Table of Contents

Navigating the complex Canadian real estate market requires homeowners, investors, and industry professionals to stay informed about emerging real estate trends and evolving real estate market risks. With shifting economic conditions and ongoing challenges, understanding these dynamics is essential for making well-informed decisions. Recently, Daniel Foch, Chief Real Estate Officer at Valery, shared critical insights into the state of the Canadian housing market in Valery’s January Market Call. This article breaks down the real estate trends shaping the market today, along with the risks that demand attention.

The Looming Threat of a Trade War

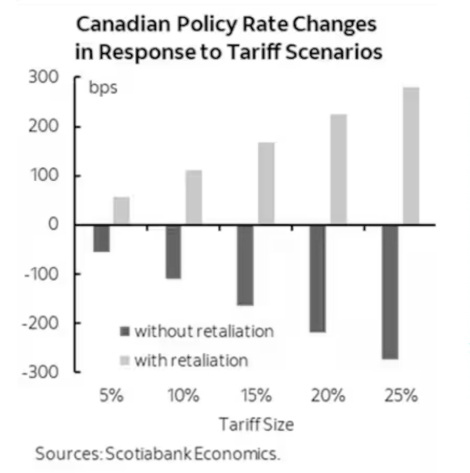

One of the most pressing macroeconomic factors facing Canada is the possibility of a trade war with the United States. As Canada’s largest trading partner, any disruption in trade could have significant repercussions on the economy. The impact of a trade war on the real estate market could be profound. There is a fear that a trade war could become inflationary. In response, Scotiabank released an article regarding President Trump’s threat of raising tariffs and its effect on Canadian policy rate changes. They predict that the Bank of Canada may have to increase rates. The analysis states that Canadians could face an increase of 300 basis points if the Canadian government responds with retaliation to tariffs. For example, if rates increased by 25 per cent, it would add 25 per cent to the price of goods. Foch states that monetary policy would not have an impact on this, so he doesn’t believe that this is a likely outcome.

The more likely outcome is rates will have to be cut in response to tariffs regardless of retaliation, because if goods become more expensive, Canadians buy less of them, and that will have a continuous drain on the economy.

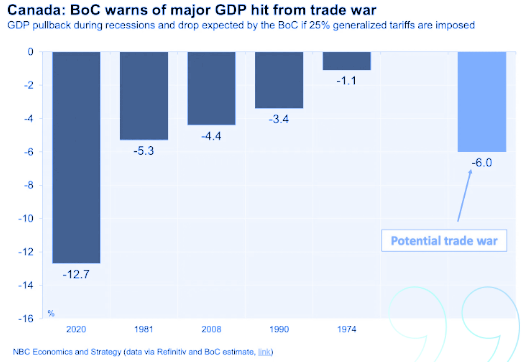

The Bank of Canada did a similar analysis where they believe that a full-scale trade war could shrink Canada’s GDP by 6%, leading to economic instability.

Foch states, the Bank of Canada’s actions don’t have an impact until we get to the point where variable rates are significantly lower than fixed rates, or if more consumers are using fixed rates. As a trade-dependent economy, reduced exports and investments could ripple through other sectors, driving inflation higher and prompting tighter monetary policies. These are some key real estate market risks to keep an eye on as consumers navigate the real estate market in 2025.

Housing Affordability in Canada Remains a Challenge

Housing affordability in Canada continues to be a significant concern despite a slowdown in home price growth. Major urban centers now exceed previous affordability peaks, with home prices relative to median household income reaching record highs.

While income growth has eased some affordability pressures, rising interest rates remain a critical hurdle. If rates increase or stay elevated, homebuyers and renters alike will struggle with higher costs, further limiting demand and potentially depressing home prices. This affordability crisis also impacts renters, as many Canadians priced out of homeownership turn to the rental market, creating increased competition and driving up rents.

The question remains: How is housing affordability impacting buyers in Canada today? The answer lies in a delicate balance between income levels, interest rates, and home prices. Without policy intervention, housing affordability is likely to remain a persistent issue, requiring buyers and investors to carefully evaluate their financial readiness.

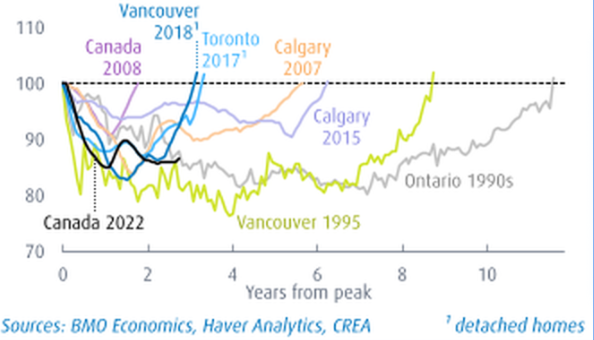

Flat Prices Mirror the 1990s Housing Correction

Instead of a dramatic crash, the Canadian housing market is experiencing a prolonged period of flat or slightly declining prices, echoing the 1990s housing correction. National home prices have stabilized since their 2021 peak, reflecting economic uncertainty.

