Table of Contents

Want to see where Canada’s headed? Don’t just follow the money, follow the mortgages. The 2025 CMHC Mortgage Consumer Survey unpacks Canadian mortgage trends like never before.

Behind every amortization schedule is a story. One of compromise, calculation, and increasingly, quiet concern. The survey is more than just numbers. It’s a pulse-check on Canadian households navigating inflation, rate shocks, and the increasing role of family support in bridging the affordability gap for buyers.

And what it reveals is both encouraging and unnerving. Canadians still believe in homeownership. But they’re working harder than ever to hold onto it.

The Mortgage Landscape Is Changing, Quietly

Renewals Dominate, But First-Time Buyers Are Stirring

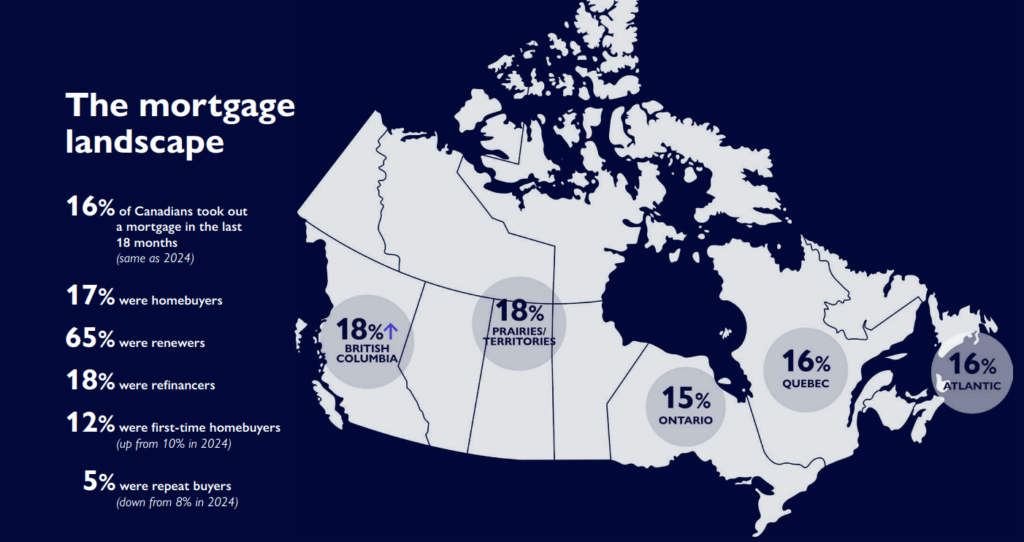

Let’s start with the big picture. 65 per cent of recent mortgage activity was renewals, a clear sign that many homeowners are holding their ground. But what’s more telling is the uptick in first-time buyers, rising to 12 per cent from 10 per cent last year.

It’s easy to dismiss that as statistical noise. But dig deeper, and a more revealing trend emerges: half of all first-time buyers shared their home purchase with someone other than a spouse or partner. Among younger buyers aged 18–24, that number jumps to 64 per cent.

In other words, younger Canadians are reinventing homeownership. Through shared purchases, family gifts, and co-buying with friends, they’re finding creative ways to get a foothold in a market that increasingly demands it.

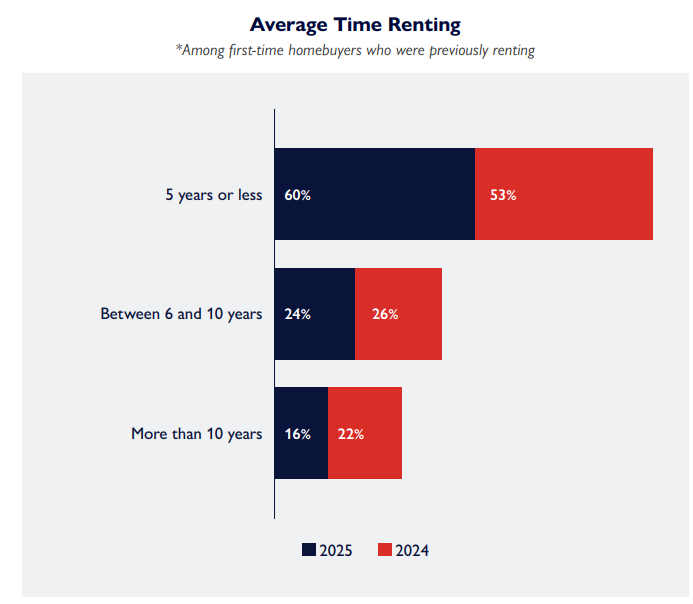

Average Renting Time Before Buying

Among first-time buyers, 64 per cent were renting before purchasing, and they rented for an average of 6.3 years. While that number might sound high, it’s actually a slight decrease in long and medium term renting compared to last year, i.e. fewer first-time buyers reported renting for 6–10 years or more than a decade compared to 2024.

