International students reshaped rental demand across Canada, especially Ontario, tightening supply and accelerating rents. The federal cap has slowed this pressure, revealing how dependent colleges and housing markets had become on constant inflows.

Table of Contents

Canada is entering a population slowdown with few historical parallels. Ottawa’s decision to constrain international student inflows, combined with a decade of unchecked post-secondary expansion, has triggered a sudden unwinding across the housing market. The shift arrives after seven years in which Ontario colleges increased their overseas enrolment by 240 per cent, added more than 80,000 new students, and constructed almost no new student residences.

Those students poured into private rentals across mid sized cities, reshaping local markets with a speed that many communities could not absorb. The system that once relied on these students as its financial engine has moved sharply into reverse, with nearly 10,000 college jobs now at risk and rental markets beginning to cool for the first time in years. The consequences reach far beyond education. They redefine rental demand, challenge assumptions about population driven growth, and expose the fragility of a model that counted on perpetual inflows.

How Ontario Built a High Growth Model Without the Housing to Support It

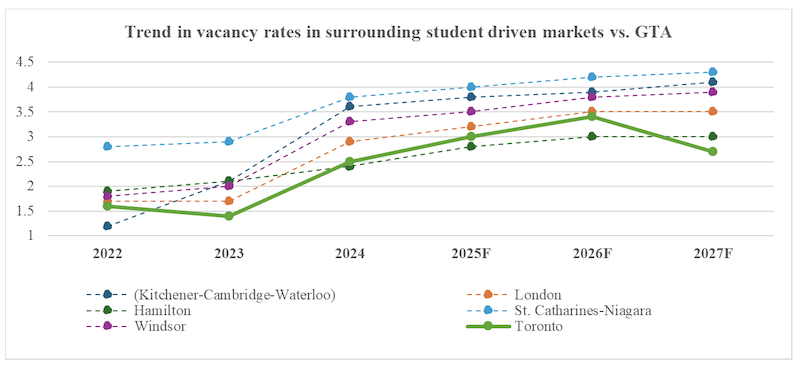

Ontario’s post-secondary sector did not stumble into this surge. It was engineered through a mix of provincial underfunding, frozen domestic tuition, and an open federal visa pipeline that allowed colleges to scale without regard to housing capacity. Public funding stagnated through the 2010s. Domestic tuition was cut by 10 per cent in 2019 and then frozen. Colleges faced shrinking domestic enrolment and a structural revenue shortfall at the very moment they were expected to modernize programs and remain competitive. International students paying three to four times domestic tuition became the financial outlet of choice. The sector responded with speed and intensity.

