To help in your search for lower-cost cities, we explore the affordable cities in Ontario in 2024; the most affordable and least affordable housing across Ontario’s Northern, Eastern, Southern, and Western regions, exploring what it all means for potential homebuyers, families, and investors. Housing affordability has become a hot-button issue across Ontario, particularly as property prices have surged far beyond income growth.

Understanding this dynamic is crucial for both prospective homebuyers and real estate investors. One of the most effective ways to gauge housing affordability is by examining the price-to-income ratio. This simple but powerful metric compares the median home price to the median after-tax household income, offering a snapshot of whether housing in a given area is accessible to the average family.

How is Housing Affordability Measured in Ontario? The Data Behind This Valery Analysis

To put it simply, housing affordability refers to how easily an average family can buy a home without overextending their finances. One of the key metrics used to measure this is the price-to-income ratio, which compares the median home price to the median after-tax household income. The lower the ratio, the more affordable the housing market is. A ratio of less than 5 typically indicates that housing is within reach for most families, while a ratio above 7 suggests a market where home prices significantly outpace income levels.

We gathered real-world data from 38 cities across Ontario, with a minimum population of 40,000 people and have compiled the information in this Ontario housing affordability report. To get a clear picture of the housing landscape, we looked at two key figures: the median home price and the median after-tax household income for each city. The most recent data for these metrics was obtained from The Canadian Real Estate Association (CREA) and Statistics Canada, giving us insight into the current housing market for all property types.

Then, we calculated the price-to-income ratio for each city and ranked them across four main regions—Northern, Eastern, Southern, and Western Ontario. This method allows us to highlight the most and least affordable cities for potential homebuyers.

Which Cities are Affordable, and Which Aren’t?

Let’s get into the numbers. Which cities are giving home buyers a better chance at securing affordable homes, and which cities are pushing them out of the market? Here’s the breakdown:

