The GTA housing market has crossed from momentum to negotiation. Sales volume has collapsed, inventory has accumulated, and prices are adjusting slowly, creating a market where time and leverage now work against sellers rather than for them.

Table of Contents

Something fundamental has shifted in the Ontario and Greater Toronto Area (GTA) housing markets, and it did not arrive with a crash, a panic, or a single headline moment. It arrived quietly, through accumulation. One data release at a time. One failed listing after another. One more month where buyers waited and sellers adjusted. By the end of 2025, as the latest Toronto Regional Real Estate Board (TRREB) Market Watch release shows, the numbers stopped being debatable. They started to describe a different market altogether.

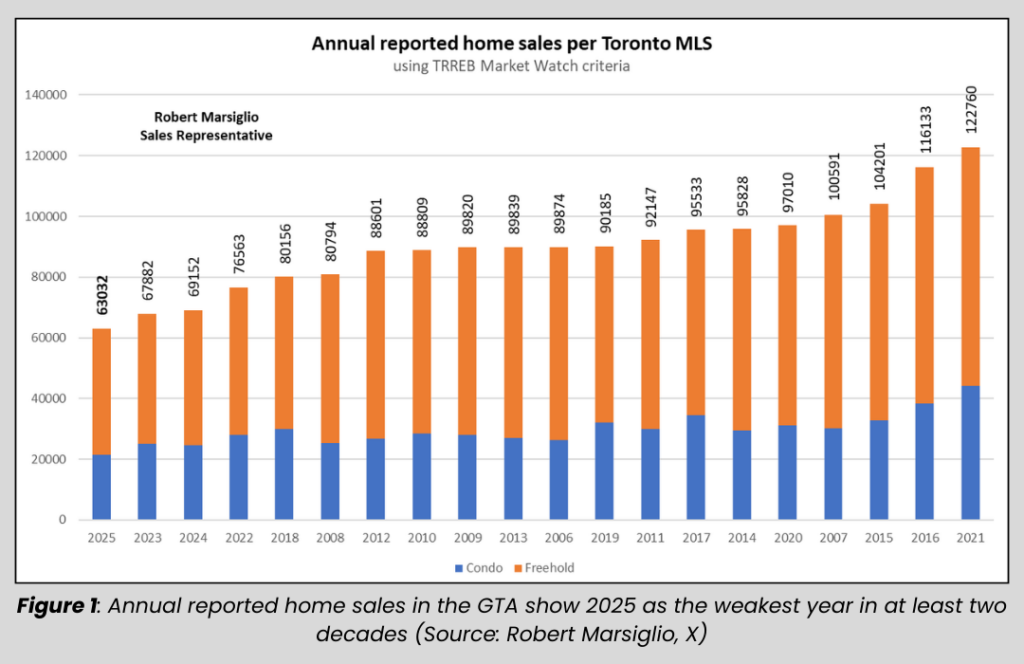

In December, 84 per cent of homes across Ontario sold below their asking price. That alone would have been unthinkable just a few years ago. At the peak of the last cycle, the typical home sold far above list price, often after a matter of days, sometimes hours. By contrast, 2025 closed as the slowest year for resale housing in the Greater Toronto Area in at least two decades. The gap between expectations and reality is no longer theoretical, but measurable across pricing, inventory, and time on market.

What follows is a story about leverage. About how the balance of power has shifted steadily away from sellers and toward buyers, and why that shift is proving more uncomfortable than a sudden correction would have been.

The End of the Bidding Era

For more than a decade, pricing strategy in Ontario followed a simple script. List low. Attract attention. Let competition do the rest. That strategy depended on excess demand and buyer urgency. In 2025, both disappeared.

At the height of the market in early 2022, the median home in Ontario sold for close to 120 per cent of its asking price. That was not an anomaly. It reflected a market where buyers were conditioned to overpay in order to secure anything at all. Today, that dynamic has reversed. The average sale to list price ratio has fallen to roughly 97 per cent, with the median closer to 96 per cent. These are the lowest readings observed across the available data set.

This shift matters because it signals more than softer prices. It marks a return to negotiation. When homes routinely sell below asking, list price regains meaning. Pricing accuracy begins to matter again. Sellers can no longer rely on momentum to rescue aggressive expectations. Buyers are no longer chasing the market upward. They are testing it downward.

Inventory and the Buyer Problem

The most revealing change in this cycle is not price. It is inventory.

Months of inventory across the GTA has climbed to levels not seen in roughly 15 years, whether measured on a one month or three month basis. This increase is even more pronounced once condominiums are fully included. That is a critical distinction, because it undercuts a narrative that dominated the market just before rates began rising in 2022. At that time, the prevailing concern was a chronic shortage of listings.

