2024 Real Estate Market Trends

Toronto housing bubble concerns have placed the Canadian real estate market under global scrutiny due to its dynamic nature, with cities like Toronto and Vancouver often serving as focal points in discussions around home affordability, interest rates, and investment opportunities. In 2024, the market continues to evolve, driven by inflation cooling down, inching closer to the Bank of Canada’s 2% target, and three interest rate cuts aimed at stimulating economic growth and reinvigorating real estate activity. On top of that, government policies such as the latest mortgage reforms are now focused on stimulating demand. As a result, the Canadian real estate market is entering a new phase, offering both challenges and opportunities for investors and homebuyers navigating this shifting economic landscape

Understanding the UBS Global Real Estate Bubble Index

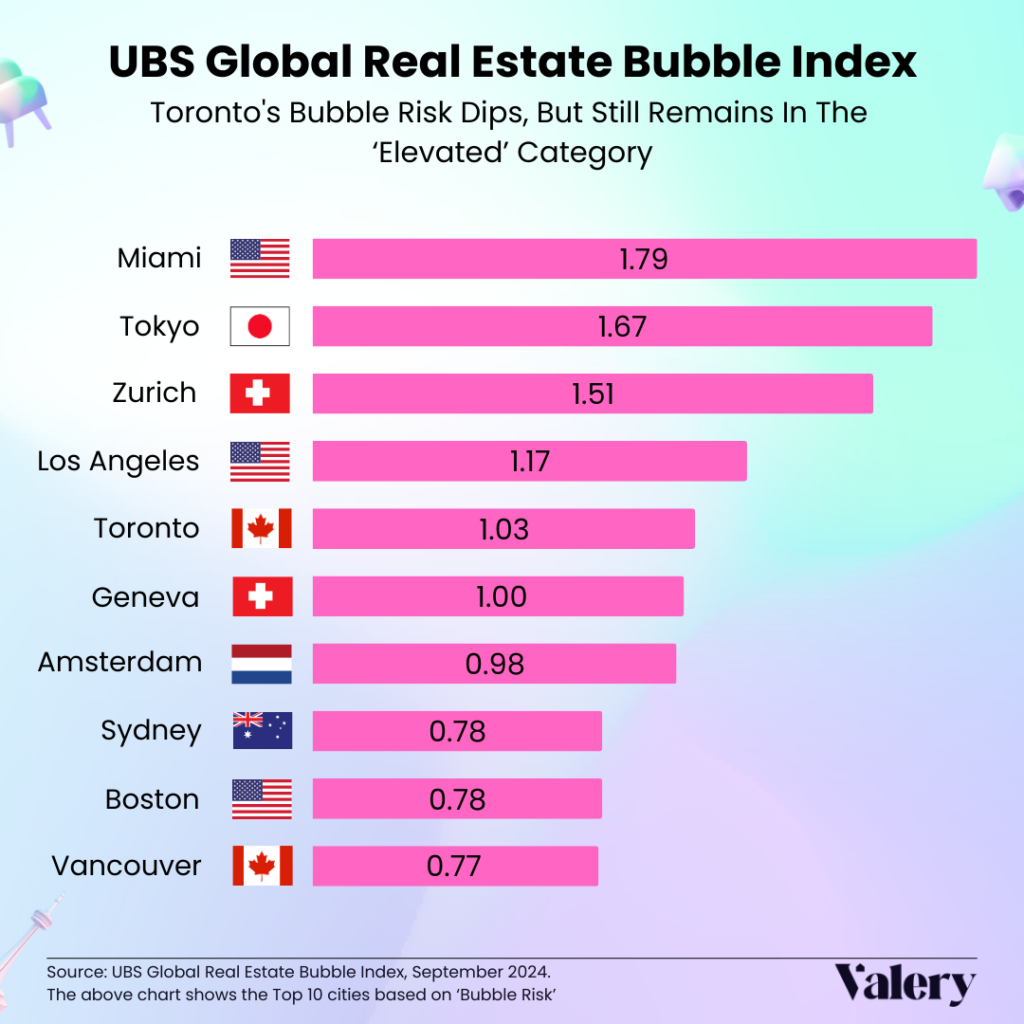

The UBS Global Real Estate Bubble Index is a comprehensive measure used to assess the risk of housing bubbles in global cities. The index score is a weighted average of the following five city sub-indices, standardized using an expanding window procedure: price-to-income and price-to-rent ratios (fundamental valuation), change in mortgage-to-GDP ratio and change in construction-to-GDP ratio (economic distortion), and city-to country price ratio.

On a global scale, the index identifies Miami, Tokyo, and Zurich as cities with the highest bubble risks, reflecting widespread housing imbalances across major metropolitan areas. In Toronto, the bubble risk score for 2024 stands at 1.03, positioning it among the cities with an elevated risk of correction, while Vancouver follows closely with a score of 0.77, indicating moderate risk. These scores are crucial as they signal potential corrections in the housing market, especially if economic conditions deteriorate or government interventions intensify.

Toronto’s Real Estate Housing Bubble Risk

Toronto, one of Canada’s largest cities, is under significant scrutiny because of its high real estate bubble risk. With a score of 1.03 on the UBS Bubble Index for 2024, Toronto remains vulnerable to housing price corrections. This score reflects a slight improvement from previous years but still indicates elevated risk.

Several factors contribute to this situation, including skyrocketing home prices relative to local incomes, which have led to affordability challenges for many residents. The city’s real estate market has experienced price booms in the past decade, with inflation-adjusted prices rising dramatically between 2015 and 2021. However, recent years have seen a stabilization, with price growth decelerating as economic uncertainties, high interest rates, and inflation pressures mount.

Price Corrections in Toronto’s Real Estate Market

