August real estate data from the Canadian Real Estate Association (CREA) shows sales ticking higher, but supply is rising even faster. With listings outpacing demand and prices stagnating, Canada’s housing market is undergoing recalibration rather than revival. The balance of power is shifting gradually toward buyers.

Table of Contents

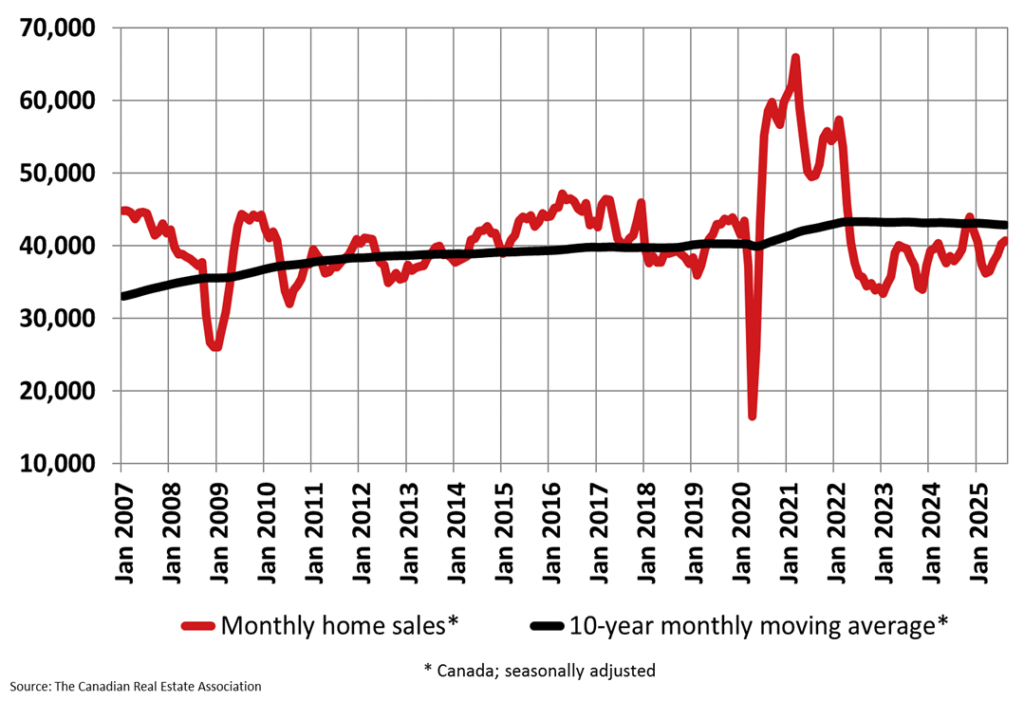

The latest housing numbers from CREA have been greeted with a familiar triumphalism. August marked the fifth consecutive month of national sales gains, with transactions rising 1.1 per cent on a seasonally adjusted basis and cumulative activity since March up 12.5 per cent. It was the strongest August since 2021. Yet this framing obscures a harsher reality. Even after half a year of steady increases, sales remain well below long-term norms. What appears to be resurgence is, in fact, only a slow return to ordinary levels of activity after a period of deep contraction.