Interestingly, a significant portion (35 per cent) lived with family or friends before buying, suggesting that informal co-living arrangements have become a necessary stepping stone, not just a transitional phase.

A Nation of Refinancers

Refinancers accounted for 18 per cent of recent activity. Their motivations? Debt consolidation, reducing monthly payments, and tapping into home equity for renovations.

Affordability Is Still the Defining Battleground

Down Payments Are a Family Affair

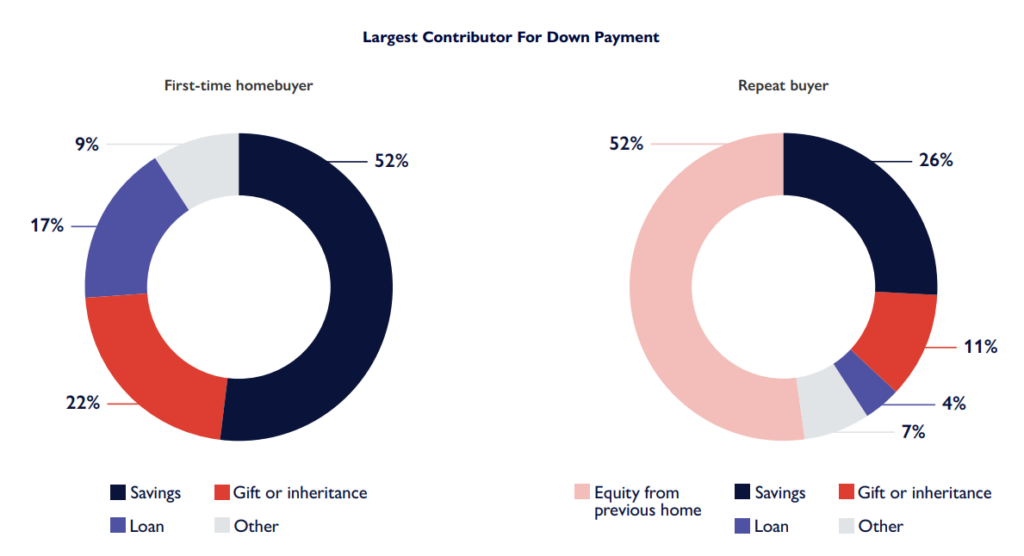

A striking 35 per cent of buyers received a gift or inheritance, with an average value of nearly $80,000. Among first-time buyers, that figure jumps to 41 per cent.

But here’s the twist: 78 per cent said they could’ve still purchased without the gift, albeit with compromises. This is an uptick from 65 per cent in 2024.

The charts given below, break down the contributors for down payments for both first-time home buyers and repeat buyers.

Canadians Are Stretching to the Limit

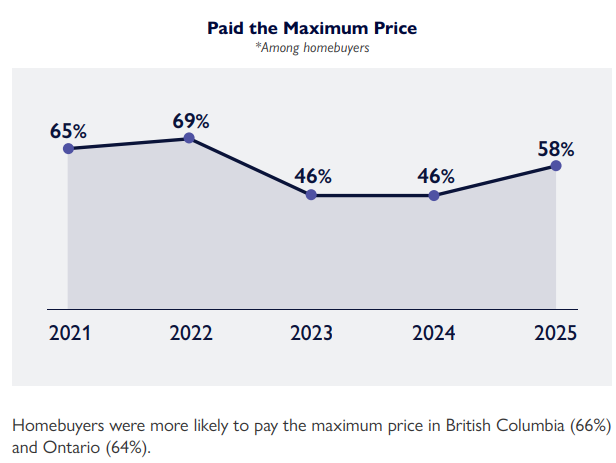

58 per cent of homebuyers paid the maximum price they could afford, which is a sharp rise from the previous two years. In Ontario and BC, that number climbs even higher.

