Table of Contents

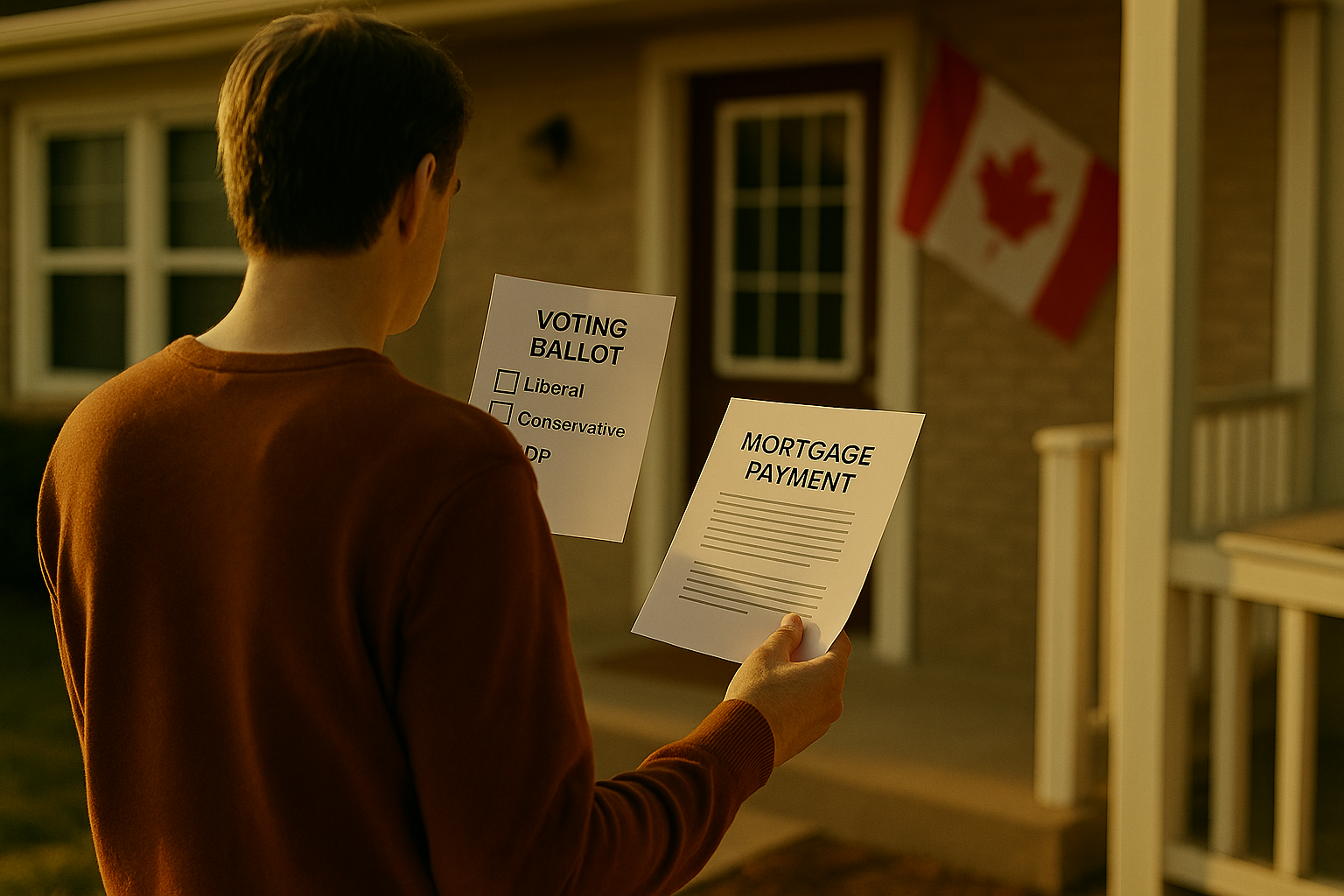

The 2025 federal election marks a pivotal moment for Canada’s economy, particularly for homeowners and prospective buyers navigating the country’s evolving housing crisis. As market uncertainty looms, the policies put forth by each political party could significantly influence how much Canadians pay on their mortgages for years to come.

This article explores how the election could affect mortgage payments, drawing from the platforms of the Liberal, Conservative, and New Democratic parties. We’ll also explore broader economic forces—like interest rate trends, inflation, and regulatory shifts—that could shape housing costs regardless of the election’s outcome.

Why the 2025 Federal Election Matters to Homeowners

Mortgage payments are influenced by a complex web of policies, including tax incentives, interest rate environments, housing supply, and government regulations. The 2025 federal election puts all these levers on the table, with each major party offering a different strategy to address Canada’s affordability crisis.

Whether you’re renewing a mortgage, buying a home for the first time, or trying to refinance under pressure, the outcome of the election could determine your financial future.

Liberal Party: Doubling Supply and Supporting First-Time Buyers

Under Mark Carney’s leadership, the Liberal Party has introduced an ambitious housing plan focused on boosting supply and providing upfront tax relief. Their “Build Canada Homes” initiative is designed to double housing starts to 500,000 units per year—a figure they believe will stabilize the housing market over the long term.

Liberal Proposals Impacting Mortgages

- GST elimination on first-time home purchases under $1 million.

- $25 billion in financing for modular construction to reduce building costs.

- $10 billion in low-interest financing for deeply affordable housing.

While the Liberal plan does not directly manipulate mortgage interest rates, their emphasis on market stability and long-term affordability could help prevent future spikes in housing costs. Their cautious economic stance also reassures investors, potentially resulting in steady or declining mortgage rates over time.