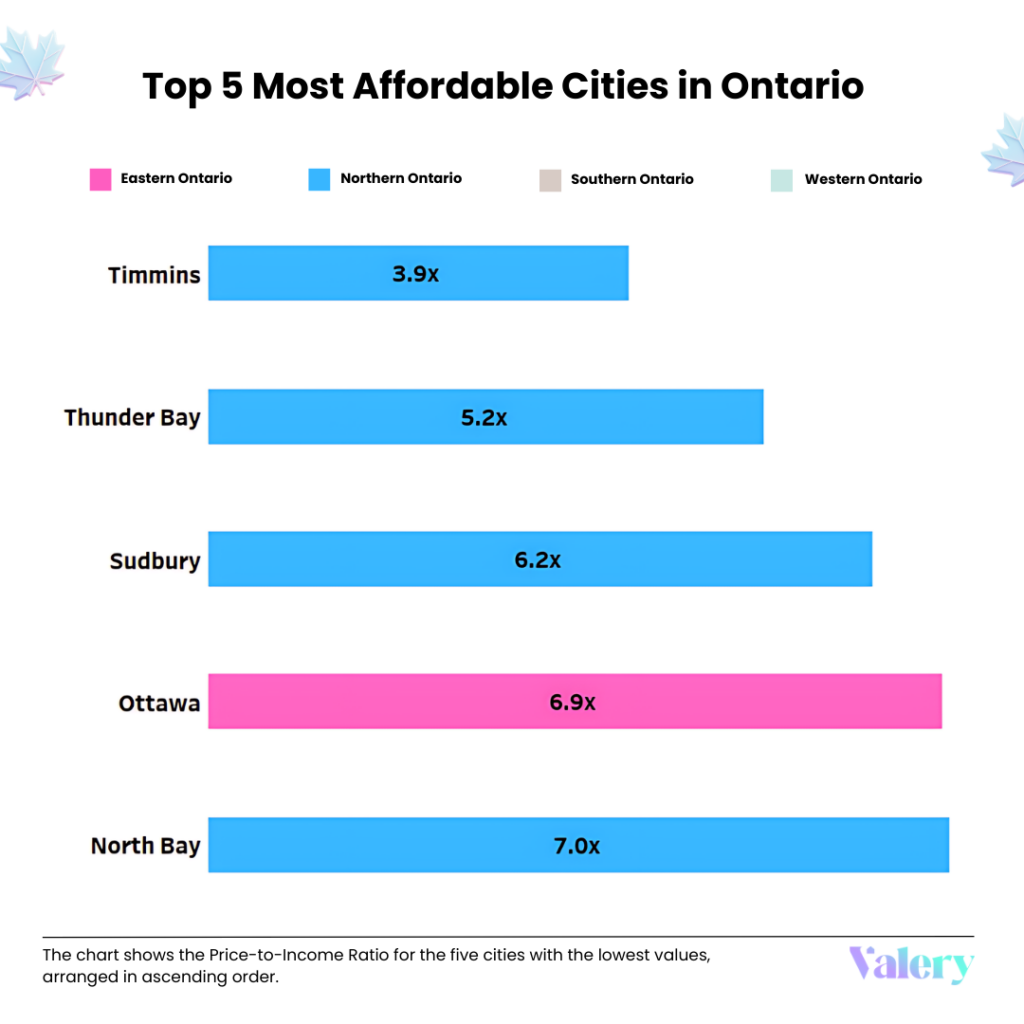

Top 5 Most Affordable Cities in Ontario:

Timmins – Price-to-income ratio: 3.9

Timmins takes the crown for Ontario’s most affordable city from the cities we analysed. With a price-to-income ratio of 3.9, homebuyers can find budget-friendly housing while enjoying a slower-paced lifestyle. Timmins is also home to a stable mining industry, which means steady employment opportunities for residents. If you’re someone who values nature and outdoor activities, Timmins, with its proximity to vast wilderness areas, is a hidden gem.

Thunder Bay – Price-to-income ratio: 5.2

Thunder Bay offers both affordability and a rich cultural scene. The city’s growing healthcare sector and its role as a transportation hub make it a desirable place for families and professionals alike. While it’s more affordable than cities in Southern Ontario, Thunder Bay is experiencing a slow increase in home prices as more buyers look to escape the skyrocketing costs of larger cities.

Greater Sudbury – Price-to-income ratio: 6.2

Greater Sudbury strikes a balance between affordability and access to urban amenities. Known as Northern Ontario’s largest city, it boasts a diverse economy driven by mining, education, and healthcare. With a vibrant park system and numerous recreational opportunities, Sudbury offers an excellent quality of life for families looking to escape the high costs of Southern Ontario.

Ottawa – Price-to-income ratio: 6.9

Ottawa combines affordability with urban convenience, making it an appealing place to live. As Canada’s capital, the city’s economy is anchored by government jobs, complemented by thriving sectors such as technology and education. Ottawa is home to renowned universities and research institutions, which bolster its knowledge-driven workforce. In addition to its economic opportunities, Ottawa offers abundant green spaces, including the picturesque Rideau Canal and Gatineau Park, providing residents with access to nature alongside the amenities of a bustling city. This makes Ottawa an attractive option for families and professionals looking for a balanced lifestyle compared to more expensive Southern Ontario cities.

North Bay – Price-to-income ratio: 7.0

North Bay stands out as a scenic and affordable city, offering residents a relaxed lifestyle while maintaining access to key urban conveniences. As the “Gateway to the North,” the city’s economy is driven by a strong mix of tourism, education, and technology, with institutions like Nipissing University and Canadore College fostering growth and innovation. Its location on the shores of Lake Nipissing provides ample opportunities for outdoor activities, such as boating, hiking, and skiing. With a vibrant arts and cultural scene, North Bay offers families and professionals a balanced, community-focused lifestyle that combines affordability with natural beauty and modern amenities.

