Table of Contents

The tone across Canada’s real estate landscape shifted dramatically in March 2025. While the industry had been holding onto hopes of recovery, the latest data from the Canadian Real Estate Association (CREA) shows the Canadian housing market is no longer just taking a breather—it’s being pulled downward by growing fear and fading confidence.

Momentum Stalls as Sales Drop Again

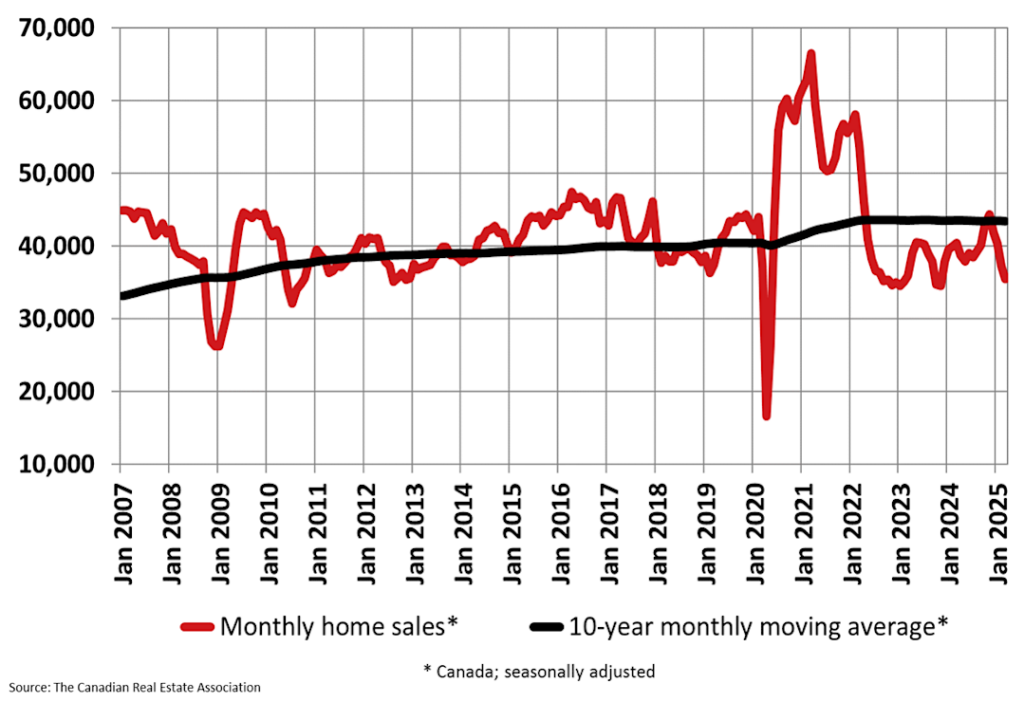

March wasn’t just another month in the books. It marked the fourth consecutive monthly drop in home sales, falling 4.8% compared to February. That’s particularly troubling given that spring typically brings a surge in activity. Instead, since reaching a high point in November 2024, sales have plunged 20%, putting the “rebound year” theory to rest.

What’s more, this past March now ranks as the weakest March since 2009, a year that still conjures memories of a global economic downturn.

CREA’s Shaun Cathcart didn’t sugarcoat it: “We’ve gone from a slam dunk rebound year to treading water at best.” But let’s call it what it is—we’re no longer just staying afloat. We’re dealing with hidden currents tugging at the very structure of the Canadian housing market.

Not Just Policy—It’s Psychology

Surface-level analysis points to trade policy tensions and interest rate debates. But the slowdown is about more than economic levers—it’s about human behavior. When people fear for their jobs, their financial future, or the broader stability of the world, they don’t buy homes. They hesitate. They hit pause.

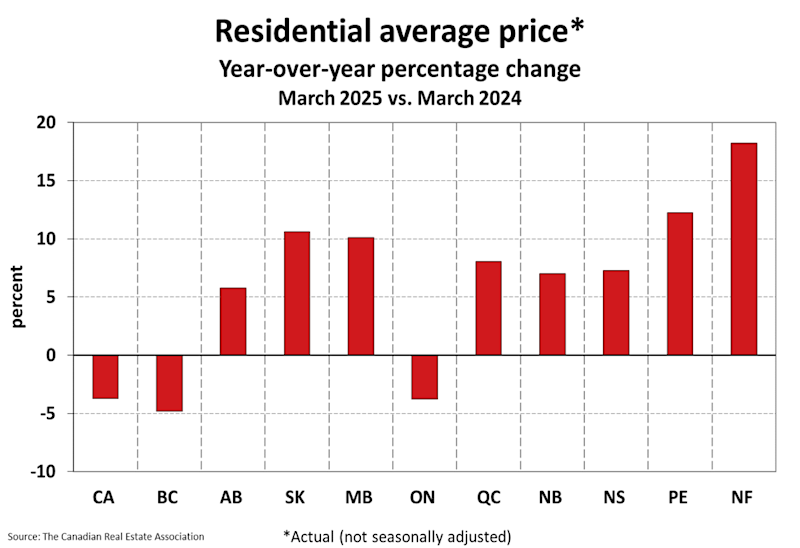

The numbers support this emotional pullback. Compared to March 2024, sales were down 9.3% year-over-year. Prices didn’t escape the decline either. The national average home price dropped 3.7%, landing at $678,331. While still high in absolute terms, it’s the steepest year-over-year price dip in recent memory and the most significant monthly index decline since late 2023.

