Table of Contents

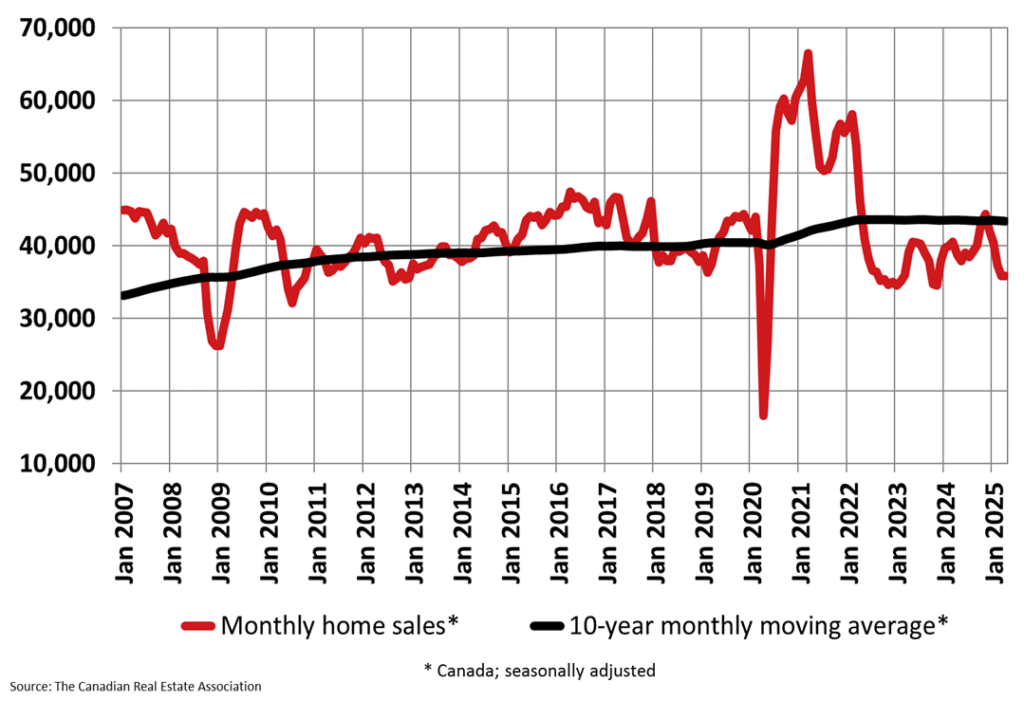

After half a year of falling sales, the Canada housing market finally saw a movement in the opposite direction. According to CREA, national home sales rose by 3.6% month-over-month, the first increase since November. But calling this a comeback would be premature.

If this is what pent-up demand looks like, it’s moving in slow motion.

Yes, activity improved. But it didn’t accelerate. Buyers are stepping back in, but so are sellers and they’re doing it faster. The latest data suggests that new listings are comfortably outpacing buyer demand. What many expected to be a rebound has instead materialized as a muted ripple.

This quiet shift is easy to miss unless you’re reading beyond the headlines.

Sales Are Stirring, Not Surging

The 3.6% gain in national sales was driven mainly by large urban markets like Toronto, Calgary, and Ottawa. These cities carry enough weight to move national figures, but even with their push, total activity remained 4.3% lower than in May of last year.

In other words, we saw movement, and just that. No frenzy. Most buyers still seem to be on alert, and that restraint is telling in a market that’s grown used to extremes.

The Listings Keep Coming

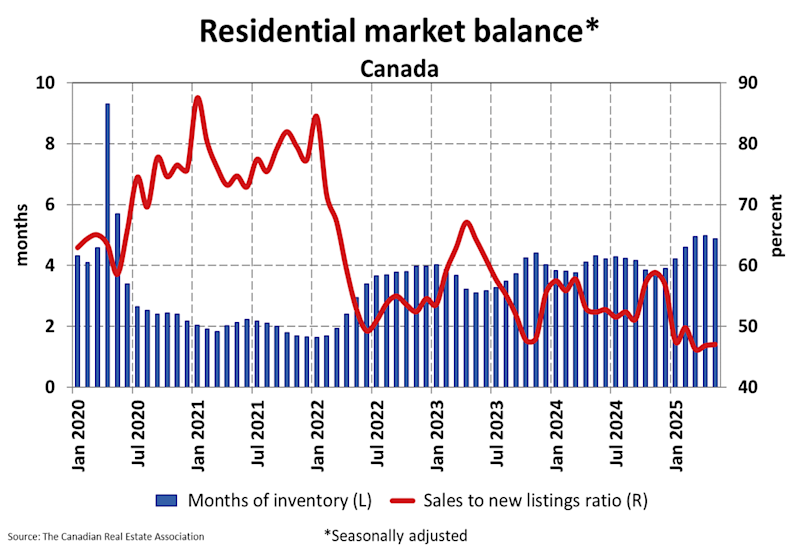

If buyers are trickling back in, sellers are returning with more conviction. New listings rose another 3.1% in May, marking three consecutive months of gains. With 201,880 homes on the market, a 13.2% year-over-year increase, supply is quickly closing in on the long-term average.

These aren’t distressed sellers. They’re confident ones, stepping back in after sitting out much of 2024. The national sales-to-new listings ratio held at 47%, notably below the 10-year average of 55%. On paper, the market looks balanced. In practice, it’s tilting toward buyers.

That’s where the real shift lies: more choice, more negotiating room, and for now, more control in the hands of buyers. It mirrors what’s unfolding in the GTA, where growing inventory and tempered demand have created conditions we haven’t seen in years, a market where buyers set the pace.

Prices Have Stabilized, But There’s No Springboard

After several months of price declines, May brought a modest pause. The MLS® Home Price Index dipped just 0.2% from April, while the actual average sale price landed at $691,299, still 1.8% below last year’s level.

While there are signs that prices may be finding a floor, there’s little to suggest a rebound is underway.

Regionally, price trends diverge. Ontario and B.C. posted declines of 3% to 4%, pulling down the national average. But in much of the rest of the country, prices are rising. Manitoba, Quebec, Saskatchewan, and Newfoundland saw year-over-year gains between 8% and 10%.

In short, this is a market with pockets of heat, but no national flame.

Negotiation Is the New Normal

The market, with its latest performance, can be termed as a negotiation market, where nothing is guaranteed, and every deal is up for discussion.

In these conditions, knowledge is leverage.

Buyers have the advantage for now. Inventory is rising. Competition is thin. And the sense of urgency that defined the last cycle has faded. For the first time in years, the market is giving buyers time, to evaluate, to compare, and to push back. But that window won’t stay open forever. If interest rates ease further in the second half of 2025, demand could reaccelerate and shift the balance.

Some relief has already made its way through. According to National Bank’s Q1 2025 Housing Affordability Monitor, mortgage rates have edged lower, and the MPPI, mortgage payments as a share of income, dropped to 55.4%, the lowest level in nearly three years.

On the other side of the table, sellers still have a path forward, but not without intention. The market will reward strategy: listings that are timed right, priced well, and presented with purpose will move.

Still a Market for the Measured

What we saw in May wasn’t the start of a boom. It was a return to discipline.

Buyers are back, but they’re moving with calculation, not emotion. They’re more informed, more selective, and more willing to walk away. This time, it’s not about chasing the market. It’s about understanding it.

What comes next won’t be defined by who moves first, but by who moves smartest.

Because in this new chapter of Canadian real estate, success doesn’t go to the boldest. It goes to the best-informed.

The market may be shifting quietly, but the smartest buyers are already positioning themselves.

Explore active listings, local insights, and data-backed guidance on our website, where informed decisions begin.