The period between 2022 and 2024 saw a major correction in Toronto’s real estate market. The city’s real estate market has experienced price booms in the past decade; home prices, which peaked in 2021, dropped by about 10-13% in real terms by mid-2023 This decline marked the largest correction since the peak in early 2022. This correction was driven primarily by the sharp increase in interest rates, which reduced borrowing capacity and demand. High inflation further complicated matters, eroding purchasing power and slowing the market’s momentum.

Despite the price declines, affordability remains a significant challenge in Toronto. Stagnant wage growth has made homeownership increasingly difficult for many. However, the expectation of further interest rate cuts in the future offer some hope for market stabilization and potential recovery.

The Role of Supply and Demand in Toronto

The Toronto housing bubble and Canadian real estate market trends are deeply influenced by supply and demand imbalances, and Toronto is a prime example of this. The city is grappling with a housing shortage, while strong demand continues to grow, fueled by population growth and real estate pressures, largely due to immigration. Housing starts in the Greater Toronto Area (GTA) have slowed sharply, dropping between 30-37% in 2024, according to an estimate. This decline is heightened by rising construction costs and regulatory hurdles, which have reduced building permits and constrained new developments.

Rental prices have remained high, despite a slight decline compared to last year, continuing to put pressure on both renters and prospective homebuyers. To help ease the strain, the Canadian government has announced plans to reduce the share of non-permanent residents to 5% by 2027. This reduction, aimed at curbing demand for rentals, is particularly focused on addressing the impact of international students and temporary foreign workers, who have contributed significantly to the increased demand in the rental market

However, experts caution that while this policy could eventually reduce rental demand, its effects will take time to materialize. In the short term, the rental market is likely to remain under pressure due to existing supply shortages and continued high demand.

Affordability Challenges in Toronto

Affordability remains a significant concern in Toronto’s real estate market and for the Toronto housing bubble, with the city having one of the highest price-to-income ratios both within Canada and globally. Estimates vary, with the ratio ranging from 8 to 15 years of income required to afford a home, depending on the property type and location. According to the UBS Global Real Estate Bubble Index 2024, a skilled worker would need 5 to 7 years of income to purchase a modest 60-square-meter apartment near the city center, reflecting the affordability challenges facing Toronto residents.