In a market where housing feels like a one-time lottery ticket, buyers are maxing out their financial capacity just to get a foot in the door.

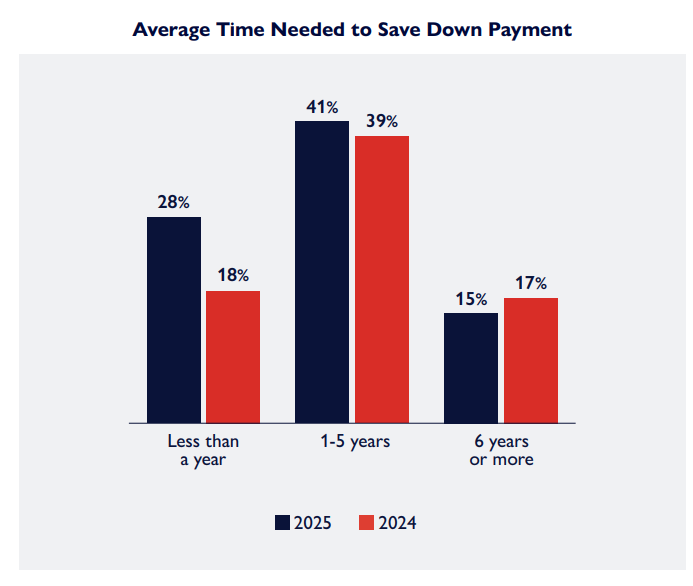

Saving for a Down Payment Takes Years and Sacrifice

On average, buyers spent 3.4 years saving for their down payment, down from 4.2 years in 2024. That drop isn’t necessarily a sign of improved affordability as many buyers are leaning harder on outside help or opting for smaller homes.

First-time buyers took even longer, 3.7 years on average, and were nearly twice as likely to rely on gifts compared to repeat buyers. Meanwhile, repeat buyers still cite equity from a previous home as their primary down payment source.

Why Canadians Are Still Buying, Despite It All

So why are Canadians still diving into ownership? For nearly half (47 per cent), it’s because they finally felt financially ready. Others were motivated by the long game, i.e. viewing homeownership as an investment for themselves or their children (39 per cent). Some needed more space (39 per cent), while others were reacting to personal transitions like marriage, divorce, or separation (37 per cent).

And then there’s the fear-of-missing-out factor: 34 per cent bought because they were worried prices would climb even further.

It feels like buying a home in 2025 is a personal, financial, and emotional decision rolled into one.

Debt Stress Is No Longer a Fringe Problem

Missed Payments Are Rising

We often think of missed mortgage payments as rare events. But this year, 14 per cent of mortgage consumers missed at least one payment, a worrying leap. The breakdown reveals that 17 per cent of first-time buyers missed a payment, compared to just 6 per cent of repeat buyers. It’s a sharp reminder that new entrants are carrying more risk.

Even more troubling was the fact that 51 per cent reported difficulty maintaining debt obligations, up from 42 per cent in 2024. We are not just talking about mortgages here. Credit cards, auto loans, and utilities are all part of the pressure cooker.

Canadians Are Borrowing from Peter to Pay Paul

Barring repeat buyers, roughly 1 in 5 of all other consumers, are using one credit facility to pay off another.

It’s easy to misread this as irresponsibility. It’s not. It’s a reflection of a system where inflation outpaces wages, and the “middle class” is left balancing their futures on credit limits.

Secondary Suites Are More Than a Trend

One in Four Already Have One and More Are Coming

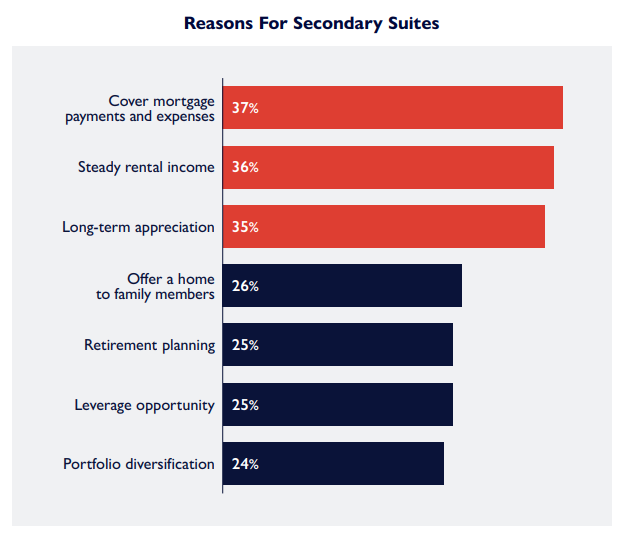

28 per cent of mortgage holders have a secondary suite, and an additional 9 per cent say they’re planning to add one.