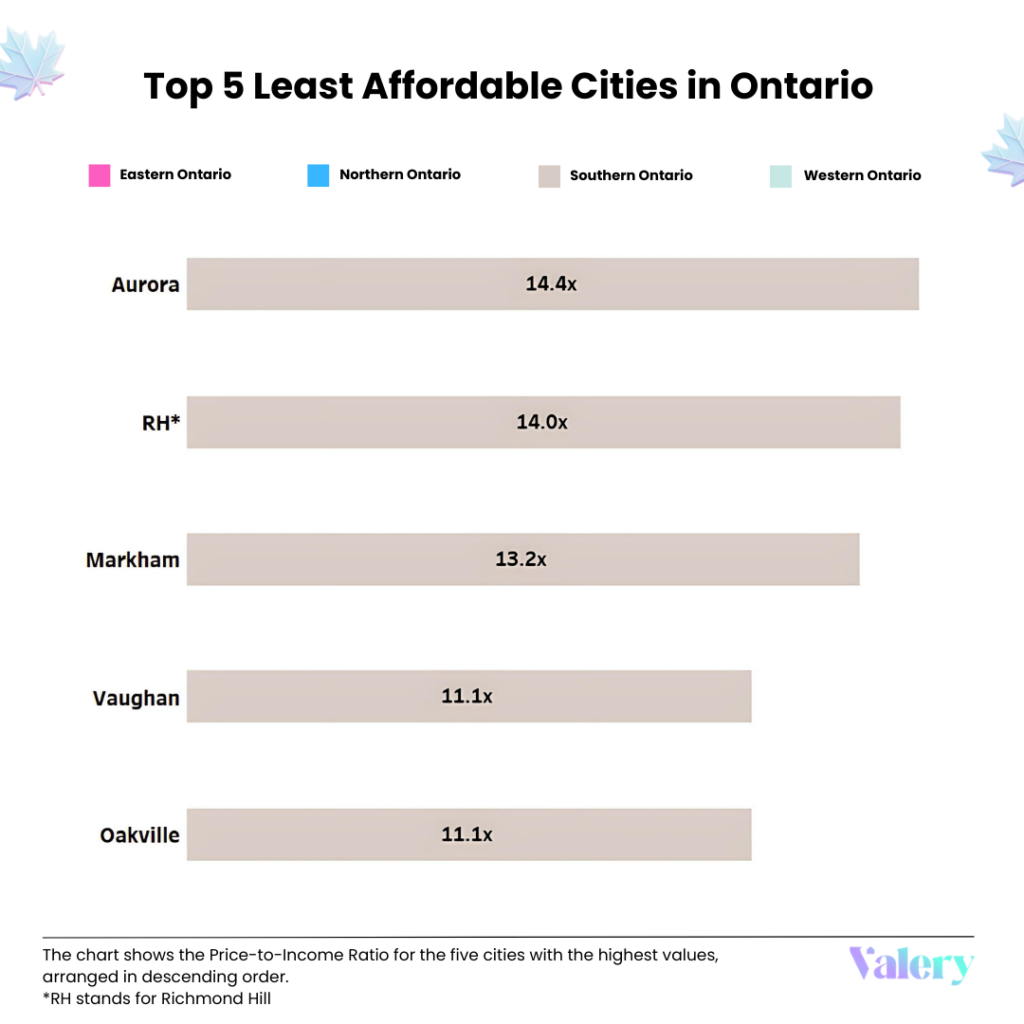

Top 5 Least Affordable Cities in Ontario:

Aurora – Price-to-income ratio: 14.4

Aurora is the least affordable city in Ontario. Its upscale market, sprawling luxury homes, and close proximity to Toronto make it a desirable place for high-income households. However, this has pushed housing prices well beyond the reach of the average buyer. Aurora’s excellent schools and family-friendly amenities add to its allure but make it a tough market for first-time buyers.

Richmond Hill – Price-to-income ratio: 14.0

Richmond Hill faces similar challenges to Aurora. Located just north of Toronto, its high-quality amenities, parks, and green spaces make it attractive for families. However, with limited land for development and an influx of high-income buyers, affordability has become a significant issue.

Markham – Price-to-income ratio: 13.2

Markham ranks as one of Ontario’s least affordable cities due to high demand for housing driven by its status as a major tech hub and its proximity to Toronto. Home to numerous multinational companies, Markham attracts professionals from around the world, further increasing competition for housing. The city’s attractiveness, featuring top-rated schools, cultural diversity, and extensive parks, make it a sought-after place to live, contributing to the high housing costs. Markham’s green spaces and vibrant community life add to its appeal, despite the challenges of affordability.

Vaughan – Price-to-income ratio: 11.1

Vaughan is one of Ontario’s pricier housing markets, largely due to rapid urban development and strong demand for housing. As a key entertainment and retail hub with attractions like Canada’s Wonderland and Vaughan Mills Shopping Centre, the city offers a rich mix of amenities that make it highly desirable. Its strategic location with major highway access and the TTC subway extension enhances its appeal for commuters to Toronto, further driving demand. Vaughan’s continued growth as a business hub in sectors like real estate and construction add to its unaffordability. Additionally, Vaughan is one of the fastest-growing municipalities in Canada, further increasing competition for housing.