Supply Sets the Tone

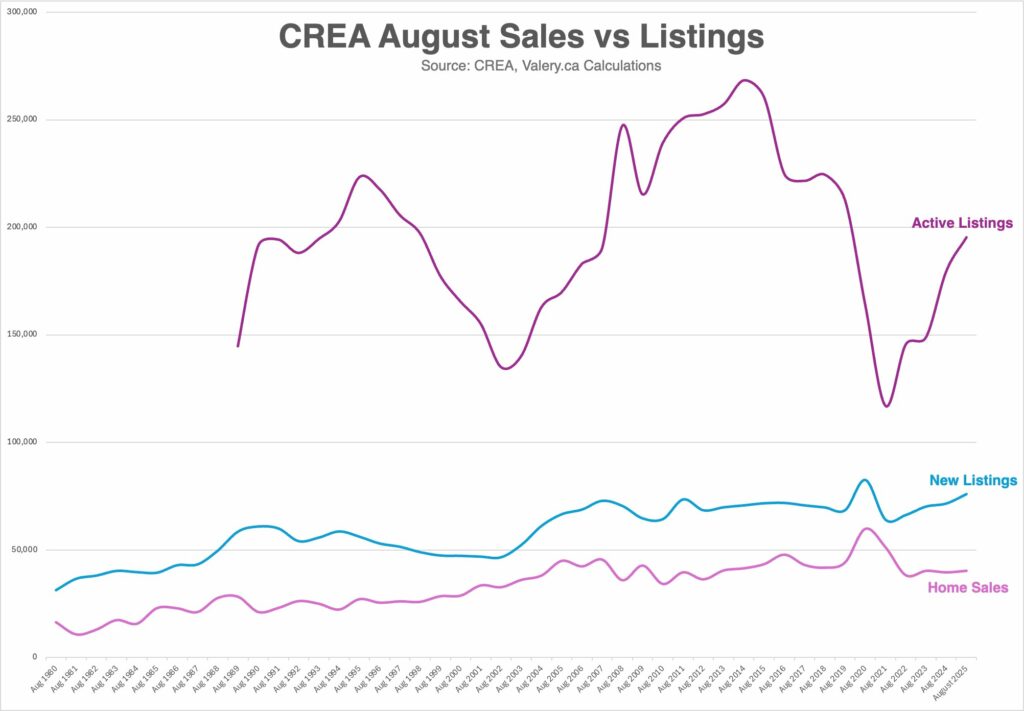

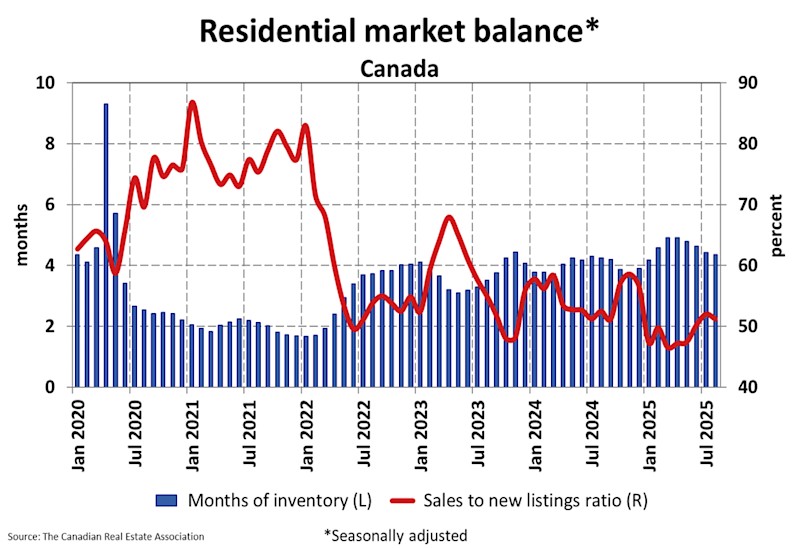

The deeper story in CREA’s August release is the surge in supply. New listings advanced 2.6 per cent month-over-month, more than double the pace of sales. Active listings stood 8.8 per cent above last year, placing inventory in line with historical averages. The sales-to-new listings ratio slipped to 51.2 per cent, down from 52 per cent in July and below its long-term average of 54.9 per cent. The balance of market conditions has shifted further toward supply.

These shifts carry important consequences. Rising inventories change market psychology. Buyers, confronted with more choice, feel less urgency to transact. Sellers, faced with more competition, lose pricing power. This is the mechanism by which price discovery bends downward, not upward, even as headline sales appear to improve.