Reasons range from mortgage support (37 per cent) to steady income (36 per cent) to retirement planning (25 per cent). In other words, Canadians are turning their homes into multi-functional financial tools.

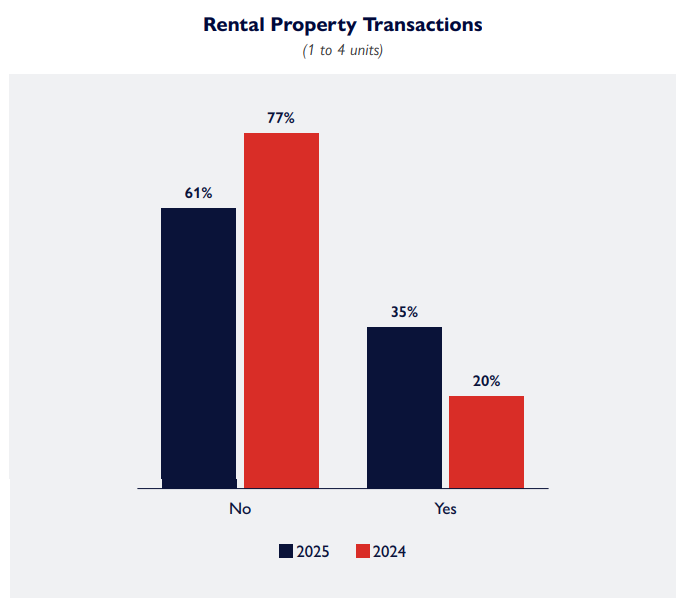

Rental Property Transactions Are Surging

Mortgage transactions for small rental properties, 1 to 4 units, jumped from 20 per cent in 2024 to 35 per cent in 2025. Canadians are increasingly combining ownership and income-generation, often out of necessity.

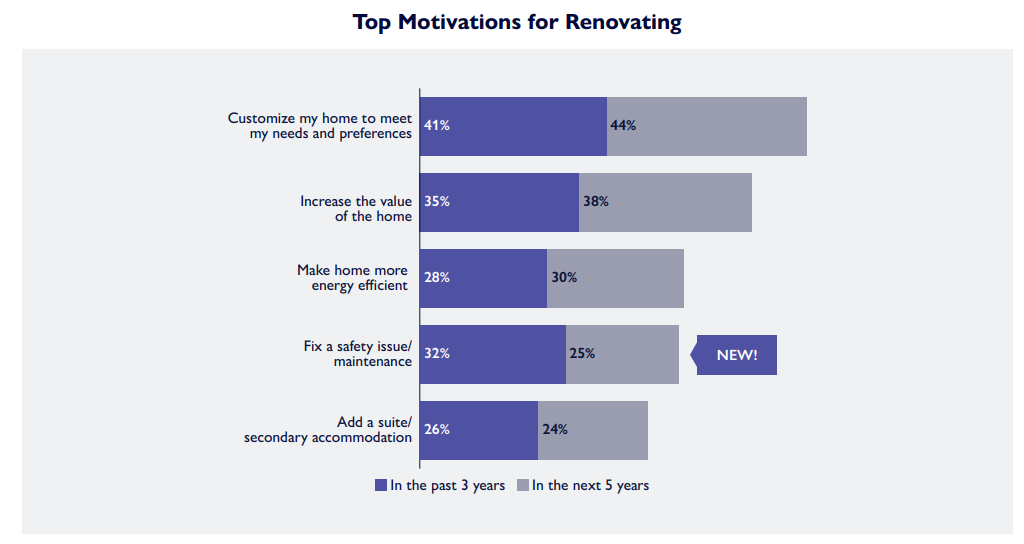

Renovation Boom Driven by Income Gaps

55 per cent renovated in the past 3 years, and 74 per cent plan to in the next 5. And these weren’t just aesthetic upgrades. Energy efficiency, secondary suites, and safety improvements are part of the list.

