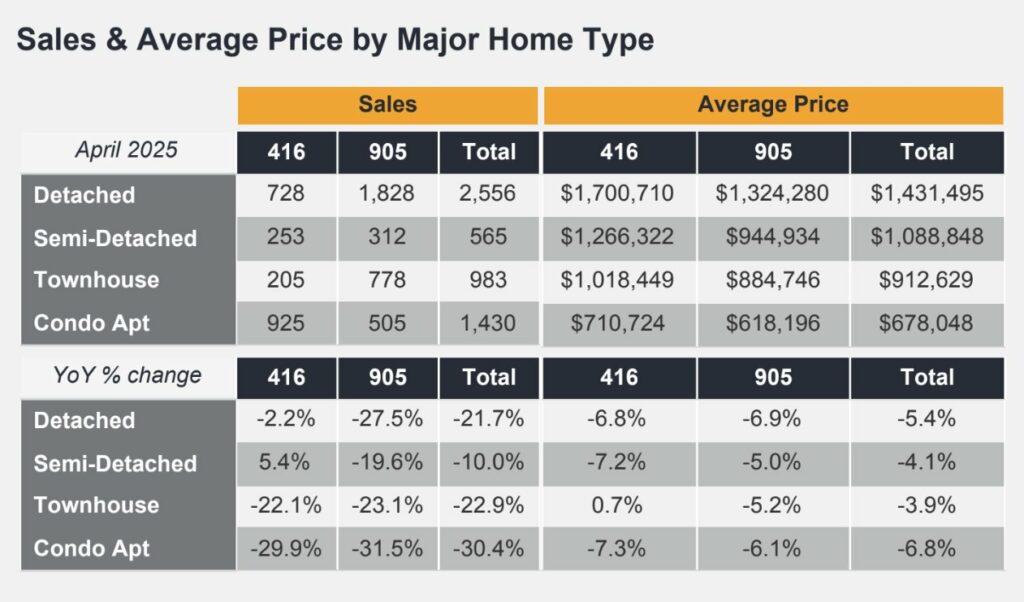

The issue is not limited to condominiums. Year-over-year sales of townhouses and detached houses also dropped considerably throughout the GTA (416 and 905 combined):

- Detached houses: -21.7 per cent

- Townhouses: -22.9 per cent

- Semi-detached homes: -10.0 per cent

One small portion of the market (416 semi-detached) managed to escape the downturn. Everywhere else, the decline has been severe.

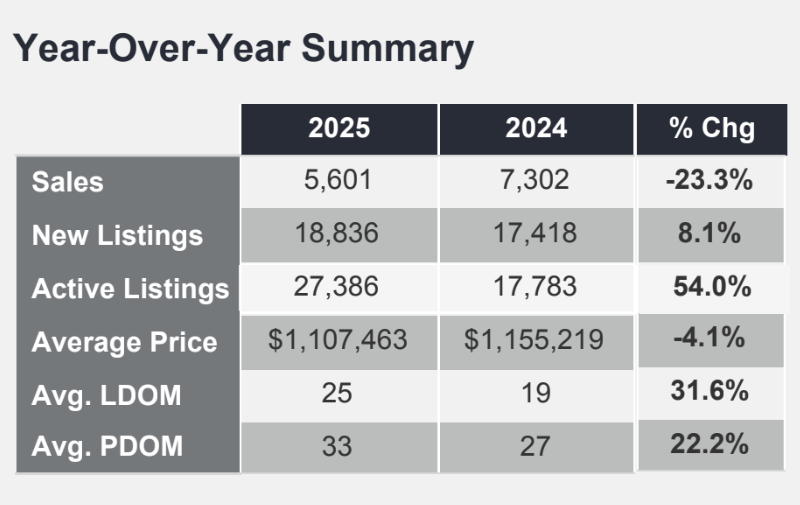

Along with a 54 per cent year-over-year rise in active listings, this shows that what we are experiencing is more than simply a slowdown. It’s a reversal across the market whereby buyers withdraw quietly and sellers flood in.

Prices Slip Further as Buyer Sentiment Softens

Death by a Thousand Cuts

Though they seem moderate at first glance, price drops are now widespread and consistent:

- GTA Detached: -5.4 per cent

- GTA Semi-Detached; -4.1 per cent

- GTA Condos: -6.8 per cent

- GTA Townhouses: -3.9 per cent

- Total GTA HPI Benchmark: -5.4 per cent

- Average Sale Price (GTA): -4.1 per cent

Only one category (416 townhouses) showed a price increase; that too was insignificant.

While some sellers are still holding on to 2022 prices, buyers are recalibrating. Many are beginning to think they would get a better deal, the longer they waited.

Caution Over Confidence: The New Macroeconomic Mood

This is not purely anecdotal. It fits with more general customer behavior. High household debt levels and modest wage growth are producing a buyer pool that is structurally cautious.

Even affordable gains from reduced costs are not stimulating demand. This implies that the fundamental problem is now conviction rather than just affordability.