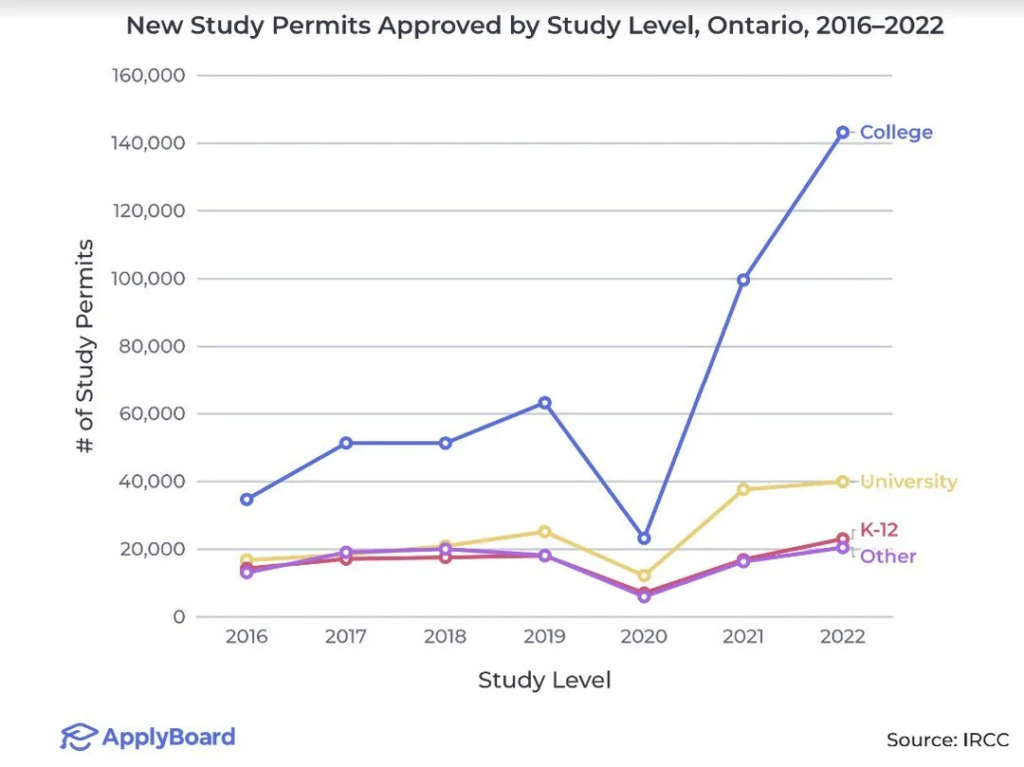

Some institutions expanded aggressively. For example, Conestoga College grew its international cohort from 763 students in 2014-2015 to more than 12,800 in 2021-2022, an increase of 1,579 per cent (see the table below for more such numbers, courtesy of PLACE Centre). The average Ontario college more than tripled its international enrolment during this period. Yet residence construction remained largely stagnant. Colleges added tens of thousands of students without adding beds. Universities followed a similar trajectory, though at a smaller scale. Between 2014 and 2022, international student enrolment across Ontario universities rose by 91 per cent.

The consequences fell directly onto local housing markets. Students rented by the room, creating a purchasing model that families could rarely match. Four students could outbid any household for a four bedroom home, each contributing about $1000/month. Investors noticed the arbitrage. Entire neighbourhoods in cities such as Kitchener, Waterloo, Niagara, North Bay, and Sudbury began converting detached homes into de facto rooming houses. Local vacancy rates collapsed, and in many cities rents accelerated at speeds rarely seen in Canada.

The Housing Distortions That Followed

The rapid increase in students amplified every pressure point in the rental market. Small cities with fragile housing stock felt the shock most intensely. In Kitchener-Cambridge-Waterloo, students competed for rooms in overcrowded homes, triggered bidding wars, and in many cases prepaid full years of rent in advance. In Belleville, North Bay, and Sudbury, single family homes that once supported local families were absorbed into high density student living arrangements. Vacancy rates in student intensive markets began separating from Toronto, revealing how concentrated student driven demand had become.

The influx did more than elevate rents. It created conditions that facilitated exploitation. Students unfamiliar with Canadian law and hesitant to jeopardize their immigration status often accepted unsafe or illegal living conditions. Reports of basements with ten or more occupants, inflated rents, and unlicensed accommodations illustrate the vulnerability embedded within the model. The dynamic created a bifurcated rental market where students paid by the bed and families struggled to secure entire units.

The Economic Boom for Colleges and the Sudden Shock That Followed

International students transformed Ontario colleges into major regional employers. Conestoga now employs more than 2,000 full time and nearly 4,000 part time staff. Seneca employs more than 4,000. Niagara College employs roughly 1,600. Smaller institutions such as Lambton, Loyalist, and Sault College became central economic anchors in their communities, often ranking among the top employers alongside hospitals and school boards. International students contributed significantly to this expansion through tuition, local spending, and indirect employment.

