The Canadian real estate market is undergoing significant changes with the introduction of new mortgage rules in Canada, aimed at enhancing housing affordability. Key reforms, such as the expansion of 30-year amortizations and an increased insured mortgage cap, are tailored to support first-time homebuyers and stimulate the new-build housing sector. In this blog, we’ll break down these new mortgage rules and analyze their impact on the Canadian homebuyer landscape.

30-Year Amortization: Boosting Buying Power

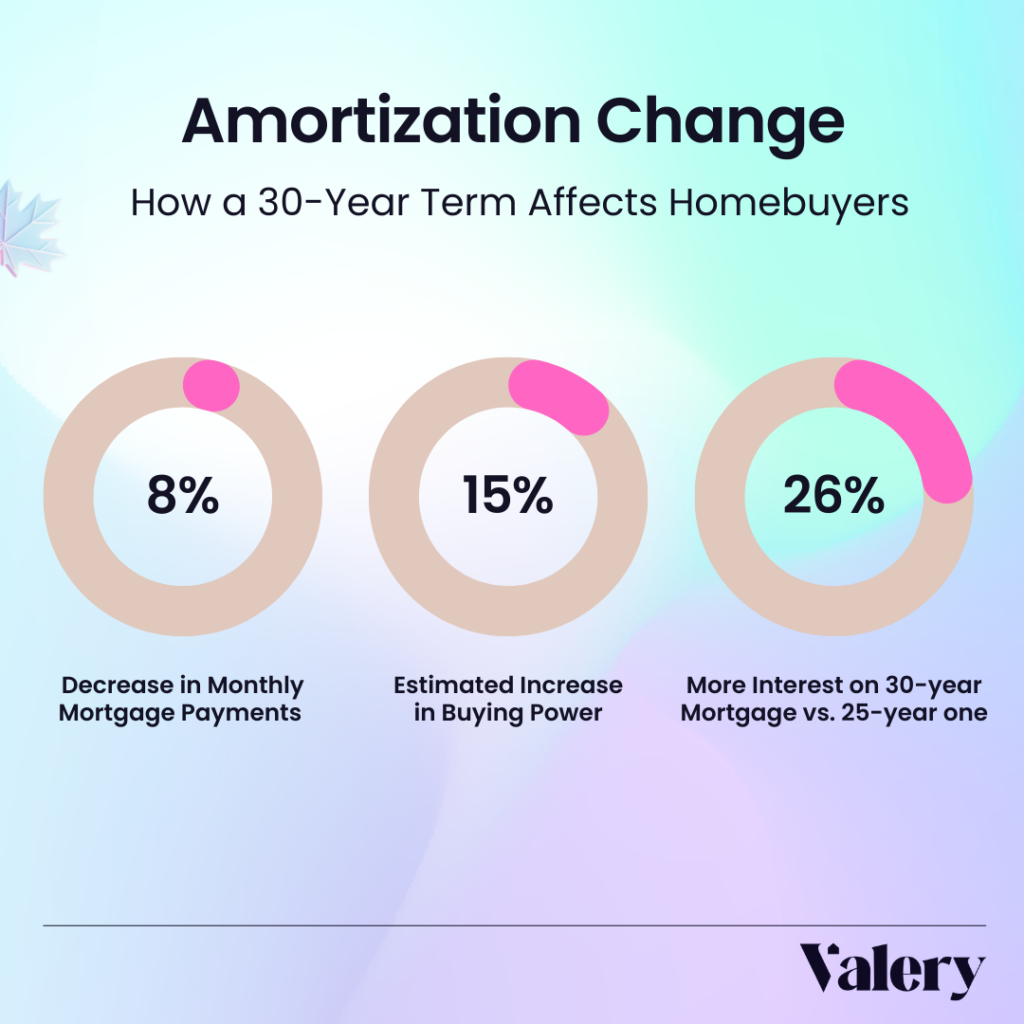

The government’s expansion of mortgage amortization periods from 25 to 30 years is a key reform designed to reduce the monthly financial burden on homebuyers. This change, primarily targeted at first-time homebuyers, can increase buying power but comes with long-term trade-offs.

What Does It Mean for Buyers?

By extending the mortgage term from 25 to 30 years, monthly mortgage payments are reduced by roughly 8%. This change instantly boosts the buying power of first-time buyers by 10-15%, enabling them to qualify for larger loans. However, buyers should be aware that the longer amortization period will result in about 26% more interest paid over the life of the mortgage compared to a 25-year loan. While the lower monthly payments are appealing, the higher long-term interest costs are significant.