Rental prices are also part of the housing affordability issue. According to the Toronto Regional Real Estate Board (TRREB), the average rent for a one-bedroom condo apartment reached $2,452 in Q2 2024. This has forced many residents to move out of the city or downsize into smaller living spaces. These affordability challenges are a key factor contributing to Toronto’s elevated bubble risk, as housing prices have become increasingly disconnected from local income levels.

Impact of Government Policies on Toronto’s Market

In recent years, various government policies have had a noticeable impact on Toronto’s real estate market. For example, the foreign buyer ban, introduced to curb speculative demand, has helped reduce purchases from international investors, particularly in high-demand urban areas. This policy, combined with stricter mortgage regulations, contributed to the real estate market correction seen in 2022 and 2023, as these measures cooled down overheated sectors of the market.

However, with interest rate cuts on the horizon, there is potential for a market revival. Lower interest rates are expected to stimulate demand, especially among first-time homebuyers who have been priced out of the market in recent years. Additionally, the latest mortgage reforms, set to take effect in December 2024, are aimed at further improving affordability for them. Despite these measures, the overall impact of government policies remains uncertain, especially given the broader economic challenges.

The Future of Real Estate Prices in Toronto

Looking ahead, the future of real estate prices in Toronto is uncertain. Interest rate cuts are likely to provide some relief, improving affordability and boosting demand. However, other factors such as economic recovery, inflation, and housing supply constraints will heavily influence future price trends. Analysts highlight that while inflation has slowed down recently, economic growth remains fragile, and housing supply issues persist. These conditions create a mixed outlook for the market.

Some analysts predict that real estate prices may stabilize or see slight increases as the interest rate cuts take effect, encouraging more buyers to enter the market. However, others caution that if economic growth slows further, price volatility could persist, leading to potential corrections.

Key Challenges in Toronto’s Real Estate Market

Toronto faces several challenges that could affect its real estate market in 2024 and beyond. High unemployment rates (8%, August 2024) have left many potential buyers financially constrained. Political and social factors, such as government interventions in the housing market and public opposition to high-density developments, further complicate the outlook. These challenges will likely continue to shape the Canadian real estate market in the coming years, influencing both price trends and investment strategies.

Lessons from the UBS Global Real Estate Bubble Index

The UBS Global Real Estate Bubble Index provides valuable insights into the risks and opportunities in Toronto’s real estate market. Past real estate price corrections, such as those seen in Vancouver and other global cities, highlight the potential for significant price adjustments when market imbalances reach unsustainable levels.

However, the index also has its limitations. While it identifies risks, it does not predict the exact timing or severity of corrections. For investors and homeowners, it’s important to use this index alongside other Canadian real estate market trends and local economic indicators to make informed decisions.

Strategies for Navigating Toronto’s Real Estate Market in 2024

Navigating Toronto’s real estate market in 2024 requires careful planning and strategy. For first-time homebuyers, timing is crucial. Waiting for interest rate cuts may improve affordability, but buyers should also be prepared for potential price increases if demand surges.

Investors should focus on strategies such as diversifying investments. Being prepared for market fluctuations will be key to success in this volatile environment.

Conclusion: The Outlook for Toronto and Canadian Real Estate

Toronto’s real estate market is facing a variety of challenges in 2024, from ongoing affordability issues to the continued Toronto housing bubble risk. Despite these concerns, the strong rental demand, primarily driven by immigration offers opportunities for savvy investors. As interest rates potentially fall and economic conditions stabilize, the market may see a resurgence, but volatility remains a key risk factor. For homebuyers and investors alike, understanding key insights from reports like the UBS Global Real Estate Bubble Index will be critical in navigating this complex and ever-changing market environment.