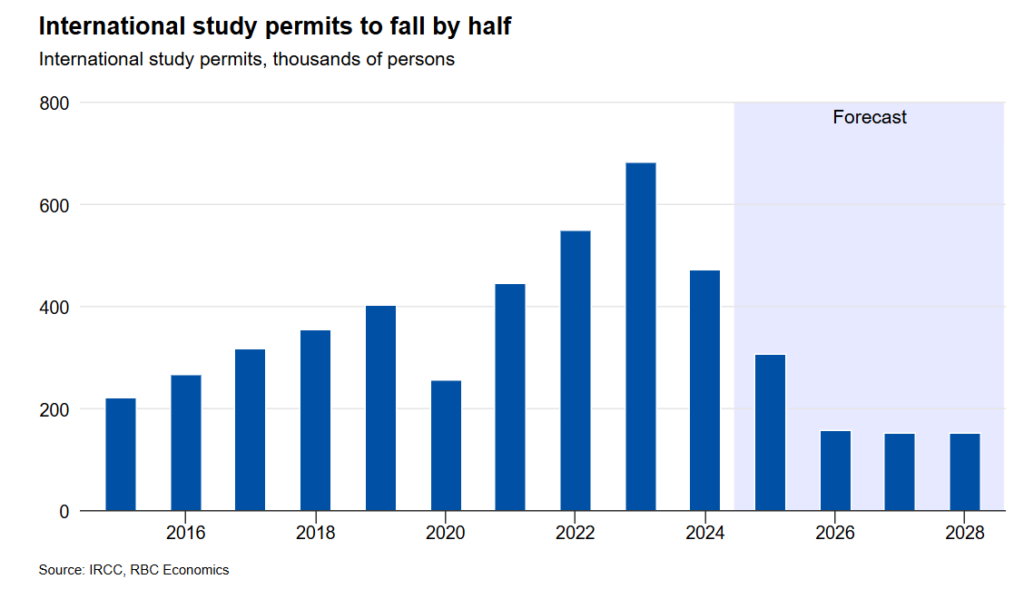

This model was always fragile. It relied on a continuous inflow of high paying students and on a permissive federal visa system. When Ottawa capped study permits for 2024 (see the chart below) and significantly reduced Ontario’s allocation, the entire structure faltered. Enrolment fell sharply. Colleges that had expanded staff, programs, and satellite campuses are now reversing course. Communities that relied on colleges for employment now face a contraction.

For housing markets, the implications are equally consequential. When an institution employing hundreds or thousands reduces its footprint, purchasing power declines. Fewer staff qualify for mortgages. Investors face a decline in student driven rental demand. Regional vulnerability increases.

The Policy Reset and the First Signs of Market Cooling

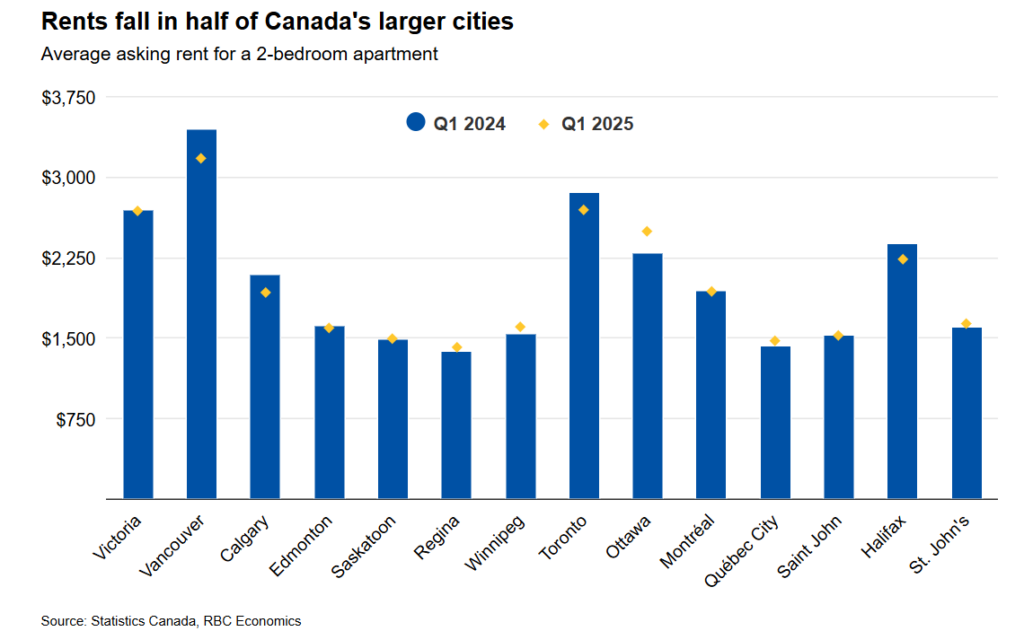

The federal cap on study permits has produced observable effects within the rental market. Royal Bank of Canada (RBC) reports that by late 2024, rents had softened in more than half of Canada’s larger cities.

