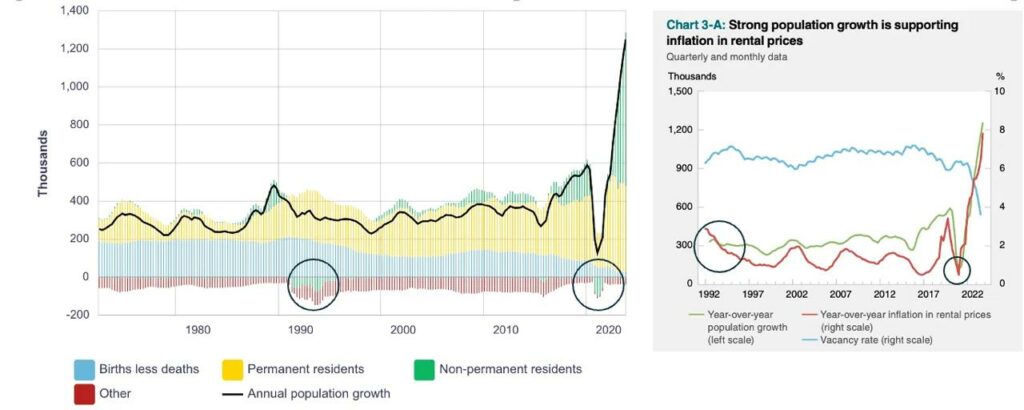

In my previous piece, I explored how Canada’s population growth—long fueled by robust immigration—may have been easing ahead of official recognition. We looked at how early signals like moderating rent inflation were apparent in on-the-ground market data, even as the Bank of Canada’s metrics lagged behind. Now, with more recent developments and data for Q3 coming into public view, it appears that this narrative is becoming more complex, blending economics with political optics in real time.

Official Data Finally Catches Up…In a Surprising Way

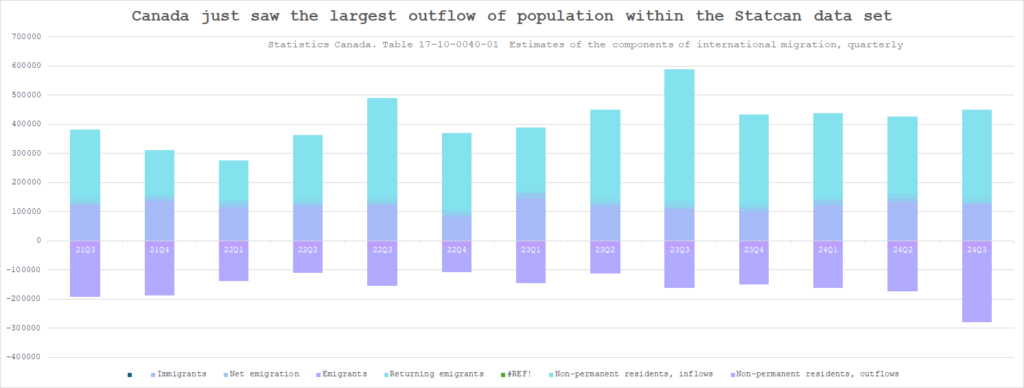

It’s easy to get lost in the noise of incremental data points, but the newly released Q3 immigration figures are anything but incremental. They show a dramatic jump—from around 150,000 new arrivals to nearly 250,000. That’s an increase of roughly 100,000, or about 67% over the prior reference figure. At first glance, this spike might seem to contradict the notion of easing immigration-driven housing pressures. But in context, it could be more a reflection of delayed official reporting rather than a genuine reversal in the trendline. Keep in mind that there are often complex seasonal patterns, backlogs in processing applications, and reporting lags that push numbers higher or lower in any given quarter.

Did The Trudeau Government See It Coming?

One of the more intriguing dimensions of this data release is the timing of the Trudeau government’s recent shift in immigration rhetoric. Just before the data hit the public sphere, the federal government adopted a noticeably tougher stance on immigration policy—suggesting a planned moderation in admissions to help align immigration with housing capacity and labor market needs.

It is plausible that senior officials had early access to these Q3 figures—or at least the internal forecasts—and recognized that the public release might generate some confusion or backlash. By getting out ahead of the data with a more restrictive narrative, they positioned themselves to claim credit for an economic trend that was already unfolding. The logic is fairly straightforward: When the Q3 spike inevitably subsides into future quarters, and the lagging data finally shows a slowdown, the government could argue that their “decisive” policy shift was responsible for steering immigration growth back toward sustainable levels. It’s political posturing 101: front-run the data release to ensure that when the public finally sees it, the messaging is already baked in.

A Perfect Example of How Data Lags and Political Timelines Intersect

This interplay between the government’s policy stance and the delayed data release underscores how official numbers often lag behind real-world conditions. In the housing market, we saw how moderating rent inflation served as an early signal of easing immigration-driven demand. On the political stage, we are witnessing how the knowledge of upcoming data allows for narrative control—public relations strategies can outpace the publication of official statistics, effectively reverse-engineering credit for a trend.