Valuations on Uneasy Ground

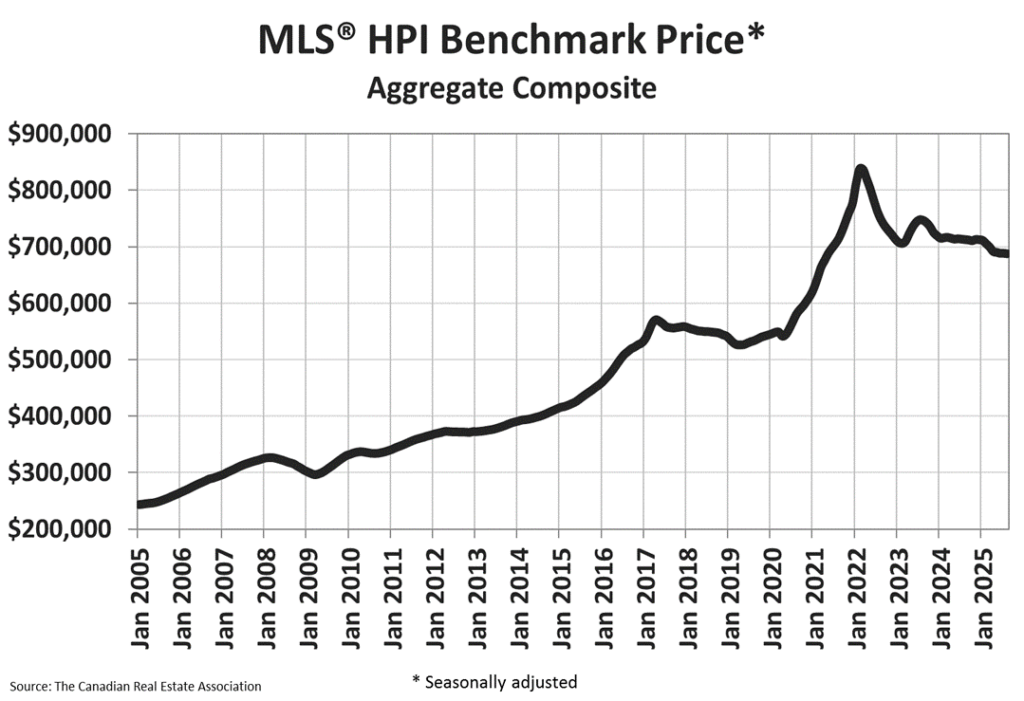

The price data confirm this fragility. The national Home Price Index edged down 0.1 per cent in August and was 3.4 per cent lower than a year earlier. The national average price rose 1.8 per cent year-over-year, but that increase reflected compositional effects rather than genuine appreciation. Benchmark prices have been flat since spring, masking continued downward pressure in markets where listings are swelling faster than sales.

At 4.4 months of inventory, conditions remain slightly tighter than the long-term average of five. But trajectory matters more than snapshot. New listings are climbing, and with the seasonal surge of autumn supply now underway, leverage is beginning to drift toward buyers.

Policy Through the Lens of Strain

The market’s next chapter will hinge in part on monetary policy. CREA’s economists noted that a September rate cut could draw some buyers off the sidelines. Yet such relief will not erase the structural imbalance created by rising supply. Lower borrowing costs may ease demand-side constraints, but they cannot eliminate the additional competition now facing sellers.

For policymakers, the lesson is sharper still. The surge in listings is less a signal of health than of strain. Investors burdened by higher carrying costs, owners facing mortgage renewal shocks, and developers working to clear unsold product all feed into this flow. Urbanation reported that completed, developer-held condo inventory in the Greater Toronto Area reached a record high in Q2 2025, while STOREYS highlighted developers offering competitive pricing and incentives as adaptations to current conditions.

Governments should resist the temptation to equate rising transactions with improved affordability. A market that clears at lower prices because of stress-driven listings is a symptom of fragility, not a solution.

Recalibration, Not Revival

The desire to declare a turning point is understandable after years of volatility. Yet the evidence demands caution. Sales are inching upward but remain subdued by historic standards. Listings are expanding more rapidly than demand, gradually shifting leverage toward buyers. Prices are not recovering; they are treading water under the weight of excess supply.

To call this a comeback is to misread the mechanics of the housing market. The Canadian real estate sector is in a phase of recalibration, not resurgence. Stakeholders who mistake volume for vitality risk misunderstanding the very forces that will shape the months ahead.

At Valery, we believe smart decisions come from clarity, not headlines. In a market where supply is rising and conditions are shifting, strategy matters more than ever.

Our AI distills the latest real estate data and local trends into actionable insights, giving you a sharper view of when and how to move.

Get your personalized, AI-crafted real estate playbook designed for today’s recalibrating market and for your goals.

Frequently Asked Questions (FAQs)

1. Why are CREA’s sales numbers for August being misinterpreted as a triumph?

Because while Canadian Real Estate sales have risen for five consecutive months, the increase is modest in historical terms. Even after cumulative growth of 12.5 per cent since March, national sales volumes remain well below long-term averages. What looks like resurgence is in reality only a return toward ordinary levels after a period of deep contraction.

2. What role is supply playing in today’s market?

Supply is the decisive force shaping Canadian Real Estate presently. New listings climbed 2.6 per cent in August, more than double the growth in sales, while active listings stood 8.8 per cent higher than a year ago. The sales-to-new listings ratio slipped to 51.2 per cent, below both July’s level and the long-term average of 54.9 per cent. This signals a market increasingly defined by excess supply rather than robust demand.

3. How are prices responding to these dynamics?

Prices remain under strain across Canadian Real Estate markets. The national Home Price Index edged down 0.1 per cent month-over-month and stood 3.4 per cent lower year-over-year. Although the average sale price rose 1.8 per cent compared with August 2024, that was due to where transactions occurred rather than genuine appreciation. Benchmark values have been flat since spring, concealing ongoing downward pressure in many local markets.

4. What does this mean if I am considering buying a home right now?

For buyers, Canadian Real Estate conditions are gradually becoming more favourable. Listings are increasing faster than sales, which means more choice and less competition. Prices are not rebounding; they remain flat or under pressure in many areas. While mortgage qualification remains challenging, the shift in leverage means buyers who are financially ready can approach the market with greater patience and bargaining power.

About the author

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, The Globe & Mail, Storeys and Real Estate Magazine (REM). His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.