That problem no longer exists. The market today does not lack homes for sale. It lacks willing buyers.

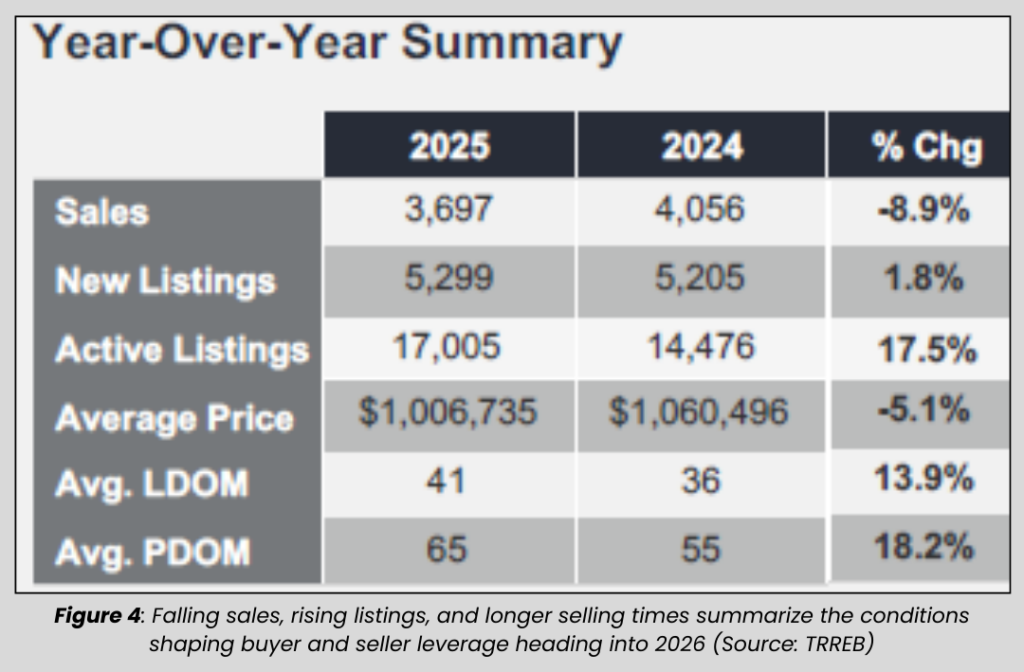

Sales have slowed enough that inventory continues to build even after accounting for record numbers of terminated listings. In other words, sellers are pulling properties off the market at historic rates, yet supply still outpaces demand. That is the clearest signal of a buyer constrained environment.

When inventory rises faster than sales, leverage shifts. Buyers gain time. Sellers lose urgency. The structure of the market begins to change.

Time on Market Returns as a Constraint

One of the defining features of the last cycle was speed. Homes sold in days. Sometimes in hours. That speed reinforced confidence and compressed decision making. It also masked pricing errors.

In 2025, time returned as a constraint.

Average days on market are now comparable to the peak reached in 2014, more than a decade ago. Median days on market remain elevated and show signs of rising further. For condominiums in particular, the transition has been stark. What was once the fastest moving segment has become one of the slowest.

Longer selling times have consequences beyond inconvenience. They allow inventory to accumulate. They weaken negotiating positions. They expose unrealistic pricing. Most importantly, they affect psychology. When a listing sits for weeks or months, both buyers and sellers recalibrate what the asset is truly worth.

Terminated Listings and Seller Psychology

Every month of 2025 set a new record for terminated listings. That pattern demands interpretation.

Some sellers are capitulating. Others are refusing to accept lower prices and choosing to wait. Many are likely postponing plans, hoping that a future market will look more like the past one they remember. In all cases, the result is the same. Listings are elevated. Sales remain weak. Inventory continues to rise.

Terminated listings should not be mistaken for vanished supply. A property removed from the market is not a property removed from existence. In many cases, it becomes future supply. That is why the concept of pent up supply deserves more attention than pent up demand.

There is no economic requirement for a seller to re list. There is, however, a clear economic barrier preventing many buyers from entering the market at current price to income ratios. Until that relationship improves, demand remains limited. Supply does not face the same constraint.