Oakville – Price-to-income ratio: 11.1

With its lakeside beauty and exclusive lifestyle, Oakville has become one of Ontario’s most sought-after and expensive cities. Featuring a picturesque waterfront, top-tier schools, and luxurious neighbourhoods, it attracts families and professionals seeking refined living. Limited land availability and a strong economy in advanced manufacturing and life sciences drive high housing demand. Its proximity to Toronto, Hamilton, and Lake Ontario adds to its allure, while Bronte Creek Provincial Park provides residents with extensive green spaces and outdoor activities, further enhancing its desirability.

Regional Breakdown: A Closer Look at Housing Affordability

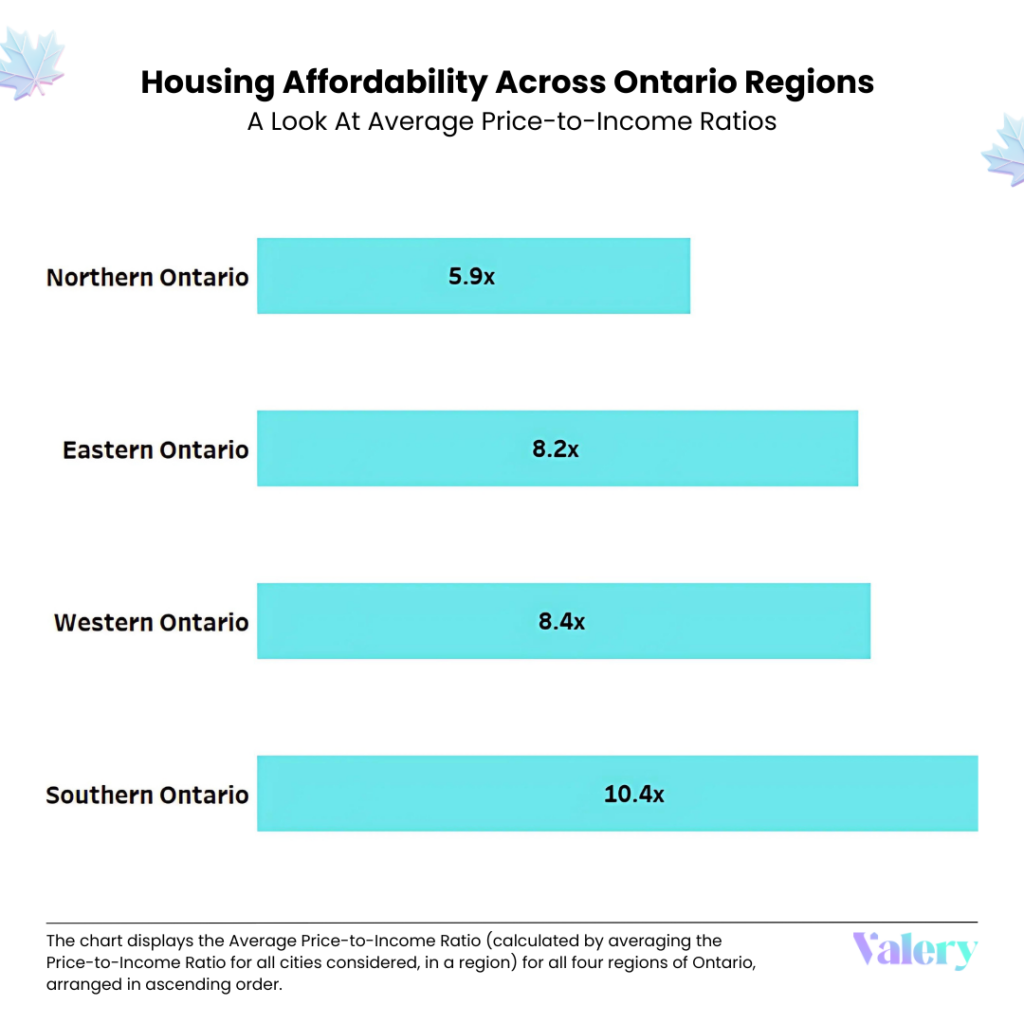

Southern Ontario: The Heart of the Affordability Crisis

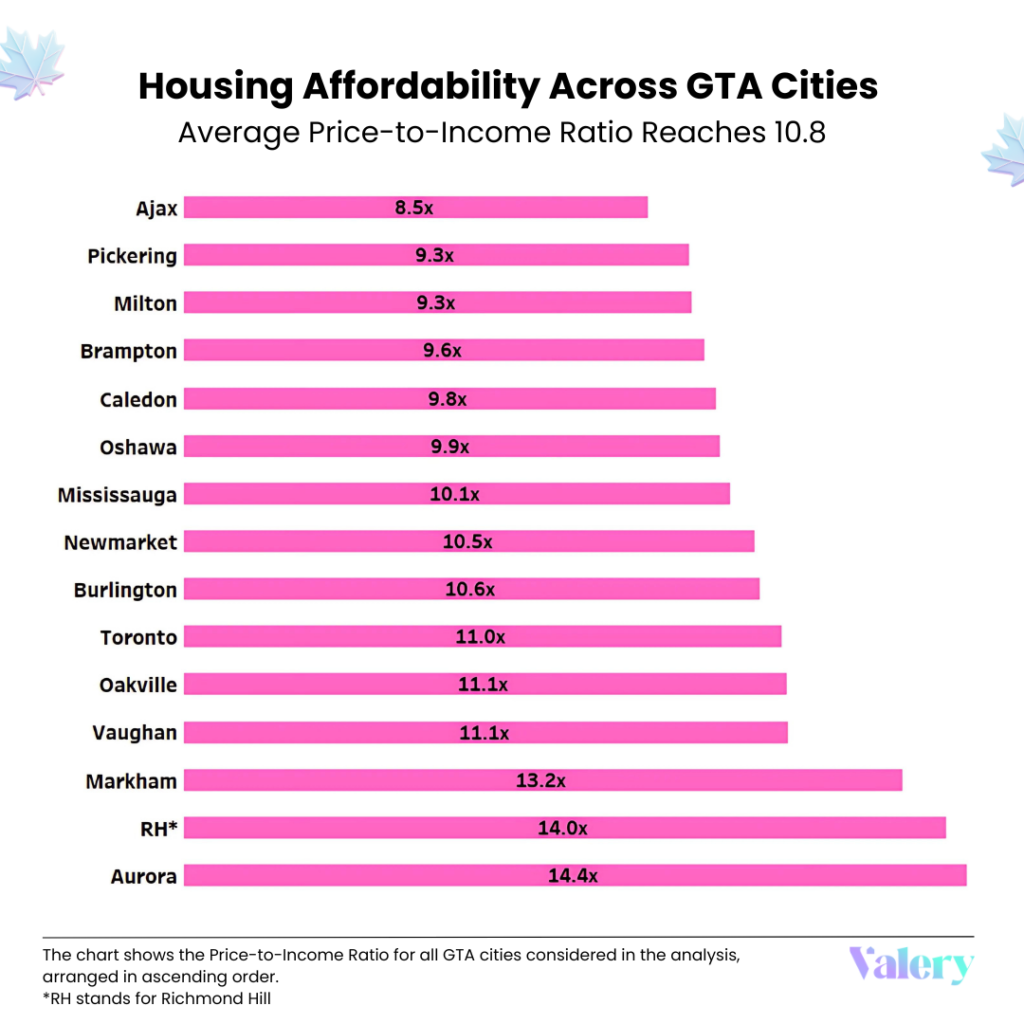

Southern Ontario is home to some of the most unaffordable cities in the province. Cities like Toronto and Mississauga are popular for their amenities, job opportunities, and vibrant cultures, but their housing markets are out of reach for many. Even smaller cities like Cambridge and Waterloo have seen rising prices as people move away from the GTA in search of more affordable options. But even in these cities, price-to-income ratios are creeping closer to 9.0, making it harder for families to buy homes.

If you are looking to live in Southern Ontario, be prepared to compromise on either location or budget. Many families are now choosing suburbs like Orangeville (price-to-income ratio: 8.5) and Ajax (price-to-income ratio: 8.5) as a more affordable alternative, but even these are becoming pricier as demand continues to rise.

Eastern Ontario: Moderately Affordable

Eastern Ontario presents a more balanced housing market compared to Southern Ontario. Cities like Ottawa (6.9 ratio) and Cornwall (7.5 ratio) offer a combination of relative affordability and quality of life. While Ottawa benefits from its role as the nation’s capital and a stable government-driven economy, Cornwall offers a quieter, affordable lifestyle with key industries in manufacturing and logistics, along with easy access to the U.S. border.

