The Canadian housing market looks balanced by conventional measures according to CREA, but that balance reflects a late-cycle holding pattern rather than renewed strength. Buyers and sellers are waiting. In this phase, calm data can mask fragility rather than signal resilience.

Table of Contents

Canada’s housing market is once again being alluded to as balanced. Monthly sales difference is minimal. Inventory is not climbing. Prices are moving lower, but only modestly. On the surface, the data suggests a market that has sort of found its footing after years of volatility.

That reading misses what is actually happening.

Late in a housing cycle, stability can emerge not because the system is healthy, but because buyers and sellers are simultaneously stepping back. When that occurs, balance becomes a holding pattern rather than a sign of resilience. The November 2025 national housing data from the Canadian Real Estate Association fits this description closely.

What the November Data Actually Shows

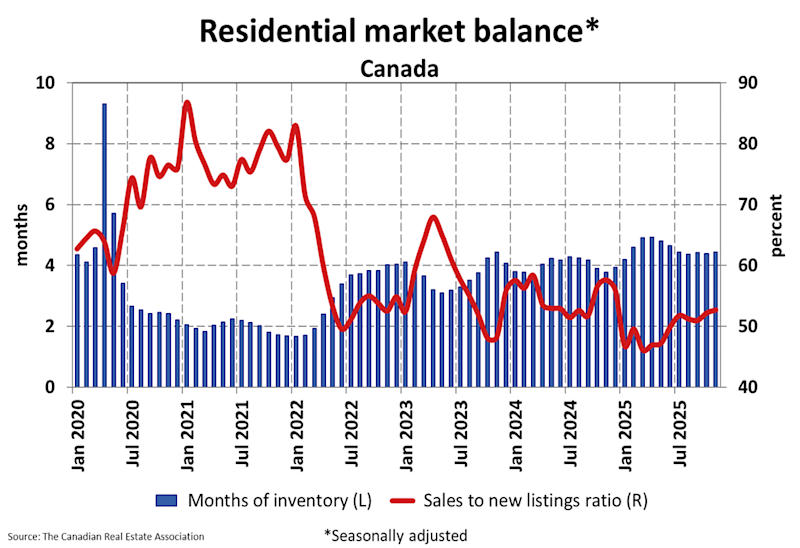

National home sales declined 0.6 per cent from October. New listings fell by a slightly larger 1.6 per cent. As a result, the sales-to-new-listings ratio tightened marginally to 52.7 per cent, just below the long-term average of 54.9 per cent and well within the range typically associated with balanced market conditions.

Months of inventory held steady at 4.4, unchanged since July and close to the five-month long-term norm. Active listings stood at roughly 173,000 nationally, up from last year but still modestly below historical seasonal averages.

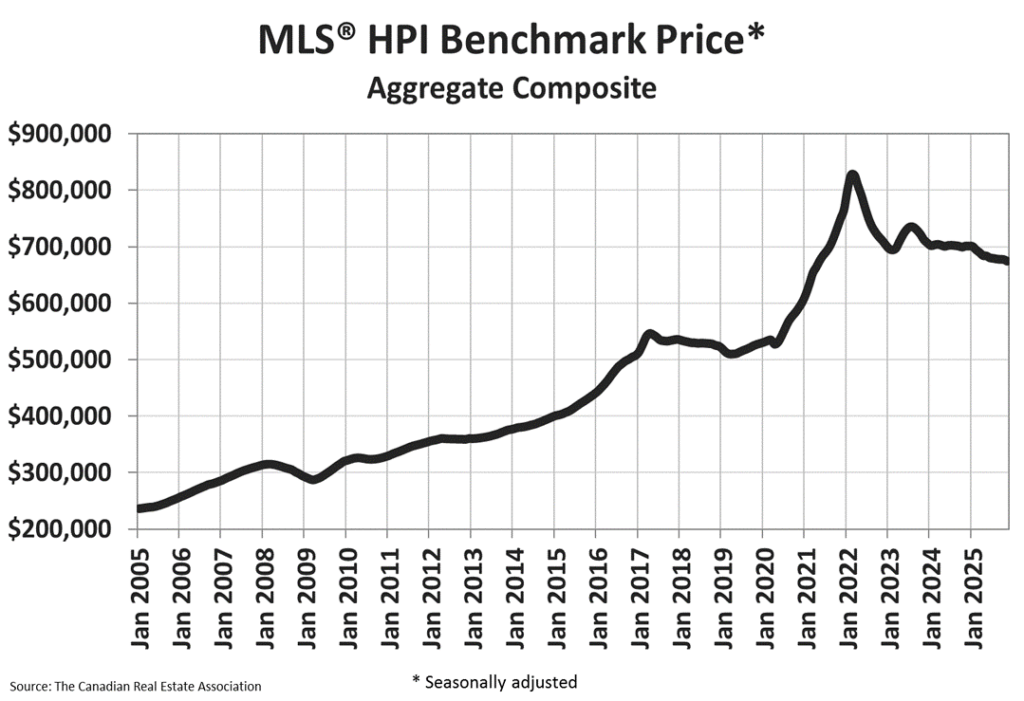

On prices, the MLS Home Price Index slipped 0.4 per cent month over month and sat 3.7 per cent below its level a year earlier. The national average home price declined roughly 2 per cent year over year to about $682,000.

