Budget 2025 marks a quiet but strategic reset in Canada’s housing policy. Instead of new subsidies, Ottawa is using $20B in conditional funding to push cities toward faster approvals, lower development charges, and more accountable growth.

Table of Contents

There is a temptation to read every federal budget through the lens of housing. When affordability is the crisis of a generation, every new fiscal plan feels like a referendum on whether Ottawa finally gets it. Yet Budget 2025 does something unusual. It does not try to fix housing by spending more. It tries to fix housing by changing the rules of the game.

Instead of more grants, credits, or headline programs, Ottawa has tied nearly $20B in infrastructure funding to one simple condition. Cities will only receive the money if they cut development charges and approve housing faster. It is a subtle move, but a consequential one. It shifts the federal role from builder to enforcer, using capital as leverage to compel the governments that actually control zoning and permits to start moving.

It is also an implicit admission that Ottawa cannot build its way out of a shortage rooted in municipal process. The question now is not whether the federal government has a housing plan, but whether municipalities will cooperate with it.

The Political Reset Beneath the Budget

The first impression of this budget is misleading. On paper, it allocates $25B over five years to housing-related spending. In practice, most of that money reinforces existing frameworks rather than introducing new ones. The emphasis is on partnership and conditionality, not direct intervention.

The Build Canada Homes initiative receives $8.5B and carries a lofty goal of enabling 3.9M homes by 2031. That amount of money spread over nearly four million homes translates to roughly $2,000 per unit. The funding is clearly meant to be catalytic rather than comprehensive, assuming private debt and equity will do most of the heavy lifting.

Another $5B goes to the CMHC’s Apartment Construction Loan program, which provides direct loans to developers. Yet that program remains small relative to its better-known cousin, MLI Select, which now supports the overwhelming majority of CMHC-insured rental starts. Add $1.5B for affordable and co-op housing, and $600M for modular and factory-built projects, and the picture becomes clear. Ottawa is trying to unlock capital and accelerate approvals by aligning incentives downstream.

Infrastructure as the New Housing Policy

Conditional infrastructure funding is not a new idea. It builds on the model of the Housing Accelerator Fund, which has already committed billions to municipalities that promised zoning reform and faster approvals. What distinguishes the new approach is its accountability. Cities and provinces will no longer receive funding based on pledges alone. They will need to show measurable progress before federal dollars are released.

Still, the system remains vulnerable to the same political cycles that undermined earlier programs. Calgary’s recent municipal election, where candidates campaigned on reversing prior upzoning decisions, shows how quickly momentum can fade once commitments are made. Ottawa can withhold funding, but it cannot compel compliance. For that reason, the 2025 framework is best understood as an incentive mechanism rather than a guarantee of new supply.