If the Liberals win the 2025 federal election, homeowners can expect continuity with some targeted affordability relief, especially for first-time buyers.

Conservative Party: Incentives, Deregulation, and Tax Cuts

Pierre Poilievre’s Conservatives advocate for deregulation, private-sector involvement, and aggressive supply-side solutions to tackle the housing crisis. Their platform includes bold proposals aimed at reducing both the upfront and long-term costs of homeownership.

Conservative Housing and Mortgage Proposals

- GST removal on ALL new home purchases, regardless of buyer type.

- Federal land sales to free up space for residential development.

- Potential return of 30-year amortizations for insured mortgages.

- Pressure on municipalities to increase housing starts via tied funding.

The Conservatives also support relaxing the mortgage stress test, particularly for renewals, allowing homeowners to shop around for better rates without requalifying.

For homeowners concerned about affordability and market rigidity, a Conservative victory in the 2025 federal election could bring immediate relief through lower payments and more borrowing flexibility.

NDP: Public Mortgages and Anti-Speculation Measures

Jagmeet Singh’s New Democratic Party takes a different approach, focusing on public intervention, long-term affordability, and market regulation. Their platform proposes publicly backed low-interest mortgages via CMHC and expanded funding for affordable, rent-controlled housing.

NDP Mortgage-Focused Measures

- Publicly provided CMHC loans at below-market rates for first-time buyers.

- Reintroduction of 30-year terms for CMHC-insured mortgages for first-time buyers.

- 100,000 rent-controlled units by 2035 to alleviate buyer pressure.

- Regulations to deter corporate speculation and predatory landlords.

If the NDP wins the 2025 federal election, Canadians can expect a more direct form of mortgage relief, particularly for young or first-time buyers. Over time, their initiatives could shift the housing market away from speculation and toward utility-driven ownership.

Economic Factors Beyond the 2025 Federal Election

Even with differing party platforms, external economic forces will continue to influence mortgage rates and housing affordability after the 2025 federal election:

Bank of Canada Interest Rate Policy

As of early 2025, the Bank of Canada has begun lowering interest rates following the inflation surge of 2022-23. At the time of publication, the overnight rate stands at 2.75%, with forecasts suggesting further cuts. Lower interest rates benefit borrowers across the board, reducing monthly payments on both fixed and variable mortgages.

Regardless of which party wins, the trend of falling interest rates is a tailwind for mortgage affordability.

Global Trade and Inflation Pressures

The global economy, particularly US-Canada trade relations, could impact inflation and borrowing costs. With ongoing trade tensions under the Trump administration, Canadian economic growth may be tested, influencing how the Bank of Canada sets rates. The 2025 federal election outcome will determine how Canada responds to these external shocks—either through stimulus, restraint, or regulatory reform.

Mortgage Renewals: A Key Election Year Pressure Point

In 2025, over 1.2 million Canadian homeowners are expected to renew their mortgages. Most of these loans were originally taken out at ultra-low interest rates in 2020 or 2021. As those rates expire, borrowers could see monthly payments increase by hundreds or even thousands of dollars.

Policies proposed during the 2025 federal election—such as stress test reforms (Conservatives), low-rate public loans (NDP), or continued tax credits (Liberals)—will be crucial in helping Canadians navigate these financial shocks.

Housing Supply and Demand Post-Election

The success of any mortgage-affordability policy will depend on housing supply. Each party proposes increasing housing construction, but the methods vary:

- Liberals: Federal agency-driven building and modular housing.

- Conservatives: Deregulation and incentivizing private builders.

- NDP: Public housing with strict affordability mandates.

Regardless of party, the winner must ensure their policies translate into actual homes. If supply fails to materialize, demand-side incentives may only drive prices higher, worsening affordability in the long run.

Conclusion: Planning Ahead in a Shifting Mortgage Landscape

The 2025 federal election is more than a ballot—it’s a financial crossroads for Canadian homeowners. Whether you’re refinancing, house-hunting, or strategising your next investment, the policy direction post-election will shape your mortgage costs for years to come.

In all likelihood, interest rates will continue to fall, easing the burden for millions. But which party wins will determine who gets the most help and how fast relief arrives. By understanding each party’s housing and mortgage priorities, Canadians can better prepare for what’s ahead—and maybe even save a lot of money in the process.

Still confused by how the 2025 federal election could impact your mortgage? Valery, your AI real estate companion, will give you personalized guidance—helping you stay ahead in a shifting mortgage and housing landscape. Chat with Valery now to get clarity in seconds.

Frequently Asked Questions (FAQs)

1. Will mortgage payments go down after the 2025 federal election?

If interest rates continue to fall and if the winning party implements pro-buyer policies, mortgage payments may ease for many homeowners—especially those with variable rates or who are renewing.

2. What if I’m buying a new home in 2025?

Depending on the election outcome, you might qualify for GST exemptions, longer amortization options, or even government-backed low-interest mortgages (especially under NDP or Conservative leadership).

3. How will the election affect my mortgage renewal?

Renewals in 2025 are expected to be more expensive due to past rate hikes, but platform promises around easing stress tests and promoting refinancing options could mitigate these costs.

4. Will mortgage interest rates be affected by the election?

Directly, no—interest rates are set by the Bank of Canada. However, fiscal policies post-election (like deficits or tax changes) can influence inflation expectations, indirectly affecting rates.

5. Who has the best plan for affordable mortgage payments?

Each party offers a different route: Liberals focus on supply and tax relief, Conservatives on deregulation and cost-cutting, and the NDP on direct public support and rent control. The best option depends on your situation—first-time buyer, investor, or current homeowner.