Canada’s housing correction is still unfolding and the forces that would support a true recovery will not align until after the renewal and economic pressures of 2026.

Table of Contents

Canada’s housing market is sending a complex and unsettling message that cuts against the hopeful cadence of recent headline statistics. Sales have risen in six of the past seven months and real interest rates have drifted lower as inflation softens. Inventory appears stable at first glance and industry groups have already begun to anticipate a resurgence of demand in 2026. Yet, the deeper currents of the market point in a very different direction. The surface impressions of stability mask a late-cycle structure where vulnerability accumulates silently until a decisive break. Canada is entering the final act of a housing correction, not a premature revival, and the path to recovery runs through a period of capitulation that has yet to fully unfold.

This piece explains the forces that will shape that transition. It traces how the 2026 renewal cycle, rising inventory, weakening economic signals, and investor strain interact. It also shows why foundations for a durable recovery remain further away than current narratives suggest.

The Mirage of Stability

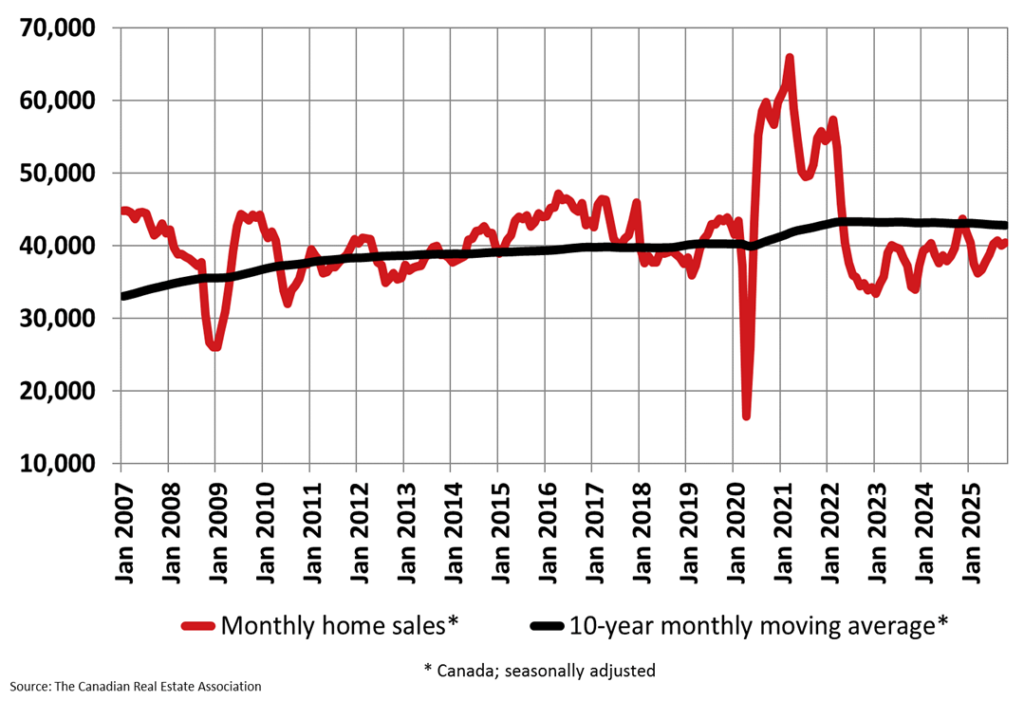

The Canadian Real Estate Association (CREA) reported a modest 0.9 per cent rise in national home sales in October, a predictable seasonal uptick between September and late autumn. The year-over-year comparison tells the truer story. Transactions remain more than 4 per cent below last year and far below the long-term average that historically defines a functional market. This is evident in the chart below. Prices continue to record year-over-year declines near the 3-4 per cent range and have done so for most of 2024 and 2025. These figures place the market in a narrow and fragile band of activity, where momentum appears to be slowing rather than turning.