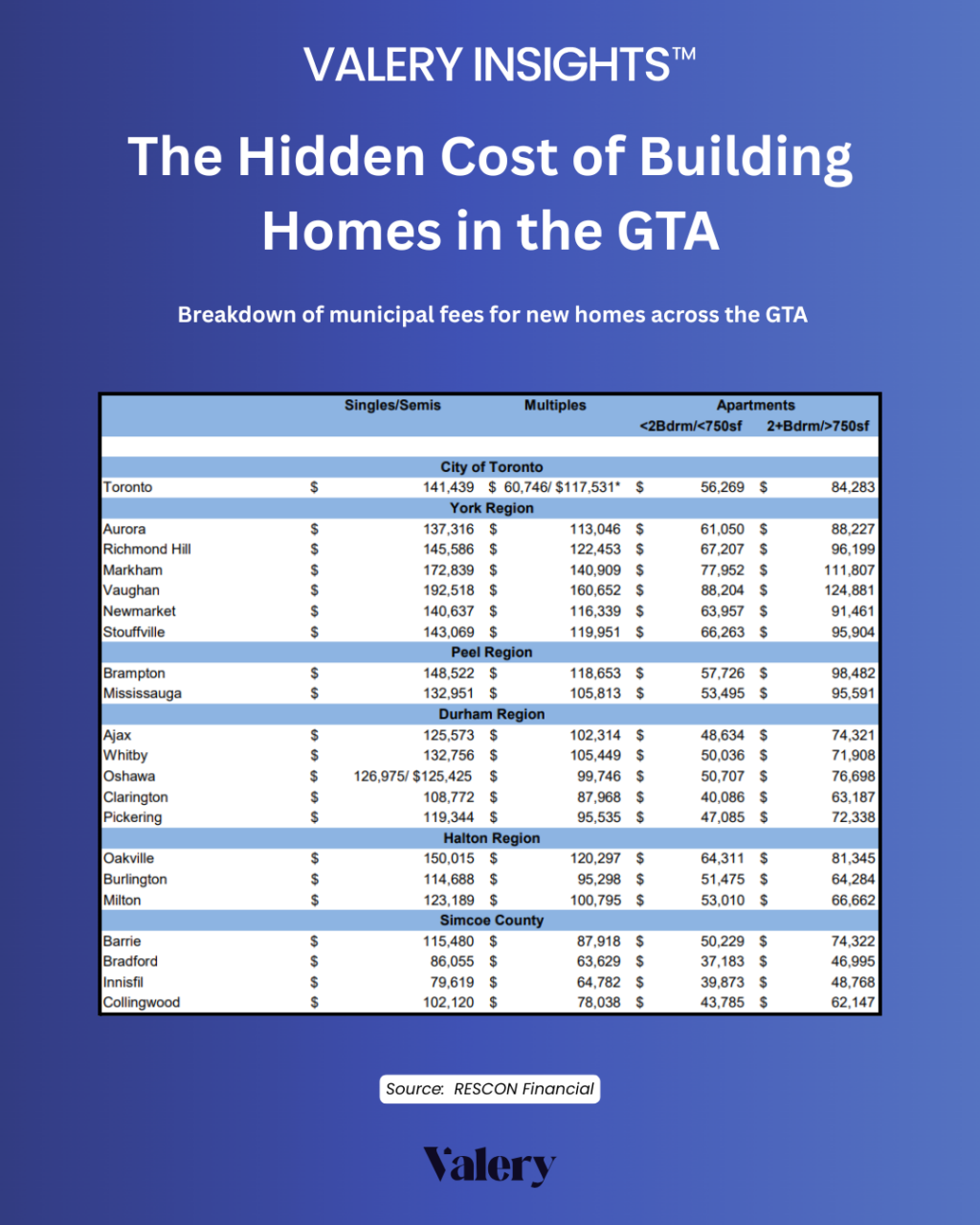

If it works, the payoff could be significant. Development charges add tens of thousands of dollars to the cost of a new home. Cutting them, even slightly, can reset the pricing structure for new construction. The path to affordability may lie not in new subsidies, but in removing municipal friction.

The Demand Side of the Equation

Housing policy is rarely just about supply. The budget also signals a decisive shift on the demand side by slowing immigration growth. Permanent resident targets are set to fall from roughly 400,000 to 365,000 by 2027, while temporary resident admissions are projected to decline by almost half.

The implications are twofold. In the short term, this could relieve pressure in the rental market, where population growth has been the primary driver of rent inflation. The Bank of Canada has documented the tight correlation between population spikes and rent growth, and the data have borne that out since 2021.

In the longer term, slower population growth will temper entry-level demand for ownership housing. That will not reverse years of undersupply, but it may soften the pace at which demand runs ahead of completions. Policymakers appear to be accepting slower household formation as the price of stability in rents and starter-home values.