Taken at face value, these figures suggest equilibrium. Demand is neither accelerating nor collapsing. Supply is neither flooding the market nor disappearing. Price declines appear contained. It would be easy to interpret this as confirmation that the market has stabilized.

That interpretation would be misplaced.

Why Late-Cycle Balance Is Fragile

Balanced conditions are often assumed to signal resilience. In earlier stages of a housing cycle, that assumption can hold. Late in the cycle, it frequently does not.

At this stage, stability is less a function of confidence and more a product of hesitation. Buyers are present, but selective. Sellers are active, but increasingly flexible. Transactions occur, but only when expectations converge closely. Sales have stopped falling, yet they have also stopped building momentum, moving sideways since mid-year despite lower interest rates and clearer rate expectations. This is the behaviour of a market waiting.

When both sides defer decisions, headline balance metrics can remain deceptively calm. Months of inventory and sales-to-new-listings ratios stay within familiar ranges not because the system is strong, but because activity is constrained on both sides.

Thin Liquidity and Conditional Stability

What makes this phase particularly vulnerable is thin liquidity. Fewer marginal participants are willing or able to transact. Decisions that might have been pulled forward in other cycles are being postponed. As a result, price discovery is left to a narrower set of buyers and sellers.

In that environment, stability becomes conditional.

Small changes begin to matter more. A shift in rate expectations. A labour market wobble. A policy adjustment. With limited depth in the underlying structure of the market, these shocks can move outcomes disproportionately.

The November data already hints at this dynamic. Price concessions appeared without a meaningful rise in listings. Sellers adjusted expectations not because supply surged, but because year-end timing and carrying costs forced pragmatism. The resulting price declines reflect execution pressure rather than panic.

Canadian Housing Market’s Missing Ingredient

Interest rates are no longer the primary constraint on demand. Mortgage rates have come down meaningfully from their peaks. Fixed-rate options sit at their lowest levels since early 2022. Variable rates have already adjusted lower.

Yet buyers continue to hesitate.

The reason is sentiment. Markets do not recover on math alone. They recover when participants believe prices have stopped falling and that future conditions will be stable enough to justify long-term commitments. That confidence has not fully returned.

Instead, buyers have been rewarded for patience. Waiting six months has produced better pricing. Waiting a year has produced even better terms. In that context, urgency remains elusive.

What This Means Heading Into 2026

The market has not broken. There is no evidence of widespread capitulation. Months of inventory remain below buyer’s market territory. Listings sit modestly below long-term seasonal norms.

At the same time, there is little evidence of renewed momentum.

This is the tension that defines late-cycle balance. The system is neither overheating nor healing. Stability exists, but it rests on restraint rather than conviction.

For investors, policymakers, and market participants, the implication is straightforward. Calm data should not be mistaken for durable stability. In markets shaped by deferred decisions and constrained liquidity, balance is fragile by definition.

The coming year will test this fragility. If confidence improves meaningfully, activity should follow. If uncertainty persists, stability will continue to depend on waiting. In either case, the risk is not found in headline ratios, but in how quickly they can shift once waiting gives way to necessity.

Late in the cycle, balanced markets are often the most revealing.

Ask Valery, your AI real estate companion, how these late-cycle conditions affect your local market. Click on her in the bottom right corner.

Frequently Asked Questions (FAQs)

1. Is the Canadian housing market stable right now?

The Canadian housing market appears stable by headline metrics, such as months of inventory and the sales-to-new-listings ratio, but that stability is largely conditional. Current conditions reflect a holding pattern driven by hesitation among buyers and sellers rather than renewed confidence or underlying strength.

2. What does “late-cycle balance” mean in the Canadian housing market?

Late-cycle balance in the Canadian housing market refers to a phase where activity has stopped deteriorating but has not regained momentum. Sales move sideways, prices adjust modestly, and inventory stabilizes, not because the market is healthy, but because participants are delaying decisions.

3. Why are prices still adjusting in the Canadian housing market despite balanced conditions?

Prices in the Canadian housing market are adjusting because price discovery is being driven by constraint rather than enthusiasm. Mortgage renewals, balance-sheet pressures, and timing needs force some sellers to transact, while patient buyers retain negotiating power in a market with limited liquidity.

4. Are interest rates still the main issue holding back the Canadian housing market?

Interest rates are no longer the primary constraint on the Canadian housing market. Mortgage rates have declined meaningfully, but buyer confidence has not fully returned. The dominant factor holding back activity is sentiment, as buyers continue to believe that waiting may yield better outcomes.

5. What does this mean for the Canadian housing market heading into 2026?

Heading into 2026, the Canadian housing market is neither overheating nor healing. Stability exists, but it rests on restraint rather than conviction. If confidence improves, activity should follow. If uncertainty persists, the market’s apparent balance may remain fragile and prone to sudden shifts.

ABOUT THE AUTHOR

Daniel Foch is the Chief Real Estate Officer at Valery, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & PropTx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, The Globe and Mail, Storeys and Real Estate Magazine (REM). His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.