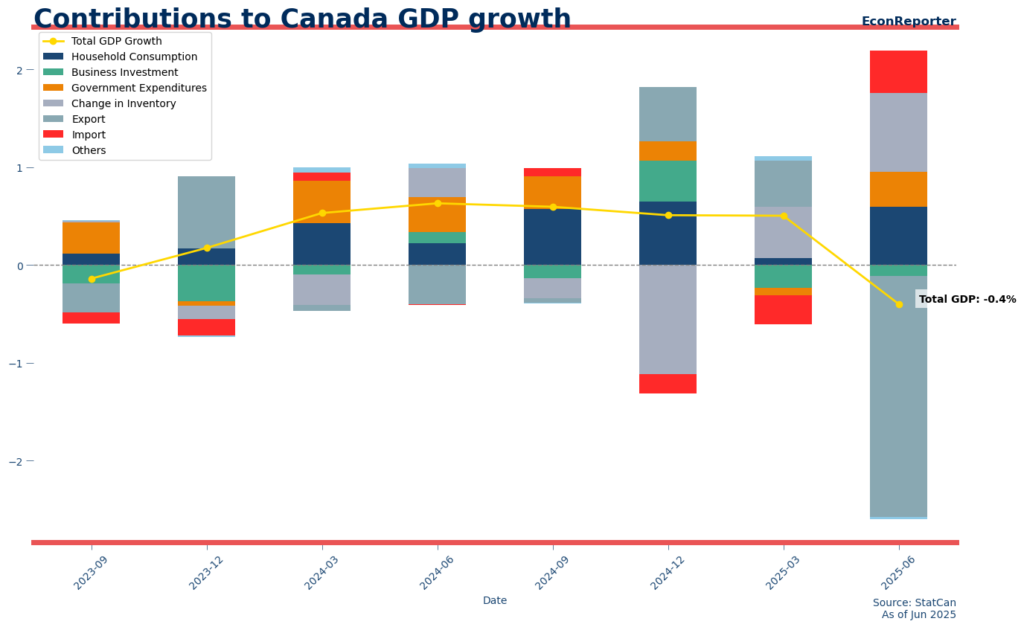

In late-cycle corrections, a few months of improving sales often create the illusion of stabilization. Similar patterns emerged in the early 1990s, during the global financial crisis, and again in 2017 to 2019 when policy tightening collided with speculative excess in major metropolitan regions. Activity briefly steadied, then gave way to a more forceful repricing once the macroeconomic backdrop shifted. Today’s environment carries the same weight. Canada already recorded a quarter of negative GDP growth (see the chart below, courtesy of EconReporter) and another contraction remains plausible. Rate cuts cannot counteract recessionary forces that suppress mobility, weaken labour markets, and drain the confidence required for households to make a high-stakes financial commitment.