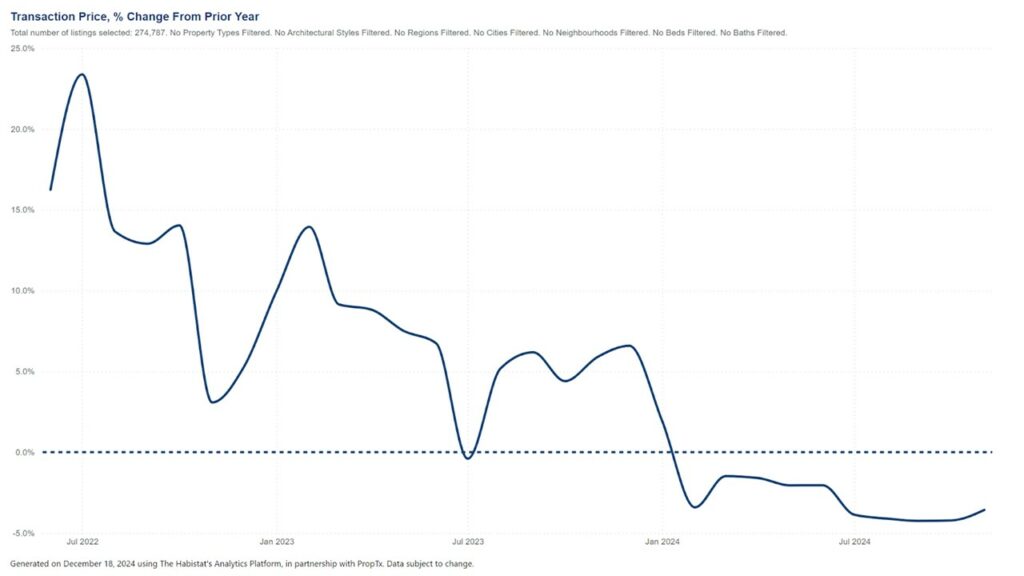

Rental Markets and Anecdotal Feedback Still Ahead of the Curve

While population growth data for Q3 suggests a headline-level jump, many forward-looking indicators in the rental market remain consistent with an underlying easing of demand:

- Rental Listings and Vacancy Rates:

Units are staying on the market slightly longer, and while we may not see rents actually dropping en masse, the frenetic pace of 2022 is gone. The market feels more balanced, and this moderation started before any official pivot in immigration policy—implying that changes in demand were in motion well before any public policy announcements. - Anecdotal Reports from Industry Participants:

Property managers and realtors continue to note that tenants are less rushed, more selective, and showing less willingness to pay a premium just to secure a unit. These behavioral shifts can’t be orchestrated overnight by policy pronouncements; they suggest a natural cooling process that aligns more with organic demographic trends than top-down directives.

Long-Term Implications: Who Benefits From Taking Credit?

If the immigration numbers eventually settle into a more moderate growth pattern, the Trudeau government will be well-positioned to claim that their recent policy tough talk “solved” the issue. However, this might be a classic case of taking credit for a train that was already slowing down:

- Policy Overcorrection:

A risk emerges if policymaking aligns too closely with lagging data—overcorrecting based on outdated numbers. If future quarters confirm a downward trend in population-driven demand, the government might find itself implementing policies that are too restrictive, potentially missing out on the economic benefits that well-managed immigration can bring. - Investor and Developer Assumptions:

Market participants need to be cautious about overestimating long-term demand based on legacy data points. If the political narrative overstates the government’s influence on an already unfolding trend, developers and landlords might be misled into thinking that new supply constraints or a re-acceleration of demand are just around the corner when, in reality, the fundamentals may be pointing to a continued moderation. - Policymaker Credibility:

Taking credit for economic shifts that arise naturally can improve short-term credibility for policymakers, but it risks long-term trust. Savvy market observers, data analysts, and even the public may eventually see through the narrative, recognizing that the ground-level indicators provided warnings well before the government’s maneuver.

Conclusion: Watch the Early Signals, Not Just the Headlines

As we navigate the intersection of economic data, political narrative, and real-time market signals, one lesson remains clear: Early indicators and anecdotal evidence often reveal trends long before they appear in official reports. While the Trudeau government may have strategically front-run the Q3 immigration data release to claim credit for a shift in population dynamics, the on-the-ground reality—and the indicators that told this story first—suggest that the market was already in the process of recalibrating.

Understanding these dynamics equips investors, policymakers, and the public with the ability to read between the lines. Rather than relying solely on lagging figures and political sound bites, informed observers can track forward-looking measures to gain early insight into where Canada’s economy, housing market, and population growth are really headed.

About the Author

Daniel Foch is the Chief Real Estate Officer at Valery.ca, and Host of Canada’s #1 real estate podcast. As co-founder of The Habistat, the onboard data science platform for TRREB & Proptx, he has helped the real estate industry to become more transparent, using real-time housing market data to inform decision making for key stakeholders. With over 15 years of experience in the real estate industry, Daniel has advised a broad spectrum of real estate market participants, from 3 levels of government to some of Canada’s largest developers.

Daniel is a trusted voice in the Canadian real estate market, regularly contributing to media outlets such as The Wall Street Journal, CBC, Bloomberg, and The Globe & Mail. His expertise and balanced insights have garnered a dedicated audience of over 100,000 real estate investors across multiple social media platforms, where he shares primary research and market analysis.