Insured Mortgage Cap Raised to $1.5 Million

The second major change is the increase of the insured mortgage cap from $1 million to $1.5 million, a shift that aims to help buyers in expensive housing markets like Toronto and Vancouver.

Why This Matters

Raising the insured mortgage cap allows more buyers to qualify for Canada Mortgage and Housing Corporation (CMHC) insurance. This reduces the required upfront down payment for homes priced under $1.5 million, expanding access to high-demand markets. Previously, homes priced over $1 million required a 20% down payment, but with the new cap buyers may need as little as 5-10% for homes up to $1.5 million.

CMHC Insurance: New Down Payment Structure

Under the current system, the minimum down payment requirement for homes under $1 million is structured as follows:

- 5% down payment on the first $500,000.

- 10% on the portion between $500,000 and $999,999.

For homes valued at $1 million or more, CMHC insurance is not available, and a 20% down payment is required.

With the new cap set to rise to $1.5 million, a potential new tier of down payment requirements could be introduced:

- 5% down payment on the first $500,000.

- 10% down payment on the portion between $500,000 and $999,999.

- 15-20% down payment on the portion between $1 million and $1.5 million.

Let’s break this down with an example. For a $1.5 million home, the buyer would need:

- 5% down payment on the first $500,000 = $25,000.

- 10% on the portion between $500,000 and $999,999 = $50,000.

- 15% on the portion between $1 million and $1.5 million = $75,000.

This totals to a down payment of $150,000 or 10% of the total home price.

The “Price Floor” Effect on Housing Prices

The term “price floor” refers to the minimum price level supported by market factors. By increasing the insurable mortgage cap from $1 million to $1.5 million, the government is indirectly supporting housing prices by boosting the buying power of first-time buyers. This price floor effect helps stabilise the market and prevents home prices from falling below a certain threshold, especially in entry-level markets. It’s important to understand that while the government is not directly imposing a price floor, the policy aims to support demand in lower-priced housing segments.

Why These Mortgage Rules in Canada Matter for Real Estate Investors

While the recent mortgage reforms are primarily designed to benefit first-time homebuyers, real estate investors should also take note. Entry-level homes are highly competitive, attracting both investors and first-time buyers. With more buyers now gaining access to CMHC-insured mortgages, investors may encounter increased competition for affordable properties.

Additionally, many first-time buyers eventually leverage the equity from their first home to purchase investment properties. This means the reforms could significantly impact the real estate investment landscape and influence buying behaviour for years to come.

It’s also important to consider that 70-90% of homeowners in Canada view their homes as a long-term investment. This underscores the role that homeownership plays in wealth-building, making these changes relevant not only to homebuyers but to real estate investors as well.

Impact on the Rental Market with the New Mortgage Rules in Canada

With more first-time buyers transitioning to homeownership, there could be a reduction in rental demand, particularly in urban centres. Currently, around 80% of first-time buyers were renters before purchasing their home. However, the impact on the rental market will depend on several factors. One important factor is population growth. High immigration rates or regional population increases can sustain strong demand for rental properties, even as more people transition into homeownership. Another factor is investor activity. Investors who continue to purchase properties with the intention of earning rental income can help maintain the supply of rental units, ensuring that the rental market remains stable.

Long-Term Economic Effects

While these reforms provide immediate relief, they also come with risks. Canada faces concerns around high household debt and a financial literacy gap, with many buyers focusing more on monthly payments rather than the overall price of the home or the interest paid over the life of the loan. Any increase in interest rates could negatively affect the affordability of these longer-term mortgages, potentially leading to future market corrections.

Conclusion: Mortgage Reforms and Their Impact on Homebuyers

The Canadian government’s 2024 mortgage reforms – expanding 30-year amortizations and raising the insured mortgage cap – are designed to make homeownership more accessible. While these changes primarily benefit first-time homebuyers, they come with long-term financial implications including higher interest costs and increased debt, that buyers and investors should carefully consider.

As these reforms take effect on December 15, 2024, it will be essential to monitor their impact on the housing market, including home prices, rental demand and investment opportunities.

If you’re considering buying a home, try Valery’s AI-powered listing platform for a personalized home search experience.