But affordability here is not guaranteed forever—rising demand in cities like Kingston (8.9 ratio) shows that even Eastern Ontario is not immune to price increases.

Northern Ontario: The Most Affordable Option

Northern Ontario tops the list for the most affordable housing in the province. Cities like Timmins and Thunder Bay consistently post low price-to-income ratios, making them ideal for those seeking budget-friendly options. The trade-off? Job opportunities in these regions are more limited compared to the booming industries of Southern Ontario.

But if you’re someone who prioritises a slower pace of life and easy access to nature, Northern Ontario might just be the place for you. The region’s affordable housing, combined with its natural beauty, makes it ideal for homebuyers who don’t mind being a bit further from urban centres.

Western Ontario: Rising Demand and Prices

Western Ontario’s average price-to-income ratio sits at 8.4, indicating that while it’s more affordable than Southern Ontario, housing prices are on the rise. Sarnia (7.2 ratio) is the most affordable option in the region. Cities like London and Windsor are experiencing growing housing demand as buyers move from more expensive regions like the GTA.

Though still more affordable than the GTA, families looking to buy in Western Ontario may need to act quickly as housing demand continues to grow. As a result, even smaller cities and suburban areas in the region are starting to experience upward pressure on prices, making affordability more of a concern for future buyers.

Factors Influencing Housing Affordability in Ontario

Population Growth and Migration

Southern Ontario has seen a significant population boom, particularly in the GTA. This influx of people has driven up housing demand, pushing prices higher in cities like Toronto, Mississauga, and Oakville. As demand increases, buyers are being forced to look at surrounding suburban areas, such as Orangeville, Burlington, Milton, and Hamilton, which are now facing similar affordability.

In contrast, cities in Northern and parts of Eastern Ontario have lower population growth, resulting in more balanced price-to-income ratios. Cities like Thunder Bay and Timmins benefit from slower population growth, which keeps housing demand and prices in check.

Job Market Variations

Despite a relatively high unemployment rate of around 8%, cities such as Toronto, Mississauga, and Oakville have seen home prices soar, largely due to housing demand outpacing wage growth. While sectors like tech, finance, and services in the Greater Toronto Area (GTA) remain vibrant, the high cost of housing continues to outstrip wage increases, making it increasingly difficult for residents to afford living in these areas.

In contrast, Northern Ontario cities like Timmins offer more affordable housing, although they offer fewer high-paying job opportunities. For individuals who prioritise cost-of-living over higher wages, these cities may present a more attractive alternative.

Government Policies Affecting Housing Affordability

First-Time Home Buyer Incentive (FTHBI)

The First-Time Home Buyer Incentive is designed to help new buyers by reducing monthly mortgage payments through shared equity. However, in high-cost cities like Toronto and Oakville, this program offers minimal relief, as home prices are far above the program’s cap.

Ontario’s Housing Supply Action Plan

Ontario’s Housing Supply Action Plan aims to address the shortage of housing by cutting red tape and encouraging construction. While the long-term benefits could help affordability, the immediate impact has been limited, especially in expensive areas like Richmond Hill and Aurora.

What Homebuyers Need to Know About Ontario’s Housing Market

If you’re looking to buy a home, Southern Ontario poses significant challenges, particularly in cities like Aurora and Richmond Hill. However, there are affordable options in Northern and Eastern Ontario, such as Thunder Bay and Cornwall.

For those looking for a balance between job opportunities and affordability, cities like Ottawa offer a solid middle ground.

What Investors Need to Know About Ontario’s Housing Market

Investors may want to focus on cities with rising demand but still affordable housing markets, such as Windsor or London. These cities offer long-term growth potential as people migrate from the GTA in search of cheaper homes.

Cities in Northern Ontario also present decent investment opportunities, particularly for those looking to capitalise on more affordable housing markets that may see increased demand as affordability worsens elsewhere.

Key Takeaways from Ontario’s Housing Affordability Analysis

Ontario’s housing market is incredibly diverse, with significant regional differences in affordability. While Southern Ontario leads the province in unaffordability, Northern and Eastern Ontario present more budget-friendly options.

For those looking to purchase their first home, considering more affordable cities outside of the GTA may be the best move. Meanwhile, investors may find opportunities in cities with growing demand but lower price-to-income ratios.

Want to know how your city compares? Get an instant home evaluation with Valery.ca’s AI-powered tools.