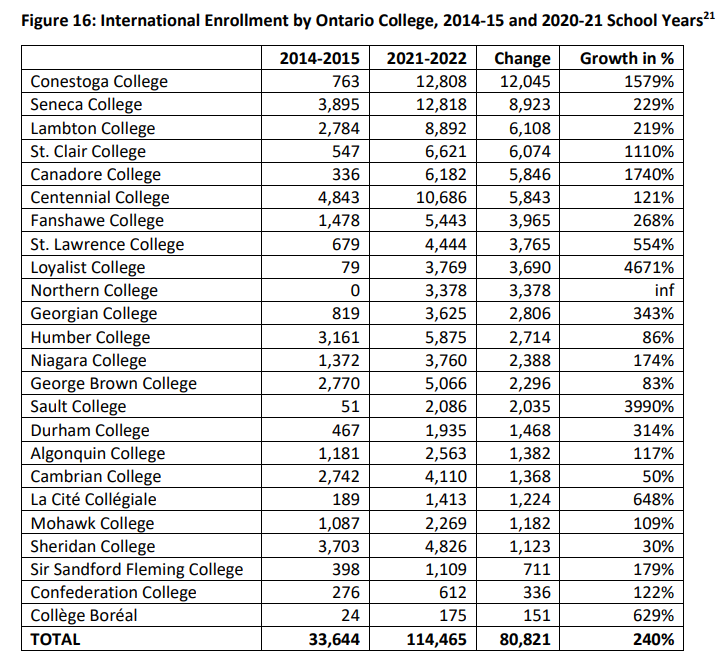

Vacancy rates are rising in regions where student demand once absorbed every available unit. Markets such as Kitchener Waterloo, London, Windsor, and Niagara are already seeing early signs of rebalancing.

If the cap remains in place through 2026 and beyond, Canada will see a sustained decline in the total international student population. The contraction will ripple through rent growth, vacancy rates, and regional demand, as it has already.

Implications for Real Estate Markets Across Ontario

The student boom and subsequent contraction underscore that rental markets can shift rapidly when demand is artificially amplified and then curtailed. Investors who purchased with assumptions of perpetual rent growth now face a different landscape. Demand in student intensive markets will be more measured. Cash flow projections will require greater scrutiny. Some regions will experience further cooling if job losses within the college sector persist.

Yet the reset also offers an opportunity to evaluate fundamentals. Markets driven by genuine employment growth, diverse industries, and demographic stability will continue to demonstrate resilience. The GTA, with its scale and economic diversity, remains structurally strong despite the student adjustment.

A System Reset With Long Term Implications

Canada’s international student boom delivered growth, employment, and tuition revenue. It also produced unintended outcomes that reshaped housing markets, strained infrastructure, and exposed governance failures. The policy reversal marks a decisive shift toward a more managed population model. The next few years will test whether provinces and institutions recalibrate toward sustainable growth and whether federal and provincial authorities can coordinate more effectively.

For the housing sector, the reset signals a transition toward more balanced rental dynamics. The most acute pressures are beginning to ease. Yet the underlying structural shortage of rental housing remains. If Canada intends to continue relying on international education as an economic lever, it will require planned student housing, better oversight of partnerships, and an alignment of immigration and education policies that prevents demand from drifting beyond the capacity of local markets.

The present moment offers a rare chance to repair a system that grew too quickly and collapsed too abruptly. The lessons are clear. Expansion requires planning. Incentives shape outcomes. Housing must be treated as essential infrastructure rather than an afterthought. If these lessons guide the next phase of policy, Canada’s housing market may move toward a more sustainable equilibrium.

Frequently Asked Questions (FAQs)

1. How did international students influence rental prices across Canada?

International Students accelerated rental demand by occupying private market housing at a scale that local supply could not match, especially in mid sized cities where vacancy rates fell rapidly and rents surged.

2. Why did Ontario colleges rely so heavily on international students?

A decade of frozen domestic tuition and stagnant provincial funding pushed colleges to seek revenue from International Students, whose higher tuition fees became essential to institutional budgets.

3. What housing pressures emerged as international students increased?

Since colleges built few residences, tens of thousands of International Students moved into nearby neighbourhoods, intensifying competition for rentals, encouraging room-by-room pricing, and reducing availability for families.

4. How is the federal cap on international students affecting the rental market now?

The cap has slowed inflows, contributing to softer rent growth and modest increases in vacancy rates in areas where International Students once drove most of the marginal demand.

5. Which regions are most vulnerable to changes in international student enrolment?

Cities with high concentrations of International Students, such as Kitchener Waterloo, London, Windsor, and Niagara, face the largest adjustments as enrolment declines reduce rental demand and local employment tied to college contracts caps.

ABOUT THE AUTHOR

Daniel Foch is the Chief Real Estate Officer at Valery, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & PropTx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, The Globe and Mail, Storeys and Real Estate Magazine (REM). His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.