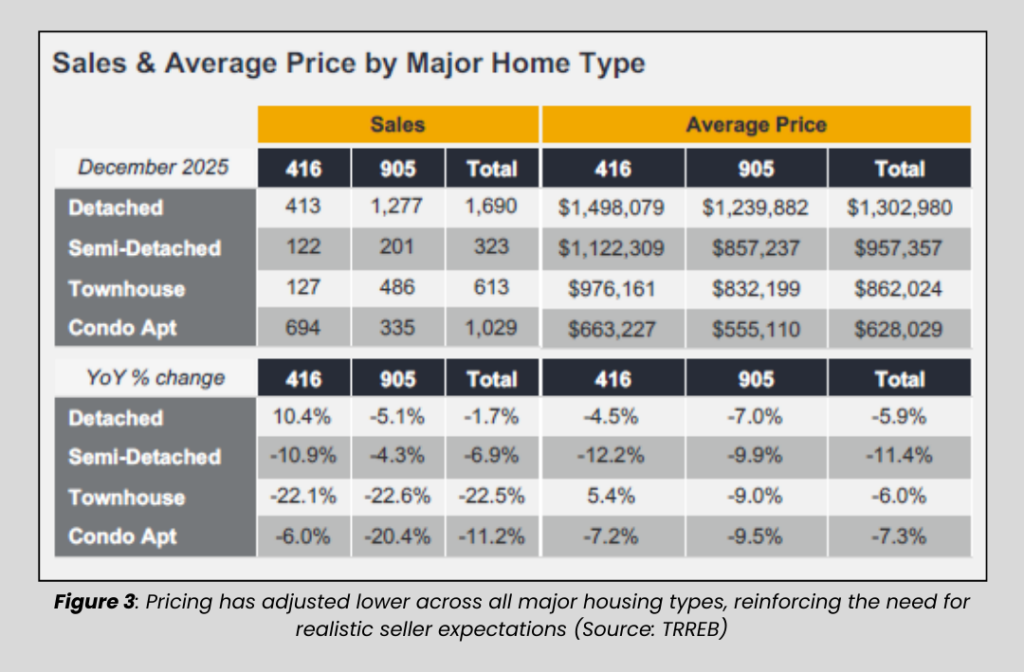

A Full Year of Falling Prices

Prices have now been falling for twelve consecutive months. With the exception of January, every month of 2025 recorded declines on both a year over year and two year basis. Current price levels are approaching those seen in 2020, with only a modest premium remaining.

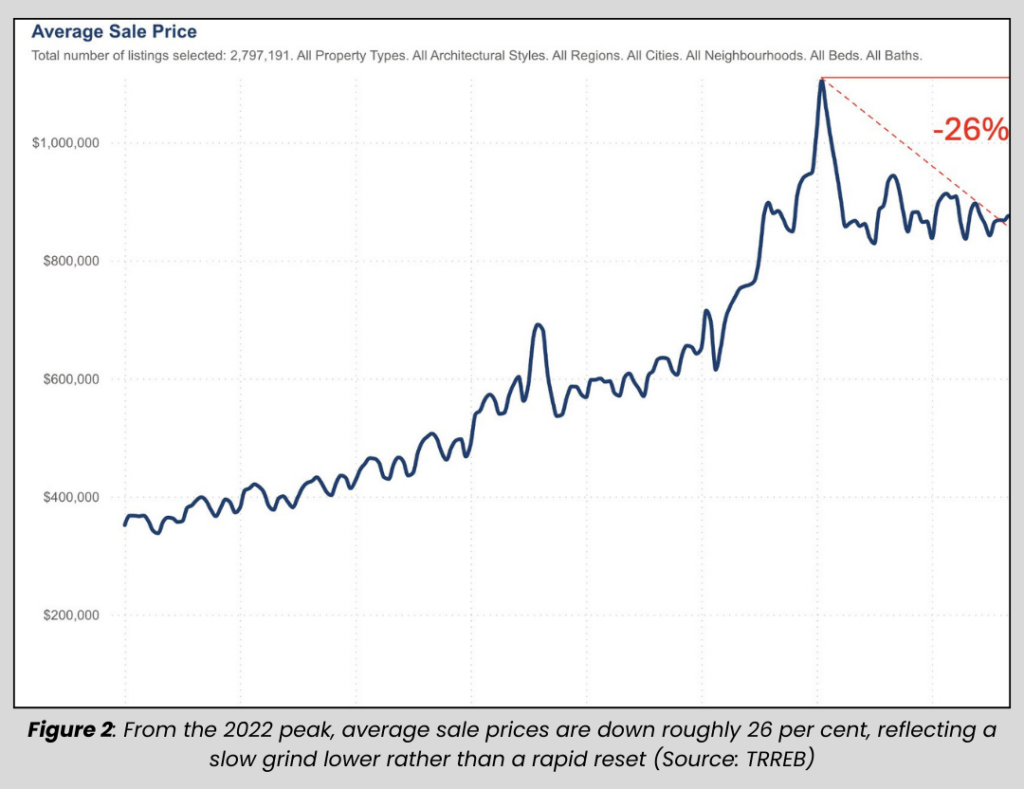

From the peak, prices are down by roughly 26 per cent. Four years of gains have effectively been erased.