The Renewal Shock That Will Drive the Housing Correction

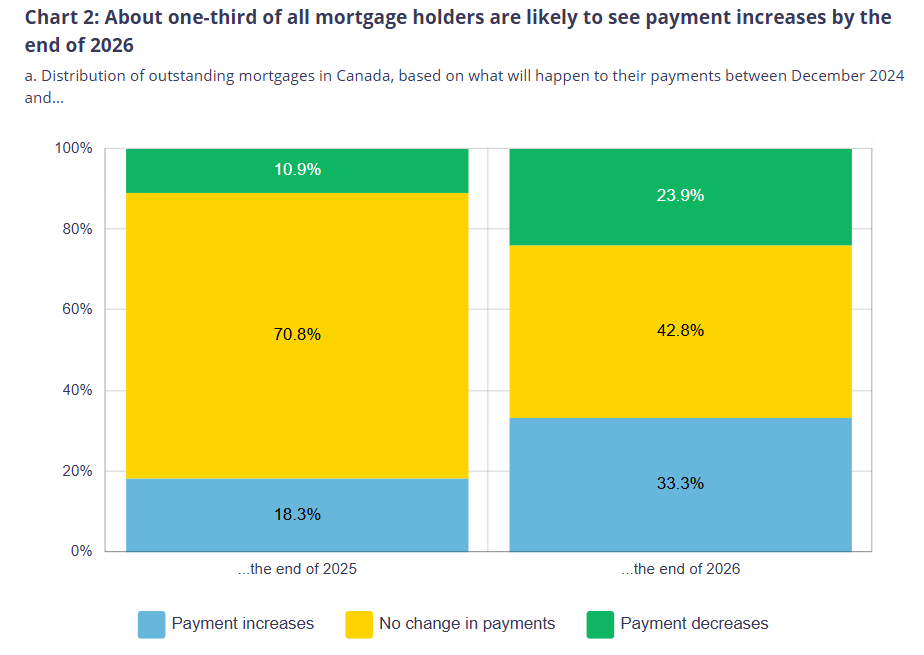

The most consequential pressure point remains the mortgage renewal cycle of 2026. More than a million households will transition from pandemic-era mortgages priced at 1 to 2 per cent into a rate environment that is three to four times higher. An analysis from the Bank of Canada suggests that one third of borrowers will see their payments rise by the end of 2026, while fewer than half will avoid a change altogether (chart given below). Household incomes have not kept pace with the rising cost structure of daily life, and tax burdens have increased. These dynamics imply a financial squeeze whose magnitude has not yet been reflected in listing behaviour or arrears data.

Investor exposure compounds this tension. A significant share of pre-construction buyers are sitting on units that no longer appraise anywhere near their contracted prices, a dynamic that often intensifies the later stages of a housing correction. The pipeline remains heavy, with an estimated 50,000-60,000 units still scheduled for delivery. Many will enter the market in negative cash flow positions. Power-of-sale listings have already begun to rise, offering a preview of the forced supply that may accelerate once renewals collide with a weakening labour market.

Inventory Is Not as Calm as It Looks

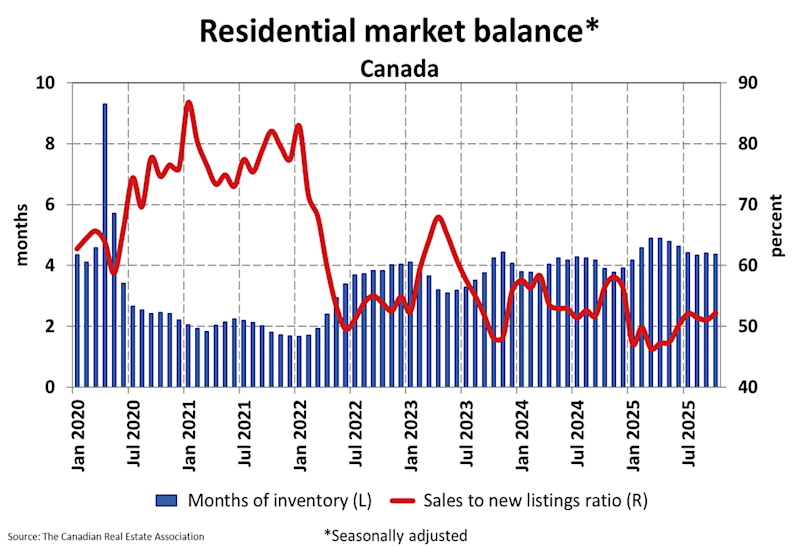

CREA’s month-over-month framing obscures the scale of inventory now accumulating beneath the surface. New listings in October approached 87,000, well above the long-term average of 65,000. Active listings reached approximately 240,000, the highest October figure since 2019. These numbers place Canada in a markedly different environment than the scarcity of 2020 and 2021. Even the tightening sales-to-new-listings ratio, shown in the chart below, which rose to 52 per cent, may signal seller hesitation rather than genuine market strength. The dynamic resembles a retail store whose backroom is overflowing with unsold products while new shipments have been slowed to a trickle. The shelves appear orderly, yet the underlying inventory burden remains unresolved. Homes are taking longer to sell, the bid-ask spread remains wide and many owners continue to anchor expectations to the valuations of 2021 despite the very different conditions now shaping the market.