Buyers Retreat, Sellers Step Forward

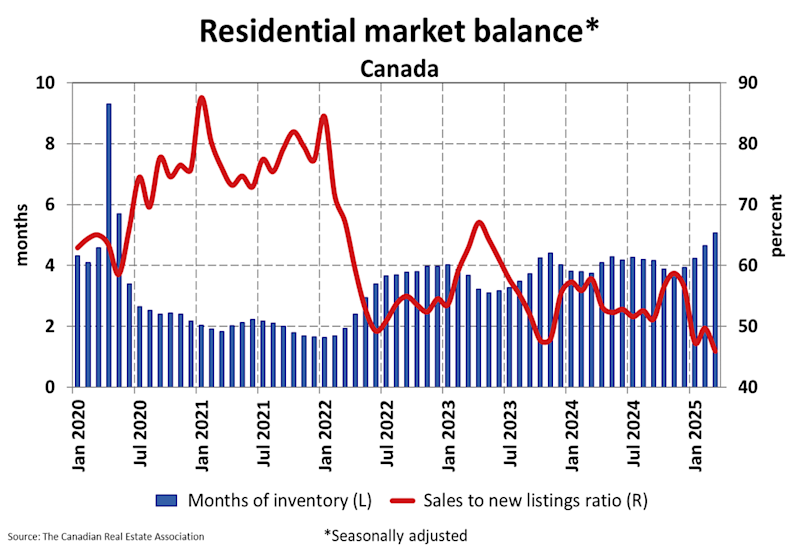

Another sign of imbalance is the rising inventory. Listings have surged 18.3% over the past year, but buyers aren’t meeting them. The sales-to-new listings ratio now sits at 45.9%—a level not seen since February 2009. This indicates that while more homeowners are trying to sell, the pool of active buyers is shrinking, leaving listings sitting longer.

Canada’s Housing Story Is Splitting in Two

CREA Chair Valérie Paquin highlighted a growing truth: there is no single Canadian housing market anymore. Ontario and British Columbia, long dominant in real estate metrics, are dragging the national averages down with notable drops in both sales and prices.

On the flip side, areas like the Prairies, Quebec, and much of Atlantic Canada are showing strength. These regions, often overlooked, are seeing either price stability or moderate growth, creating a stark contrast with more volatile urban centers.

This isn’t just temporary. We’re witnessing a fundamental shift—from a nationally synchronized market to a regionally fractured one. Local conditions now matter more than ever, and buyers and sellers alike must focus on what’s happening in their backyard, not just the headlines.

A Market Fuelled by Feelings, Not Fundamentals

As the federal election cycle kicks off, political uncertainty adds another layer of hesitation. With Canada now in caretaker mode, major decisions on housing policy are effectively frozen until a new government is elected.

Simultaneously, renewed trade friction—especially escalating tariffs—is weighing on both business and consumer confidence. Canadians are growing increasingly cautious, pulling back on big-ticket purchases like homes and preparing for potential economic turbulence ahead.

In this climate, market dynamics are less about supply and demand and more about emotional risk tolerance. Buyers are questioning everything. Sellers are stuck between holding out for better prices or slashing their asking numbers just to move forward.

Not All Doom and Gloom—Opportunities Still Exist

Amid the fog, some clearings appear. In markets where inventory is still catching up to demand, prices are holding steady—or even climbing. For investors and current homeowners looking to trade up, reduced competition and lower asking prices could provide a unique advantage.

However, first-time buyers remain the most cautious group. Many are waiting on the sidelines, hoping the next federal government introduces policies that make homeownership more attainable.

What Comes Next for the Canadian Housing Market?

This CREA report offers more than raw data—it reflects the national psyche. After years of policy-driven highs and market mania, Canadians are coming to terms with a new, more grounded reality.

Yes, election results will matter. Housing platforms will be debated, and promises will be made. But no single policy can restore market confidence overnight. Affordability issues and inventory shortages will still require years of effort and planning.

Ultimately, the next chapter of the Canadian housing market will be written by individuals and families. Around kitchen tables, they’ll do the math, weigh the risks, and decide whether to leap—or wait. Their collective choices will shape the path forward more than any policy announcement from Ottawa.

Final Thoughts

We’re not in a crisis—but we are at a crucial fork in the road. The March 2025 CREA report doesn’t just chart where we’ve been—it asks hard questions about where we’re going. The real estate industry is adjusting to a slower, more fragmented pace, while Canadians across the country confront new definitions of value, stability, and risk.

The Canadian housing market is evolving. Whether that evolution brings renewal or stagnation will depend on how we respond—not with fear, but with clarity and foresight.