What makes this cycle distinct is its pace. Rather than a sharp break, prices have drifted lower through a slow grinding process. Sellers remain anchored to 2022 comparisons. Buyers refuse to meet them there. Price discovery continues, but it unfolds gradually, one negotiation at a time.

This slow adjustment is often more painful than a rapid one. Mortgage costs have risen. Carrying costs persist. Losses are realized incrementally rather than all at once.

Why Leverage Has Shifted Back to Buyers

Sale to list price ratios capture the essence of the current market. They reflect dispersion between expectations and outcomes. When the ratio falls well below 100 per cent, it tells a simple story. Buyers are dictating terms.

That shift is now visible in practice. Conditional offers have returned. Financing conditions are common again. Home inspection conditions are no longer seen as optional. Sale of buyer property conditions, largely absent for years, are beginning to reappear.

Negotiation itself has been normalized. Price reductions are expected. Initial offers often prove to be the strongest ones a seller receives. Overpriced listings are punished through time rather than competition.

Price, conditions, and closing flexibility all matter again.

Sellers Face a Different Reality

For sellers, the market no longer provides cover for weak strategy. Pricing errors are exposed. Presentation matters. Marketing matters. Expectation management matters.

Those who do not need to sell may choose to step aside. That choice alone reinforces the buildup of future supply. Those who do need to transact face a clearer mandate. Price realistically. Adjust to current conditions. Accept that past benchmarks no longer apply.

Buyers are aware of price trends. They know prices are down roughly five per cent year over year. They see the headlines. Twelve consecutive months of negative price movement shapes sentiment in ways that rate cuts alone cannot easily reverse.

What This Means Heading Into 2026

This environment does not resemble a traditional crash. It is slower. More drawn out. More psychologically taxing for sellers. It rewards patience, discipline, and realism.

For buyers, leverage is the strongest it has been in over a decade. For sellers, the margin for error is thin. For investors, underwriting discipline and cash flow sensitivity matter more than directional bets.

The market has reset its rules. Negotiation has returned. Time has returned. Price discovery has slowed, but it has not stopped.

The uncomfortable truth for many participants is that this process may continue longer than expected. Inventory can accumulate as long as demand remains constrained. Until affordability improves meaningfully, leverage is unlikely to shift back.

Frequently Asked Questions (FAQs)

1. Is the GTA housing market crashing or just slowing down?

The GTA housing market is not experiencing a traditional crash, but it is undergoing a prolonged adjustment. By the end of 2025, resale activity in the GTA reached its slowest level in at least two decades, while prices declined gradually rather than collapsing. From peak levels in early 2022, prices are down by roughly 30 per cent, reflecting a slow grind lower rather than a rapid reset.

2. Why are so many homes in the GTA housing market selling below asking price?

Homes in the GTA housing market are selling below asking price because buyer leverage has returned. In December 2025, 84 per cent of homes across Ontario sold below their asking price, compared with early 2022 when the median home sold for close to 120 per cent of asking. Today, the average sale to list price ratio is roughly 97 per cent, with the median closer to 96 per cent, the lowest readings in the available data.

3. What does rising inventory mean for the GTA housing market?

Rising inventory in the GTA housing market signals a clear shift in market power. By late 2025, months of inventory climbed to levels not seen in roughly 15 years, whether measured on a one month or three month basis. This increase occurred even as sellers terminated listings at record rates, indicating that supply continues to outpace demand despite properties being pulled off the market.

4. How does time on market affect buyers and sellers in the GTA housing market?

Longer selling times in the GTA housing market reflect weaker demand and slower price discovery. In 2025, average days on market rose to levels comparable to the previous peak in 2014, more than a decade earlier. Median days on market remained elevated, particularly for condominiums, which shifted from being the fastest selling segment earlier in the cycle to one of the slowest by the end of the year.

5. What should buyers and sellers expect from the GTA housing market in 2026?

Heading into 2026, the GTA housing market is likely to remain negotiation driven rather than momentum driven. Sales declined by roughly 9 per cent year over year in 2025, while listings and inventory increased, keeping downward pressure on prices. With affordability still constrained and prices having fallen for twelve consecutive months, leverage is expected to remain with buyers unless demand improves materially.

ABOUT THE AUTHOR

Daniel Foch is the Chief Real Estate Officer at Valery, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & PropTx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, The Globe and Mail, Storeys and Real Estate Magazine (REM). His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.