The Rise of the Digital Mortgage Shopper

Social Media Use Has Doubled

In just one year, mortgage-related social media use jumped from 29 per cent to 54 per cent. YouTube leads the way, with Instagram and Facebook close behind.

To label this as entirely Gen-Z behaviour, would be wrong. Even mid-career buyers and refinancers are turning to online creators, mortgage influencers, and comparison videos to guide their decisions.

But Human Advisors Still Matter

Despite the digital surge, 70 per cent of mortgage consumers spoke with a broker or lender, up from 60 per cent last year. Real estate agents remain the most valuable guide in the process.

Why? Because while rates can be compared online, confidence and clarity still require conversation.

Market Uncertainty and Unexpected Costs Remain a Constant

Buyers Still Feel Anxious and Often Unprepared

62 per cent of mortgage consumers reported feeling some form of uncertainty during their homebuying process. The top concerns? Paying too much, managing post-purchase costs, and rate hikes.

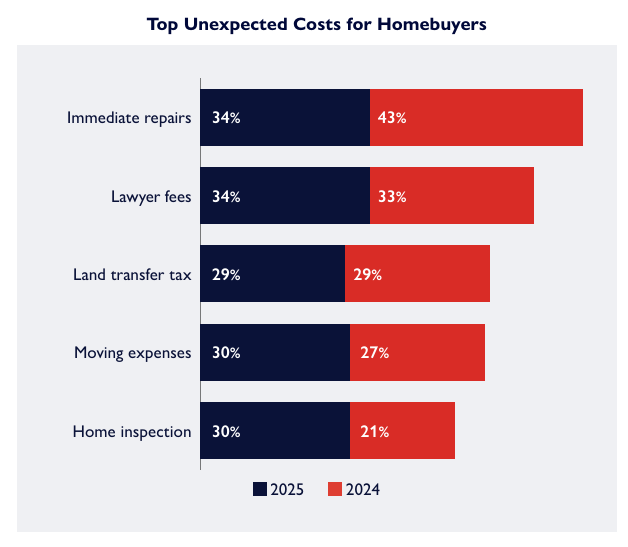

A growing number of buyers, 42 per cent this year, were hit with unexpected expenses, with legal fees, immediate repairs, and moving costs topping the list.

And Fewer Are Using Savings to Cover Emergencies

In 2025, fewer buyers relied solely on savings for those surprises. Instead, 53 per cent turned to credit, and nearly a third leaned on family. That’s a shift that reflects deeper vulnerability.

Mortgage Characteristics Are Quietly Shifting

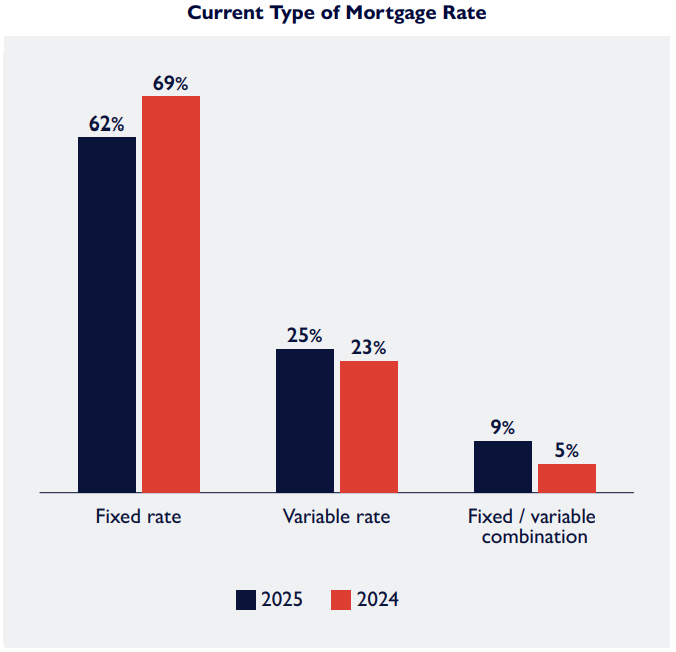

Fixed Rates Still Dominate, But Momentum Is Changing

62 per cent of mortgage holders have fixed-rate mortgages, but that’s down from 69 per cent last year. Variable and hybrid rate mortgages are slowly gaining ground.