First-Time Buyers Get Relief, But Only in Small Numbers

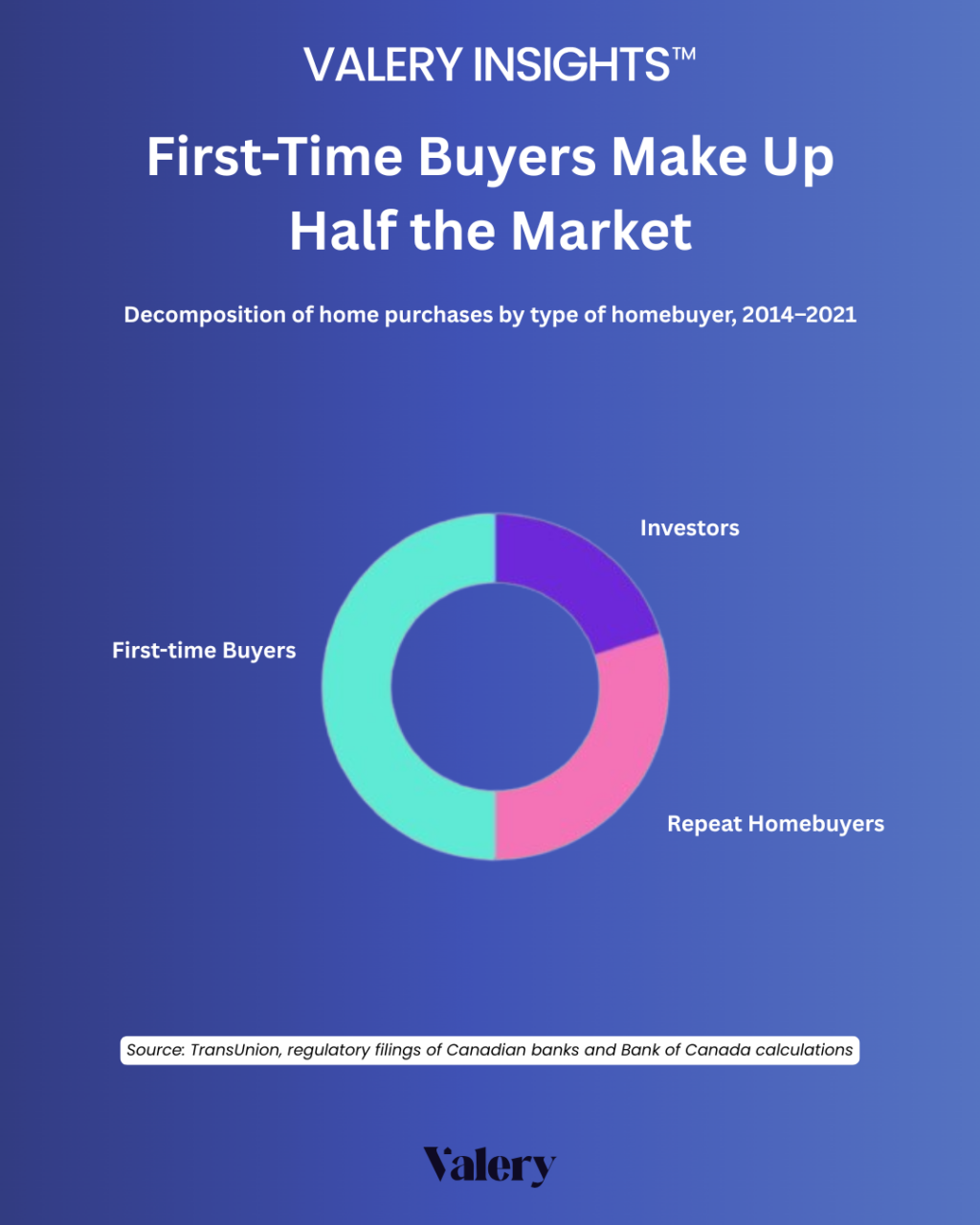

The federal GST rebate for first-time buyers of new homes under $1M is now fully costed in the budget. Ottawa has allocated $3.9B over five years, which implies an annual uptake of roughly 20,000 buyers nationwide. In a country that averages more than half a million home transactions per year, the reach is limited.

Still, for those who qualify, the savings are meaningful. The rebate covers the entire federal portion of the HST, five per cent of the purchase price, up to $50,000. Combined with Ontario’s matching rebate, total savings can approach $80,000 on a new build. The measure targets a narrow slice of the market, but one that has been squeezed hardest by higher rates and construction costs.

First-time buyers remain the most responsible borrowers in the system, with the lowest total debt-service ratios among mortgage holders. Regulators at OSFI are exploring changes to loan-to-income caps and stress-test rules that could further redirect credit toward this cohort. If implemented, those reforms could make 2026 a pivotal year for first-time buyers, particularly in markets where distressed builder inventory is re-entering supply.

The Test Ahead

There is no clear verdict in my view, regarding Budget 2025. It is neither a breakthrough nor a disaster. We can think of it as a re-engineering of incentives, a bet that aligning municipal behaviour with national objectives will yield more housing than another round of subsidies. Its success depends entirely on execution, on whether cities cut fees, accelerate approvals, and follow through once the federal cheques arrive.

For now, the outcome remains uncertain. Municipal elections, economic shifts, and bureaucratic inertia can all slow the process. Yet the direction is something we can applaud. Canada is moving away from the politics of announcement toward the politics of performance.

Frequently Asked Questions (FAQs)

1. What is the main housing focus of Budget 2025?

Budget 2025 ties $20B in federal infrastructure funding to one condition. Cities must cut development charges and approve housing faster. This shifts Ottawa’s role from builder to enforcer, using funding to influence local policy.

2. How much money is being spent on housing overall?

The budget allocates $25B over five years for housing initiatives, including $8.5B for Build Canada Homes, $5B for the CMHC Apartment Construction Loan program, $1.5B for affordable and co-op housing, and $600M for modular projects.

3. Will first-time buyers benefit from Budget 2025?

Yes. The GST rebate for new homes under $1M covers the full 5 per cent federal portion of HST, up to $50K. Combined with Ontario’s matching rebate, total savings can reach $80K for eligible buyers.

4. How does the budget affect housing demand?

Ottawa plans to slow immigration growth. Permanent resident targets will fall from 400K to 365K by 2027, and temporary resident admissions will decline by nearly half. This could ease pressure on rents and entry-level home prices.

5. Will Budget 2025 solve Canada’s housing crisis?

Not immediately. The outcome depends on whether cities follow through by cutting fees and accelerating approvals. The budget changes incentives, but results will hinge on local execution.

ABOUT THE AUTHOR

Daniel Foch is the Chief Real Estate Officer at Valery, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, The Globe & Mail, Storeys and Real Estate Magazine (REM). His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.