One data point deserves particular attention. Terminations have surged, especially on the Toronto Regional Real Estate Board (TRREB), suggesting that many sellers withdrew their listings during the autumn lull and intend to relist in the spring. This behaviour often precedes a supply wave. The United States experienced a similar pattern in 2006, when inventory remained controlled until unemployment began to rise. Only then did the listings curve steepen sharply. Canada may be standing in the same lag window now.

Spring 2026 Will Set the Direction

Industry associations continue to promote the idea of pent-up demand returning next spring. Experience points to an alternative scenario. Rising terminations, large renewal cohorts, strained investor balance sheets, and elevated active listings all suggest that pent-up supply may define the spring market more than sidelined buyers. Activity will likely increase. Prices, however, may remain pinned between competing forces. A balanced market can still conceal fragility when the broader macroeconomic landscape is deteriorating.

Regional divergence complicates the narrative. Affordable markets continue to show resilience while expensive ones remain under pressure. Some regions have shifted from buyer’s conditions back into nominal balance, yet this balance may prove temporary if unemployment rises or if sentiment erodes further. A meaningful recovery requires stable employment, healthy credit formation, and confidence that economic and trade conditions will not worsen. These conditions are not yet visible on the horizon.

The Bottom Lies Ahead, Not Behind

A true bottom forms when optimism is exhausted and sellers prioritise liquidity over price. Historical cycles show that recoveries begin only after forced listings surge, valuations overshoot downward, and the belief in real estate as an unbreakable investment weakens. That psychological reset has not occurred. Buyers remain cautious but not distressed. Sellers remain patient but not panicked. Investors remain strained but not capitulating. The ingredients for the final leg of the correction continue to accumulate.

I expect the bottom to form in mid to late 2026 and see a credible case for slippage into 2027 if the CUSMA review, labour conditions, or trade tensions intensify. The removal or scaling back of OSFI’s mortgage stress test presents the only near-term catalyst capable of shifting affordability by double-digit margins, particularly for first-time buyers. Even that change would influence recovery on the margins rather than redefine the trajectory of the cycle.

What Stakeholders Should Prepare For

Buyers should remain patient and strategic. Negotiated opportunity exists for those willing to transact only when exceptional value appears. Sellers should avoid anchoring to the price levels of 2021 and recognise that waiting for a better season has not been rewarded over the past two years. Investors must acknowledge the reality of flat or declining rents, rising cap rates, and the likelihood that more distressed assets will surface as renewals mount.

A disciplined approach is essential. The national data may seem stable, but stability at this stage of the cycle often precedes turbulence. Canada is approaching the point where renewal stress, labour market strain, and accumulated inventory converge. Once the renewal wall is behind us, once forced supply clears, and once confidence begins to rebuild alongside lower rates and steadier employment, the market will have the foundations for a durable recovery. That moment appears far more consistent with 2027 than with the optimism now surrounding 2026.

Frequently Asked Questions (FAQs)

1. What defines the current stage of Canada’s housing correction?

The correction has moved into a late-cycle phase marked by falling prices, sales below long-term norms, rising inventory, and weakening economic signals, all of which indicate that the downturn has not yet run its course.

2. Why is 2026 considered critical for the housing correction?

More than a million mortgages will renew out of 1 to 2 per cent pandemic rates into much higher rates, a shift that is likely to trigger forced supply and intensify the correction before conditions stabilise.

3. How does inventory influence the direction of the housing correction?

New and active listings are well above long-term averages, properties are taking longer to sell, and terminations are rising. These pressures point to a supply-heavy environment that can extend the correction into 2026.

4. Is pent-up demand strong enough to reverse the housing correction?

The evidence suggests otherwise. Investor strain, pre-construction completions, higher renewal costs, and elevated listings all indicate that pent-up supply is more likely to define the spring market than a surge of demand.

5. When is the housing correction expected to end?

A durable recovery requires stable employment, cleared forced supply, and renewed confidence. These conditions appear more consistent with 2027, placing the end of the housing correction further out than current industry expectations.

ABOUT THE AUTHOR

Daniel Foch is the Chief Real Estate Officer at Valery, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & PropTx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, The Globe and Mail, Storeys and Real Estate Magazine (REM). His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.