Older Canadians and repeat buyers are more likely to opt for stability, while refinancers and younger buyers appear more willing to bet on future rate drops.

Term Choices Reflect Uncertainty, Not Strategy

While the 5-year term is still the most popular (34 per cent), shorter terms are on the rise, especially 3-year options.

Why? Many buyers are caught in the middle, wanting stability, but hoping for relief. Those who chose short terms often expected falling rates, while those who locked in longer simply couldn’t stomach more risk.

Financial Confidence Remains, But for How Long?

Canadians Still Believe in Real Estate

It’s almost poetic: despite everything, 74 per cent believe their home will increase in value over the next 12 months. Nearly as many feel comfortable with their mortgage debt.

This speaks to the cultural resilience of homeownership in Canada. A house is more than an asset here. It’s identity, security, and legacy.

Default Fears Persist Beneath the Optimism

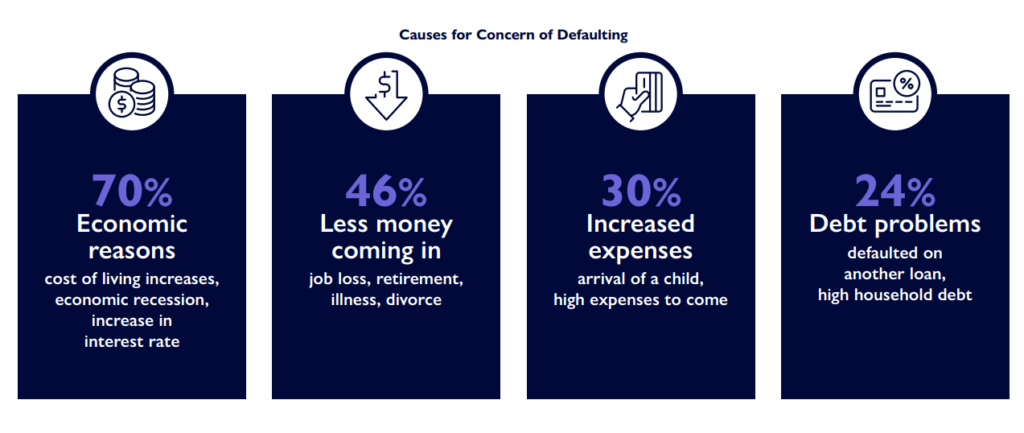

Still, over half of mortgage holders (53 per cent as of 2025) worry about defaulting. Economic reasons top the list of concerns, which include rising cost of living, increase in interest rates, etc.

What This Means for the Market and for Policy

Homeownership Is Holding On, But Needs Support

Canadians haven’t given up. They’ve adapted through multi-generational wealth transfers, suite conversions, and financial engineering.

Tools like the First Home Savings Account (FHSA) are gaining traction (used by 71 per cent of aware first-time buyers), but it’s clear we need more than tax shelters. We need structural changes, including faster housing approvals, more flexible financing options, and policies that reflect today’s buyer, not yesterday’s market.

Investors, Urban Planning, and Regulation Need a Rethink

The rise of secondary suites should trigger a serious policy discussion: if homeowners are solving affordability with rental units, why aren’t we formalizing, streamlining, and even incentivizing that shift?

It’s also time to revisit how we regulate mortgages. The stress test, designed for stability, now often feels like a barrier to survival. Can we innovate without compromising prudence?

Conclusion: A New Generation of Buyers, A New Kind of Market

While not alarmist, the 2025 CMHC report presents a clear-eyed, sobering view of the housing landscape.

It shows us a country still deeply committed to the dream of ownership, but navigating it with caution, creativity, and at times, quiet desperation. It reveals a housing system strained by outdated norms, and a population doing everything in its power to adapt.

If we want to preserve that dream, not just for this generation, but the next, we need to stop romanticising the past and start building a market that works for today’s realities.

Homeownership is by no means dead. It is evolving. The question now is whether our policies, institutions, and strategies are ready to evolve with it.

For expert insight on what these findings mean for Canadian homebuyers, watch Daniel Foch, Chief Real Estate Officer at Valery, break it down in this short video.

And if you’re wondering how these trends apply to you, our AI-powered real estate chatbot, Valery, is here to help. Whether you’re buying, refinancing, or just exploring, start a conversation using the chat widget in the bottom right corner.