This trend varies by region. Ontario and British Columbia, which saw rapid price growth in recent years, now face the steepest declines. Meanwhile, more affordable areas like the Maritimes and the Prairies continue to see modest price growth as buyers seek cost-effective alternatives.

For investors, this signals the need to focus on regions with strong economic fundamentals and affordable price points. Strategies for investing in Canadian real estate during downturns often emphasize diversification and targeting regions with steady population growth.

Rental Market Trends in Canada: Rising Vacancies and Declining Rates

A notable shift is occurring in the rental market trends in Canada, particularly in Toronto and Vancouver, where vacancy rates are rising, and rental prices are softening. This trend is driven by reduced immigration levels and an increase in rental housing supply.

Declining rental rates pose challenges for real estate investors, as rental income directly influences property valuations. Lower yields may reduce the attractiveness of investment properties, leading to cautious investor behavior. While this trend offers relief to renters, it requires landlords and investors to reevaluate their strategies.

For example, focusing on multi-family properties in high-demand areas or transitioning to short-term rental markets could help mitigate risks.

Mortgage Renewal Challenges Looming Over Canadians

A significant hurdle facing Canadian homeowners is the “mortgage renewal wall” – Over the next two years, 60% of fixed-term mortgages are expected to renew at higher interest rates. This shift could translate into significantly higher monthly payments for many, increasing the risk of mortgage delinquencies.

The potential rise in delinquencies poses risks not just to individual borrowers but also to the housing market and financial system. Higher foreclosures and distressed property sales could depress home values further, creating a negative feedback loop of declining prices and weakening consumer confidence.

To manage these challenges, homeowners should evaluate their options early. For consumers wondering how to prepare for mortgage renewal in Canada? Consider locking in rates, consolidating debt, or exploring variable-rate options if they align with your financial goals. Working with a mortgage advisor can also help mitigate risks.

Unemployment Is A Growing Risk to the Canadian Real Estate Market

One of the greatest threats to the Canadian housing market is the risk of rising unemployment. A weakening labor market could lead to widespread financial stress for homeowners, particularly in regions reliant on vulnerable industries like energy, manufacturing, or tourism.

If unemployment rises, mortgage delinquencies and forced home sales could increase, adding downward pressure on home prices. Even if interest rates were to decline, the combined impact of job losses and financial insecurity could significantly affect housing demand and market stability.

Strategies for Navigating an Uncertain Market

Despite these challenges, opportunities remain for those who plan strategically. Here’s how to navigate the Canadian real estate market in 2025:

- Homeowners: Focus on managing household budgets and building savings for unexpected expenses. Prepare for modest price changes and prioritize long-term financial health.

- Investors: Target markets with stable rental yields and economic resilience. Diversify portfolios to minimize risks.

- Real Estate Professionals: Stay informed about real estate trends and advise clients on navigating the current landscape. Building trust and offering valuable insights will be essential.

What Lies Ahead?

The Canadian real estate market is at a crossroads, marked by housing affordability challenges, rising mortgage renewal risks, and macroeconomic uncertainties. While a sharp correction appears unlikely, the period of stagnation requires homeowners, investors, and professionals to stay informed and adaptable.

By understanding the real estate trends shaping the market today, participants can make decisions aligned with their financial goals and risk tolerance. Whether you’re buying, investing, or advising clients, staying prepared and informed is the key to navigating Canada’s dynamic housing market.

Daniel Foch is back on Feb 18 with another data-driven breakdown on the market.

With tariffs, inflation, rate cuts—how will they impact home prices & your decisions?

Sign Up for the Next Market Call

Stay ahead of the market with real-time insights and expert analysis.

Next Market Call: February 18, 2025 – Hosted by Daniel Foch

FAQs

1. What are the current risks in the Canadian housing market?

The main risks include rising unemployment, mortgage renewal challenges, and housing affordability pressures.

2. How do rising interest rates affect homebuyers in Canada?

Higher rates increase borrowing costs, reducing affordability for homebuyers and pressuring home prices.

3. What are the current trends in Canadian real estate?

Flat or slightly declining home prices, increased rental vacancies, and regional disparities in housing demand are notable trends.

4. How is housing affordability impacting buyers in Canada today?

Rising interest rates and stagnant income growth are making it harder for buyers to afford homes, shifting more demand to the rental market.

5. How to prepare for mortgage renewal in Canada?

Evaluate rate options early, work with a mortgage advisor, and consider consolidating debt to manage increased payments.

6. What effects does unemployment have on the Canadian housing market?

Unemployment increases financial stress, leading to higher delinquencies, forced sales, and lower housing demand.