Rental Market Red Flags Are Hard to Ignore

Anyone looking to the rental market for clues about missing buyers won’t find much clarity, but they might find a red flag:

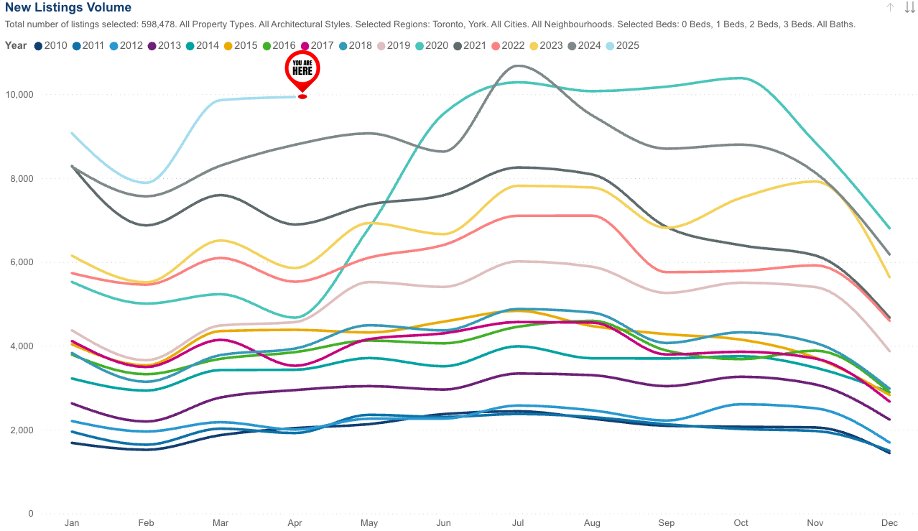

- New Toronto condominium rental listings for 2025 are at a record high.

- Active rental listings in April hit their highest level ever recorded.

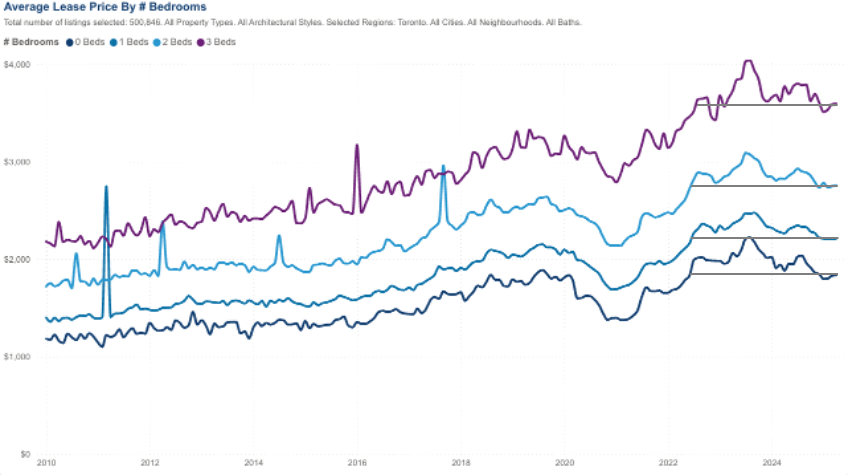

- Rents have rolled back to Summer 2022 levels.

Given rental supply is exceeding tenant demand, we may start to notice early signs of departure from the investor segment. Should that trend hold, it is possible that those who formerly consumed inventories for rental income are now receding and leaving a larger percentage of listings unoccupied.

In short, two of the market’s mainstays, end-users and rental investors, may both be sitting off.

Outlook: What Comes Next

Pricing Pressure Is Building

With inventory on the rise and demand still muted, the trajectory for prices remains downward. Unless buyers return in greater numbers over the next few months, particularly in the condo market, sellers will find themselves adjusting expectations in real time.

At this point, it’s not just rates or fundamentals moving prices. It’s psychology. Buyers know the leverage has shifted and they’re pricing that in before making a move.

Pre-Construction Faces a Stress Test

Nowhere is the pressure more acute than in the pre-construction space. With softening rents and falling resale values, many investor purchases from the 2021–2022 cycle are under water before closing.

As financing costs bite and cash flows tighten, assignment listings could increase sharply. Developers, in turn, may have little choice but to delay, repackage, or reprice.

The Market Isn’t Frozen—But It’s Directionless

Transactions are still taking place, but there’s little momentum. The usual mechanics (price, supply and urgency) feel misaligned.

There’s liquidity, yes. But only if sellers are willing to cut, and only if buyers are convinced it’s worth jumping in.

This is a market drifting without a rudder.

All Eyes on the Bank of Canada

The Bank of Canada now holds the narrative thread. Should it begin signaling rate relief, the second half of the year could see demand slowly return. But a continued pause or mixed messaging could leave the market suspended in its current state through Q3 or beyond.

In the meantime, expect more time on market, more price adjustments, and more buyers choosing to wait rather than act.

Final Thought: Drifting, Not Collapsing

There’s no crash here. But there’s no conviction either.

April didn’t bring panic, it brought pause. What’s playing out in the GTA right now isn’t driven by urgency or shock. It’s being shaped by hesitation, caution, and a growing reluctance to move without clarity.

Until something shifts, the market will keep floating sideways. And the longer it drifts, the harder it will be to find direction again.